Ppp Loan Amount Calculator For Sole Proprietor

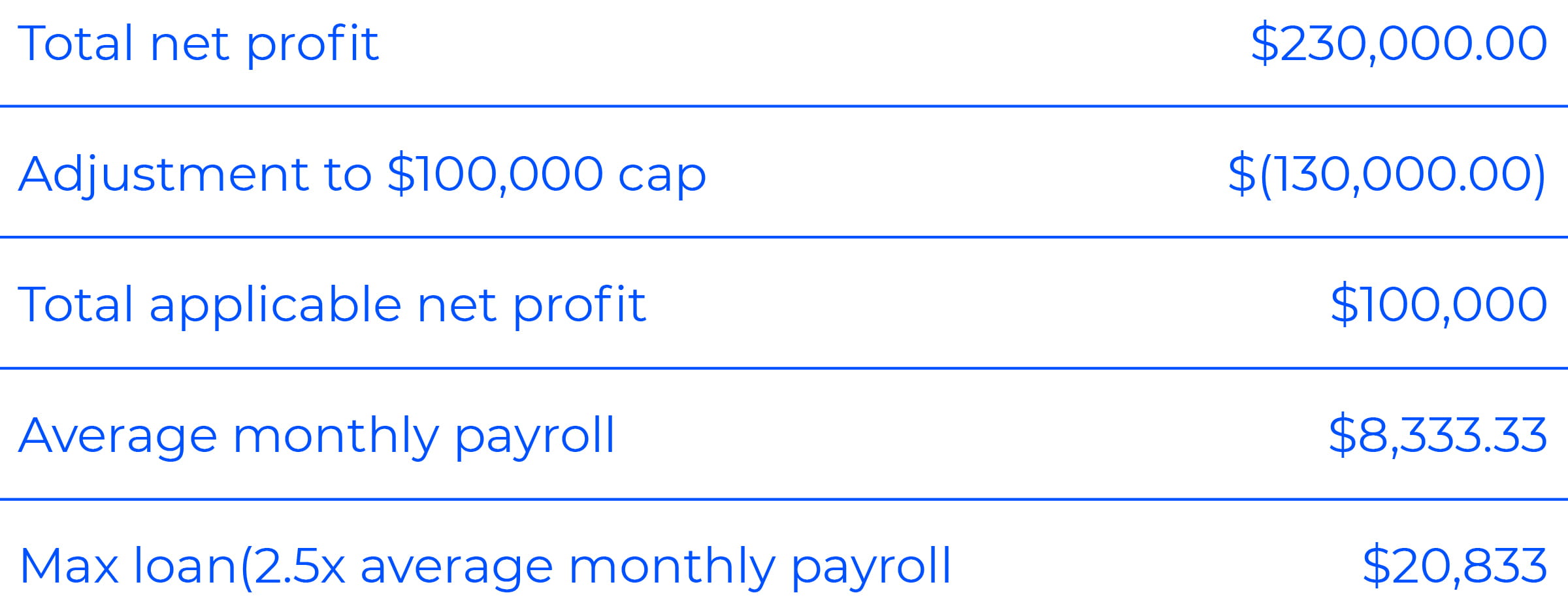

The new sole proprietor PPP loan formula looks at the 60000 of gross income calculates a 5000 per month profit and returns a 12500 PPP loan amount. Add the sole proprietors 2019 Schedule C line 31 net profit up to 100000 to 2019 gross wages paid to employees up to 100000 max per employee to calculate the gross earnings portion of the loan amount calculation.

Sole Proprietorship Ppp Loan Applications Evergreen Small Business

Sole Proprietorship Ppp Loan Applications Evergreen Small Business

Solutions Simple solutions that deliver powerful results.

Ppp loan amount calculator for sole proprietor. This comment refers to an earlier version of this post and may be outdated. The calculator is not designed to cover every unique situation. This calculator estimates forgiveness for self-employed individuals who file Schedule C and have no employees.

To find your number of employees you use the average number of employees you held during 2019 or 2020. Contractor or operate a sole proprietorship but not if you are a partner in a partnership. In this case its 31250.

