Third Party Payment Processor Questionnaire

The Third Party Payment Processors Association TPPPA will give you certification after completing certification audits successfully. 3 See the Merchant Processing booklet of the Comptrollers Handbook pp.

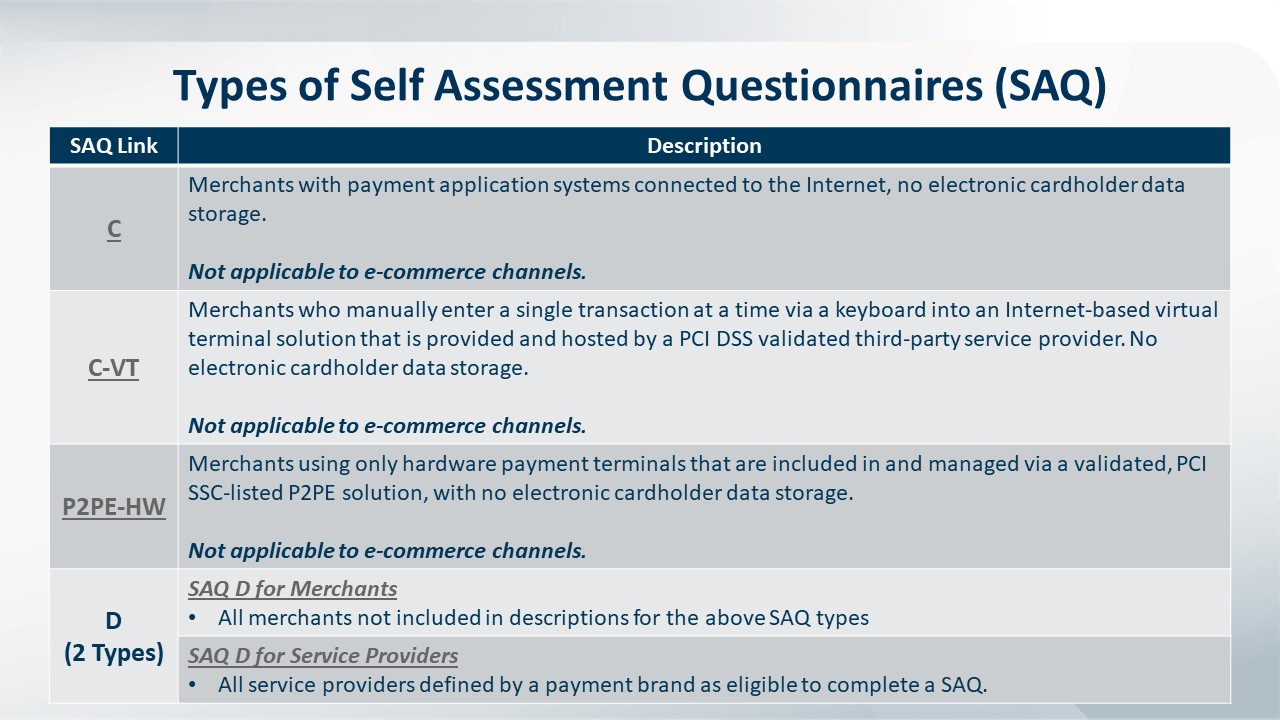

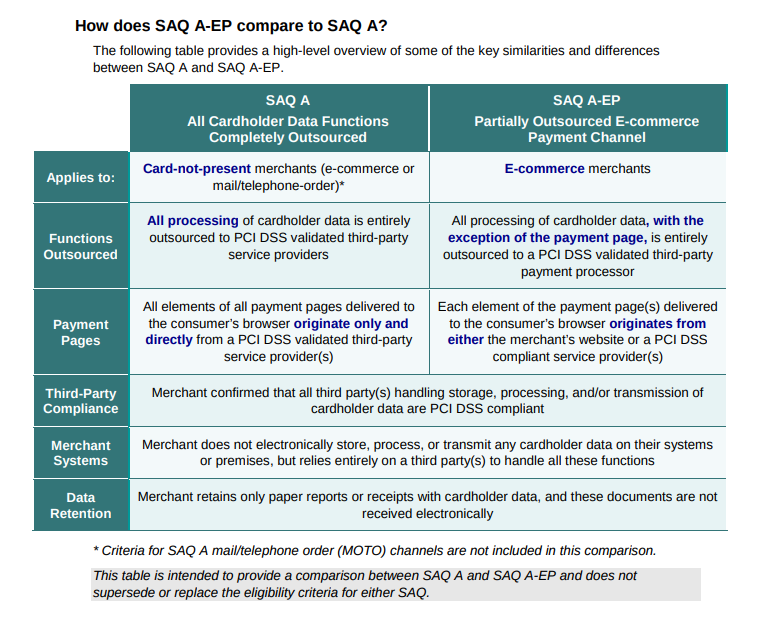

Pci Standards Which Pci Saq Is Right For My Business

Pci Standards Which Pci Saq Is Right For My Business

Our processor and bank compliance management system certification audits are performed through the TPPPA by accredited payment professionals.

