Sba Payment Protection Program Guidelines

How Paycheck Protection Loans Are Different From Traditional 7a SBA Loans The 350 billion lending program authorized by the latest stimulus package aims to expand the access and availability of. Eleventh Circuit Finds SBA Can Deny Payment Protection Program Loans to Debtors in Bankruptcy.

Alta Eight Details About Sba S Paycheck Protection Program

Alta Eight Details About Sba S Paycheck Protection Program

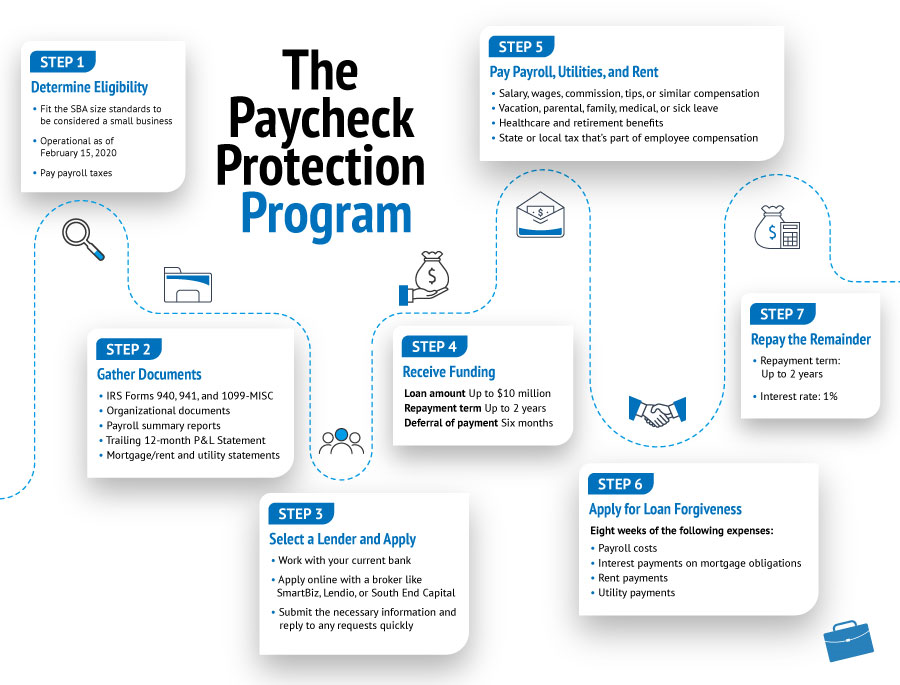

The Paycheck Protection Program provides small businesses with funds to pay up to 8 weeks of payroll costs including benefits.

Sba payment protection program guidelines. And b the date that is 10 months after the date that is the earlier of i 24 weeks after the end of the borrowers Covered Period or ii December 31 2020 if the borrower does. Neither the government nor lenders will charge small businesses any fees. Can demonstrate at least a 25 reduction in gross receipts between comparable quarters in 2019 and 2020.

JPMorgan Chase Bank NA. No collateral or personal guarantees are required. Frequently Asked Questions for Lenders and Borrowers participating in the Paycheck Protection Program PPP.

SBA and the Department of the Treasury are granted authority to determine additional lenders to administer the Payment Protection Program loans. This program provides small businesses with funds to pay up to 8 weeks of payroll costs including benefits. All loans are subject to other requirements and availability of funds under the SBA program.

The Paycheck Protection Program PPP provides loans to help businesses keep their workforce employed during the Coronavirus COVID-19 crisis. Funds can also be used to pay interest on mortgages rent and utilities. The Eleventh Circuit recently affirmed the US.

