Payment Terms For Ppp Loan

PPP loan forgiveness can be up to the full principal amount of the loan and any accrued interest. Changes to PPP Loan forgiveness.

Ppp Loan Forgiveness Guidance For Employers

Ppp Loan Forgiveness Guidance For Employers

With a 1 interest rate and loan.

Payment terms for ppp loan. 100 basis points or 1 calculated on a non-adjustable non-compounding. If a borrowers PPP loan is disbursed on June 25 2020 the 24-week period ends on December 10 2020. PPP loans will generally be guaranteed under the same terms conditions and processes as other 7a loans though there are changes including but not limited to.

Borrowers can receive two and a half times their average monthly payroll costs excluding compensation in excess of 100000 per employee incurred 12 months before the date the loan is made some lenders are simply using 2019 numbers. Neither collateral nor guarantor is required to qualify for the loan. This is determined by the time the amount was disbursed.

In other words you wont have to begin repaying the loan right away. PPP loan amount using net p payroll costs are computed using line 31 net profit amount limited to 100000 plus any eligible payroll costs for rofit employees to calculateloan amount using gross income see SBA Form 2483 -C. 1 interest rate Maturity of 5 years meaning the full amount of non-forgiven principal and any interest is due in 5 years previously 2 years.

Terms for a PPP Loan The paycheck protection program loan attracts an interest of 1 Two to five years repayment period. The new forgiveness process for these loans doesnt require you to submit documentation at the time of your applicationand only requires you to complete a 1-page form. Any PPP loan amount not forgiven at the end of the 24-week covered period would be subject to five-year repayment terms with 1 interest.

If your loan is forgiven any interest accrued during the deferral period is eligible for forgiveness. The Rules provide the following example. For some businesses that scenarioreceiving at most partial loan forgivenessisnt a bad thing.

If your PPP Loan was 150000 or less your loan forgiveness is now even easier. If you have previously received a PPP loan certain businesses are eligible for a Second Draw PPP Loan. All loan terms will be the same for everyone.

For Applicants that are partnerships payroll costs are computed using. The FAQ states that the promissory note for the PPP loan will state the term of the loan. The PPP loan will accrue interest at an annual rate of 1.

