How Much Does Quickbooks Charge For Credit Card Processing

The pay-as-you-go plan charges no monthly fee 240 plus 025 per swipe transaction and 340 plus 025 per keyed-in card transaction. Sales Orders Refunds and Credits Receive Payments and Create InvoicesThe QuickBooks integration automatically applies payments back to invoices and updates the balance due.

How To Enter Credit Card Charges In Quickbooks Desktop Pro

How To Enter Credit Card Charges In Quickbooks Desktop Pro

So the new transaction fee is 090 more.

How much does quickbooks charge for credit card processing. The total allowed charge usually caps at 4. Indeed there is a cost involved with credit card payments. QuickBooks Desktop Pay monthly Plan.

According to the companys website it offers a swipe rate of 260 plus 015 and a keyed-in rate of 340 plus 015. Payments We accept all major credit cards and support payments from 22 different countries. The companys products and services include EMV-compatible countertop terminals a virtual terminal an online payment gateway an online shopping cart mobile phone processing QuickBooks integration online invoicing and.

Once youre a QuickBooks Online user you can activate QuickBooks Payments and start accepting credit card and ACH payments. Customers can conveniently pay directly from their invoice with the click of a button. What if there were a way to process inside QuickBooks just like you do now.

The exact price varies depending on things like the average transaction and the type of business. Active since early 2014 Fattmerchant is a merchant account provider leading the industrys move toward flat-rate subscription-style pricing. At the same time many providers are now offering smart wireless terminals that include.

Plus if you key in transactions regularly or if you process card not present transactions CNP then your rate goes up to 35. They like the service theyre getting very much. The Wells Fargo Program Guide details pricing and fees for merchant accounts that appear to vary based on a merchants business type processing volume and the representative setting up the account.

Businesses who charge extra fees often post signs and have their employees disclose the fees whenever a customer opts for a card payment. This option is best for very small business owners with small ticket sizes or lower volume up to 5000 in card transactions per month. Intuit also charges a flat fee per transaction which costs 025 for Quickbooks Online Quickbooks Desktop and Pay as You Go.

Typically the type of credit card transaction and the. For example if you incur 1500 in processing fees during the month your monthly minimum fee. A swiped card will cost you 24 25 cents per transaction while an invoice payment will cost 29 25 cents per transaction.

QuickBooks credit card processing fees can be brutal. A monthly fee of 995 is attached for storefront. Payments to you will automatically be entered into your accounting records.

There are two different QuickBooks Payments plans a no-fee plan and a. Credit card - swiped. They pay entirely too much for it.

29 25 35 30 33 30 Credit card - keyed. An added benefit of QuickBooks Payments is our instant or next-day deposits. Keyed cards come in the highest at 34 25 cents per transaction.

24 25 24 30 16 30 Credit card - online invoice. QuickBooks Online offers two pricing plans for merchants one of which is charged on a pay-as-you-go basis and one of which charges a fixed monthly fee. Just use these modules.

Below we discuss some of the most overlooked profit-maximizing techniques that can help businesses reduce QuickBooks credit card processing fees. Accept credit and debit payments in QuickBooks is easy. Sharing an online invoice with your customer who then pays it using an ACH bank transfer or credit or debit card.

The transaction fees vary depending on whether the card is swiped 24 invoiced 29 or keyed 34 plus a flat 025 fee per transaction. However processing fees typically range between 15 to 29 for swiped credit card transactions and 35 for keyed-in transactions due to the greater risk. As you can see from the screenshot above the flat rates vary depending on how you take the card.

Manually typing in a customers credit or debit card info. QuickBooks users who utilize the native credit card processing feature in QuickBooks all seem to have two things in common. QuickBooks Desktop Pay as you go Plan.

Traditional wireless credit card machines are declining in popularity due to the availability of smartphone-based mobile processing systems such as Square see our review which perform the same credit card processing function for a much lower price. When I process the transaction the credit card company will charge a 3 fee based upon the total which is now 1030. 1 max 10 Swiping a customers credit or debit card using one of our card readers.

To better understand how a merchant is affected by the various processing rates lets review why processing rates exist. 24 025 for swiped cards 6 Stripe. 1 Max 10 300.

Not a big deal on a smaller invoice but over time and on larger invoices it adds up. 34 25 35 30 35 30. Any convenience fee or surcharge assessed must be disclosed before any payment is made.

29 030 for online transactions 7 The downside is that the transaction cost could be quite high. Ecommerce merchants are charged 030 per transaction. Quickbooks Payments does not charge monthly fees or setup fees.

