Irs Payment Plan Security Clearance

You stand a good chance of losing your clearance or being denied a clearance if you havent done so. Whenever people apply for security clearance they are required to fill out and submit a 120-page Questionnaire for National Security Positions for the US.

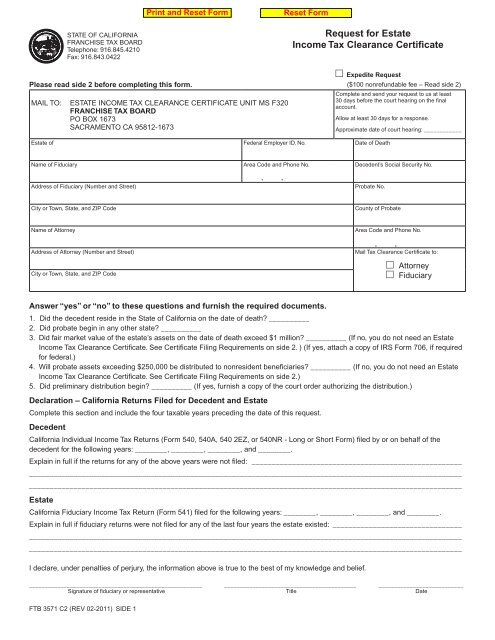

Ftb 3571 Request For Estate Income Tax Clearance Certificate

Ftb 3571 Request For Estate Income Tax Clearance Certificate

A payment plan is an agreement with the IRS to pay the taxes you owe within an extended timeframe.

Irs payment plan security clearance. Payments Internal Revenue Service. Under that plan he will pay 4731 per month for 36 months to fulfill the outstanding balance of 153619. Security clearance holders are held to a higher standard and therefore are expected to know whether or not they owe debts to any creditors.

A security clearance is a precious jewel granted by the federal government and you have to care for it every day no sloppy missteps. Again it comes down to a matter of trust. FS-2020-10 July 2020 Taxpayers have a variety of options to consider when paying federal taxes.

Many articles on this site discuss delinquent debt as it affects security clearances most notably Tax Debt Plagues Clearance Holders which reports that 8400 federal employees holding security clearances had delinquent tax obligations. This is a. If you are looking to file a chapter 13 bankruptcy you can even pay back any back tax that is owed as part of your chapter 13 plan.

Penalties and interest may apply to money you owe after the due date. Whether you owe taxes or simply have failed to file an income tax return even if youre due a refund IRS problems can cost you your security clearance. Financial issues can be mitigated provided the individual takes the appropriate steps.

Security training is also required if your work is 50 percent or more related to the Federal Information Security Act FISMA. More Than 8000 Individuals Eligible for Security Clearances Owe about 85 Million in Federal Taxes. He was denied a security clearance and appealed that decision.

Note that Applicant appeared pro se during the DOHA proceedings meaning he represented himself. If you work in more than one position then you must complete the greater number of security training hours between the different positions. The critical elements are that the individual has both established a payment plan on the tax lien as well as taking reasonable steps on the credit card debt.

Just prior to his appeal the applicant entered into an installment payment plan with his state in which he agreed to pay his past-due state income taxes. You must complete training outside the IRS. The GAO report did not include those individuals who are granted security clearances by non-DOD entities such as those within the intelligence community.

Pay your taxes view your account or apply for a payment plan with the IRS. This year in response to the COVID-19 pandemic the filing deadline and tax payment due date was postponed from April 15 to July 15 2020. At the IRS that determination is related specifically to the individuals need for access to classified information also referred to as a need for a security clearance or eligibility to hold a sensitive position.

One would expect the security clearance population to be more law abiding on average than the general public GAO was able to prepare its estimate by matching Social Security numbers from the IRS Unpaid Assessment database with Defenses database of security clearances the Joint Personnel Adjudication System. About Half Are on Payment Plans with the IRS 15 Federal Agencies Have Mechanisms to Detect Tax Debt but Opportunities Exist to Strengthen Detection Capabilities 17 Conclusions 27 Recommendation for Executive Action 28. If you owe delinquent debt to a creditor you obviously want to try to pay this off before your background investigation.