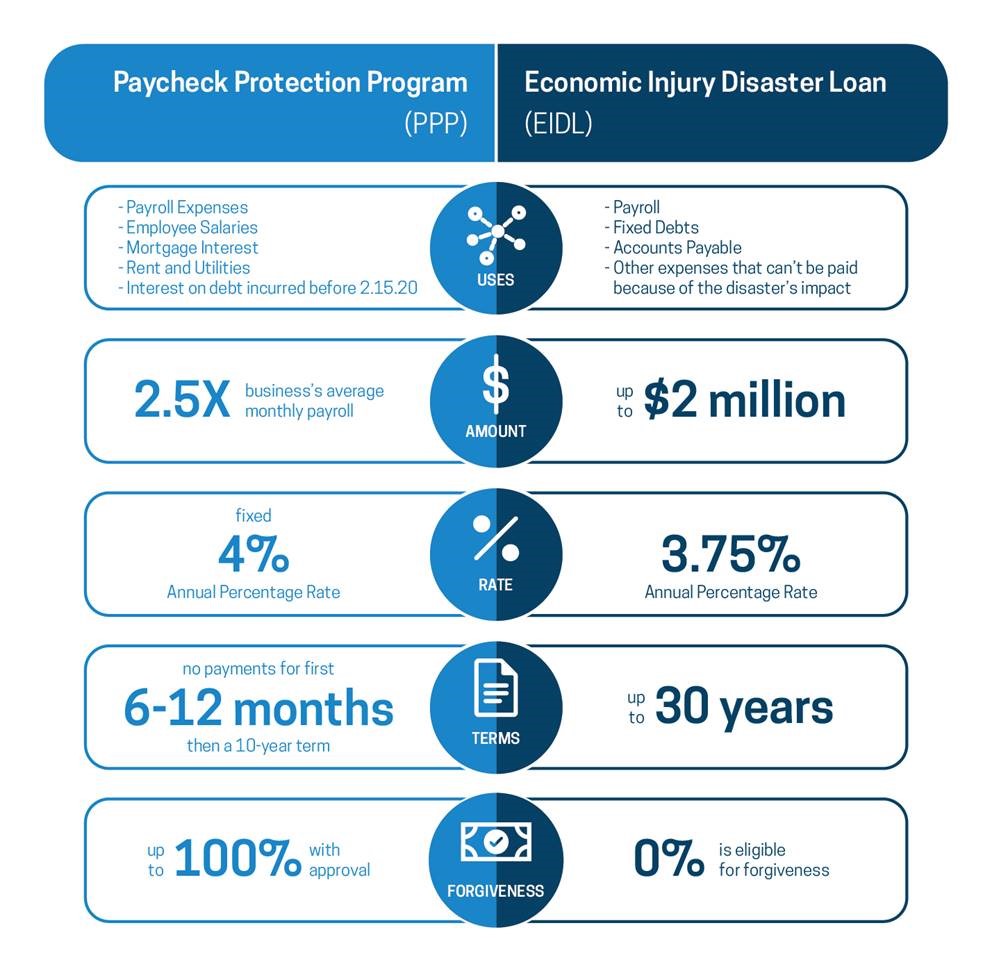

SBA Payment Protection Program PPP Update. Interest Rate Not to exceed 4 percent during the covered period. Small Business Administrations SBA rule that makes bankruptcy debtors ineligible for a Payment Protection Program PPP loan under the Coronavirus Aid Relief and Economic Security Act CARES Act.

Washington DC 20416. Below is a summary of the key components of the new PPP program including some material changes from the initial program and guidelines for second-time borrowers. Borrowers have until March 31 2021 to apply for a PPP loan or until the funds are exhausted.

PPP Guidance from SBA Administrator Carranza on Accessing Capital for Minority Underserved Veteran and Women-owned Business Concerns. If a borrower does not apply for loan forgiveness payments are deferred 10 months after the end of the covered period for the borrowers loan forgiveness either 8 weeks or 24 weeks. Get matched with a lender.

So UBT and other banks are still waiting on SBA to issue these rules and even the application process its self. Go to Next Section. However SBA Express loans carry a maximum of 50 percent guaranty and Export Express loans carry a maximum 90 percent guaranty.

SBA Form 2483 first-time borrowers or 2483-SD second-draw borrowers If second-draw loan is greater than 150000 income statements andor bank statements documenting 25 decrease in gross receipts. Borrowers may be eligible for PPP loan forgiveness. The loan amounts will be forgiven as long as.

Search for lenders in your area. Paycheck Protection Program Loan Forgiveness Application. If you have previously received a PPP loan certain businesses are eligible for a Second Draw PPP Loan.

The new guidance released includes. SMALL BUSINESS PAYCHECK PROTECTION PROGRAM. Small Business Administration 409 3rd St SW.

Still Waiting The SBA still has not issued formal guidelines or their SOPs for this new program. The program has been allocated an additional 284 billion. IRS Schedule C or Schedule F depending on type of business.