Solved How Do I Add The Credit Card Processing Fee To An Invoice Without Being Charged The Processing Fee For The Base Amount And The Processing Fee

Solved How Do I Add The Credit Card Processing Fee To An Invoice Without Being Charged The Processing Fee For The Base Amount And The Processing Fee

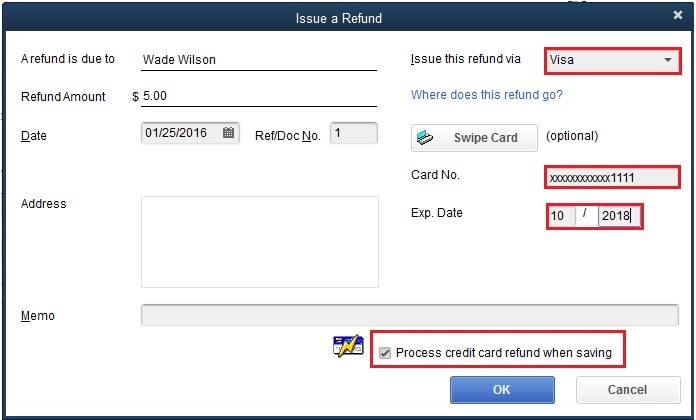

Void Or Refund Customer Payments In Quickbooks Des

Void Or Refund Customer Payments In Quickbooks Des

Quickbooks Credit Card Processing Updated 2021

Quickbooks Credit Card Processing Updated 2021

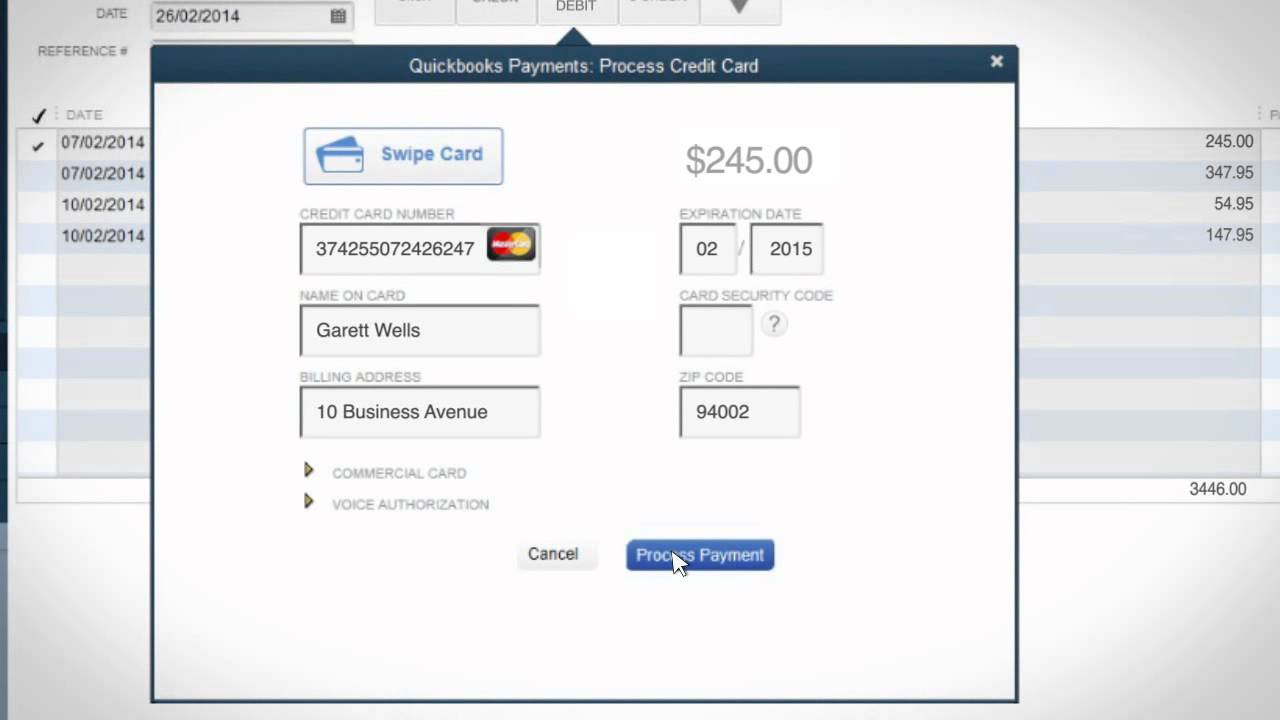

Electronic Payments Quickbooks Data Migrations Data Conversions

Electronic Payments Quickbooks Data Migrations Data Conversions

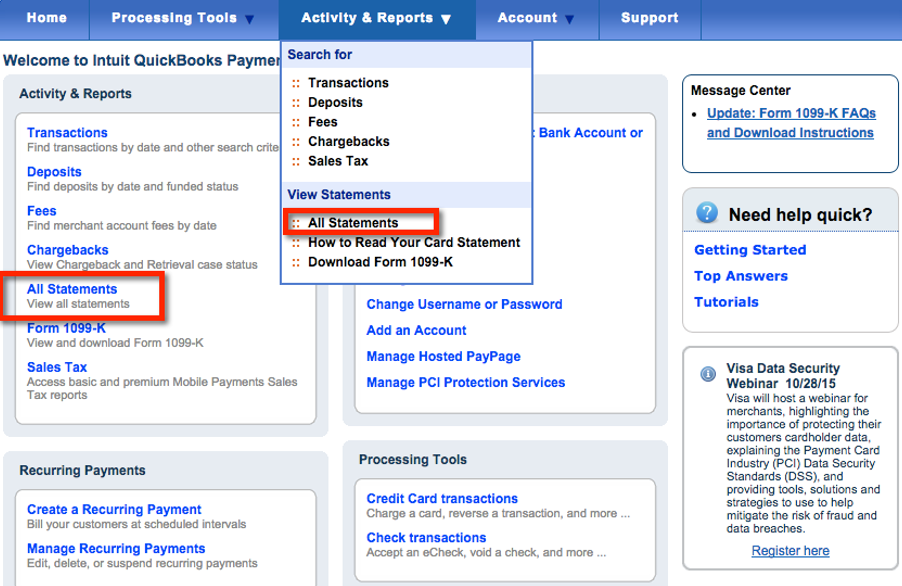

View And Download Statements In The Merchant Servi

View And Download Statements In The Merchant Servi

Quickbooks Credit Card Processing Reviews Payment Collect

Quickbooks Credit Card Processing Reviews Payment Collect

