Payment Protection Program Fact Sheet

Nonrecourse Marketing Assistance Loans and Loan Deficiency Payments PDF 977 KB September 2020. The loan amounts will be forgiven as long as.

Ppp Loans Vs Unemployment Benefits How To Choose Bench Accounting

Ppp Loans Vs Unemployment Benefits How To Choose Bench Accounting

Get matched with a lender.

Payment protection program fact sheet. Not be in bankruptcy 3. Noninsured Crop Disaster Assistance Program NAP PDF 580 KB September 2020. States will identify priority source water protection areas and may offer increased incentives and higher payment rates for practices that address water quality andor water quantity.

As of January 29 2021. The funding for ECP is determined by Congress. Livestock Indemnity Program LIP LIP provides benefits to livestock producers for livestock deaths in excess of normal mortality caused by adverse weather or by attacks by animals reintroduced into the wild by the Federal Government.

All loan terms will be the same for everyone. Up to 75 of the cost to implement emergency conservation practices can be provided however the final amount is determined by the committee reviewing the application. Payment Eligibility and Payment Limitations PDF 425 KB June 2019.

BORROWERS The Paycheck Protection Program PPP authorizes up to 349 billion in forgivable loans to small businesses to pay their employees during the COVID-19 crisis. The Paycheck Protection Program provides small businesses with funds to pay up to 8 weeks of payroll costs including benefits. Participants earn CSP payments for conservation performancethe higher the performance the higher the payment.

We are providing this information based on current laws regulations and guidance from the SBA and other regulatory authorities. The Conservation Stewardship Program CSP helps agricultural producers maintain and improve their existing conservation systems and adopt additional conservation activities to address priority resources concerns. Funds can also be used to pay interest on mortgages rent and utilities.

Margin Protection is area-based using county-level estimates of average revenue and input costs to establish the amount of coverage and indemnity payments. Loans made under the Small Business Administrations new Paycheck Protection Program can be made at the lenders discretion without FSA approval. CRP is a land conservation program administered by FSA.

Market Facilitation Program PDF 914 KB September 2019. Search for lenders in your area. Key Paycheck Protection Program Round 2 Updates.

For the 2020 DMC program year payments have triggered for March April May and September. In exchange for a yearly rental payment farmers enrolled in the program agree to remove environmentally sensitive land from agricultural production and plant species that will improve environmental health and quality. Qualified limited resource producers may earn up to 90 cost-share.

1 65 percent of the operating outlier threshold for the claim. Funds can also be used to pay interest on mortgages rent and utilities. The Paycheck Protection Program PPP provides loans to help businesses keep their workforce employed during the Coronavirus COVID-19 crisis.

Borrowers may be eligible for PPP loan forgiveness. Lenders are also encouraged to submit status and default status reports online through the Lender LINC System. Have billed Medicare for claims within 180 days immediately prior to the date of signature on the providers or suppliers application 2.

At a milk margin minus feed costs of 950 or less DMC payments are possible depending on the level of coverage chosen by the dairy producer. LIP payments are equal to 75 percent of the average fair market value of the livestock. PAYCHECK PROTECTION PROGRAM PPP INFORMATION SHEET.

The 2018 Farm Bill requires a national 10 percent of mandatory program funding be targeted towards source water protection. The application period for PPP Round 2 loans will end on March 31 2021. Or 2 65 percent of the cost of a COVID-19 stay beyond the operating Medicare payment including the 20 percent add-on payment under section 3710 of the CARES Act for eligible cases.

Paycheck Protection Program Forgiveness Documentation Introduction PPP orrowers are responsible for understanding the Small usiness Administrations rules. SMALL BUSINESS PAYCHECK PROTECTION PROGRAM. The Paycheck Protection Program established by the CARES Act is implemented by the Small Business Administration with support from the Department of the Treasury.

Contracts for land enrolled in CRP are 10-15 years in length. To receive an accelerated or advance payment during the COVID-19 PHE the provider or supplier must. The Families First Coronavirus Response Act FFCRA or Act requires certain employers to provide employees with paid sick leave or expanded family and medical leave for specified reasons related to COVID-19.

Not be under active medical review or program integrity investigation and 4. The Economic Aid Act makes available approximately 2845 billion in new Paycheck Protection Program PPP funding and reopens the PPP for initial and second-draw loans on terms that are generally favorable to nonprofits. The Department of Labors Department Wage and Hour Division WHD administers and enforces the new laws paid leave requirements.

