Payment Protection Program Deadline

The federal Paycheck Protection Program was created as part of the Coronavirus Aid Relief and Economic Security CARES Act to help businesses cover payroll and other expenses while theyre. House lawmakers unanimously passed the.

Effective Jan 19 2021.

Payment protection program deadline. June 30 is the deadline for small businesses to apply for forgivable PPP loans. By Office of Capital Access. Key Paycheck Protection Program Round 2 Updates Certain borrowers may be eligible for a second-draw PPP loan of up to 2 million.

It was originally expected there could be some resistance from Democrats but the move was unanimously passed by the senate. The application period for PPP Round 2 loans will end on March 31 2021. Time is running out on the Paycheck Protection Program PPP.

The Paycheck Protection Program established by the CARES Act is implemented by the Small Business Administration with support from the Department of the Treasury. Hours before the original Paycheck Protection Program deadline was due to expire the Senate reached a last minute agreement to extend the June 30th deadline until August 8th. The extension of PPP which was established to.

The Paycheck Protection Program allows entities to. CBSNewYork Small businesses have just over a week left to apply for another round of loans from the Paycheck Protection Program to keep their employees paid during the pandemic. July 4 UPI -- President Donald Trump signed a law Saturday extending the deadline for small business loans under the Paycheck Protection Program.

You will need to provide. 9 The original application deadline was June 30 2020. This program provides small businesses with funds to pay up to 8 weeks of payroll costs including benefits.

Even for businesses now reopening the PPP is still. CNN President Donald Trump on Saturday signed an extension of the small business loan Paycheck Protection Program into law according to the White House. 7010 passed both houses of Congress on June 3 2020 and signed into law on June 5 2020.

What other documents will I need to include in my application. Funds can also be used to pay interest on mortgages rent and utilities. Payment Protection Program PPP update and deadline reminders.

The Paycheck Protection Program Flexibility Act of 2020 Flexibility Act extended the deferral period for borrower payments of principal and interest on all PPP loans to the earlier of a the date that the SBA remits the forgiven amount to the lender or notifies the lender that no forgiveness is allowed. The Payment Protection Program Loan Deadline is June 30 June 25 2020 by hallcpas With the deadline for the Payment Protection Program PPP loans fast approaching we wanted to share a quick reminder regarding what you need to know when it comes to applying and achieving loan forgiveness. Deferral of employment tax deposits and payments through December 31 2020 The Coronavirus Aid Relief and Economic Security Act CARES Act allows employers to defer the deposit and payment of the employers share of Social Security taxes and self-employed individuals to defer payment of certain self-employment taxes.

Click HERE for the application. An SBA-backed loan that helps businesses keep their workforce employed during the Coronavirus COVID-19 crisis. We anticipate being able to provide you with new forgiveness application examples that reflect the law changes in the coming week s.

And b the date that is 10 months after the date that is the earlier of i 24 weeks after the end of the borrowers Covered Period or ii December 31 2020 if the borrower does. The Paycheck Protection Program Flexibility Act of 2020 HR. You will need to complete the Paycheck Protection Program loan application and submit the application with the required documentation to an approved lender that is available to process your application by June 30 2020.

The Paycheck Protection Program PPP is a 953-billion business loan program established by the 2020 US Federal government Coronavirus Aid Relief and Economic Security Act CARES Act to help certain businesses self-employed workers sole proprietors certain nonprofit organizations and tribal businesses continue paying their workers. Round 3 PPP Application Deadline The Consolidated Appropriations Act 2021 CAA extends the Paycheck Protection Program PPP through March 31 2021 or until funds are depleted. The law changes several provisions of the Paycheck Protection Program PPP in particular loan forgiveness procedures were updated.

