What To Write In Bir Ledger Book

Folioing Put the page number for a journal entry on the ledger accounts folio column. The main types include the sales ledger the purchase ledger the distributed or shared ledger and the general ledger.

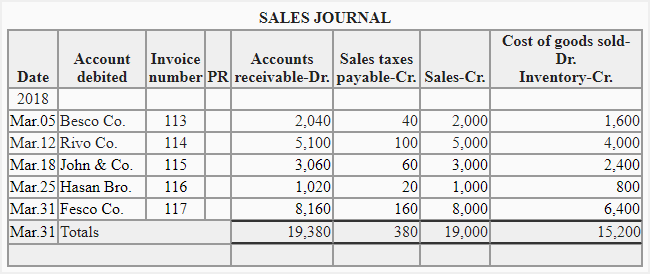

Sales Journal Sales Day Book Double Entry Bookkeeping

Sales Journal Sales Day Book Double Entry Bookkeeping

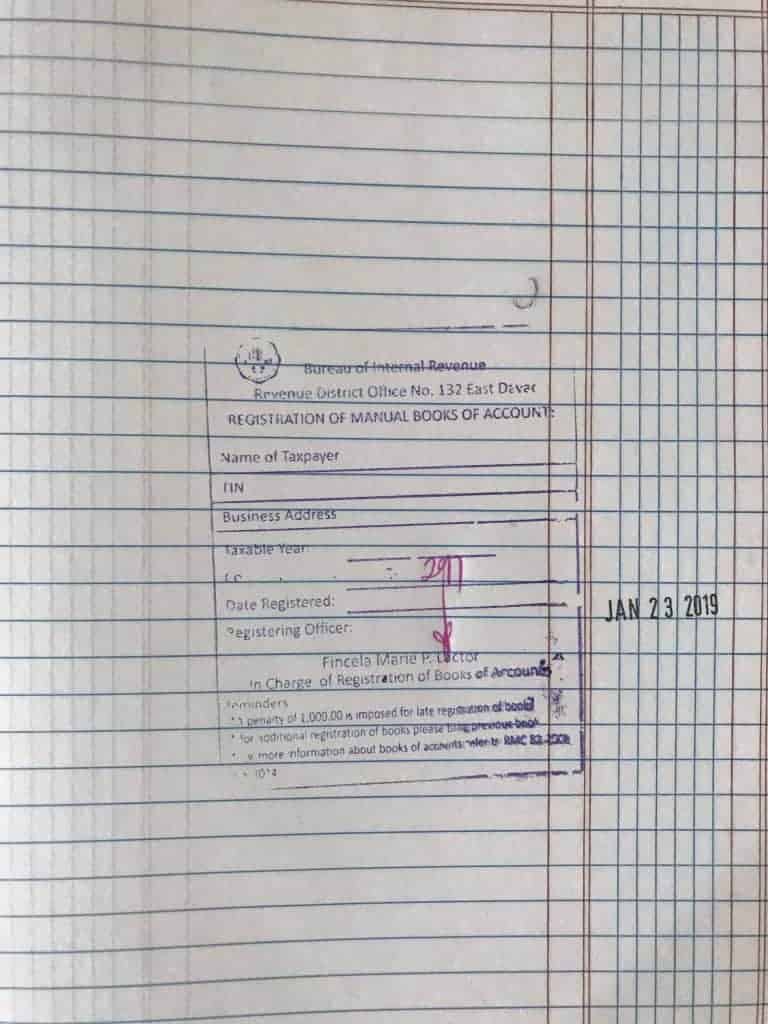

Manual books of account are the traditional journal ledger and columnar books you can buy in the book and office supplies store.

What to write in bir ledger book. List summary totals at the end of each page if this is a financial ledger. It is also the most popular type of books filed by small enterprises. The books of accounts including the purchase journal may need to be presented to BIR upon tax mapping or audit.

Transaction reference an internal reference for the transaction. Loose-leaf Books of Accounts. The above sample ledger page is for the bank account as can be seen in the heading that says Bank.

So the 5 simple steps for writing and preparing ledger are. You should write on Cash Receipts your sales based on your receipts given to the customers. General Journal otherwise called the book of original entry it is a recording of business transactions entered into the books based on the date of transaction using the principle of debit and credit.

Entries in the books of accounts are required to be supported with source documents such as official receipts sales invoices vouchers and other related supporting documents proving the occurrence of business transactions. These books of account are bound journals and ledgers from printed excel spreadsheets. Now its nowhere stated in our tax laws that your manual bookkeeping should consist of four books that must be used for the purposes stated above that you should for example assign a book exclusively for purchases another for.

Keeping a book of your business transactions is a requirement of the Bureau of Internal Revenue BIR. Drawing the Form Get pen and paper start drawing the ledger account. The minimum amount to issue receipt is 25 pesos.