If you qualify for a short-term payment plan you will not be liable for a user fee. If you owe the IRS or the state any money work out a WRITTEN payment plan that you absolutely commit to and follow through on so that you can provide perfect proof of a payment to the government if your clearance is called into question. Of those 83000 according to the IRS 34000 had an active payment plan in place.

Then once ALL of your returns are filed and if you owe taxes pay it or work out a payment plan with the taxing authorities. After they submit this form the applicants are put through a rigorous background check that uncovers whether or not people owe money to the government. Pay off your debt or have a payment plan in place.

The employees -- who either retain or are deemed qualified for secret top secret or interim security clearances -- owe anywhere from 100 to millions of dollars per taxpayer with a median of. If you dont your security clearance will be in GREAT jeopardy. You should request a payment plan if you believe you will be able to pay your taxes in full within the extended time frame.

Audit Clearance Letter Sample Top Ten Fantastic Experience Of This Year S Audit Clearance Le Letter Example Lettering Letter Sample

Audit Clearance Letter Sample Top Ten Fantastic Experience Of This Year S Audit Clearance Le Letter Example Lettering Letter Sample

Tj Maxx Bill Pay Login To Tjmaxx Tjx Com Payment Paying Bills Bills Paying

Tj Maxx Bill Pay Login To Tjmaxx Tjx Com Payment Paying Bills Bills Paying

List Of Relatives Covered Under Section 56 2 Of Income Tax Act 1961 Http Taxguru In Income Tax List Relatives Covered Under Secti Taxact Income Tax Income

List Of Relatives Covered Under Section 56 2 Of Income Tax Act 1961 Http Taxguru In Income Tax List Relatives Covered Under Secti Taxact Income Tax Income

Filing Taxes Security Clearance What Is The Link

Filing Taxes Security Clearance What Is The Link

Https Www Governmentattic Org 25docs Irs Eprg 2017 Pdf

9 4 2 Sources Of Information Internal Revenue Service

9 4 2 Sources Of Information Internal Revenue Service

Know These 3 Facts To Avoid Paying Half Your Retirement Income To The Irs December 11 2019 Retirement Savings Plan Retirement Income Retirement Portfolio

Know These 3 Facts To Avoid Paying Half Your Retirement Income To The Irs December 11 2019 Retirement Savings Plan Retirement Income Retirement Portfolio

25 6 1 Statute Of Limitations Processes And Procedures Internal Revenue Service

25 6 1 Statute Of Limitations Processes And Procedures Internal Revenue Service

Publication 957 01 2013 Reporting Back Pay And Special Wage Payments To The Social Security Administration Internal Revenue Service

Publication 957 01 2013 Reporting Back Pay And Special Wage Payments To The Social Security Administration Internal Revenue Service

For Clearance Holders Paying Delinquent Debt Isn T The Only Way Of Resolving It Clearancejobs

For Clearance Holders Paying Delinquent Debt Isn T The Only Way Of Resolving It Clearancejobs

Tax Audit Due Date For Ay 2016 17 And Things To Keep In Mind Online Taxes Tax State Tax

Tax Audit Due Date For Ay 2016 17 And Things To Keep In Mind Online Taxes Tax State Tax

The Impact Of Unfiled Tax Returns On Your Security Clearance

The Impact Of Unfiled Tax Returns On Your Security Clearance

Steps To Access Pan Card Details Online Online Cards Investing

Steps To Access Pan Card Details Online Online Cards Investing

Can Failing To File Taxes Lead To A Security Clearance Denial

Can Failing To File Taxes Lead To A Security Clearance Denial

4 75 16 Case Closing Procedures Internal Revenue Service

4 75 16 Case Closing Procedures Internal Revenue Service

Capability Statement Template Doc Unique Tech P Capability Statement Statement Template Statement Mission Statement Template

Capability Statement Template Doc Unique Tech P Capability Statement Statement Template Statement Mission Statement Template

3 10 72 Receiving Extracting And Sorting Internal Revenue Service

3 10 72 Receiving Extracting And Sorting Internal Revenue Service

Want That Clearance Failing To Pay Taxes Is Not Just A Matter Of Whether You Owe Money

Want That Clearance Failing To Pay Taxes Is Not Just A Matter Of Whether You Owe Money

Tax Clearance Certificates Department Of Taxation

Tax Clearance Certificates Department Of Taxation

Post a Comment for "Irs Payment Plan Security Clearance"