Third party payment processor questionnaire. Whether selecting a third-party processor is good or not for your business depends on the volume and type of transactions you anticipate to process in a single day. We provide the highest standard of professional excellence for companies in the debt relief legal and medical industries. A third-party payment processor is an entity that helps you receive payments online from your customers without first setting up your own merchant account with a bank.

And OCC Bulletin 2006-39 pp. Third Party Payment Processors Job Aid This job aid is to be used by state institution examiners as a means to understand identify and assess the risks associated with institutions relationships with a common type of third-party service provider third-party payment processors or senders herein referred to as TPPPs or processors. A third-party payment questionnaire should be prepared and used to collect documentation to support any decision to move forward with a third-party payment arrangement.

Form 1099-MISC is generally used to report payments made directly to independent contractors. When it comes to policy setting in the world of payment security its never a one-off event. What Is a Third-Party Payment Processor.

The subject company makes a payment to a third party knowing that all or a portion of the money will eventually be improperly paid to foreign officials. 4 See the Merchant Processing booklet of the Comptrollers Handbook pp. Running a business comes with a whole set of tasks and potential difficulties even for the most successful companies.

Financial Institution Letters FIL-3-2012 January 31 2012. Assess the adequacy of the banks systems to manage the risks associated with its relationships with third -party payment processors and managements ability to implement. The questionnaire is split into three parts.

The FFIECs Bank Secrecy ActAnti-Money Laundering Examination Manual Third Party Payment Processors. Of course this brings us to ask when a company knows that a third party will make an improper payment. Overview this section introduces the questionnaire explaining how it should be filled out.

A Prescriptive Guide to Third Party Risk Management. A third-party payment questionnaire should be prepared and used to collect documentation to support any decision to move forward with a third-party payment arrangement. Get Answers The latest discussions in the CBANC community.

Revised Guidance on Payment Processor Relationships. If youre wondering what a merchant account is its a business bank account through which merchants can accept online or card payments from their customers. Form 1099-K is used by credit card companies and third-party processors to report the payment transactions they process for retailers or other third parties.

Third Party Payment Processor Questionnaire. We provide a reliable bridge between companies for accurate and secure commercial transactions. Is anyone willing to share the procedures for Third Party Payment Processor and any forms that you use for review.

Square read our review one of the largest third-party payment processors also sits on the board to help form the policy as it pertains to new tech and updating best practices. As part of the due diligence a background check credit check and basic due diligence inquiry is the starting point of the due diligence process. A payment intermediary can fill a variety of roles depending on the nature of its arrangements with specific customers.

Does anyone have a TPPP Questionnaire they would be willing to share. Any information is greatly appreciated. Third-party payment processing allows you as an entrepreneur or a business owner to accept payments online without having to first set up your own merchant account.

RAM Reliant Account Management is a specialized independent third party payment processor and trust accounting company. Third-Party Payment Processors Overview FFIEC BSAAML Examination Manual 235 2272015V2 Third-Party Payment Processors Overview Objective. ODFIs in particular are required to know the nature of their customers use of the ACH Network whether as Originators Third-Party Senders or other types of.

The FDIC has recently seen an increase in the number of relationships between financial institutions and payment processors in which the payment processor who is a deposit customer of the financial institution uses its relationship to process payments for third-party merchant clients. This questionnaire is designed to provide HSBC with information about your organisations financial crime policies and procedures as well as its products services and client base. Revised Guidance on Payment Processor Relationships.

Document Library A searchable sortable archive of the documents uploaded to CBANC. As part of the due diligence a background check credit check and basic due diligence inquiry is the starting point of the due diligence process. The Third-Party Sender Identification Tool was developed to help financial institutions and their ACH customers understand their roles when an intermediary is involved in some aspect of ACH payment processing.

Other large brands contribute to the council in a consulting role too. The FDIC has recently seen an increase in the number of relationships between financial institutions and payment processors in which the payment processor who is a deposit customer of the financial institution uses its relationship to process payments for third-party merchant clients. One of the many necessities that small and medium-sized businesses SMBs encounter is payment processing.