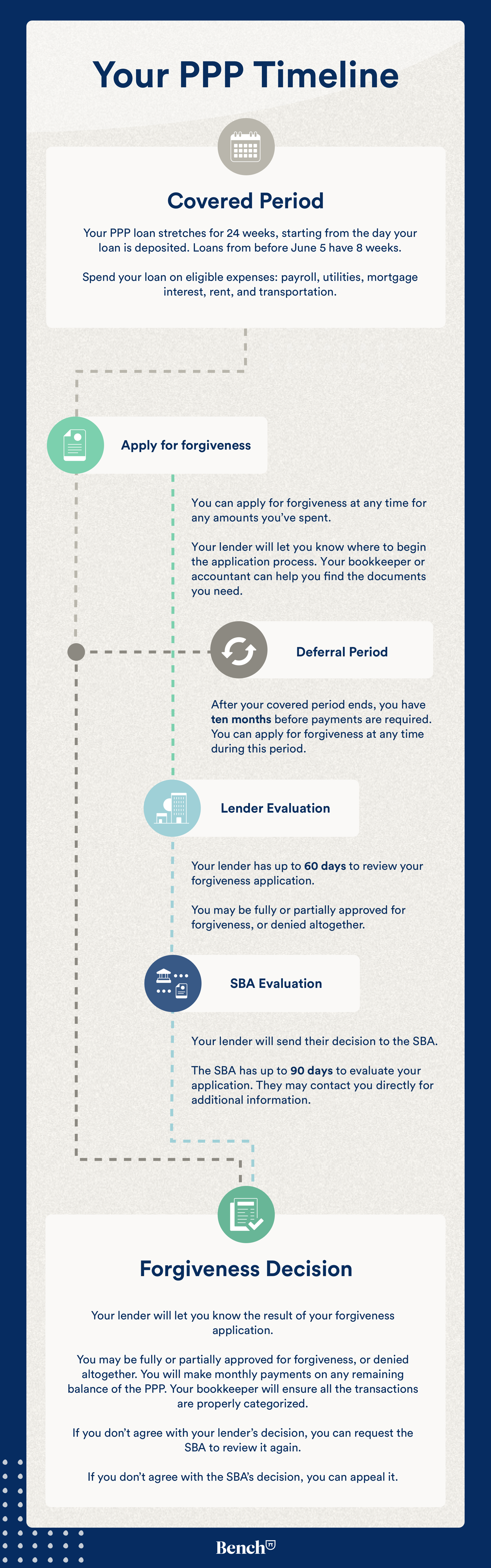

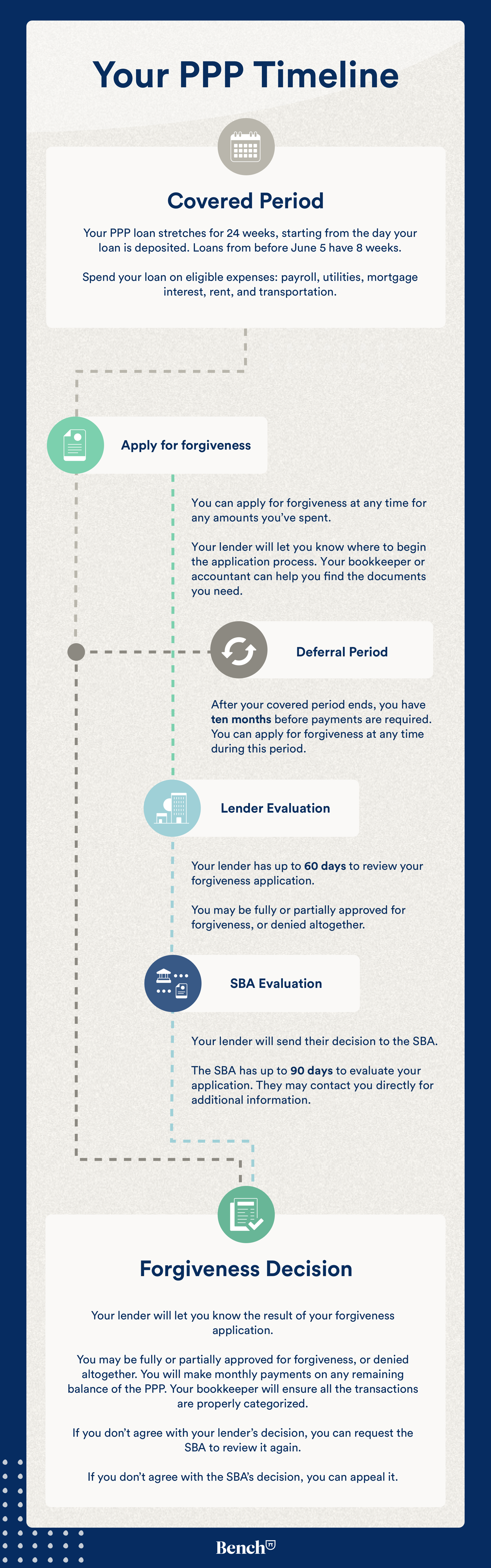

The loan amounts will be forgiven as long as. No payment is due during the deferral period which ends the earlier of. All PPP loans have 10 months of deferred payments.

An SBA-backed loan that helps businesses keep their workforce employed during the Coronavirus COVID-19 crisis. An eligible borrower will not be responsible for any loan payment if the borrower uses all of the loan proceeds for forgivable purposes and employee and compensation levels are maintained or if not an applicable safe harbor or exemption applies. If the borrower does not submit a loan forgiveness application to its lender by October 10 2021 the borrower must begin making payments on or after October 10 2021 Loan Forgiveness.

If a PPP loan received an SBA loan number before June 5 2020 the loan has a two-year maturity unless the borrower and lender mutually agree to extend the term of the loan to five years. Terms of a PPP Loan The governments efforts to help businesses have resulted in generous terms for PPP loans. The US Small Business Administration released guidance Wednesday clarifying that lenders must recognize the previously established extended deferral period for payments on the principal interest and fees on all Paycheck Protection Program PPP loans even if the executed promissory note indicates only a six-month deferral.

