Irs Payment Plan Affect Credit Score

An IRS tax lien can compromise credit as much as a bankruptcy or judgment. The way you pay the IRS may impact your credit Paying the IRS on time doesnt automatically benefit your credit unlike other types of payments to your credit card or mortgage for example.

How Do Taxes Affect Credit Score Credit Com

How Do Taxes Affect Credit Score Credit Com

Will my credit scores be affected by the IRS Installment Agreements absolutely not.

Irs payment plan affect credit score. There are other ways unpaid taxes could hurt your credit score which is why you should carefully consider your payment options. Outstanding taxes do not appear on your credit report so if you owe the IRS you can breathe easy as far as your credit is concerned. While a payment plan with the IRS in and of itself will not negatively impact your credit not paying what you owe the government.

Its only when you fail to pay what you owe in a timely manner that your credit score can be affected. Effects on Credit Report The installment plan in and of itself will not harm a credit rating. However if by any chance the money you owe to the IRS exceeds 10000 then they might file a Federal Tax Lien on you and that is a public declaration.

The IRS recognizes consumer needs. Not everyone will receive a tax lien but anyone the IRS feels is a risky investment could receive one. Luckily despite the penalties and interests adhering to an IRS payment plan will not affect your credit score.

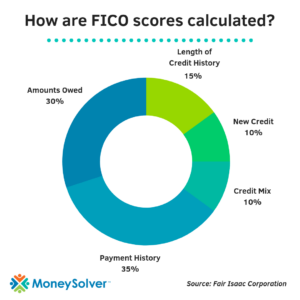

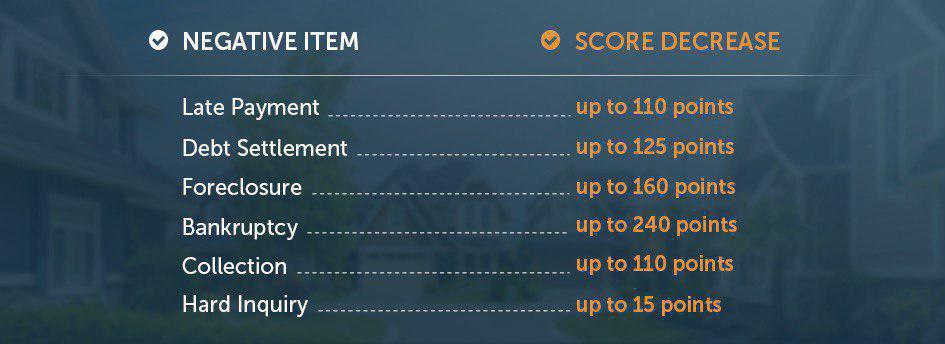

However failing to pay your taxes or filing a late tax return can easily turn a good credit score into a bad one because the IRS can place a tax lien against you. The Fair Isaac Corporation the group behind the FICO score the most common type of credit score gives a scenario in which a person with a 680 credit score who already has one late payment on. But while your overdue taxes wont hurt your credit score the IRS charges interest and penalties on back taxes and these costs can snowball quickly.

The only way it would affect your credit is if you fool around and default on your agreement. Work with Our Team for The Right Installment Agreement. It can reap havoc on your credit score dropping it as much as 200 points or more.

Do IRS Payment Plans Affect Your Credit. Do IRS Payment Plans Affect Your Credit. The installment agreement wont impact your FICO credit scoreits an installment agreement not a loan.

One way to avoid a tax lien or other collection action is to establish a payment plan with the IRS when you receive a tax bill. So if youre struggling to pay the tax you owe the worst thing you can do is avoid it. However if the IRS files a tax lien against someones property his credit will take a hit.

Then you open yourself to levies and possibly a federal tax lien. However as we stated above if the IRS files a Federal Tax Lien your creditors would be able to see it. Unlike other debts the IRS installment plan payments will not be reported to the credit bureaus so that aspect of the lien will not impact your credit.

Negotiating an installment agreement or an offer in compromise OIC with the IRS is one of the best ways to prevent tax liens and its always better to start this process sooner rather than later. Federal Tax Liens are filed in offices of public record. A tax lien stays on your credit report for years and unlike other debts you wont be able to get rid of it through bankruptcy.

An installment agreement to pay your back taxes will not negatively affect your credit. IRS installment agreements are not reported to the credit reporting agencies. Agreeing to pay a tax bill via an installment agreement with the IRS doesnt affect your credit.

