Payment Protection Program Regulations

The size of the bond is based on the volume of business generally an average 2 days business with a minimum of 10000 bond. All loan terms will be the same for everyone.

Taxation Of Forgiveness Of Paycheck Protection Program Loans 2020 Articles Resources Cla Cliftonlarsonallen

Taxation Of Forgiveness Of Paycheck Protection Program Loans 2020 Articles Resources Cla Cliftonlarsonallen

BORROWERS The Paycheck Protection Program PPP authorizes up to 349 billion in forgivable loans to small businesses to pay their employees during the COVID-19 crisis.

Payment protection program regulations. The Paycheck Protection Program established by the CARES Act is implemented by the Small Business Administration with support from the Department of the Treasury. According to legislation signed into law on June 5 the program now. The Paycheck Protection Program PPP provides loans to help businesses keep their workforce employed during the Coronavirus COVID-19 crisis.

This was originally a 350-billion program intended to provide American small businesses with eight weeks of cash-flow assistance through 100 percent federally guaranteed loans. The applicant must submit SBA Form 2483 Paycheck Protection Program Application Form and payroll documentation. Market agencies and dealers must maintain a bond as a measure of protection for livestock sellers against non-payment.

In the evening of April 2 2020 mere hours before the application period was set to open SBA and Treasury published interim regulations a revised Borrowers Application and Lenders Application for the Paycheck Protection Program PPP. If you do not apply for forgiveness your first payment will be due 10 months after the end of the 24-week covered period or 10 months after December 31 2020 whichever is earlier. A third round of Paycheck Protection Program PPP loans was authorized by the passage of HR.

Search for lenders in your area. PAYCHECK PROTECTION PROGRAM PPP INFORMATION SHEET. Documentation of the sum of all retirement plan funding paid by your nonprofit excluding contributions from the employees.

And b the date that is 10 months after the date that is the earlier of i 24 weeks after the end of the borrowers Covered Period or ii December 31 2020 if the borrower does. SOP 50 10 can be found here. Allows forgiveness for expenses beyond the eight-week period to 24 weeks and extending the rehiring deadline.

Small Business Administration at Press_Officesbagov or 202 270-3876. Borrowers may be eligible for PPP loan forgiveness. The lender must submit SBA Form 2484 electronically in accordance with program requirements and maintain the forms and supporting documentation for its files.

Borrowers will also need to maintain the forms and supporting documentation in their files. The Paycheck Protection Program is a loan program that originated from the Coronavirus Aid Relief and Economic Security CARES Act. The maximum amount of the PPP loan is based upon 250 of monthly payroll.

Get matched with a lender. Packers whose annual livestock purchases exceed 500000 are also required to be bonded. First-Draw PPP loans are.

Accordingly the reference period for forgiveness is less than 74 of the reference period for the loan amount. The Paycheck Protection Program Flexibility Act of 2020 Flexibility Act extended the deferral period for borrower payments of principal and interest on all PPP loans to the earlier of a the date that the SBA remits the forgiven amount to the lender or notifies the lender that no forgiveness is allowed. Increases the current limitation on non-payroll expenses rent utility payments and mortgage interest for loan forgiveness from 25 to 40.

Businesses that are not eligible for Paycheck Protection Program PPP loans are identified in 13 CFR 120110 and described further in SBAs Standard Operating Procedure SOP 50 10 Subpart B Chapter 2 except that nonprofit organizations authorized under the Act are eligible. Consolidated Appropriations Act 2021 into law on Dec. These rules are immediately effective although there will be a 15 day comment period after which final rules will be issued which supersede the interim rules.

Small Business Administration SBA in consultation with the Treasury Department announced today that the Paycheck Protection Program PPP will re-open the week of January 11 for new borrowers and certain existing PPP borrowers. This program provides small businesses with funds to pay up to 8 weeks of payroll costs including benefits. Borrowers now have 24 weeks to spend loan proceeds up.

Funds can also be used to pay interest on mortgages rent and utilities. If there is a remaining balance after SBA remits payment your first payment will be due the following month. Documentation showing the total of all health dental vision life and disability insurance expenses paid by your nonprofit for your employees.

The PPP Flexibility Act amends the Paycheck Protection Program to give borrowers more time to spend loan funds and still obtain forgiveness. Section 1106 of the CARES Act provides for forgiveness of up to the full principal amount of qualifying loans guaranteed under the Paycheck Protection Program and requires SBA to issue guidance and regulations implementing section 1106 within 30 days after the date of enactment of the CARES Act. WASHINGTON The US.