Repeat this process for each entry. You need to have accurate documentation to. As noticed the Cash is debit and Sales is Credit.

How to Write and Prepare Ledger Account. Know that a journal is a list of every transaction your company makes. The opening balance is the amount brought forward from March.

It is important to note that book of accounts including the purchase journal must be written and kept in the business premise. Use the first line in the ledger book to record the starting balance. All corporations companies partnerships or persons required by law to pay internal revenue taxes shall keep a journal and a ledger or their equivalents such as subsidiary ledgers simplified books of accounts.

Transaction date the date the cash is received. It costs less and is the most popular type of books of accounts registered with the BIR. The date columns indicate that this bookkeeping ledger is for the month of April.

The credit column right-hand side of the T decreases the bank account. Keep in mind that your book of accounts and registers records vouchers and other supporting documents must be readily available and preserved accordingly in your office at all times. This is the most of popular type of books of account for small enterprises since it is less costly and easy to register with the BIR.

The purchases journal sometimes referred to as the purchase day book is a special journal used to record credit purchases. Traditional Books of Accounts. A all entries shall be handwritten b pastingglueinginserting onto pages are prohibited and subject to penalty pursuant to existing revenue issuances as stated in BIRs RMC 29-2019.

Label the seven columns Date Description Credit Debit Balance Check Number and Approval. Note that some ledger books come prelined but still can be altered by pen. All purchases must be recorded accurately and submitted to the BIR on designated deadlines.

General Ledger also known as the book of final entry it is a summary of all journal entries in order to get ending balances. Book of accounts are records that reflect the day-to-day business transactions of all corporations partnerships or persons registered in BIR and are required to pay taxes. Ledger folio a reference to the subsidiary or general ledger.

Recording in the manual books of account is handwritten. Refer to the example below. Posting transactions from journal to respective ledger account.

How to Write an Accounting Ledger. An accounting journal records the details date and amount of all the money. The purchases journal is simply a chronological list of all the purchase invoices and is used to save time avoid cluttering the general ledger with too much detail and to allow for segregation of duties.

A keen understanding of the names for these different records and of each ones function within your larger bookkeeping system will help the gears mesh smoothly and the. These books are usually encoded by hand. Save copies of all your business receipts invoices and debts.

The type of books that are typically prescribed are. These books can easily be registered with the BIR thus becoming a big hit for micro and small businesses. Please modify accordingly the handwritten entries eg add a column for non-operating income such as dividends miscellaneous etc on your BIR-registered accounting books based on the latest BIR Form 1701 see pages 6 and 7 and the nature of your business as a freelancer or self-employed professional income earner.

Description a description of the transaction indicating the account to be credited. Good bookkeepers are sticklers for detail and accuracy. The debit column left-hand side of the T increases the bank account.

Where do you write and keep the purchase journal. For instance if you have a cash ledger book your headers might read Date Cash Received Invoice Number Description of Transaction The first entry might read 1112011 6 10-0293 Television-Model 1234 respectively. How to write on Books of Accounts Cash Receipts.

Amount the total cash receipt amount. Keep note that using this. There are only 2 accounts in this book Cash and Sales.

