Paycheck Protection Program Out Of Money Again

Search for lenders in your area. By The Associated Press NEW YORK The governments lending program for small businesses is on hold.

U S Paycheck Protection Program Is A Mess Here S How We Know Barron S

U S Paycheck Protection Program Is A Mess Here S How We Know Barron S

Small business has been.

Paycheck protection program out of money again. Many lenders had been processing backlogs of small-business loan applications since the programs initial 350 billion had run dry. The SBA released a trove of data about the Paycheck Protection Program including the names of companies that received larger loans. The amount of funds currently available is 284.

The Paycheck Protection Program was enacted as part of the Coronavirus Aid Relief and Economic Security Act CARES Act. In total 22969. All of the Paycheck Protection Programs original 349 billion was allocated between April 3 and April 16 2020.

Msn back to msn home money powered by Microsoft News. This looks to be a promising opportunity for small business owners and the self-employed to recoup some of the damages inflicted by the economic and social effects of COVID-19 and the subsequent government. But that Paycheck Protection Program money has now been spent at many restaurants leaving them in the same precarious position they were in during outbreaks early days.

The SBA website reads that it is unable to accept new. CNBC reported that the Small Business Administration announced that the Paycheck Protection Program has officially run out of money. The most recent stimulus bill includes funding to restart the program through March 2021 for businesses that had not previously participated.

If you were rejected in the first round or didnt receive funds you have a chance to apply again for an initial PPP loan. But when it runs out of money in a hurry again move on to the next opportunity. News 5 found 76 of the 1848 billion in Paycheck Protection Program loans disbursed to Ohio businesses went to only 155 of the states 147868 loan recipients.

The Consolidated Appropriations Act 2021 CAA extends the Paycheck Protection Program PPP through March 31 2021 or until funds are depleted. In making the announcement the agencys administrator at the time Jovita Carranza hailed the program for serving as an economic lifeline to millions of small businesses. Get matched with a lender.

The Small Business Administration stopped accepting new PPP applications on April 16 2020. The Small Business Administration said Thursday that it reached the 349 billion lending limit. Funding for the Paycheck Protection Program the federal governments big initiative to aid small businesses and their employees during the coronavirus lockdown appeared ready to run out of cash.

Heres how we make money. Already one of the largest federal aid efforts ever the SBA reopened the Paycheck Protection Program last month with a new infusion of nearly 300 billion. On Friday April 24 President Trump signed into law a new bill providing a much needed additional 310 billion into the Paycheck Protection Program PPP created under the CARES Act Coronavirus.

A new round of Paycheck Protection Program money will start becoming available to select lenders and borrowers on Monday according to senior administration officials. The Paycheck Protection Program PPP is part of the national response to the economic impact of COVID-19. The 349 billion Paycheck Protection Program was completely depleted after just 13 days in operation as Democrats in Congress refused to allow a general extension of funding without approving.

Right now for small business the focus should be on the Paycheck Protection Program. The Paycheck Protection Program PPP provides loans to help businesses keep their workforce employed during the Coronavirus COVID-19 crisis. Borrowers may be eligible for PPP loan forgiveness.

I f youre like me and you run a small business you could qualify for the Paycheck Protection Program PPP. April 28 2020 To say Mondays reopening of the Paycheck Protection Program PPP portal was hotly anticipated may understate it. President Joe Biden announced several revisions Monday to the Paycheck Protection Program which Congress approved last year as part of a nearly 2 trillion COVID-19 relief bill.

It started in April 2020 and after two rounds of funding and one extension continued through the first week of August.

The Paycheck Protection Program Ran Out Of Funding What S Next For Small Business Owners

The Paycheck Protection Program Ran Out Of Funding What S Next For Small Business Owners

