How To File Payroll Protection Program

If this amount is over 100000 reduce it to 100000. The Paycheck Protection Program increases the maximum loan amount for loans made under Section 7a of the Small Business Act to 10 million and states that eligible applicants will receive the lesser of i the average monthly payroll costs for the one-year period ending on the date the loan was made multiplied by 25 or ii 10 million.

Paycheck Protection Program Loan Forgiveness Application.

How to file payroll protection program. The Ohio Employee Assistance Program Ohio EAP is an intake information counseling referral and support service for state employees and their family members. 2019 and 2020 IRS Form 941 or quarterly filing for quarterly wages and federal employment taxes. On the payments screen select the Pay From account and confirm the PPP loan is displayed in the Pay To field.

If this amount is zero or less you are not eligible for a PPP loan. For instance the Ohio EAP can assist. The Paycheck Protection Program PPP loan is a type of SBA loan designed to provide funds to help small businesses impacted by COVID-19 to keep their workers on payroll.

Much of the talk surrounds the Paycheck Protection Program PPP part of the larger 2 trillion coronavirus relief package the CARES Act created by Congress. Use this form to apply for the Paycheck Protection Program PPP with an eligible lender for a First Draw loan. The Paycheck Protection Program established by the CARES Act is implemented by the Small Business Administration with support from the Department of the Treasury.

Borrowers may be eligible for PPP loan forgiveness. These loans may be completely forgiven if spent on eligible expenses mainly payroll during a specific time period. Search for lenders in your area.

When you call tell them you are interested in the Paycheck Protection Program and they will guide you through the steps for applying for the program. 2019 IRS Form 944 or annual filing for the smallest of employers to pay federal taxes once per year. This program provides small businesses with funds to pay up to 8 weeks of payroll costs including benefits.

You will need to complete the Paycheck Protection Program loan application and submit the application with the required documentation to an approved lender that is available to process your application by June 30 2020. The Paycheck Protection Program PPP provides loans to help businesses keep their workforce employed during the Coronavirus COVID-19 crisis. PPP Loan Forgiveness Calculation Form.

2019 IRS Form W-3 which reports employee wage info. Find your 2019 or 2020 IRS Form 1040 Schedule C line 31 net profit amount. Paycheck Protection Program PPP loans as provided for under section 1106 of the Coronavirus Aid Relief and Economic Security Act CARES Act as amended by the Paycheck Protection Program Flexibility Act Flexibility Act.

The Ohio EAP is designed to help employees managers and agencies meet the many life challenges while remaining healthy engaged and productive. This video file cannot be. 27 2020 includes new funding for the Paycheck Protection Program PPP which expired Aug.

Sign in with your Business Advantage 360 username and password select your CARES Act Paycheck Protection Program loan. By Office of Capital Access. Funds can also be used to pay interest on mortgages rent and utilities.

Seasonal employers may calculate their maximum loan amount based on a 12-week period beginning February 15 2019 through February 15 2020. Borrowers and lenders may rely on the guidance provided in this document as SBAs. PPP loans are designed to help small business owners stay.

2019 IRS Form 940 or annual filing for FUTA tax. The Paycheck Protection Program PPP is part of the larger government stimulus package the Coronavirus Aid Relief and Economic Security CARES Act. Get matched with a lender.

Paycheck Protection Program loans are meant to minimize the number of unemployed persons by helping small business owners make payroll. The Consolidated Appropriations Act 2021 CAA signed into law by President Trump on Dec. What do I need to apply.

New entities may receive loans of up to 25X the sum of average monthly payroll costs. If you are using 2020 to calculate payroll costs and have not yet filed a 2020 return fill it out and compute the value. From the account details screen click Make a Payment.

You will need to complete the Paycheck Protection Program loan application and submit the application with the required documentation to an approved lender that is available to process your application by June 30 2020. Effective Jan 19 2021. Entities with NAICS code 72 can apply for 35X the sum of average monthly payroll costs.

Is providing this updated guidance to assist businesses in calculating their payroll costs and the relevant documentation that is required to support each set of calculations for purposes of determining the maximum amount of a First Draw Paycheck Protection Program PPP loan for each type of business.

Paycheck Protection Program Application Process

How To Apply For The Sba Payroll Protection Program Loan Simple Guide

How To Apply For The Sba Payroll Protection Program Loan Simple Guide

Irs Taxes Most Loan Forgiveness Be Careful With Exceptions Loan Forgiveness Irs Taxes Filing Taxes

Irs Taxes Most Loan Forgiveness Be Careful With Exceptions Loan Forgiveness Irs Taxes Filing Taxes