Intuit Merchant Services Quickbooks Payments Review 2021

Intuit Merchant Services Quickbooks Payments Review 2021

Intuit Merchant Accounts Will Cost You

Intuit Merchant Accounts Will Cost You

How Do I Make A Credit Card Receipt And Email To The Customer

How Do I Make A Credit Card Receipt And Email To The Customer

Accept Credit Cards Quickbooks Merchant Services

Accept Credit Cards Quickbooks Merchant Services

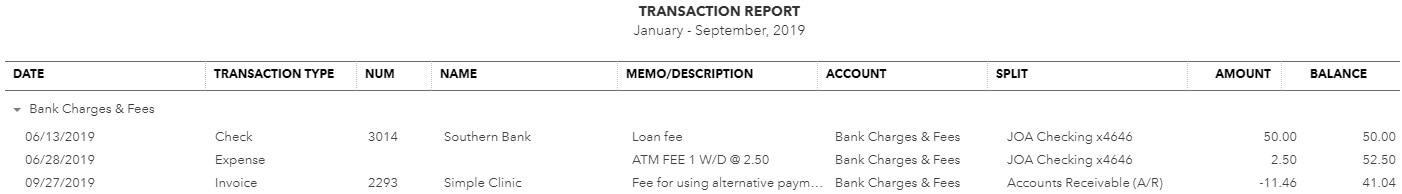

How To Handle Merchant Fees In Quickbooks Pro Merchant Maverick

How To Handle Merchant Fees In Quickbooks Pro Merchant Maverick

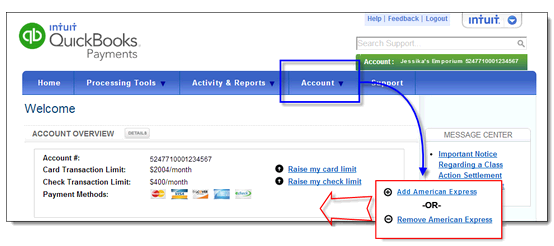

Add Or Remove Amex Credit Card Processing For A Qu

Add Or Remove Amex Credit Card Processing For A Qu

How To Reduce Quickbooks Credit Card Processing Fees

How To Reduce Quickbooks Credit Card Processing Fees

Post a Comment for "How Much Does Quickbooks Charge For Credit Card Processing"