Pruwealth Plus Payment Term

Stage payment - Payment of agreed amounts at stage. Fulfill the dreams of the ones you hold dear.

Buying a life insurance is a long-term commitment.

Pruwealth plus payment term. Payer Security Plus Waiver of premiums for five years upon diagnosis of Early Stage Medical Conditions8 and allows a claim for a second time9. We at ICICI Prudential Life have made this simple and hassle-free for you. For policies of 5 years 10 years and 20 years premium payment term on an annual premium payment mode your capital guaranteed is after 15th year 18th year and 20th year respectively.

Choose from our host of convenient premium payment options. Customer helpline number - 1860 266 7766. Commonly invoice payment terms - or more simply payment terms - refers to when payment is due relative to the date in which goods or services were delivered or when an invoice for those goods or services was delivered.

Invoice payment terms are the contractually-agreed terms of payment between a business and a customer. The premium payment term for the spouse would be equal to the premium payment term of the base product and the Policyholder has to pay an additional premium for this cover. With PRU wealth gain plus you can receive a total guaranteed amount of up to 508 2 of the Basic Sum Assured by end of the policy term.

Hassle-free Application6 and Guaranteed Issuance. What are the Premium Payment Terms. Prudential PRUwealth SGD Rating on InterestGurusg.

One can also opt for the policy to mature when you are age 54 59 61 or 64. Start building a comfortable future for you and your family with PRUWealth Plus an investment-linked plan provides high coverage for death including accidental death and TPDWhats more PRUWealth Plus also provides extra coverage on fourteen different types of infectious disease and rewards you for your continuous stay with us with a loyalty. How Do I Enjoy Continuous Coverage up to age 100.

These are the payments terms that you and the buyer have agreed on. On top of that it covers. Waiver of premiums for 10 years10 upon diagnosis of Intermediate Stage Medical Conditions.

Adapts to your financial planning with choice of premium payment terms comes with a choice of 5 or 10 year premium payment terms whichever best suits your needs. The guaranteed surrender value plus non-guaranteed surrender value will be payable upon surrender after 36 months from the first premium due date and the premium had been paid for 36 months. 1Medical underwriting shall be waived if you purchase the basic plan only and the aggregate Basic Sum Assured per life for both PRUwealth gain and PRUwealth gain plus is RM300000 or less.

1MD - Monthly credit payment of a full months supply. Here are the ten most relevant invoicing and payment terms. Ground Floor Menara Prudential Persiaran TRX Barat 55188 Tun Razak Exchange Kuala Lumpur.

What is the impact of early surrender. PRUwealth SGD ensures that your capital remains intact in the long term after the 20th year while giving you potentially higher returns. You have the flexibility to control your premium payment terms of 5 years 10 years 20 years or throughout the policy term.

One can choose a premium payment term of 10 15 20 25 or 30 years for NTUC Income Endowment. PRUwealth also lets you take full control in adjusting your premium amount or making single premium top-ups. This way you can decide to save based on a premium payment term that suits you best.

Use any of these premium payment options to make sure your family is always secured. An early termination of the policy usually involves high costs and the. ICICI PruLife Towers 1089 Appasaheb Marathe Marg Prabhadevi Mumbai 400025.

Your capital is guaranteed after the 10th year for a single premium payment term. PRUWealth Plus Created to cushion the blow from the sudden loss of income due to death or Total and Permanent Disability PRUWealth Plus is a life insurance plan that helps a breadwinner leave a. Terms such as cost amount delivery payment method and when the payment is expected or due.

33 5 Prudential PRUwealth SGD Popularity on InterestGurusg. 2MD - Monthly credit payment of a full months supply plus an extra calendar month. There is no maturity or surrender benefit for the Spouse Cover and the No Claim Benefit is also not applicable under this option.

Choose to save with premium payment terms of 5 10 or 20 years based on one that suits you best. Allows for policy continuity With PRU wealth you have the option to appoint your loved one as a secondary life assured 5 so should the unforeseen occur the appointed secondary life assured can help to continue wealth accumulation 6 to give your next generation a head start in their future endeavours. Choose Your Premium Payment Term Tailor your premium payment terms to your needs and choose between single premium term or regular premium payment term of 5 10 or 20 years.

These are also the essential components of any invoice. To continue receiving policy benefits it is important that you pay your premium regularly and on time. Option to pass on the policy for wealth accumulation.

Contra - Payment from the customer offset against the value of supplies purchased from the customer. Total and permanent disability TPD and death benefit. Prudential PRUwealth SGD product details.

