Can I Pay My Hmrc Tax Bill Over The Phone

The HMRC Help Line telephone number has been discontinued. HMRC strongly prefer that applications are made over the phone as they believe it is the most efficient way for them to gather the information required for their decision.

Ebay Tax Bill Rises After Hmrc Review Ebay Uk News News

Ebay Tax Bill Rises After Hmrc Review Ebay Uk News News

This is your 10-digit Unique Taxpayer Reference UTR followed by the letter KYoull find it either.

Can i pay my hmrc tax bill over the phone. Your Self Assessment tax bill tells. If you are an employer with an enquiry about an aspect of your employees pay worker rights and entitlements or tax then call the HMRC telephone line for employers below. Credit card payments are subject to a non-refundable transaction fee according to the card used.

Your card often has a 30-45 day interest free payment period. In your HMRC online account. Hmrc Payment Helpline Telephone Number.

Faster Payments will usually reach HMRC same day including weekends and bank holidays CHAPS payments should go through on the same working day so long as you pay within your banks processing times. Make a debit or credit card payment with HMRC to pay your tax bill including Self Assessment PAYE VAT and Corporation Tax. Alternatively we are experienced in negotiating arrangements with HMRC.

Pay Self Assessment now You can pay in. If you or HMRC find a minor error on your tax return it can often be put right by a phone call. Moreover you can easily even out your liquidity and avoid applying for new loans to pay your tax bill.

To make a single CHAPS payment to cover a number of Self Assessment references called a multiple or composite payment contact your HMRC Accounts Office. If you cant afford to pay your self-assessment tax bill youll need to contact HMRC as soon as possible ideally before the tax is due. You owe 30000 or less you do not have any other payment plans or debts with HMRC.

Here is a table of all the different methods of how you can pay your tax bill and the pros and cons of each. Pay HMRC by debit card - no charge. There are three types of bank transfer.

Paying your tax should be straightforward but when it comes to a form P800 bill sometimes it isnt that easy even when you have the funds and want to make payment. HMRC telephone line for employers 0300 200 3300 This telephone number is manned from 8 am to 8 pm Monday to Friday and on Saturdays between 8 am and 4pm. If you delayed making a payment on account in July 2020 because of coronavirus COVID-19 this will be added to your tax bill due by 31 January 2021.

Use your 11-character payment reference when you pay. If your income was overstated and you have paid more tax than is due HMRC will repay the amount overpaid with an appropriate amount of interest. If youre likely to be in this position you could come unstuck if you leave your tax return until the last minute and submit it close to the deadline.

To get a headstart on your 2017-2018 tax return you can use our simple jargon-free tax calculator and file direct with HMRC. Over the 2017-18 tax year HMRC received 181bn in income tax of which 15 or 283bn was paid via self-assessment. You can pay by internet phone or mobile device whether you e-file paper file or are responding to a bill or notice.

How much tax do we pay. Payment options for your Self Assessment tax bill. The good news is there are lots of other ways you can pay.

Although the bank processing time could be three to five days. Its safe and secure - the IRS uses standard service providers and businesscommercial card networks and your information is used solely to process your payment. Not only is Billhop an easy way to pay HMRC or any other bill but you also take advantage of all the benefits of using a credit card.

Request that we temporarily delay collection until your financial situation improves. Their telephone number is 0300 200 3835. Meet your tax obligation in monthly installments by applying for a payment plan including installment agreement Find out if you qualify for an offer in compromise-- a way to settle your tax debt for less than the full amount.

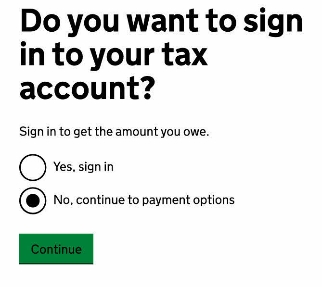

Many people may think you can call up HMRC and pay over the phone but unfortunately this isnt correct. You can set up a payment plan to spread the cost of your latest Self Assessment bill if all the following apply. You earn loyalty reward and bonus points.

This short article explains the ways in which you can pay any tax you owe HMRC shown on your form P800. But then that falls by the wayside and one month becomes three turning into six and then twelve and then your tax bill is here again. You can pay HMRC using your online or telephone banking or banking app.