What if I cant pay my tax bill. When you pay this way the amount of your payment plus a fee of nearly 2 will be added to the balance of the credit cards you use to make. If you can pay off your tax bill youll save money in the long run.

The IRS authorizes a number of private third-party companies to process tax payments by credit card. If you owe or plan to owe the IRS money after you file your tax return this year keep reading to learn when your tax payments can affect your credit. The IRS generally keeps the tax lien in place until you pay your taxes in full or have made other arrangements to pay off reduce or eliminate the debt and the IRS releases the lien.

Taking the step of setting up a payment arrangement with the IRS does not trigger any reports to the credit bureaus. How Paying Your Taxes Affects Credit Score. Once the lien is imposed your credit score can take a 100-point hit immediately.

Charging a big tax bill is an option for consumers who have credit cards with a high enough limit. In general the IRS imposes a tax lien if you owe more than 10000 and you dont make an attempt to pay it for 30 days or more. When You Pay Taxes With a Credit Card.

This is because your credit is only affected once the IRS files a Notice of Federal Tax Lien in court. Agreeing to repay your tax bill on an installment plan will not affect your credit score because they are not reported to credit bureaus. For example if you prepare your tax return and still owe additional taxes with it this by itself is not going to impact your credit score.

A lien can affect your ability to purchase a car or a home and will negatively impact your credit score. Tax liens are not included on credit reports either. If you pay your taxes with a credit card or personal loan those transactions will be recorded in your credit reports and they will be reflected in your credit scores.

A tax lien is very serious and should not be taken lightly. Because the IRS does not report back taxes to the credit reporting bureaus there is no affect on your credit score. Therefore payment plans are not reported to credit bureaus.

The IRS offers a few payment options for taxpayers who cant pay their taxes all at once including online payment agreements. The amount of tax you owe is a significant factor in determining whether your credit score will be affected. A tax lien also stays on your credit for seven years after your final payment.

Thats because the IRS charges interest and a penalty on any past-due unpaid tax until you pay in full even if you arrange for a payment plan or have an offer in compromise accepted.

5 Weighted Factors That Affect Your Credit Score Credit Score Credits Credit Repair Companies

5 Weighted Factors That Affect Your Credit Score Credit Score Credits Credit Repair Companies

Can Student Loans Improve Or Decline Your Credit Score

Can Student Loans Improve Or Decline Your Credit Score

Does Irs Debt Show On Your Credit Report H R Block

Does Irs Debt Show On Your Credit Report H R Block

Do Student Loans Affect Your Credit Credit Com

Some Things To Know About Irs Online Payment Agreements Credit Karma Tax

Some Things To Know About Irs Online Payment Agreements Credit Karma Tax

National Tax Debt Irs Tax Debt Relief And Tax Payment Plans Debt Relief Programs Irs Taxes Debt Relief

National Tax Debt Irs Tax Debt Relief And Tax Payment Plans Debt Relief Programs Irs Taxes Debt Relief

Does Paying Taxes Late Affect Credit Credit Com

Does Paying Taxes Late Affect Credit Credit Com

What Does Charged Off Mean For Your Credit Score

What Does Charged Off Mean For Your Credit Score

Does Owing The Irs Affect Your Credit Score Community Tax

Does Owing The Irs Affect Your Credit Score Community Tax

6 Surprising Things That Won T Hurt Your Credit Score Creditcards Com

6 Surprising Things That Won T Hurt Your Credit Score Creditcards Com

Will An Irs Payment Plan Affect My Credit Wiztax

Will An Irs Payment Plan Affect My Credit Wiztax

Do Taxes Affect My Credit Score Experian

Do Taxes Affect My Credit Score Experian

How Much Does A Late Payment Affect My Credit Score

How Much Does A Late Payment Affect My Credit Score

Does Owing The Irs Affect Your Credit R G Brenner

Does Owing The Irs Affect Your Credit R G Brenner

Late Payments How They Affect Your Credit Credit Karma

Late Payments How They Affect Your Credit Credit Karma

Behind On Your Taxes Here Are 6 Ways To Arrange A Payment Plan With The Irs Money Under 30

Behind On Your Taxes Here Are 6 Ways To Arrange A Payment Plan With The Irs Money Under 30

Do Tax Liens Affect My Credit Score New Rules For Liens Debt Com

Do Tax Liens Affect My Credit Score New Rules For Liens Debt Com

Can Paying Your Taxes Late Affect Your Credit Score

Can Paying Your Taxes Late Affect Your Credit Score

Post a Comment for "Irs Payment Plan Affect Credit Score"