Paycheck Protection Program What You Need To Apply Bluevine

Paycheck Protection Program What You Need To Apply Bluevine

Paycheck Protection Program Ppp For Small Businesses

Paycheck Protection Program Ppp For Small Businesses

Chase Bank Paycheck Protection Program Application Detailed Walk Through Youtube

Chase Bank Paycheck Protection Program Application Detailed Walk Through Youtube

Pin On Finance Tips And Tricks

Pin On Finance Tips And Tricks

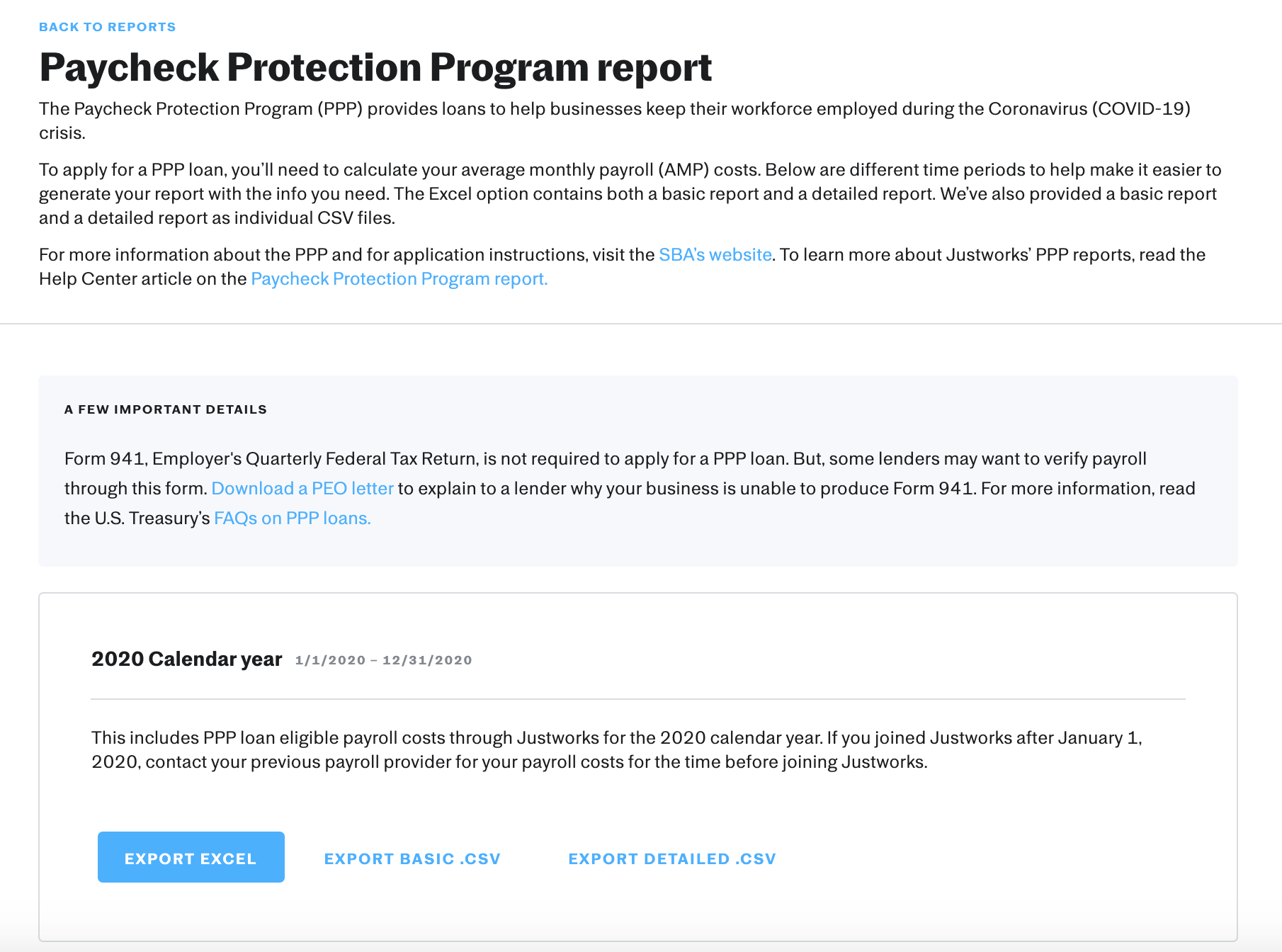

Paycheck Protection Program Report Justworks Help Center

Paycheck Protection Program Report Justworks Help Center

The Cares Act Paycheck Protection Program What You Need To Know In 2020 Paycheck Sba Loans Protection

The Cares Act Paycheck Protection Program What You Need To Know In 2020 Paycheck Sba Loans Protection

An Advisor S Guide To The Paycheck Protection Program

An Advisor S Guide To The Paycheck Protection Program

Quickbooks Paycheck Protection Program In 2020 Paycheck Quickbooks Family Medical

Quickbooks Paycheck Protection Program In 2020 Paycheck Quickbooks Family Medical

Paycheck Protection Program How To Apply Loan Calculation And More Youtube

Paycheck Protection Program How To Apply Loan Calculation And More Youtube

How To Calculate Your Paycheck Protection Program Loan Amount Bench Accounting

How To Calculate Your Paycheck Protection Program Loan Amount Bench Accounting

Pin On Youtube Videos By Jerry Banfield

Pin On Youtube Videos By Jerry Banfield

Sba Provides Application Forms For Small Business Paycheck Protection Program Workest

Sba Provides Application Forms For Small Business Paycheck Protection Program Workest

Post a Comment for "How To File Payroll Protection Program"