We all have good intentions and from the last time you paid your tax you probably decided that you were going to be super organised this time round and make sure you had money put aside to pay over to HMRC. Pay Your Taxes by Debit or Credit Card. Direct Debit bank transfer through your tax code debit or credit card cheque and flexible payments.

Worldpay it is counted as paid the same day.

Hmrc P60 Digital Copy National Insurance Number Number Words Tax Credits

Hmrc P60 Digital Copy National Insurance Number Number Words Tax Credits

Self Evaluation Letter Unique Hmrc Fines 8 000 More People For Tax Return Failures In 2020 Filing Taxes Digital Tax Tax Return

Self Evaluation Letter Unique Hmrc Fines 8 000 More People For Tax Return Failures In 2020 Filing Taxes Digital Tax Tax Return

Hmrc Tax Investigations Advice Process Costs

Hmrc Tax Investigations Advice Process Costs

Hmrc Tax Code Coding Online Sample

Hmrc Tax Code Coding Online Sample

It Is Important That You Understand What Insurance Your Business Needs Business Businessinsu Business Insurance Insurance Broker Tax Preparation

It Is Important That You Understand What Insurance Your Business Needs Business Businessinsu Business Insurance Insurance Broker Tax Preparation

30 December 2016 Deadline For Filing 2015 16 Selfassessment Taxreturns Online To Include A Claim For Under Pa Tax Return Accounting Services Tax Accountant

30 December 2016 Deadline For Filing 2015 16 Selfassessment Taxreturns Online To Include A Claim For Under Pa Tax Return Accounting Services Tax Accountant

Hmrc Tax Payment Deadline 31 St January Reminder Stock Photo Alamy

Hmrc Tax Payment Deadline 31 St January Reminder Stock Photo Alamy

A Taxing Time Of The Year The Hm Revenue Customs Phishing Scam The Defence Works

A Taxing Time Of The Year The Hm Revenue Customs Phishing Scam The Defence Works

How Do I Pay My Hmrc Corporation Tax Online Taxes Accounting Services Telephone Banking

How Do I Pay My Hmrc Corporation Tax Online Taxes Accounting Services Telephone Banking

How To Survive An Hmrc Tax Investigation Freeagent

How To Survive An Hmrc Tax Investigation Freeagent

Our Team Of Experienced Tax Attorneys Knows How To Protect Your Rights Tax Time Tax Deductions Income Tax Return

Our Team Of Experienced Tax Attorneys Knows How To Protect Your Rights Tax Time Tax Deductions Income Tax Return

Facebook S Uk Tax Return Could Reawaken Tax Avoidance Debate By Us Companies In Eu Https Www Thestreet Com Story 13846846 1 Facebook Uk Facebook S Essay Help

Facebook S Uk Tax Return Could Reawaken Tax Avoidance Debate By Us Companies In Eu Https Www Thestreet Com Story 13846846 1 Facebook Uk Facebook S Essay Help

Hmrc Tax Overview Online Self Document Templates Online

Hmrc Tax Overview Online Self Document Templates Online

Paying Hmrc Self Assessment Tax By Cheque By Cr Dr Card Or Online

Paying Hmrc Self Assessment Tax By Cheque By Cr Dr Card Or Online

Hmrc Sa302 Design 2 Online Tax Return Reference

Hmrc Sa302 Design 2 Online Tax Return Reference

Wondering Why Hmrc Have Advised That They Will No Longer Be Accepting Self Assessment Tax Bill From Credit Cards T Credit Card Payment Credit Card Cards

Wondering Why Hmrc Have Advised That They Will No Longer Be Accepting Self Assessment Tax Bill From Credit Cards T Credit Card Payment Credit Card Cards

Pin By Ein On Irs Tax Tips And Finance Tips Irs Taxes Finance Tips Finance

Pin By Ein On Irs Tax Tips And Finance Tips Irs Taxes Finance Tips Finance

Self Assessment Customers Can Now Apply For Support To Help Spread The Cost Of Their Hmrc Tax Bill Daily Record

Self Assessment Customers Can Now Apply For Support To Help Spread The Cost Of Their Hmrc Tax Bill Daily Record

The Importance Of Keeping Good Business Records Tax Accountant Tax Advisor Business

The Importance Of Keeping Good Business Records Tax Accountant Tax Advisor Business

Post a Comment for "Can I Pay My Hmrc Tax Bill Over The Phone"