However since sole props and contractors usually dont have payroll their loan is based on 2019 net profit divided by 12 to get a monthly average net profit. Interactive PPP Loan Calculator. Employer paid health insurance premiums included in Schedule C line 14 retirement benefits included in Schedule C line 19 and unemployment taxes paid on employees are then added to the gross earnings for calculating average monthly payroll costs used in the loan amount.

If this amount is zero or less you are not eligible for a PPP loan. Generally the PPP loan amount that businesses qualify for is based on 25 months of average payroll expenses. PPP Loan For example if a sole proprietor made 75000 last year without any employees the calculation would simply be 7500012 multiplied by 25 for a total PPP loan of 15625.

As a reminder when applying for the PPP you must certify that the economic uncertainty makes this loan necessary Up until now the SBA assumed any loan under 2M would automatically qualify as necessary. To date thousands of gig workers independent contractors and sole proprietors have been able to take advantage of PPP. While we dont have the details on the new.

Calculate the average monthly net profit amount divide the amount from. The Biden administration announces new PPP rules to help truly small businesses independent contractors and sole proprietors get more funding. Generally the PPP loan amount that businesses qualify for is based on their average payroll expenses.

They just wont get priority treatment once the 14-day exclusivity window. Which means your PPP loan is roughly ten weeks worth of net profit. PPP offers self-employed individuals access to COVID-19 relief funding that can compensate for earnings lost due to restrictions and closures or the general economic downturn that the crisis has caused.

Multiply 12500 by 25 to find your Loan Request amount. Of course sole proprietors will still be able to apply for PPP loans until the program deadline at the end of the month. You cannot apply for a secondseparate PPP loan.

Find your 2019 IRS Form 1040 Schedule C line 31 net profit amount if you have not yet filed a 2019 return fill it out and compute the value. Owner compensation up to 100k is a legitimate forgivable expense for sole proprietorship PPP loans and is calculated into the total amount received. If this amount is zero or less you are not eligible for a PPP loan.

If you have a copy of your last tax return handy look at what Schedule C Line. Guidance on the Application for a PPP Loan by Sole Proprietor The first piece of guidance released by. These FAQs are for informational purposes only are general in nature and should not be relied upon or construed as a legal opinion or legal advice.

Find your 2019 IRS Form 1040 Schedule C line 31 net profit amount3 If this amount is over 100000 reduce it to 100000. If youre a sole proprietor or owner of a very small business how you calculate the amount you can borrow through the Paycheck Protection Program PPP just got a lot better. If this amount is over 100000 reduce it to 100000.

The old PPP loan formula looked that 12000 bottom-line profit calculated a 1000 per month profit and returned a 2500 PPP loan amount. However since sole proprietors usually dont have payroll their PPP loan is instead based on 2019 net profit as reported on the 2019 Schedule C tax return divided by 12. This gives you 12500 which you input into the Average Monthly Payroll box on your PPP application.

I hope that clears things up for you. Reputation Read and reply to customer reviews across Google Facebook and Yelp in one place. The Biden-Harris administration is reviewing the loan calculation formula for sole proprietors independent contractors and the self-employed.

Heres a closer. Clarification on loan amount qualified expenses and forgiveness eligibility On April 14 2020 the Small Business Administration SBA issued a new Interim Final Rule IFR on the Paycheck Protection Program PPP for sole proprietors and independent contractors. This number times 25 equals your PPP loan amount.

PPP Loan Forgiveness for the Self-Employed Frequently Asked Questions. Now that threshold will be lower if you are a sole proprietor using Schedule C line 7 to calculate your loan amount.