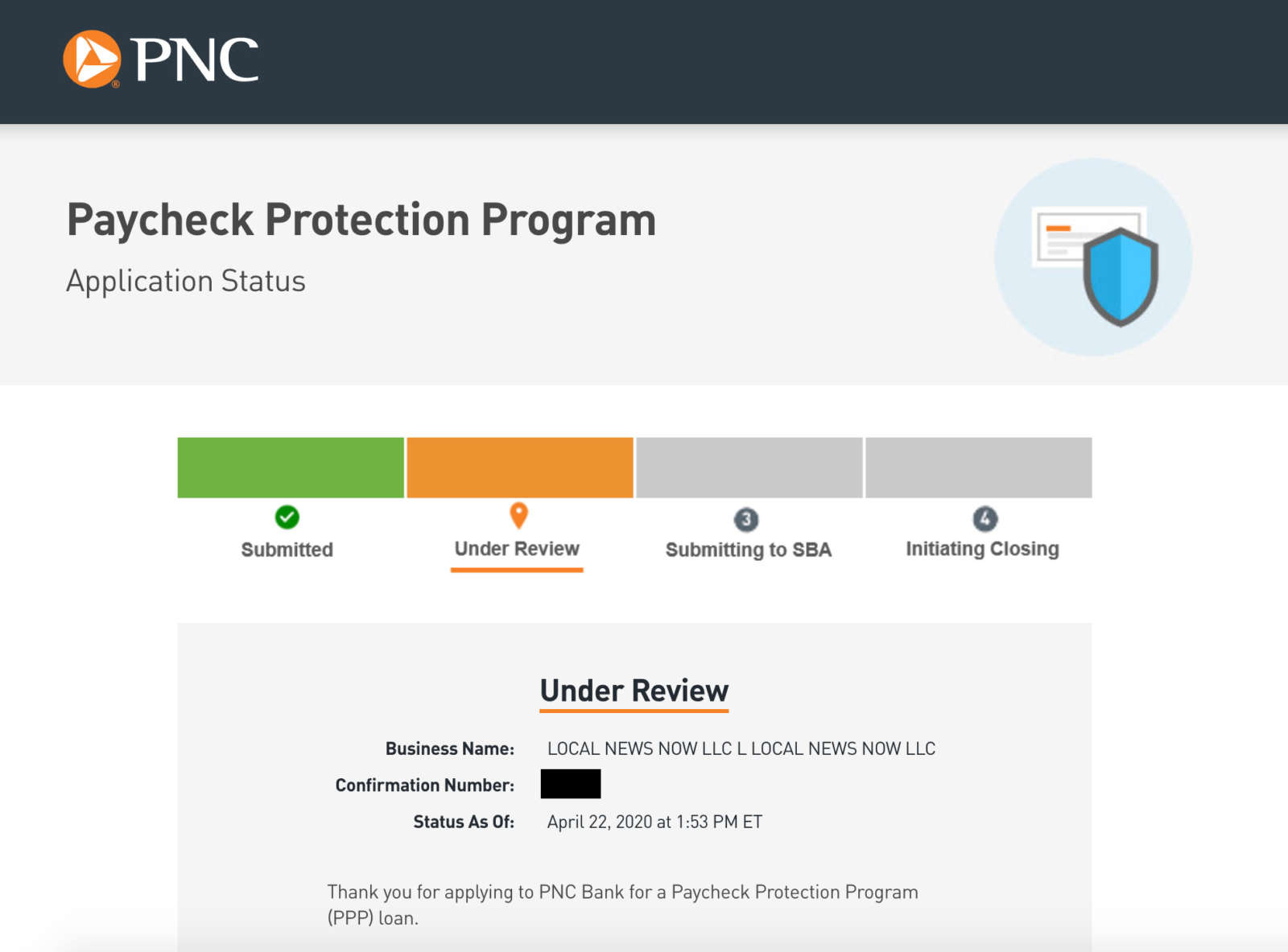

Arlnow S Experience Applying For A Paycheck Protection Program Loan Arlnow Com

Arlnow S Experience Applying For A Paycheck Protection Program Loan Arlnow Com

How To Have Your Paycheck Protection Program Loan Forgiven

How To Have Your Paycheck Protection Program Loan Forgiven

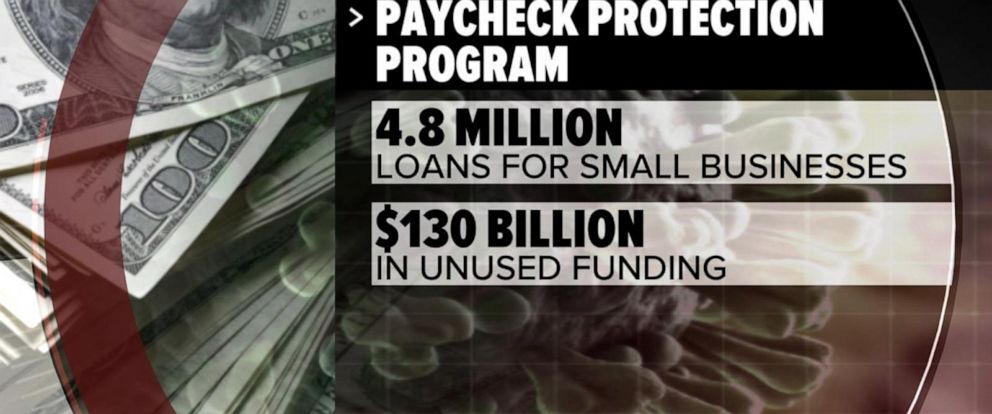

Congress Extends Paycheck Protection Program Billions Remain Available Abc News

Congress Extends Paycheck Protection Program Billions Remain Available Abc News

Paycheck Protection Program How It Works Funding Circle

Paycheck Protection Program How It Works Funding Circle

Apply Now To Get New Money From The Paycheck Protection Program Ppp Tom Copeland S Taking Care Of Business

Apply Now To Get New Money From The Paycheck Protection Program Ppp Tom Copeland S Taking Care Of Business

You Need To Change Your Thinking Paycheck Protection Program Ppp

You Need To Change Your Thinking Paycheck Protection Program Ppp

How The Upcoming Round Of The Paycheck Protection Program Ppp Works

How The Upcoming Round Of The Paycheck Protection Program Ppp Works

Ppp 2 0 Paycheck Protection Program Round 2 Shield Agency

Ppp 2 0 Paycheck Protection Program Round 2 Shield Agency

Paycheck Protection Program Wcg Cpas

Paycheck Protection Program Wcg Cpas

You Re Approved For Payroll Protection Program Loan Funds Now What Workest

You Re Approved For Payroll Protection Program Loan Funds Now What Workest

A Complete Guide To The Paycheck Protection Program Rapid Finance

A Complete Guide To The Paycheck Protection Program Rapid Finance

Paycheck Protection Program Use Of Funds Forgiveness Documentation

Paycheck Protection Program Use Of Funds Forgiveness Documentation

White House Says Small Business Loan Program For Coronavirus Impacted Firms Is Out Of Money The Washington Post

Ppp Round 2 Frequently Asked Questions

Ppp Round 2 Frequently Asked Questions

Post a Comment for "Paycheck Protection Program Out Of Money Again"