Is Irs Stopping Payments During Shutdown

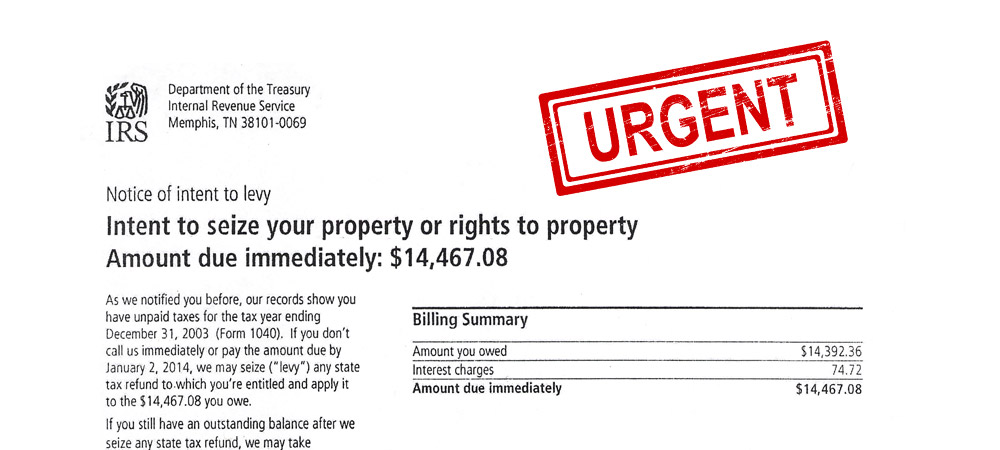

Taxpayers are in a pickle. Delinquent Return Filings and OIC Defaults.

Stimulus Payments Have Been Sent I R S Says The New York Times

Stimulus Payments Have Been Sent I R S Says The New York Times

The new tax payment deadline is July 15 according to an IRS notice.

Is irs stopping payments during shutdown. Tax Tip 2020-56 May 13 2020. Several weeks ago the IRS said it was easing installment and other payments as people deal with the pandemic. By law interest will continue to accrue on any unpaid balances.

However interest will continue to accrue on the amount owed. However taxpayers who are unable to comply with terms of their Installment Agreement may suspend payments during this period. We may also file a Notice of Federal Tax Lien to protect the governments interest in your assets.

OIC Payments Taxpayers have the option of suspending all payments on accepted OICs until July 15 2020 although by law interest will continue to accrue on any unpaid balances. The IRS said that it has always believed it has the ability to pay refunds during a shutdown. The IRS is suspending the requirement that taxpayers make their payments under these agreements during April 1 2020 through July 15 2020.

OIC Payments Taxpayers have the option of suspending all payments on accepted. Some IRS call centers and return processing centers are closing in response to COVID-19. Also the IRS is not automatically suspending direct.

All you have to do is file your taxes. Since the shutdown began on December 22 IRS. The guidance specifies that individuals and corporations can defer payments including for self-employment taxes that were due April 15 until July 15.

Our service delays include. Live phone support Processing tax returns filed on paper Answering mail from taxpayers Reviewing tax returns even for returns filed electronically Check this page periodically for updates. Existing Installment Agreements Under an existing Installment Agreement payments due between April 1 and July 15 2020 are delayed.

The IRS has resumed processing Forms 8038-CP Return for Credit Payments to Issuers of Qualified Bonds for refundable credit payments on direct pay bonds. In addition the IRS will not close any pending OIC request before July 15 2020 without the taxpayers consent. It states that the 1 million limit applies.

The IRS will not close any pending OIC request before July 15 2020 without the taxpayers consent. IRS phone lines are closed so taxpayers cannot contact the IRS to skip the automatic payments during this time. Were working to minimize the delays in processing these forms due to the government shutdown.

The Internal Revenue Service IRS isnt shutting down completely - but its getting close. IRS will continue to debit payments from the bank for Direct Debit Installment Agreements DDIAs during the suspension period. The Internal Revenue Service still expects taxpayers to pay what they owe on time - but the partial government shutdown may significantly delay refunds.

The IRS will not default any Installment Agreements during this period. This relief is effective through the filing and payment deadline Wednesday July 15 2020. Taxpayers who have their payments to the IRS made by direct deposit may also suspend their payments.

Due to COVID-19 the IRS People First Initiative provides relief to taxpayers on a variety of issues from easing payment guidelines to delaying compliance actions. Taxpayers will have the option of suspending all payments on accepted OICs until July 15 2020. Were open and processing mail tax returns payments refunds and correspondence.

The IRS will not default an OIC for those taxpayers who are. For more information see Collection Procedures. In addition the IRS will not close any pending OIC request before July 15 2020 without the taxpayers consent.

The IRS will allow taxpayers until July 15 to provide requested additional information to support a pending OIC. For taxpayers under an existing Installment Agreement payments due between April 1 and July 15 2020 are suspended. Code Section 1324 does indeed provide for payment of all tax refunds through a permanent indefinite appropriation.

However COVID-19 continues to cause delays in some of our services. The Office of Management and Budget OMB told the agency in 2011 not to pay refunds during a shutdown. Filing or Paying Late.

