Gst Payable Ledger In Tally

In this section we will see the major accounting entries to be generated under GST along with the new ledger accounts Chart of accounts to be created in the accounting software or ERP. The Course Is Completed Guide For Tally Prime Learners And I Teach Step By Step From Basic to Advance and It Will Help to improve Your Career Path to Get The Accounting Job In Easy Manner Where Tally Prime Practicing Company And in this course I have Covered All Accounting Concept With Tally Prime in Practical Manner From Basic to Advanced Concept Including GST Goods and Services Tax.

Gst Accounting In Tally Creating Gst Ledger In Tally Cgst Ledger Sgst Ledger Igst Ledger Youtube

Gst Accounting In Tally Creating Gst Ledger In Tally Cgst Ledger Sgst Ledger Igst Ledger Youtube

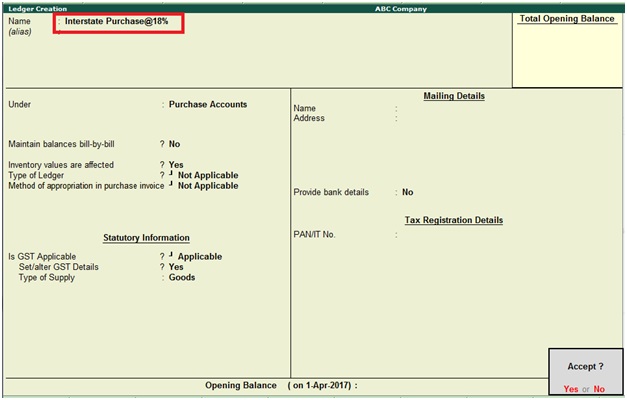

TALLY GST PURCHASE ACCOUNT CREATE LEDGER LESSON 3.

Gst payable ledger in tally. What are the Accounts types. Introduction to Tally What are the Accounts Groups of Tally. Enter the Name of the ledger Discount on Sale 3.

Accounting Entries for GST Set off and CashBank Payment. - Create ledgers such as Purchase Sales State GST Central Integrated GST Stock item names etc. How to Enter the opening balance.

Create Ledger GST Payable under Duties and Taxes Input GST Group Input IGST Input CGST Input SGST Output GST. Here in this post I am trying to provide you all the list of ledgers required for a new company opened in Tally ERP 9 under the head and sub sub heads groupsThis post is aiming for beginners who doesnt know how to start with and what are the Ledgers required for a newly started business. Electronic tax liability register - All liabilities of a person towards tax interest penalty late fee or any other amount will be debited here.

Download Income Tax Calculator in Excel for Salary - httpsimojoin1uu3lj22. For the purpose of GST tax payment every registered dealer will need to maintain 3 ledgers in the GST payment portal which is the starting step of the GST payment process. How to install the Tally.

September 26 2017 at 536 am. Under the New GST accounting process we will create the following new groups in tally or any other ERP. GST Input Under Duties taxes Current Liability 3.

GST Output Under Duties taxes Current Liability 2. Ledgers Create. GST Tax Ledger Structure.

Now just press Enter till you save the ledger. GST Cash Ledger Under Balance from Revenue Authorities Current Asset 4. Go to Gateway of Tally Accounting Vouchers F7.

Just change the name the Tax Type and you are done with creating all the ledgers. Blog Home Blog GST Accounting in Tally. Stat Payment and enter the required details.

In this case TallyERP9 maintain Accounting Invoice where list of Accounts displays instead of Items and Goods. HomeBusiness 100 OFF Tally ERP9 With GST Step By Step Guide From Basic to Advance. GST Credit Ledger Under Balance from Revenue Authorities Current Asset.

In the GST returns we need to show data under various sections. Go to Gateway of Tally Accounts Info. The granular level for capturing the reporting requirements under GST.

What is ledger made in tally for bank charges charged gst. Bank charges under Indirect expenses. How to create the Company in tally.

In the Stat Adjustment Details screen select the options as shown below. Repeat the same method and in no time you will have all the six ledgers required for passing the GST accounting entries in Tally. How to create the Ledgers in tally.

You can easily create all the GST Ledgers as in the list above by following this method. You have created a GST ledger specifically an Input CGST ledger in Tally. What are the Methods of Accounting Entry System Use.