This program provides small businesses with funds to pay up to 8 weeks of payroll costs including benefits. The enhanced payment will be equal to the lesser of. LIP Final Rule April 14 2014.

Frequently Asked Questions for Lenders and Borrowers participating in the Paycheck Protection Program PPP. Margin Protection provides coverage against an unexpected decrease in operating margin revenue less input costs. For the 2019 DMC program year payments triggered in January February March April May June and July.

How To Get A Duns Number And Register With Sam Nrcs

How To Get A Duns Number And Register With Sam Nrcs

Taxation Of Forgiveness Of Paycheck Protection Program Loans 2020 Articles Resources Cla Cliftonlarsonallen

Taxation Of Forgiveness Of Paycheck Protection Program Loans 2020 Articles Resources Cla Cliftonlarsonallen

How To Calculate Your Paycheck Protection Program Loan Amount Bench Accounting

How To Calculate Your Paycheck Protection Program Loan Amount Bench Accounting

Eidl Vs Ppp Loans What S The Difference Round 2 Update

Eidl Vs Ppp Loans What S The Difference Round 2 Update

Ppp Loan Forgiveness How To Apply And Get Accepted Nav

Ppp Loan Forgiveness How To Apply And Get Accepted Nav

Ppp Agent Fees A Guide For Accountants Attorneys And Consultants Schiffer Hicks Johnson Jdsupra

Ppp Agent Fees A Guide For Accountants Attorneys And Consultants Schiffer Hicks Johnson Jdsupra

Do Owner Draws Count As Salary For The Paycheck Protection Program Bench Accounting

Do Owner Draws Count As Salary For The Paycheck Protection Program Bench Accounting

Small Business Loan Assistance Possible

Small Business Loan Assistance Possible

Https Crsreports Congress Gov Product Pdf R R46284

Small Business Paycheck Protection Program Medical Billing And Coding Small Business Small Business Administration

Small Business Paycheck Protection Program Medical Billing And Coding Small Business Small Business Administration

How To Check The Status Of Your Ppp Loan Application

How To Check The Status Of Your Ppp Loan Application

Paycheck Protection Program Data Released By Small Business Administration After Lawsuit Shows Largest Borrowers The Washington Post

Paycheck Protection Program Data Released By Small Business Administration After Lawsuit Shows Largest Borrowers The Washington Post

Excel Payroll Calculator Template Software Download Payroll Template Payroll Sample Resume

Excel Payroll Calculator Template Software Download Payroll Template Payroll Sample Resume