The Office of Management and Budget OMB took the position during the threat of a 2011 shutdown that the IRS could not pay refunds during a budgetary lapse but the OMB reversed that opinion in 2019 agreeing with the IRS that 31 US. The IRS has since make it clear it is suspending most collection activities from March. Youll automatically not get charged interest and penalties he said.

To request a temporary delay of the collection process or to discuss your other payment options contact the IRS at 1-800-829-1040 or call the phone number on your bill or notice.

Stimulus Package When Will You Get Your Money And Other Questions Coronavirus Ktbs Com

Stimulus Package When Will You Get Your Money And Other Questions Coronavirus Ktbs Com

Irs Will Ease Tax Payment Guidelines Limit Collections Activities During Covid 19 Crisis

Irs Will Ease Tax Payment Guidelines Limit Collections Activities During Covid 19 Crisis

Expect Tax Refunds On Time During Coronavirus Pandemic

Expect Tax Refunds On Time During Coronavirus Pandemic

90 Day Break Coming For Tax Payments As Irs Joins Social Security In Closing Some Sites Pittsburgh Post Gazette

90 Day Break Coming For Tax Payments As Irs Joins Social Security In Closing Some Sites Pittsburgh Post Gazette

The Ongoing Government Shutdown Is Setting Up A Serious Question For Irs Employees Is Working There Even Worth It

The Ongoing Government Shutdown Is Setting Up A Serious Question For Irs Employees Is Working There Even Worth It

Irs Continues To Limit Operations Due To Coronavirus Crisis But Will Still Issue Tax Refunds

Irs Continues To Limit Operations Due To Coronavirus Crisis But Will Still Issue Tax Refunds

3 17 277 Electronic Payments Internal Revenue Service

3 17 277 Electronic Payments Internal Revenue Service

Shutdown Gov Workers Who Take Unemployment Benefits Must Repay Them

Shutdown Gov Workers Who Take Unemployment Benefits Must Repay Them

Irs Releases Clarifying Faqs On Cares Act Retirement Plan Relief

Irs Releases Clarifying Faqs On Cares Act Retirement Plan Relief

Irs Stimulus Why Your Check Is Not In The Mail Pymnts Com

Irs Stimulus Why Your Check Is Not In The Mail Pymnts Com

Coronavirus Covid 19 Tax Relief Taxpayer Advocate Service

Coronavirus Covid 19 Tax Relief Taxpayer Advocate Service

Laura Davison On Irs And 2019 Tax Filing Season C Span Org

Laura Davison On Irs And 2019 Tax Filing Season C Span Org

Are U S Taxes In 2020 Delayed Because Of Coronavirus Pandemic Everything You Need To Know

Are U S Taxes In 2020 Delayed Because Of Coronavirus Pandemic Everything You Need To Know

Irs Eases Tax Enforcement During Virus Shutdown

Irs Eases Tax Enforcement During Virus Shutdown

13 1 24 Advocating For Case Resolution Internal Revenue Service

13 1 24 Advocating For Case Resolution Internal Revenue Service

Second Stimulus Check Here S What We Know About Proposed 600 Check Wjbf

Second Stimulus Check Here S What We Know About Proposed 600 Check Wjbf

Did You Receive Irs Notice Lt16 What You Need To Do To Prevent An Irs Levy Tax Attorney Orange County Ca Kahn Tax Law

Did You Receive Irs Notice Lt16 What You Need To Do To Prevent An Irs Levy Tax Attorney Orange County Ca Kahn Tax Law

Faqs On Tax Returns And The Coronavirus

Faqs On Tax Returns And The Coronavirus

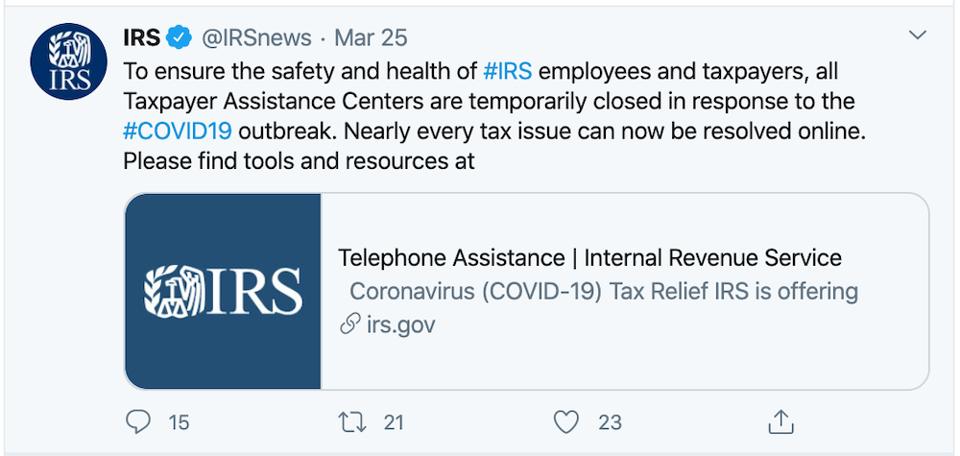

Getting In Touch With The Irs During Covid 19 Pandemic Irs Mind

Getting In Touch With The Irs During Covid 19 Pandemic Irs Mind

Post a Comment for "Is Irs Stopping Payments During Shutdown"