How To Make A Payment To Hmrc Online

Paying tax to HMRC 4 Cheques should preferably be paid in at a bank though a payslip is required and can be difficult to obtain. 08 32 10 Account name.

Tomorrow Is The Deadline To Fill In Your Online Tax Return But There Are Still Hundreds Of Thousands Of People Tax Return Tax Return Deadline Self Assessment

Tomorrow Is The Deadline To Fill In Your Online Tax Return But There Are Still Hundreds Of Thousands Of People Tax Return Tax Return Deadline Self Assessment

The time you need to allow depends on how you pay.

How to make a payment to hmrc online. Pay your tax bill by Direct Debit. Remember to use your 13-character accounts office reference number and check your bank statement for HMRC NDDS to confirm the payment. The bank details for HMRC are.

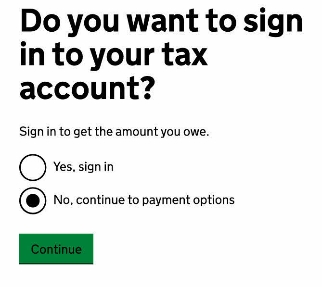

You can use the VAT payment. You can set up a Time to Pay plan online through your tax account or you can call HMRC on 0300 200 3822 open Monday to Friday 8am to 4pm. HMRC PAYE Payment Bank Details.

The new scheme lets you pay your deferred VAT in equal instalments interest-free. Make sure youve selected Payment under Payment Type. Alternatively cheques should be sent to HMRC Direct BX5 5BD.

HM Revenue and Customs HMRC has revealed that almost 25000 Self Assessment customers have set up an online payment plan to manage their tax liabilities in up to 12 monthly instalments. If a self assessment payslip is not available one can be printed off from the HMRC website. 22nd of each month for the previous tax month if you pay monthly.

The time you need to allow depends on how you pay. Updated 23 June 2019. Ways to pay HMRC.

Youll be charged interest and may have to pay a penalty if your payment is late. Make sure your payment will reach HM Revenue and Customs HMRC bank account by the deadlineYou may have to pay a surcharge if you do not pay on time. This then posts the journal and payment to the Vat vendor or supplier account normally HMRC and if a refund HMRC - Receivable.

The online service is open until the 21st June 2021. VAT payment to HMRC. The easiest way to pay your PAYE is online.

If you have other undeclared income HMRC use Connect and other methods to find it and make sure you pay your tax on it. PAYE is due to HMRC by the. Make sure you pay HMRC by the deadline.

You can choose the. Contact HMRC on 0800 024 1222 by the 30th June 2021 if you need extra help to pay. The new legislation states.

Should you file your self-assessment online you will be able to make your payment on account at the same time should you chose. If you have received a paying-in slip from HMRC you can also choose to walk into a bank or a building society and make the payment. Pay your tax bill by Certificate of Tax Deposit.

However bear in mind that those who use this system will pay simple interest meaning it doesnt compound of 26 a year from 1 February 2021 until their bill has been repaid in full. If you wish to record an interim VAT payment you can follow the steps provided below. Payments made by cheque are not guaranteed to reach HMRC in time so they should be.

By setting up a Direct Debit from your HMRC online account. You can pay your Self Assessment tax bill by various methods such as. You may have to pay interest and penalties if your payment is late.

Paying by Direct Debit You can set up a single payment for paying a PAYE tax bill through your HMRC online account. Thats just the figures youre telling them. Regulation provides that a fee is payable whenever a business credit or debit card is used to make a payment to HMRC.

If you are submitting your return via a paper return you will receive a paper bill with a Bank Giro form for you to make your payment. Yes HM Revenue and Customs can see how much you earn from your pay as you earn PAYE records and the information you provide on your self-assessment tax return. The new VAT deferral payment scheme.

Heres how to record a VAT payment. Go to Taxes and click on Record Payment for the specific VAT period you need. Make a debit or credit card payment with HMRC to pay your tax bill including Self Assessment PAYE VAT and Corporation Tax.

For payments where a reference is required you will need to use your 10-digit Unique Taxpayer Reference UTR. Where a payment reference number is asked for you should use your UTR followed by the letter K. When is HMRC PAYE Due.

This can be done in most cases via the HMRC website or commercial digital software. Make sure you pay HM Revenue and Customs HMRC by the deadline. Join the new VAT deferral payment scheme more information below.