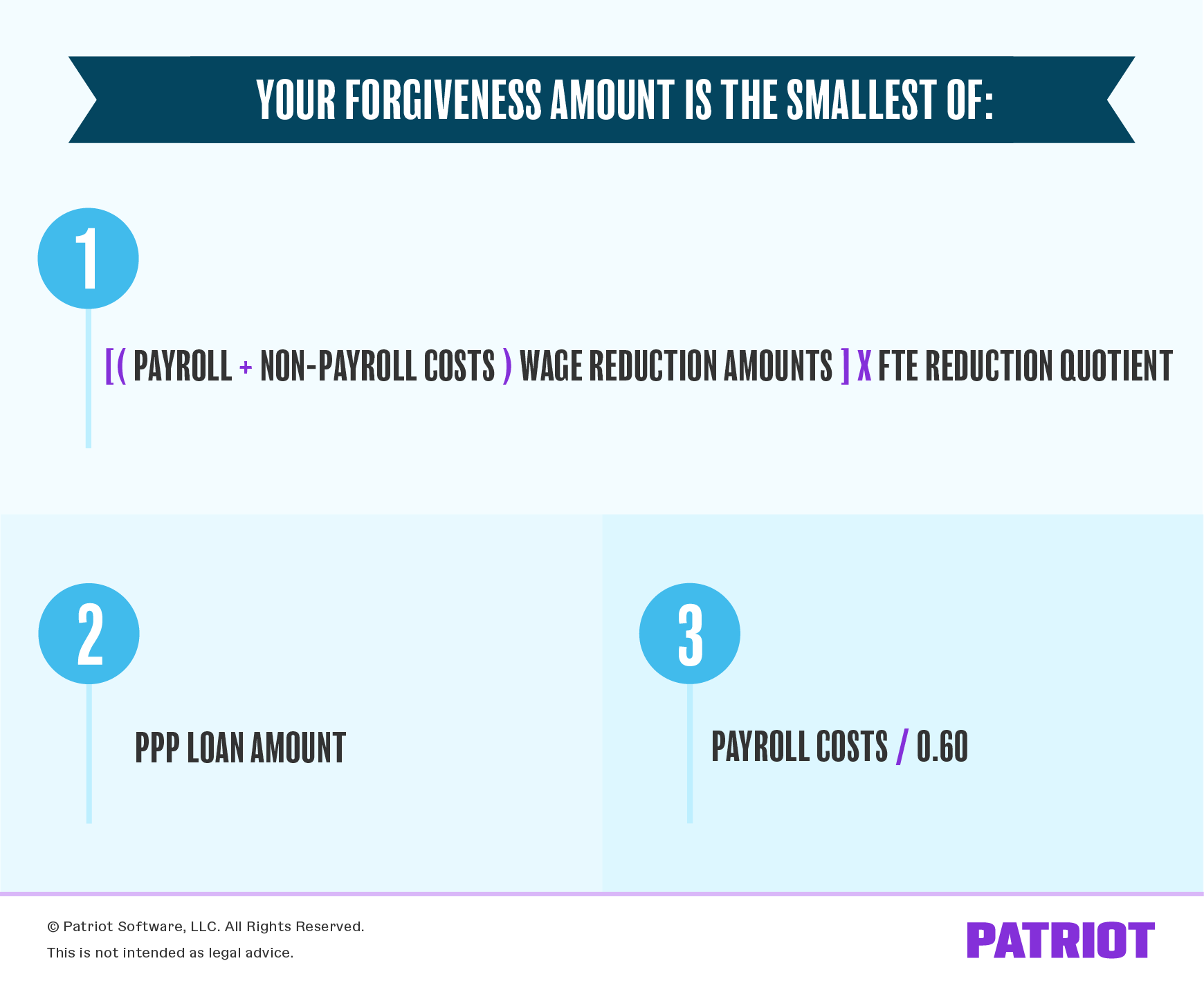

According to a Fox Business report the Paycheck Protection Program Flexibility Act PPPFA allows loan recipients to use up to 40 of their loans proceeds for certain expenses unrelated to payroll specifically rent mortgage interest and utilities without jeopardizing their eligibility for full loan forgiveness provided they use the remainder for payroll expenses. 10 months after the last day of your covered period if you have not applied for forgiveness. The loan proceeds are used to cover payroll costs and most mortgage interest rent and.

After the 10-month period your PPP loan would fully amortize over the remaining 50 months. Thats because the terms of PPP loans are incredibly generous. No penalty for prepayment Payment can be deferred.

The date when the SBA remits the amount of forgiveness on your loan. No collateral or personal guarantees will be required. The original promissory note indicated a six-month deferral for payments on the principal interest and fees on all PPP loans but the Flexibility Act of 2020 extended the deferral period to either the date the SBA remits the borrowers loan forgiveness amount to the lender or if the borrower does no apply for loan forgiveness 10 months after the end of the borrowers loan forgiveness period.

The Paycheck Protection Program PPP authorizes up to 349 billion in forgivable loans to small businesses to pay their employees during the COVID-19 crisis.

Ppp Forgiveness Calculation How To Calculate Loan Forgiveness

Ppp Forgiveness Calculation How To Calculate Loan Forgiveness

Paycheck Protection Program Round 2 Knowns Unknowns Rkl Llp

Paycheck Protection Program Round 2 Knowns Unknowns Rkl Llp

When Can I Submit My Ppp Loan Forgiveness Application Bench Accounting

When Can I Submit My Ppp Loan Forgiveness Application Bench Accounting

Paycheck Protection Program Loan Forgiveness Application Https Www Dentaltown Com Messageboard Th In 2020 Loan Forgiveness Forgiveness Loan

Paycheck Protection Program Loan Forgiveness Application Https Www Dentaltown Com Messageboard Th In 2020 Loan Forgiveness Forgiveness Loan

Ppp Loan Program Extended Loan Data Released What Small Businesses Need To Know

Ppp Loan Program Extended Loan Data Released What Small Businesses Need To Know

How Ppp Loan Forgiveness Works For The Self Employed Bench Accounting

How Ppp Loan Forgiveness Works For The Self Employed Bench Accounting

Us Covid 19 How To Bookkeep Your Ppp Loan Help Center

Us Covid 19 How To Bookkeep Your Ppp Loan Help Center

Ppp Loan Forgiveness Application And Instructions Released By Sba Current Federal Tax Developments

Ppp Loan Forgiveness Application And Instructions Released By Sba Current Federal Tax Developments

Pin On Paycheck Protection Program

Pin On Paycheck Protection Program

Everything You Need To Know About Ppp Loans In 2021 Funding Circle

Everything You Need To Know About Ppp Loans In 2021 Funding Circle

Post a Comment for "Payment Terms For Ppp Loan"