Second Ppp Loan Calculating A 25 Revenue Reduction Pursuit

Second Ppp Loan Calculating A 25 Revenue Reduction Pursuit

Ppp Loan Update For Solopreneurs The Self Employed Taxhub

Ppp Loan Update For Solopreneurs The Self Employed Taxhub

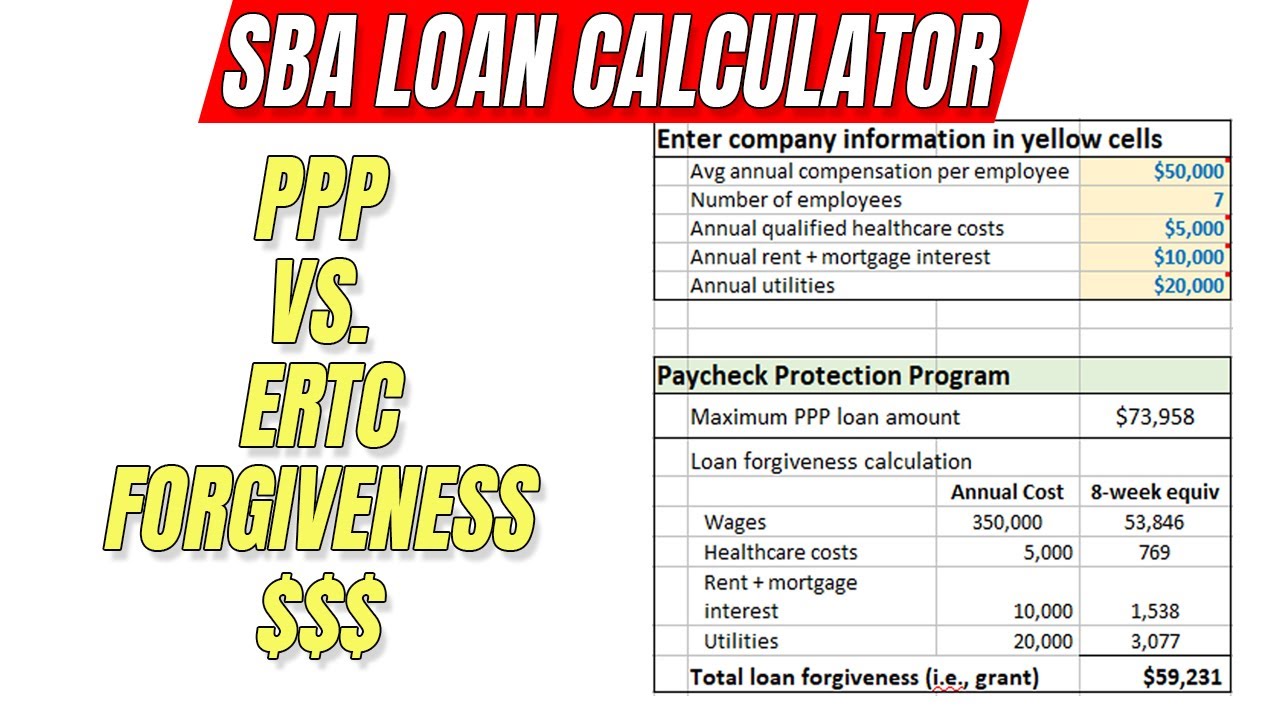

Forgivable Loan Calculator Paycheck Protection Program Ppp Stimulus Grant Youtube

Forgivable Loan Calculator Paycheck Protection Program Ppp Stimulus Grant Youtube

Nav Launches Calculator To Help Business Owners Determine Eligibility For Cares Act Sba Loans

Nav Launches Calculator To Help Business Owners Determine Eligibility For Cares Act Sba Loans

How To Calculate Your Paycheck Protection Program Loan Amount Bench Accounting

How To Calculate Your Paycheck Protection Program Loan Amount Bench Accounting

Real Estate Brokers How To Calculate Your Ppp Loan Amount Wipfli

Real Estate Brokers How To Calculate Your Ppp Loan Amount Wipfli

Paycheck Protection Program How It Works Funding Circle

Paycheck Protection Program How It Works Funding Circle

How To Calculate Payroll Costs For Your Ppp Loan

How To Calculate Payroll Costs For Your Ppp Loan

How To Calculate Your Paycheck Protection Program Loan

How To Calculate Your Paycheck Protection Program Loan

An Advisor S Guide To The Paycheck Protection Program

An Advisor S Guide To The Paycheck Protection Program

The Squire Sba Payroll Protection Program Ppp Calculator Tool Tutorial V 2 Youtube