Use file vat or run vat summary Vat 100 report and use the file vat button there. At the top select the bank account youve used to pay HMRC. 22nd of each quarter following the end of a quarter if you pay quarterly.

Online or telephone banking Faster Payments CHAPS debit or corporate credit card online at your bank or building. Under the revoked legislation a fee was only payable to HMRC in relation to payments with specified business credit cards and was not payable in relation to payments by any debit cards. You can choose to pay your Self Assessment tax bill online or by telephone banking by debit or corporate card online not personal credit card or CHAPS.

Pay your tax bill by debit or corporate credit card.

How To Fill In Your Hmrc Tax Return Goselfemployed Co Online Employment Tax Return Employment Records

How To Fill In Your Hmrc Tax Return Goselfemployed Co Online Employment Tax Return Employment Records

How Do I Pay My Hmrc Corporation Tax Online Taxes Accounting Services Telephone Banking

How Do I Pay My Hmrc Corporation Tax Online Taxes Accounting Services Telephone Banking

Hmrc Logo Business Grants How To Apply Online Business

Hmrc Logo Business Grants How To Apply Online Business

Hmrc Tax Code National Insurance Number Coding Told You So

Hmrc Tax Code National Insurance Number Coding Told You So

Why You May Become The Subject Of A Tax Investigation Business Grants Online Business How To Apply

Why You May Become The Subject Of A Tax Investigation Business Grants Online Business How To Apply

Hmrc Flexes New Powers On Contract And Freelance Workers In 5 5bn Raid Tax Tricks Online Taxes Tax Return

Hmrc Flexes New Powers On Contract And Freelance Workers In 5 5bn Raid Tax Tricks Online Taxes Tax Return

Paying Hmrc Self Assessment Tax By Cheque By Cr Dr Card Or Online

Paying Hmrc Self Assessment Tax By Cheque By Cr Dr Card Or Online

Hmrc Sa302 Design 2 Online Tax Return Reference

Hmrc Sa302 Design 2 Online Tax Return Reference

How To Register As Self Employed With Hmrc The Independent Girls Collective Financial Coach Independent Girls Woman Business Owner

How To Register As Self Employed With Hmrc The Independent Girls Collective Financial Coach Independent Girls Woman Business Owner

Employment Law Advice Costco Employment Opportunities Part Time Online Employment Opportu Small Business Bookkeeping Bookkeeping Business Accounting Jobs

Employment Law Advice Costco Employment Opportunities Part Time Online Employment Opportu Small Business Bookkeeping Bookkeeping Business Accounting Jobs

P60 Replacement P60 Online Importantdocuments P60 Is The Most Important Document That Employe Need Financial Problems National Insurance Number Number Words

P60 Replacement P60 Online Importantdocuments P60 Is The Most Important Document That Employe Need Financial Problems National Insurance Number Number Words

How To Register As Self Employed With Hmrc The Independent Girls Collective Self Bookkeeping Business Small Business Bookkeeping

How To Register As Self Employed With Hmrc The Independent Girls Collective Self Bookkeeping Business Small Business Bookkeeping

Hmrc Sa302 Cover Letter Design 1 Cover Letter Design Self Assessment Uk Date

Hmrc Sa302 Cover Letter Design 1 Cover Letter Design Self Assessment Uk Date

How To Create An Hmrc Account And Activate Your Paye For Employers Payfit Help Center

How To Create An Hmrc Account And Activate Your Paye For Employers Payfit Help Center

Pin By Ein On Irs Tax Tips And Finance Tips Irs Taxes Finance Tips Finance

Pin By Ein On Irs Tax Tips And Finance Tips Irs Taxes Finance Tips Finance

Android Uk News Etc Google Pinterest For Business Do You Work Business Planning

Android Uk News Etc Google Pinterest For Business Do You Work Business Planning

Hmrc Login Online Self Self Assessment Assessment

Hmrc Login Online Self Self Assessment Assessment

How To Complete Hmrc S Online Self Assessment Filing Crunch Online Self Self Assessment Freelancer Advice

How To Complete Hmrc S Online Self Assessment Filing Crunch Online Self Self Assessment Freelancer Advice

How To Register For Tax As Self Employed With Hmrc In The Uk Everything You Need To Know About Tax If Y Small Business Tips Starting A Business Small Business

How To Register For Tax As Self Employed With Hmrc In The Uk Everything You Need To Know About Tax If Y Small Business Tips Starting A Business Small Business

Post a Comment for "How To Make A Payment To Hmrc Online"