Payment Mode Letter Of Credit

Draw must mirror terms of letter of credit and comply with requirements for time place and mode of presentation or issuer is not required to honor. Confirmed or Unconfirmed When a Letter of Credit is advised to you by your local banker the bank is telling you.

How To Draft A Late Payment Letter About Credit Card Download This Late Payment Letter About Credit Card Template No Bill Template Lettering Business Template

How To Draft A Late Payment Letter About Credit Card Download This Late Payment Letter About Credit Card Template No Bill Template Lettering Business Template

Make sure you state explicitly what the payment is for or what paymenttransaction the letter is in regard to.

Payment mode letter of credit. If the buyer cant pay up due to the agreed contract through the Letter of Credit the bank will cover the remaining price. This provides security when the buyer and seller are in different countries. LCs help to ensure that the person on the other side of the deal performs specific actions.

An irrevocable letter of credit ILOC is a guarantee for payment issued by a bank for goods and services purchased which cannot be cancelled during some specified time period. The buyers bank gives a written commitment to the seller called a Letter of Credit. Governing Law for Letters of Credit 1.

The Standby Letter of Credit SBLC is a guarantee issued by the importers bank in favor of the exporter for an amount agreed at the signing of the commercial contract. What that means is that in a LC transaction the payment from a bank to the sellerexporter is conditional upon the ability of the seller to generate the documents that are requested by the buyerimporter in the letter of credit. When the buyer isnt able to pay in time their bank must make the payment.

The same operation can of money transfer be performed through the mail. 60 days Bill of Lading date this is referred to as a term usance or deferred payment Letter of Credit. Its economic effect is to introduce a bank as an underwriter where it assumes the counte.

Agreement to pay under certain conditions. Letters of credit are tools for payment separate from a purchase or sales agreement. Letter of credit at sight payment is among the fastest modes of payment for the sellers.

Letters of credit are used extensively in the financing of international trade where the reliability of contracting parties cannot be readily and easily determined. It is an. Be straightforward and polite.

A letter of credit is an instrument from a bank which guarantees a buyers payment to a seller if certain criteria are met. Letters of credit can also protect buyers. A letter of credit is a communication from a buyers bank to guarantee a supplier payment for goods supplied or services rendered.

The performance of the sellerexporter is tied to the documents requested in the letter of credit. For example invoices not timely paid or other default in payment. Include all relevant information such as the parties involved dates of payments and amounts due or guaranteed.

Funds are received from the importer and remitted to the exporter through the banks involved in the collection in exchange for those documents. Alternatively if payment is to be made at a future date ie. The letter is mostly used in international trade as a surety that a supplier will receive payment.

It provides a guarantee to the exporter that if due to any circumstances the importer is unable to pay then the bank will make the payment. Issuing Bankss Risks in Letters of Credit. Letters of Credit are fundamental components of international trade.

Standby Letter of Credit. A letter of credit or credit letter is a letter from a bank guaranteeing that a buyers payment to a seller will be received on time and for the correct amount. Once this acceptance is received the bank can release the documents to the buyer.

A letter of credit also known as a documentary credit or bankers commercial credit or letter of undertaking is a payment mechanism used in international trade to provide an economic guarantee from a creditworthy bank to an exporter of goods. In this mode of payment the payer deposits the cash in the bank which has a branch in the payees town once the cash is deposited by the payer the payees bank is informed telegraphically and asked to make payment in the payees account. Issuing bank is the entity which gives the main conditional payment guarantee to the beneficiary.

If you pay somebody to provide a product or service and they fail to deliver you might be able to get paid using a standby letter of credit. Letter of credit Documentary Credit refers to a written undertaking made by the importers bank to the exporter that the payment shall be made to him provided the shipment is sent by him in strict compliance with the term and conditions of the export contact. This is a safe and common international trade payment mechanism.

LC at Sight Payment Terms. Banks guarantee payment and hold onto the money until it can be proven that those requirements are satisfied. In the event that the buyer is.