The Squire Sba Payroll Protection Program Ppp Calculator Tool Tutorial V 2 Youtube

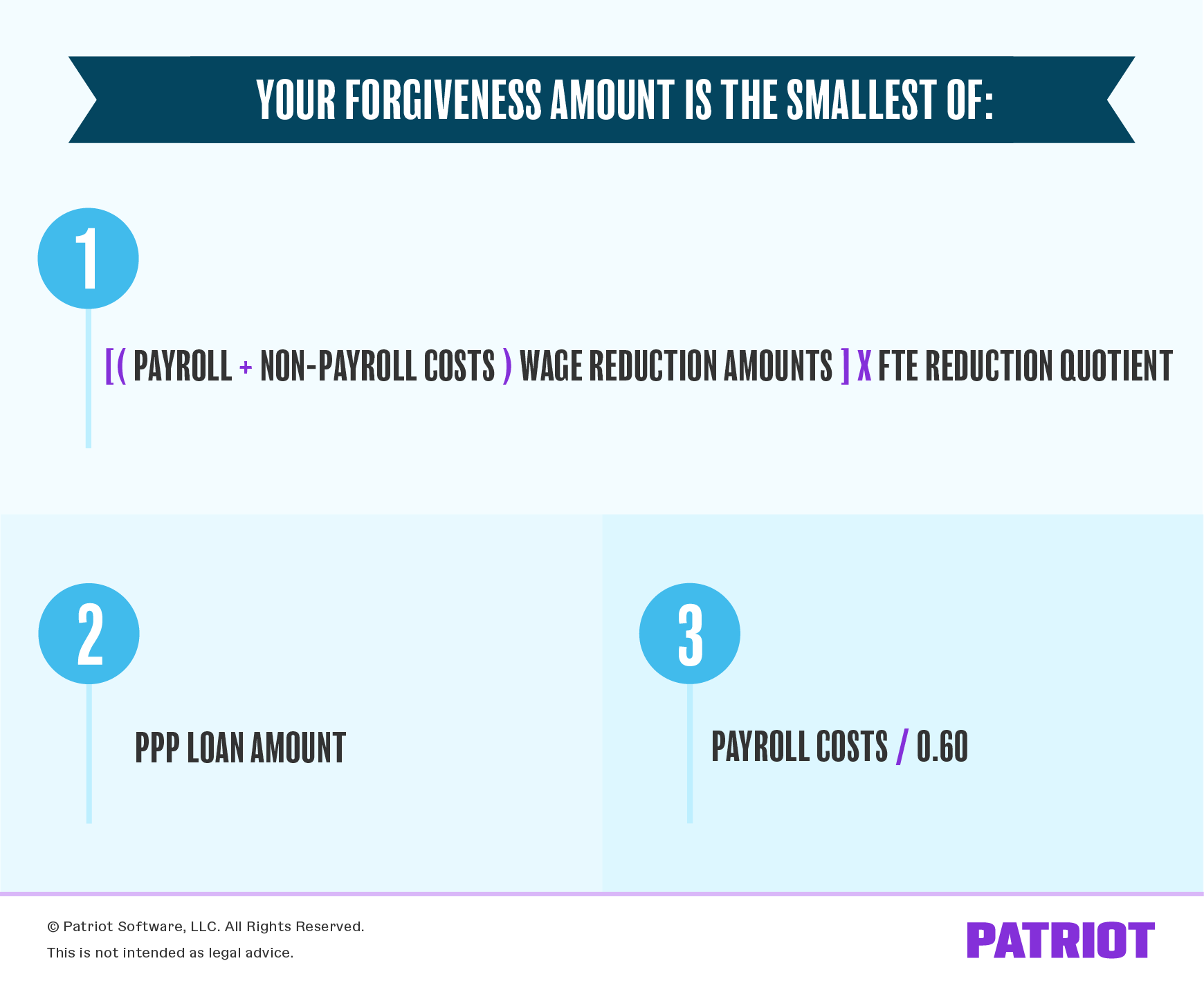

Ppp Forgiveness Calculation How To Calculate Loan Forgiveness

Ppp Forgiveness Calculation How To Calculate Loan Forgiveness

How To Calculate Your Paycheck Protection Program Ppp Loan Amount

How To Calculate Your Paycheck Protection Program Ppp Loan Amount

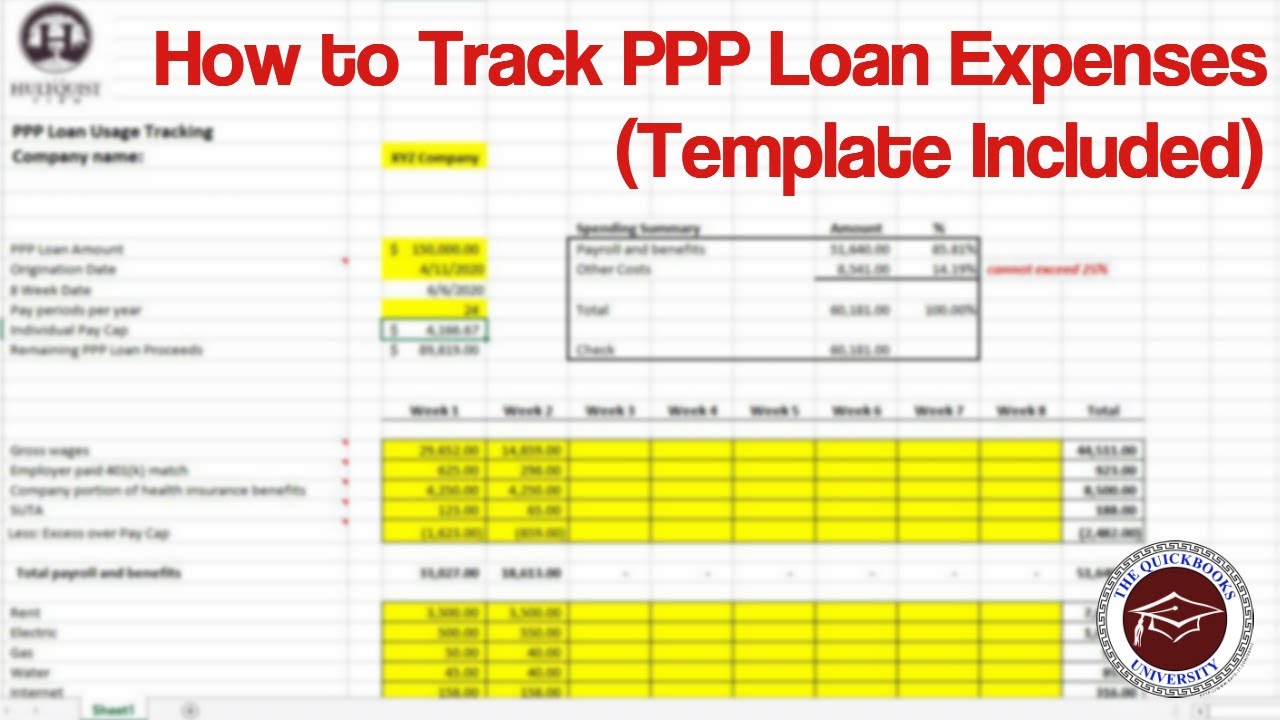

How To Track Ppp Loan Expenses Template Included Youtube

How To Track Ppp Loan Expenses Template Included Youtube

Https Efirstbankblog Com Wp Content Uploads 2020 04 Firstbank Ppp Loan Calculator New Pdf

Ppp Loan Forgiveness Application Guide Updated Gusto

Ppp Loan Forgiveness Application Guide Updated Gusto

How To Calculate Your Payroll Costs For The Ppp Loan

How To Calculate Your Payroll Costs For The Ppp Loan

Ppp Loan Forgiveness Requirements How To Apply And Calculate It Camino Financial

Ppp Loan Forgiveness Requirements How To Apply And Calculate It Camino Financial

Post a Comment for "Ppp Loan Amount Calculator For Sole Proprietor"