Go to Gateway of Tally Accounting Vouchers F5. Select the central and state tax ledgers. Press CtrlA to accept.

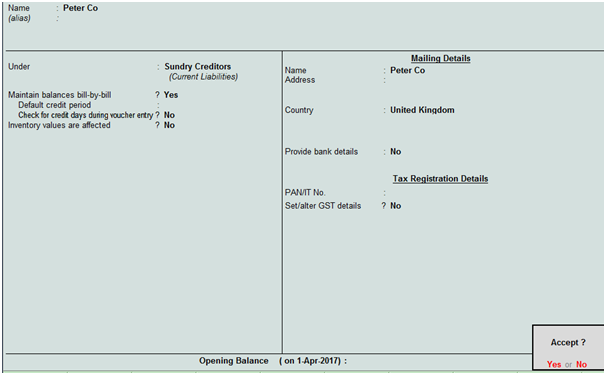

Settings can be done in company level where single tax rate and HSN code for all products. Set the option Inventory Values are affected to No. GST Regime Types of Ledger Accounts to be Maintained Under GST.

Go to Gateway of Tally Accounts Info Ledgers Create. Select the bank from which the payment will be made. What youll learn What is Accounting.

Set the option Is GST Applicable. Choice of GST Preference in Tally. Download Income Tax Calculator in Excel - httpsimojoin3f8blfh3.

Select Indirect Expenses as the group name in the Under field. Tally ERP 9 with GST A step by step Mastery Course 2020. Sale Voucher with Accounting Invoice for Service Ledger with GST in TallyERP9 In case of Service oriented business they also product invoice with their Service Charges plus GST.

- Select the appropriate group to which such ledger belongs for example state tax under duties and taxes group. Debit the expense ledger and credit the tax ledgers. Set the type of payment as Regular.

Tally ERP 9 is a simplified solution that runs the complex parts of your business such as accounting compliance and processes in the background. CGST Payable Ac_____ Dr. Practical hands-on training on the core concepts like accounting inventory Payroll with practical hands-on.

The 3 ledgers are.

Using Voucher Class For Inclusive Of Tax Calculation

Using Voucher Class For Inclusive Of Tax Calculation

Gst Input Output Adjustment Entry In Tally Erp 9 Youtube

Gst Input Output Adjustment Entry In Tally Erp 9 Youtube

Tally Ledger Groups List Ledger Under Which Head Or Group In Accounts

Tally Ledger Groups List Ledger Under Which Head Or Group In Accounts

Gst Sales With Discount At The Item Level

Gst Sales With Discount At The Item Level

Update A Service Ledger For Gst Compliance

Update A Service Ledger For Gst Compliance

Creating Gst Ledger Cgst Sgst Cess In Tally Erp Youtube

Creating Gst Ledger Cgst Sgst Cess In Tally Erp Youtube

Record Inter State Purchases Under Gst In Tally Erp9 Waytosimple

Record Inter State Purchases Under Gst In Tally Erp9 Waytosimple

Gst Taxation Ledgers In Tally 5 Gst Ledgers Free Pdf Download

Gst Taxation Ledgers In Tally 5 Gst Ledgers Free Pdf Download

Gst On Rent Paid In Tally Erp9 Registered Youtube

Gst On Rent Paid In Tally Erp9 Registered Youtube

Creating Gst Cgst Sgst Igst Ledger In Tally Erp9

Creating Expenses And Income Ledgers Without Gst Compliance In Tally Erp9

Import Of Goods Under Gst In Tally Erp9 Waytosimple

Import Of Goods Under Gst In Tally Erp9 Waytosimple

Record Expenses With Gst In Purchase Payment Or Journal Voucher

Record Expenses With Gst In Purchase Payment Or Journal Voucher

Creating Party Ledgers For Gst

Creating Party Ledgers For Gst

How To Create Sales Return Ledger Account In Tally Erp 9 We Can Record Goods Returned By The Customer In Tally Accounting Accounting Software Capital Account

How To Create Sales Return Ledger Account In Tally Erp 9 We Can Record Goods Returned By The Customer In Tally Accounting Accounting Software Capital Account

How To Create Supplier Ledgers In Tally Create Lesson Language

How To Create Supplier Ledgers In Tally Create Lesson Language

Post a Comment for "Gst Payable Ledger In Tally"