Https Www Inflatableoffice Com Docs Controlscan 20walkthrough 20saq 20a Pdf

Become A Merchant Business Finance Solutions

Become A Merchant Business Finance Solutions

2019 Shared Assessments Third Party Risk Management Toolkit Shared Assessments

2019 Shared Assessments Third Party Risk Management Toolkit Shared Assessments

Gdpr Is Here Assess Risk From Vendors And From Internal Teams Qualys Security Blog

Gdpr Is Here Assess Risk From Vendors And From Internal Teams Qualys Security Blog

Pci Tutorial Ecatholic Help Center

Pci Tutorial Ecatholic Help Center

How To Prepare A Self Assessment Questionnaire Pci Saq Cybersecurity And Training

How To Prepare A Self Assessment Questionnaire Pci Saq Cybersecurity And Training

Pci Compliance Questionnaire Chesapeake Bank

Pci Compliance Questionnaire Chesapeake Bank

Payment Solutions Apex Payment Solutions

Payment Solutions Apex Payment Solutions

Pcidss Compliance Fondy Documentation

Pcidss Compliance Fondy Documentation

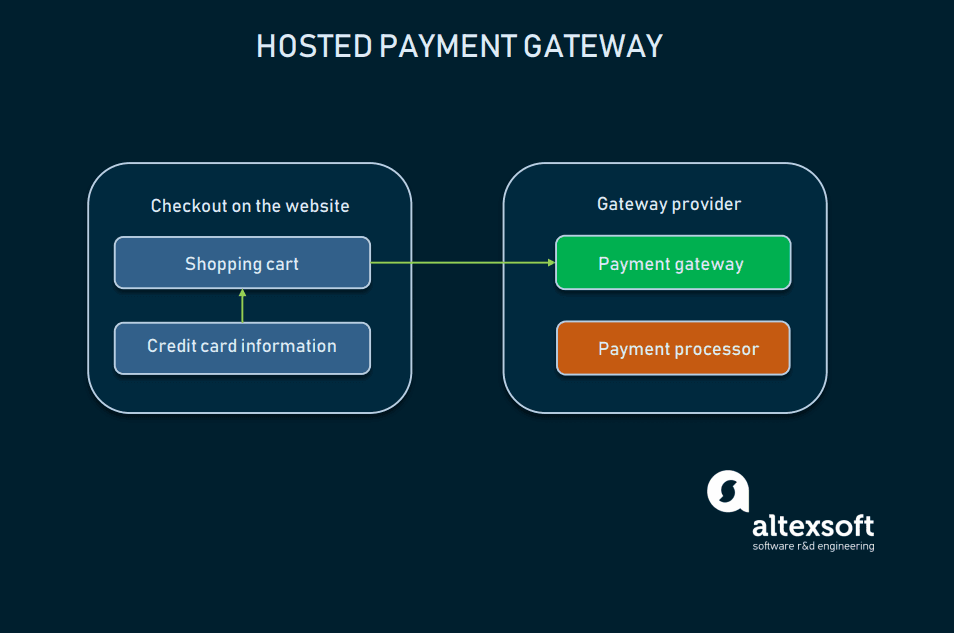

How To Integrate Local Or 3rd Party Payment Gateway In Your Mobile Application

How To Integrate Local Or 3rd Party Payment Gateway In Your Mobile Application

How To Choose Payment Gateway Main Providers And Integration Altexsoft

How To Choose Payment Gateway Main Providers And Integration Altexsoft

Wild Apricot Launches Payment Processor

Wild Apricot Launches Payment Processor

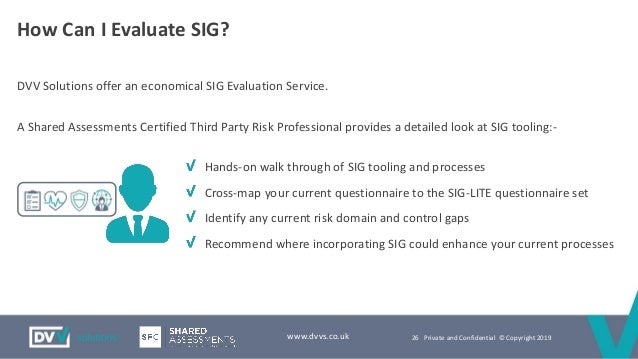

Standards In Third Party Risk Dvv Solutions Isaca North May 19

Standards In Third Party Risk Dvv Solutions Isaca North May 19

Ensuring Vendor Compliance And Thirdparty Risk Mitigation

Ensuring Vendor Compliance And Thirdparty Risk Mitigation

Gdpr Risk Assessment And Compliance Infosec Risk Assessment Coupa Software

Gdpr Risk Assessment And Compliance Infosec Risk Assessment Coupa Software

Managing Third Party Payment Risk

Managing Third Party Payment Risk

Self Assessment Questionnaire A Explained Aeris Secure

Self Assessment Questionnaire A Explained Aeris Secure

Https Www Fdic Gov Regulations Examinations Supervisory Insights Sisum11 Sisummer11 Article1 Pdf

Post a Comment for "Third Party Payment Processor Questionnaire"