Documentary credits also known as letters of credit are one of the payment methods in international trade. Under LC at sight payment the sellerexporter receives the payment within 7 to 10 days on fulfilling the conditions of the letter of credit. Referred to as a sight Letter of Credit.

If a buyer fails to pay a seller the bank that issued a letter of credit must pay the seller as long as the seller meets all of the requirements in the letter. In this mode the buyer accepts the time draft and makes a promise to pay. Like LC at sight payment there are various other types of LC.

As a result issuing bank is more vulnerable to the risks in letters of credit transactions than any other parties involved.

Late Payment Letter Debt Recovery Letter Overdue Payment Letter Lettering Debt Recovery Sample Resume

Late Payment Letter Debt Recovery Letter Overdue Payment Letter Lettering Debt Recovery Sample Resume

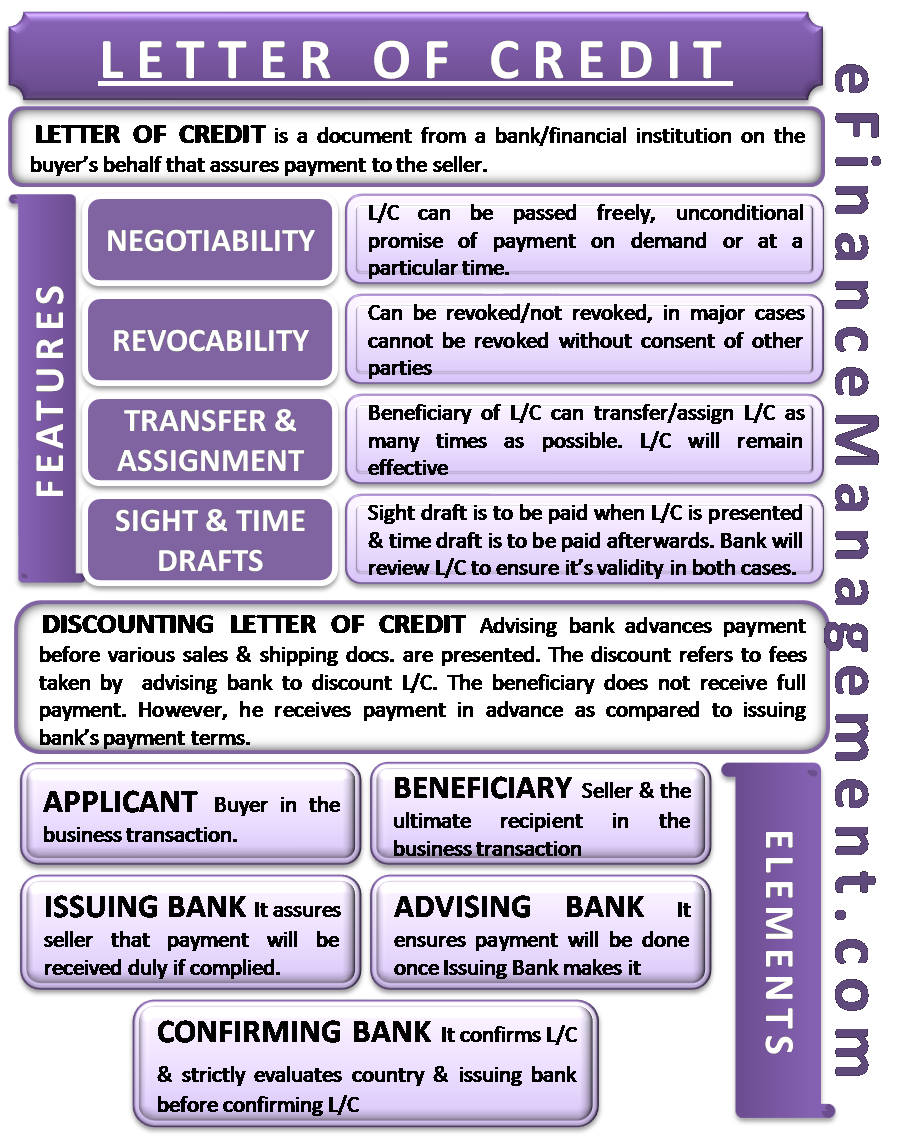

Letter Of Credit Definition Features Elements Discounting More Efm

Letter Of Credit Definition Features Elements Discounting More Efm

Resignation Letter Format 5 Resignation Letter Format Resignation Letter Word Template