If an employer has no eligible expenses aside from payroll costs close to 25 of the loan may not be eligible for forgiveness. The loan amounts will be forgiven as long as. The rules state that to apply borrowers must submit the Paycheck Protection Program Application Form SBA Form 2483 the Application and supporting payroll documentation to verify eligibility.

Osha Fall Protection Plan Template Awesome Nice Fall Protection Plan Template S Citation How To Plan Separation Agreement Template Business Plan Template Free

Osha Fall Protection Plan Template Awesome Nice Fall Protection Plan Template S Citation How To Plan Separation Agreement Template Business Plan Template Free

Paycheck Protection Program Silicon Valley Bank

Paycheck Protection Program Silicon Valley Bank

Image Result For Gdpr Privacy Impact And Risk Assessments Gdpr Compliance Assessment Data Protection

Image Result For Gdpr Privacy Impact And Risk Assessments Gdpr Compliance Assessment Data Protection

Pin On Home Equity Lending For Credit Unions

Pin On Home Equity Lending For Credit Unions

Unemployment Benefits And The Cares Act Bench Accounting

Unemployment Benefits And The Cares Act Bench Accounting

Cares Act What The Paycheck Protection Program Fenwick West Llp

Cares Act What The Paycheck Protection Program Fenwick West Llp

Osha And The Small Business Owner Cogent Analytics Small Business Small Business Owner Small Business Resources

Osha And The Small Business Owner Cogent Analytics Small Business Small Business Owner Small Business Resources

Opportunity Zone Final Regulation Guidance Internal Revenue Service Guidance Opportunity

Opportunity Zone Final Regulation Guidance Internal Revenue Service Guidance Opportunity

Paycheck Protection Program Data Released By Small Business Administration After Lawsuit Shows Largest Borrowers The Washington Post

Paycheck Protection Program Data Released By Small Business Administration After Lawsuit Shows Largest Borrowers The Washington Post

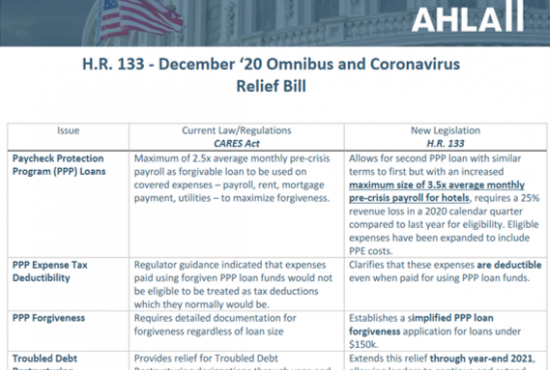

Covid 19 Legislative Regulatory Updates Ahla

Covid 19 Legislative Regulatory Updates Ahla

After Inc Publishes Latest Research On California Consumer Protection Act Ccpa Effective Jan 1 2020 And Its Implications For Manufacturers Send2pres Data Driven Marketing Consumer Protection Program Management

After Inc Publishes Latest Research On California Consumer Protection Act Ccpa Effective Jan 1 2020 And Its Implications For Manufacturers Send2pres Data Driven Marketing Consumer Protection Program Management

12 Steps To Gdpr Compliance General Data Protection Regulation Data Protection Act 2018 Data Protection

12 Steps To Gdpr Compliance General Data Protection Regulation Data Protection Act 2018 Data Protection

Pin On Paycheck Protection Program

Pin On Paycheck Protection Program

Ppp Loan Forgiveness How To Apply And Get Accepted Nav

Ppp Loan Forgiveness How To Apply And Get Accepted Nav

Pin On Reclaiming Our Downtown Santa Clara Ca

Pin On Reclaiming Our Downtown Santa Clara Ca

Pin On How To Articles For Small Businesses

Pin On How To Articles For Small Businesses

Stampede For Emergency Loans Is Crushing Lenders Putting Millions Of Small Businesses At Risk Here Are Steps To Fix The System How To Get Money Emergency Loans Economy

Stampede For Emergency Loans Is Crushing Lenders Putting Millions Of Small Businesses At Risk Here Are Steps To Fix The System How To Get Money Emergency Loans Economy

Do Owner Draws Count As Salary For The Paycheck Protection Program Bench Accounting

Do Owner Draws Count As Salary For The Paycheck Protection Program Bench Accounting

Post a Comment for "Payment Protection Program Regulations"