Pruwealth Gain Plus Uob Malaysia

Pruwealth Gain Plus Uob Malaysia

Prudential Pruwealth Ii Review Grow Your Wealth With Withdrawals

Prudential Pruwealth Ii Review Grow Your Wealth With Withdrawals

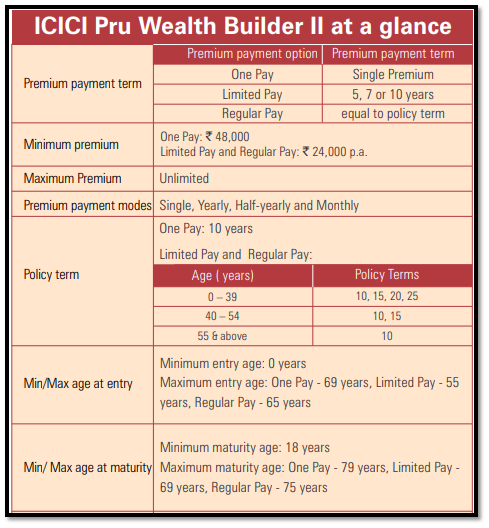

Icici Pru Wealth Builder Ii Plan Review 2021 Expert S Insights

Icici Pru Wealth Builder Ii Plan Review 2021 Expert S Insights

Pruwealth Plus Leaving A Legacy To Protect Your Family S Future Free Malaysia Today Fmt

Pruwealth Plus Leaving A Legacy To Protect Your Family S Future Free Malaysia Today Fmt

Does Your Family Have Enough Savings In Case Of An Emergency

Does Your Family Have Enough Savings In Case Of An Emergency

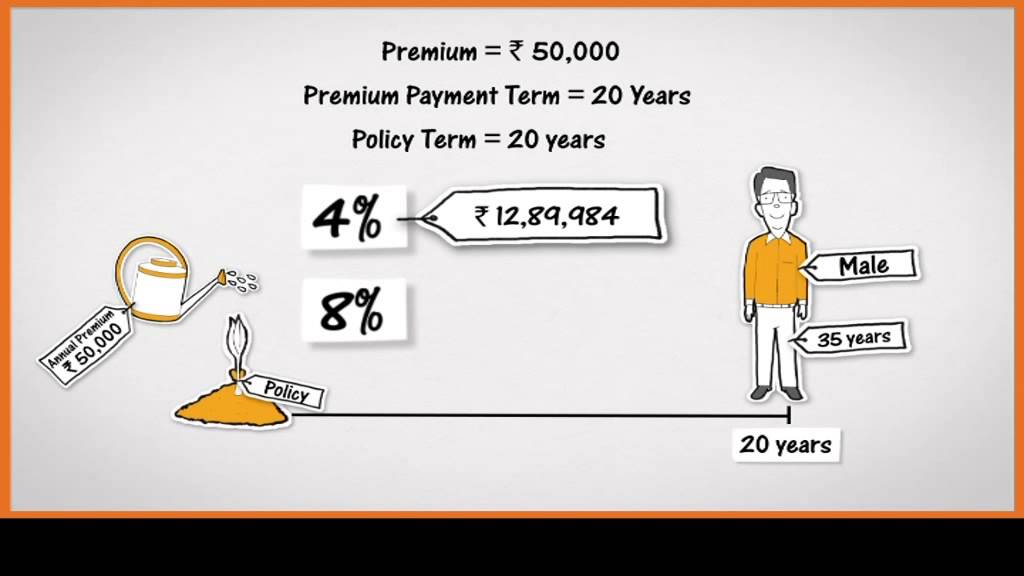

Icici Pru Wealth Builder Ii Youtube

Icici Pru Wealth Builder Ii Youtube

Https Www Prudential Com My Export Sites Prudential Pamb Galleries Pdf En Leaflet Pruwealth Max Pdf

Https Www Prudential Com My En Galleries Pdf 16219 Prubest Gift Eflyer Eng Address Update Fa Pdf

Pruwealth And Manulife Readybuilder Not For Retirement

Pruwealth And Manulife Readybuilder Not For Retirement

Pruwealth Insurance Savings Plan Standard Chartered Singapore

Pruwealth Insurance Savings Plan Standard Chartered Singapore

Smart Investment With Ulip Plans How To Plan Investing Best Investments

Smart Investment With Ulip Plans How To Plan Investing Best Investments

What S The Difference Between An Insurance Savings Plan For Retirement As Compared To Relying Solely On Cpf Sa And Srs Seedly

What S The Difference Between An Insurance Savings Plan For Retirement As Compared To Relying Solely On Cpf Sa And Srs Seedly

Anyone With Pruwealth And What Are Your Thoughts Www Hardwarezone Com Sg

Pru Wealth Plan Prudential Life Insurance Ghana

Pru Wealth Plan Prudential Life Insurance Ghana

Post a Comment for "Pruwealth Plus Payment Term"