Resignation Letter Format 5 Resignation Letter Format Resignation Letter Word Template

Payment Plan Letter Template In 2021 Letter Writing Template Letter Templates Payment Agreement

Payment Plan Letter Template In 2021 Letter Writing Template Letter Templates Payment Agreement

How To Distinguish Sight L C And Usance L C Types Of Letter Of Credit Types Of Lettering Lettering Business Solutions

How To Distinguish Sight L C And Usance L C Types Of Letter Of Credit Types Of Lettering Lettering Business Solutions

Infographics Letter Of Credit Vs Bank Guarantee Mt700 Vs Mt760 Trade Finance Finance Lettering

Infographics Letter Of Credit Vs Bank Guarantee Mt700 Vs Mt760 Trade Finance Finance Lettering

Pin By Legalraasta Simplifying Your On Use Letter Of Credit Loc As Payment Mode For Import Export Transactions Lettering Learning Credit Market

Pin By Legalraasta Simplifying Your On Use Letter Of Credit Loc As Payment Mode For Import Export Transactions Lettering Learning Credit Market

How To Draft A Delay Payment Reminder Letter To Client Download This Payment Delay Letter To Resignation Letter Sample Resignation Template Resignation Letter

How To Draft A Delay Payment Reminder Letter To Client Download This Payment Delay Letter To Resignation Letter Sample Resignation Template Resignation Letter

Infographics Difference Between Lc And Sblc Infographic Lettering Trade Finance

Infographics Difference Between Lc And Sblc Infographic Lettering Trade Finance

Letter Of Credit Example Pdf Template Document Lettering Letter Sample Memo Format

Letter Of Credit Example Pdf Template Document Lettering Letter Sample Memo Format

New Debt Validation Letter Sample Download Https Letterbuis Com New Debt Validation Letter Sample Downl Credit Repair Letters Lettering Dispute Credit Report

New Debt Validation Letter Sample Download Https Letterbuis Com New Debt Validation Letter Sample Downl Credit Repair Letters Lettering Dispute Credit Report

Get Our Free 30 Day Cancellation Notice Template Letter Templates Lettering Letter Templates Free

Get Our Free 30 Day Cancellation Notice Template Letter Templates Lettering Letter Templates Free

Credit Card Authorization Form Credit Letter Pack Of 5 Premium Printable Templates Lettering Credit Card Letter Templates

Credit Card Authorization Form Credit Letter Pack Of 5 Premium Printable Templates Lettering Credit Card Letter Templates

Letters Of Credit And Bills Of Lading In Commercial Transactions The Geography Of Transport Systems

Letters Of Credit And Bills Of Lading In Commercial Transactions The Geography Of Transport Systems

Sample Notice Cancellation Letter Free Documents Pdf Word For Service

Sample Notice Cancellation Letter Free Documents Pdf Word For Service

Download Payment Agreement For Free Tidyform Credit Card Payoff Plan Car Payment Paying Off Credit Cards

Download Payment Agreement For Free Tidyform Credit Card Payoff Plan Car Payment Paying Off Credit Cards

Download Credit Reference Letter Reference Letter Lettering Reference Letter Template

Download Credit Reference Letter Reference Letter Lettering Reference Letter Template

Credit Card Receipt Template Fresh 11 Credit Payment Receipt Template Sampletemplatess Santa Letter Template Receipt Template Templates

Credit Card Receipt Template Fresh 11 Credit Payment Receipt Template Sampletemplatess Santa Letter Template Receipt Template Templates

Letter Of Credit Safe And Secure Mode For International Payment Lettering Banking Services Risk Management

Letter Of Credit Safe And Secure Mode For International Payment Lettering Banking Services Risk Management

Post a Comment for "Payment Mode Letter Of Credit"