Manual Books Of Accounts Bookkeeping Youtube

Manual Books Of Accounts Bookkeeping Youtube

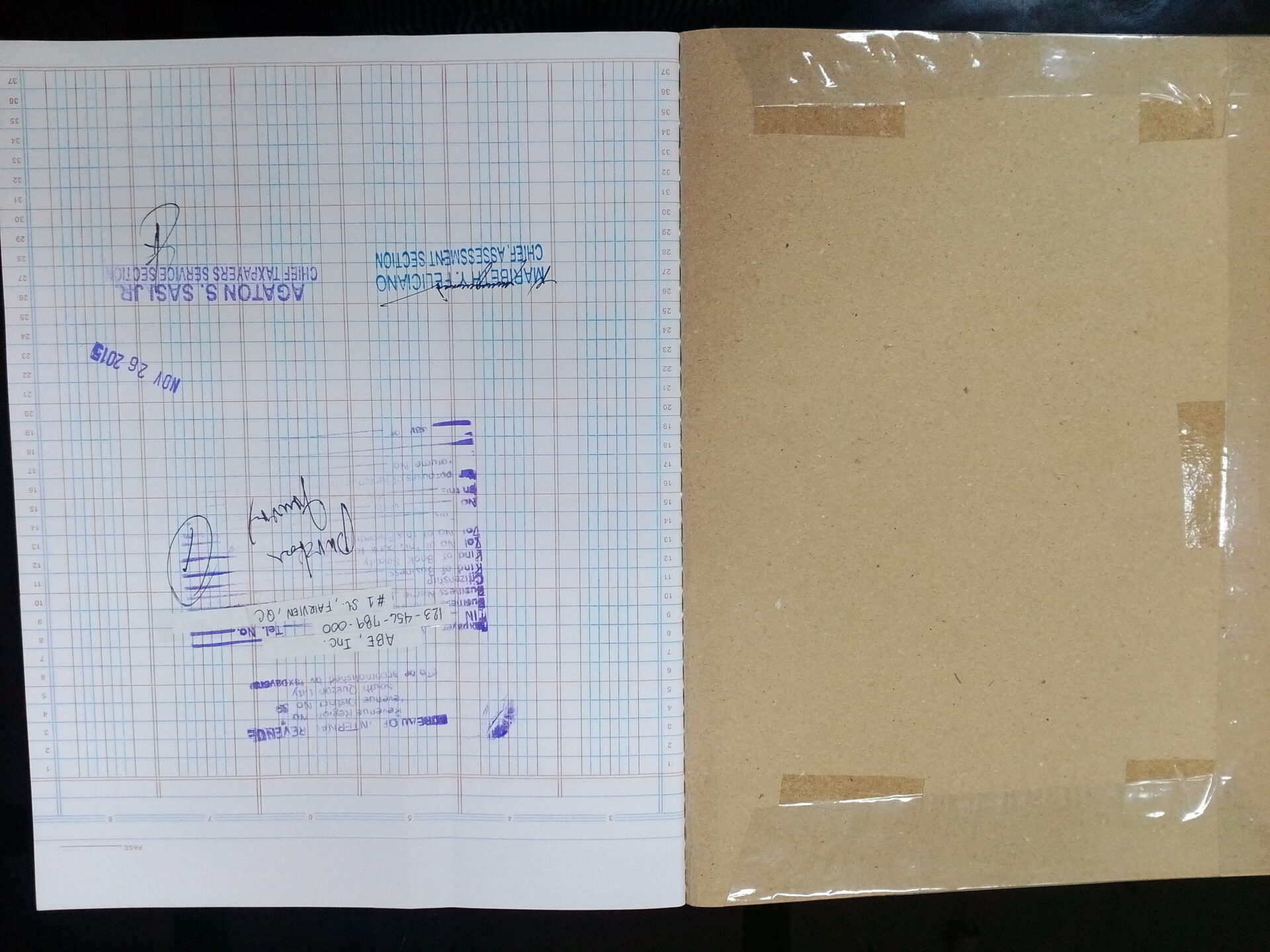

Books Of Accounts What Are These And How To Write Manually Accountableph

Books Of Accounts What Are These And How To Write Manually Accountableph

Everything You Need To Know About Bookkeeping Book Of Accounts

Everything You Need To Know About Bookkeeping Book Of Accounts

3 Bir Approved Formats For Books Of Account Fullsuite

3 Bir Approved Formats For Books Of Account Fullsuite

Purchase Journal What Is It And How To Write Manually

Purchase Journal What Is It And How To Write Manually

Book Of Accounts Paano Gamitin Ang Cash Receipts Book Bookkeeping Youtube

Book Of Accounts Paano Gamitin Ang Cash Receipts Book Bookkeeping Youtube

The Books Of Entries Your Final Answer To No Entry Books Of Accounts Youtube

The Books Of Entries Your Final Answer To No Entry Books Of Accounts Youtube

Bir New Books Of Accounts Under Train Law Youtube

Bir New Books Of Accounts Under Train Law Youtube

Manual Books Of Accounts What To Do With The Four Books You Bought When You Registered In Bir Cpa Bponline

Book Of Accounts Paano Gamitin Ang Cash Disbursement Book Bookkeeping Youtube

Book Of Accounts Paano Gamitin Ang Cash Disbursement Book Bookkeeping Youtube

The Simplest Method On How To Register As A Freelancer In Bir Updated 2020 Virtual Assistant Bootcamp

The Simplest Method On How To Register As A Freelancer In Bir Updated 2020 Virtual Assistant Bootcamp

Uncategorized Grab Peer Cebu Blog

Uncategorized Grab Peer Cebu Blog

How To Post Journal Entries To The General Ledger Business Tips Philippines

Sales Journal Explanation Format Example Accounting For Management

Sales Journal Explanation Format Example Accounting For Management

Following Outgoing Cash With The Cash Disbursements Journal Dummies

Following Outgoing Cash With The Cash Disbursements Journal Dummies

Filipino Freelancer Bir Books Of Account Registration George Mikhail R Aurelio Cpa

Filipino Freelancer Bir Books Of Account Registration George Mikhail R Aurelio Cpa

What You Need To Know About Books Of Accounts Beyond D Numbers Consulting Co

What You Need To Know About Books Of Accounts Beyond D Numbers Consulting Co

Post a Comment for "What To Write In Bir Ledger Book"