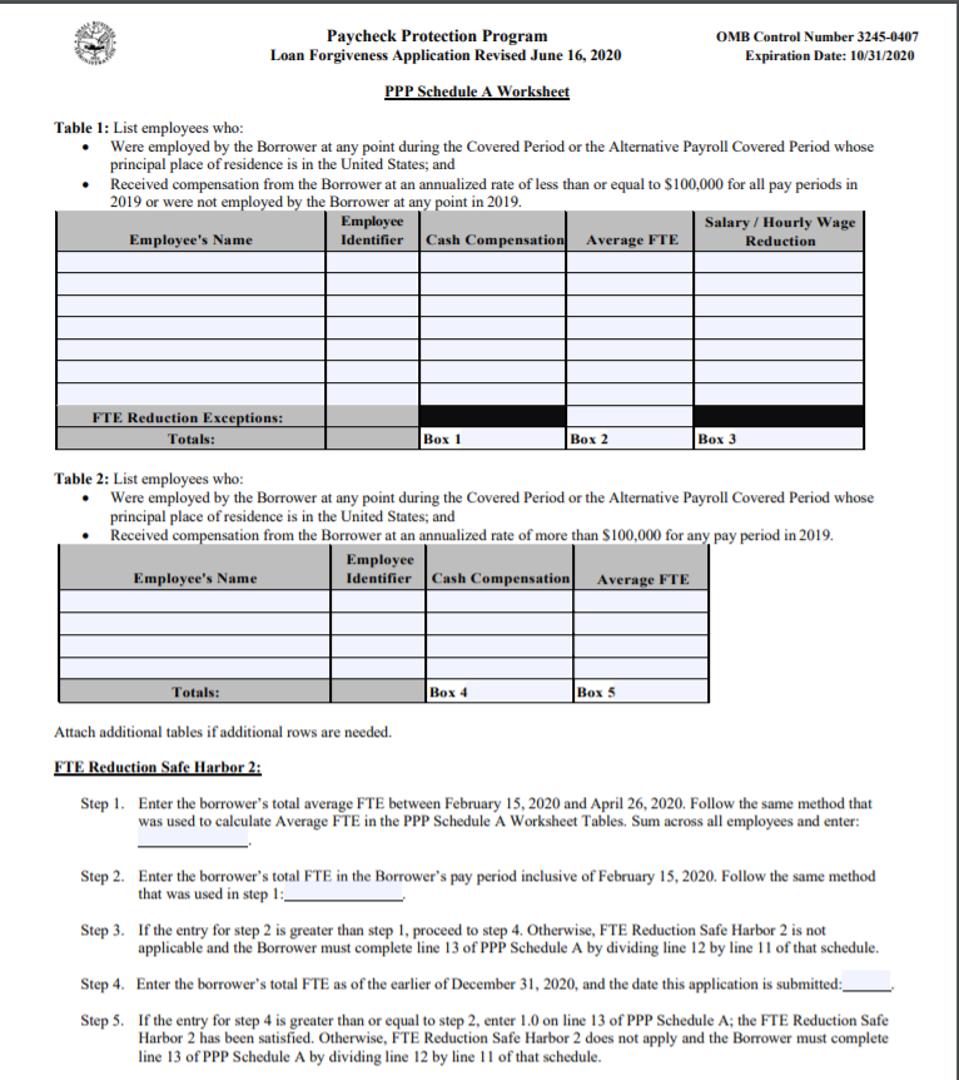

Paycheck Protection Program Loan Forgiveness Application. New legislation signed by Trump on July 4 2020 extended the deadline to apply for a Paycheck Protection Program Loan through Aug.

Paycheck Protection Program Farm Credit Administration

Paycheck Protection Program Farm Credit Administration

Which Banks Are Accepting Paycheck Protection Program Loan Applications Forbes Advisor

Which Banks Are Accepting Paycheck Protection Program Loan Applications Forbes Advisor

The Not Quite Definitive Guide To Paycheck Protection Program Loan Forgiveness

The Not Quite Definitive Guide To Paycheck Protection Program Loan Forgiveness

Sba Paycheck Protection Program Loan Level Data U S Department Of The Treasury Paycheck Data Loan

Sba Paycheck Protection Program Loan Level Data U S Department Of The Treasury Paycheck Data Loan

White House Says Small Business Loan Program For Coronavirus Impacted Firms Is Out Of Money The Washington Post

Usda Extends Application Deadline For Dairy Margin Protection Program To June 22 Usda Protection June 22

Usda Extends Application Deadline For Dairy Margin Protection Program To June 22 Usda Protection June 22

The Future Of The Paycheck Protection Program Under The Biden Administration Waller

The Future Of The Paycheck Protection Program Under The Biden Administration Waller

Nearly 900b Relief Act Becomes Law Includes Funds For Second Round Of Paycheck Protection Program Loans Paychex

Nearly 900b Relief Act Becomes Law Includes Funds For Second Round Of Paycheck Protection Program Loans Paychex

Usda Extends Dairy Margin Protection Program Deadline Again Farm And Dairy Nutrition And Dietetics Nutrition Consultant Dietetics

Usda Extends Dairy Margin Protection Program Deadline Again Farm And Dairy Nutrition And Dietetics Nutrition Consultant Dietetics

Quickbooks Paycheck Protection Program In 2020 Paycheck Quickbooks Family Medical

Quickbooks Paycheck Protection Program In 2020 Paycheck Quickbooks Family Medical

Ppp Loan Forgiveness How To Apply And Get Accepted Nav

Ppp Loan Forgiveness How To Apply And Get Accepted Nav

This Google Log In Program Is The Strongest Account Protection The Company Offers Here S How It Works And Who Might Need To Use It In 2020 Digital Tax Social Sites Google Advanced

This Google Log In Program Is The Strongest Account Protection The Company Offers Here S How It Works And Who Might Need To Use It In 2020 Digital Tax Social Sites Google Advanced

Pin On Small Biz Coronavirus Info

Pin On Small Biz Coronavirus Info

Post a Comment for "Payment Protection Program Deadline"