Paycheck Protection Program Silicon Valley Bank

Paycheck Protection Program Silicon Valley Bank

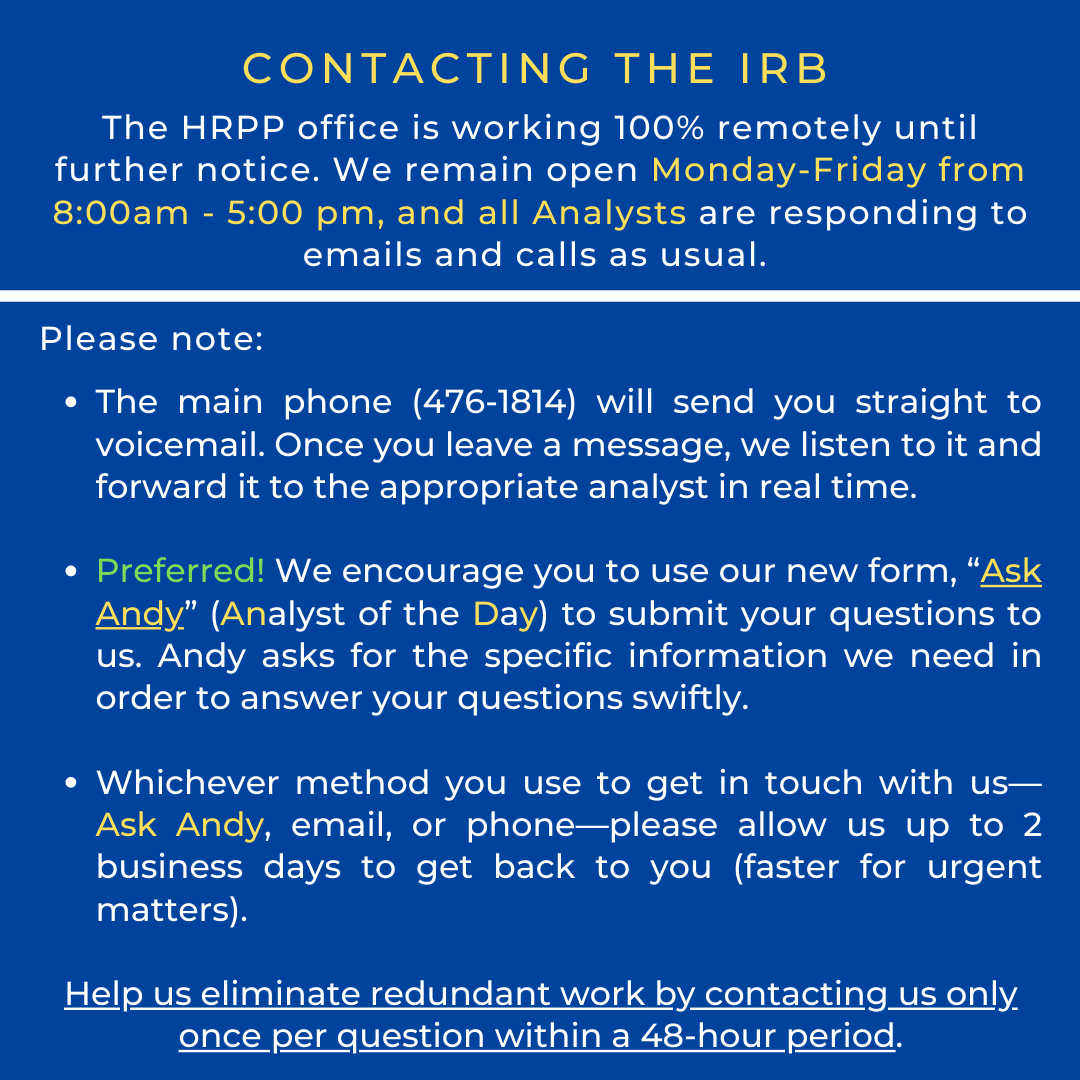

Human Research Protection Program Hrpp Ucsf Institutional Review Board

Human Research Protection Program Hrpp Ucsf Institutional Review Board

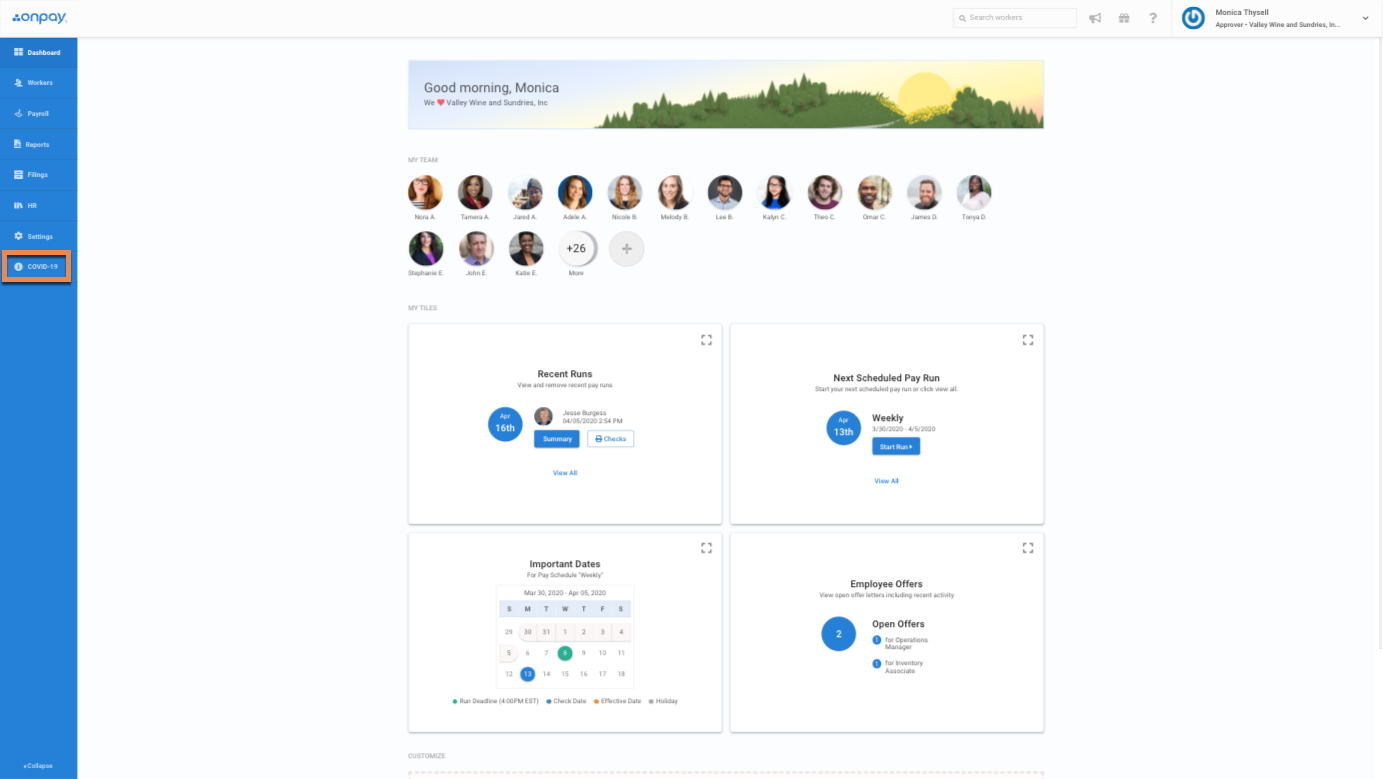

Run A Report In Onpay When Applying For A Paycheck Protection Program Loan Covid 19 Help Center