BORROWERS The Paycheck Protection Program PPP authorizes up to 349 billion in forgivable loans to small businesses to pay their employees during the COVID-19 crisis. Effective Jan 19 2021. By Office of Capital Access.

PAYCHECK PROTECTION PROGRAM PPP INFORMATION SHEET. In FAQ 46 on the Paycheck Protection Program the SBA states it will not audit companies on the necessity hardship certification if the PPP loan amount is under 2 million. For most 7 a loan programs the SBA can guarantee up to 85 percent of loans of 150000 or less and up to 75 percent of loans above 150000.

Update on the SBA. Maturity Schedule Maximum 10-year maturity after application for loan forgiveness. All loan terms will be the same for everyone.

As a reminder PPP is an SBA program that JPMorgan Chase facilitates as an SBA lender. The Paycheck Protection Program established by the CARES Act is implemented by the Small Business Administration with support from the Department of the Treasury. In its comprehensive opinion the Eleventh Circuit determined that the SBAs rule is not an unreasonable interpretation of the.

Funds can also be used to pay interest on mortgages rent and utilities. It was expected that on Friday 3 April 2020 SBA would begin accepting applications for Paycheck Protection Program PPP loans. 1040 Filer With No Employees.

The Paycheck Protection Program Flexibility Act of 2020 Flexibility Act extended the deferral period for borrower payments of principal and interest on all PPP loans to the earlier of a the date that the SBA remits the forgiven amount to the lender or notifies the lender that no forgiveness is allowed. State Trade Expansion Program STEP SBA associated awards.

Sba Releases Guidelines On Applying For Paycheck Protection Program

How To Apply For The Sba Payroll Protection Program Loan Simple Guide

How To Apply For The Sba Payroll Protection Program Loan Simple Guide

Sba Paycheck Protection Program Loan Faq And Application Process With Kabbage 2020 Stimulus Bill Paycheck Loan Sole Proprietor

Sba Paycheck Protection Program Loan Faq And Application Process With Kabbage 2020 Stimulus Bill Paycheck Loan Sole Proprietor

Sba Cares Act Relief Loans Money Source Of America Llc

Sba Cares Act Relief Loans Money Source Of America Llc

How The Upcoming Round Of The Paycheck Protection Program Ppp Works

How The Upcoming Round Of The Paycheck Protection Program Ppp Works

Sba Guidelines On Payroll Protection Program Ppp Bartow Chamber Of Commerce

Sba Guidelines On Payroll Protection Program Ppp Bartow Chamber Of Commerce

Payroll Protection Program Loan Forgiveness Sba Eidl Changes What You Need To Know Youtube

Payroll Protection Program Loan Forgiveness Sba Eidl Changes What You Need To Know Youtube

Sba Info Including Paycheck Protection Program Bedford County Chamber Of Commerce

Sba Info Including Paycheck Protection Program Bedford County Chamber Of Commerce

Paycheck Protection Program Loan Forgiveness

Paycheck Protection Program Loan Forgiveness

Paycheck Protection Program Sba Interim Final Rule Guidance For Borrowers Mcafee Taft

Paycheck Protection Program Sba Interim Final Rule Guidance For Borrowers Mcafee Taft

Do You Really Need That Business Checking Account Event Planning Event Planning Business Event Planning Career

Do You Really Need That Business Checking Account Event Planning Event Planning Business Event Planning Career

Sba Easing Forgiveness Of Paycheck Protection Program Loans Of 50 000 Or Less Loan Forgiveness Loan Business Journal

Sba Easing Forgiveness Of Paycheck Protection Program Loans Of 50 000 Or Less Loan Forgiveness Loan Business Journal

Sba Paycheck Protection Program Faqs

Sba Paycheck Protection Program Faqs

South Dakota S Paycheck Protection Program Loans Mapped And Listed

South Dakota S Paycheck Protection Program Loans Mapped And Listed

Required Documents Sba Paycheck Protection Program Synovus

Required Documents Sba Paycheck Protection Program Synovus

Paycheck Protection Program Loans New Sba Guidance Ko

Paycheck Protection Program Loans New Sba Guidance Ko

Post a Comment for "Sba Payment Protection Program Guidelines"