Run A Report In Onpay When Applying For A Paycheck Protection Program Loan Covid 19 Help Center

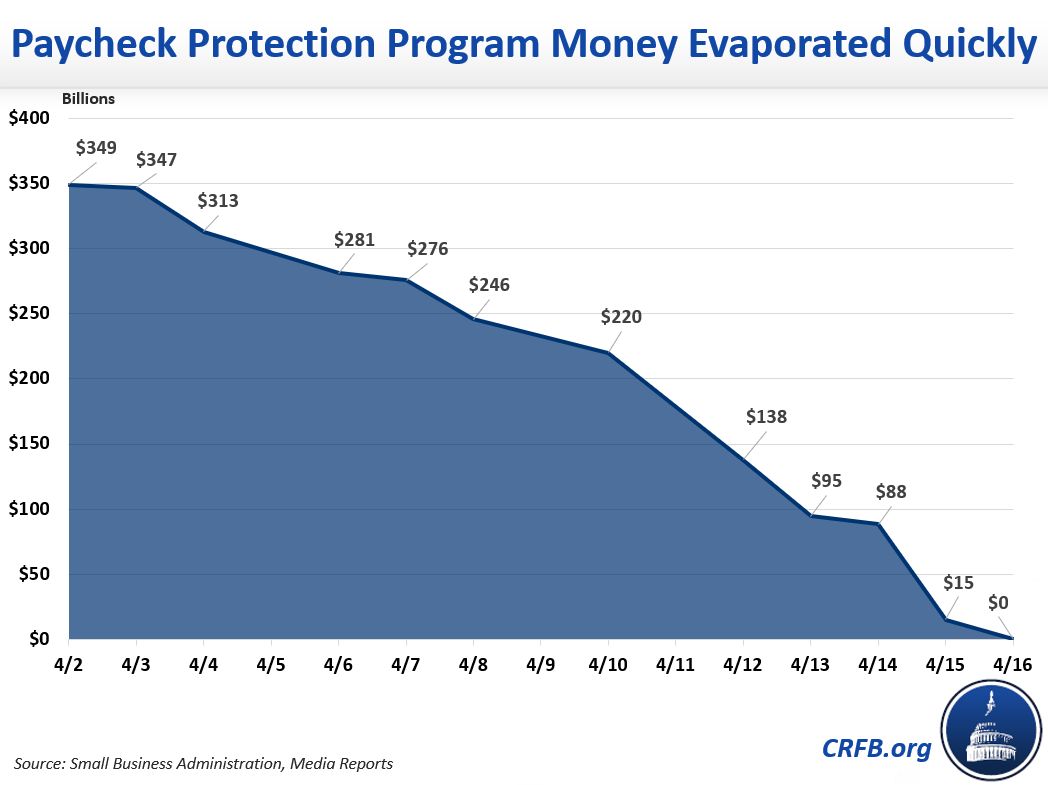

What S In The Fourth Coronavirus Package Committee For A Responsible Federal Budget

What S In The Fourth Coronavirus Package Committee For A Responsible Federal Budget

Post a Comment for "Payment Protection Program Fact Sheet"