Payment Protection Program Application Status

Paycheck Protection Program PPP Small Business Administration Loan Application. Please note the White House announced PPP changes effective Wednesday February 24.

Determining Loan Availability And Forgiveness Under The Paycheck Protection Program Small Business Loans Federal Income Tax Paycheck

Determining Loan Availability And Forgiveness Under The Paycheck Protection Program Small Business Loans Federal Income Tax Paycheck

Funding is available to businesses who are looking to obtain a PPP loan for the first time as well as to businesses who qualify for a second draw PPP loan.

Payment protection program application status. 155000 small businesses apply quickly for PPP funds. Each PPP lender will have a somewhat different process for checking the status of your loan application. Click HERE for the application.

We are now accepting new applications through March 31 or until funds run out whichever comes first. The Paycheck Protection Program established by the CARES Act is implemented by the Small Business Administration with support from the Department of the Treasury. For loans made before June 5 2020 the maturity is 2 years but borrowers may be able to work with their lender to extend the maturity of the loan to 5 years.

Asking your lender about the status of your application through normal processes such as contacting a bank branch directly or contacting a customer care center may not work due to the volume of applications being processed. Failure to submit the information would affect that determination. The SBA Paycheck Protection Program.

A business can authorize another person to complete the application however we recommend the business owner complete the application. Funds can also be used to pay interest on mortgages rent and utilities. This form is to be completed by the authorized representative of the applicant and submitted to your SBA participating lender.

Sign up for Wells Fargo Online. You will need to complete the Paycheck Protection Program loan application and submit the application with the required documentation to an approved lender that is available to process your application by June 30 2020. A Paycheck Protection Program loan has an interest rate of 1.

As part of these changes for a 14-day period beginning on Wednesday February 24 the Small Business Administration SBA will only accept PPP loan applications from companies with. Interest rates at 10. The Paycheck Protection Program PPP provides loans to help businesses keep their workforce employed during the Coronavirus COVID-19 crisis.

STATUS UPDATE AS OF MARCH 1 2021. Payroll costs include wages commissions income or net earnings from self-employment capped at 100000 on an annualized basis for each employee. Apply for a Paycheck Protection Loan.

If you made your request online you can check the status of your request here. Continue to check this page for updates and visit SBAgov and Treasurygov for full program details. Answer for sole proprietor or independent contractor.

The Economic Aid to Hard-Hit Small Businesses Nonprofits and Venues Act was recently enacted allocating an additional 284 billion in funding for the Paycheck Protection Program PPP. Borrowers may be eligible for PPP loan forgiveness. Once the SBA receives the lenders decision they have 90 days to review the application before remitting a forgiveness payment to the lender.

We are currently accepting PPP loan applications. Wells Fargo customers can get to their applications quickly with a username and password. 2020 The PNC Financial Services Group Inc.

Important Update In an effort to further promote equitable access to Paycheck Protection Program PPP loans on February 22 the federal government announced several changes to the PPP application process. Find out if you qualify in minutes. Youll have time to request Forgiveness before you need to start making payments.

Deadline to apply is March 31 2021. Paycheck Protection Program information center. No payments for 10 months.

Search for lenders in your area. Loans up to 2 million. Wells Fargo small business customers - access your accounts when where and how you want.

Its important that you review and e-sign this document as soon as possible. You will need to provide. Submission of the requested information is required to make a determination regarding eligibility for financial assistance.

If your application is approved you will receive an email from Wells Fargo Paycheck Protection Programs DocuSign system asking you to review and e-sign the promissory note in the principal amount of your PPP loan. Under the Economic Aid to Hard-Hit Small Businesses Nonprofits and Venues Act an additional 28445 billion was provided in funding for the Paycheck Protection Program PPP. A business owner does not have to key in the application.

MT Bank MT is not working with third-party agents on Paycheck Protection Program PPP loans. PPP Applications are Now Being Accepted Complete your PPP Application in 15 minutes or less. Read more about that legislation and apply for a PPP loan here.

A PPP loan made on or after June 5 2020 has a maturity of 5 years. On December 22 2020 Congress passed the stimulus bill which provides for new for Paycheck Protection Program loans and other small business relief. Get matched with a lender.

What other documents will I need to include in my application. Guidance from the SBA states that lenders have 60 days after receiving a complete forgiveness application to review a PPP Forgiveness application and submit the lenders decision to the SBA. This program provides small businesses with funds to pay up to 8 weeks of payroll costs including benefits.

This approach is based upon the Payment Protection Program Information Sheet provided by the Treasury Department. To get started contact your banker. In 2020 we helped more than.

Instead youll have to follow the specific instructions of your bank or lender concerning PPP loan applications.

Irs Taxes Most Loan Forgiveness Be Careful With Exceptions Loan Forgiveness Irs Taxes Filing Taxes

Irs Taxes Most Loan Forgiveness Be Careful With Exceptions Loan Forgiveness Irs Taxes Filing Taxes

Paycheck Protection Program Loan Forgiveness Application Loan Forgiveness Forgiveness Loan

Paycheck Protection Program Loan Forgiveness Application Loan Forgiveness Forgiveness Loan

Eidl Vs Paycheck Protection Program The Breakdown Bench Accounting

Eidl Vs Paycheck Protection Program The Breakdown Bench Accounting

Pin On Coronovirus Business Tips

Pin On Coronovirus Business Tips

How To Check The Status Of Your Ppp Loan Application

How To Check The Status Of Your Ppp Loan Application

Sba Easing Forgiveness Of Paycheck Protection Program Loans Of 50 000 Or Less Loan Forgiveness Loan Business Journal

Sba Easing Forgiveness Of Paycheck Protection Program Loans Of 50 000 Or Less Loan Forgiveness Loan Business Journal

Paycheck Protection Program Marine Federal Blog In 2020 Paycheck Apply For A Loan Sba Loans

Paycheck Protection Program Marine Federal Blog In 2020 Paycheck Apply For A Loan Sba Loans

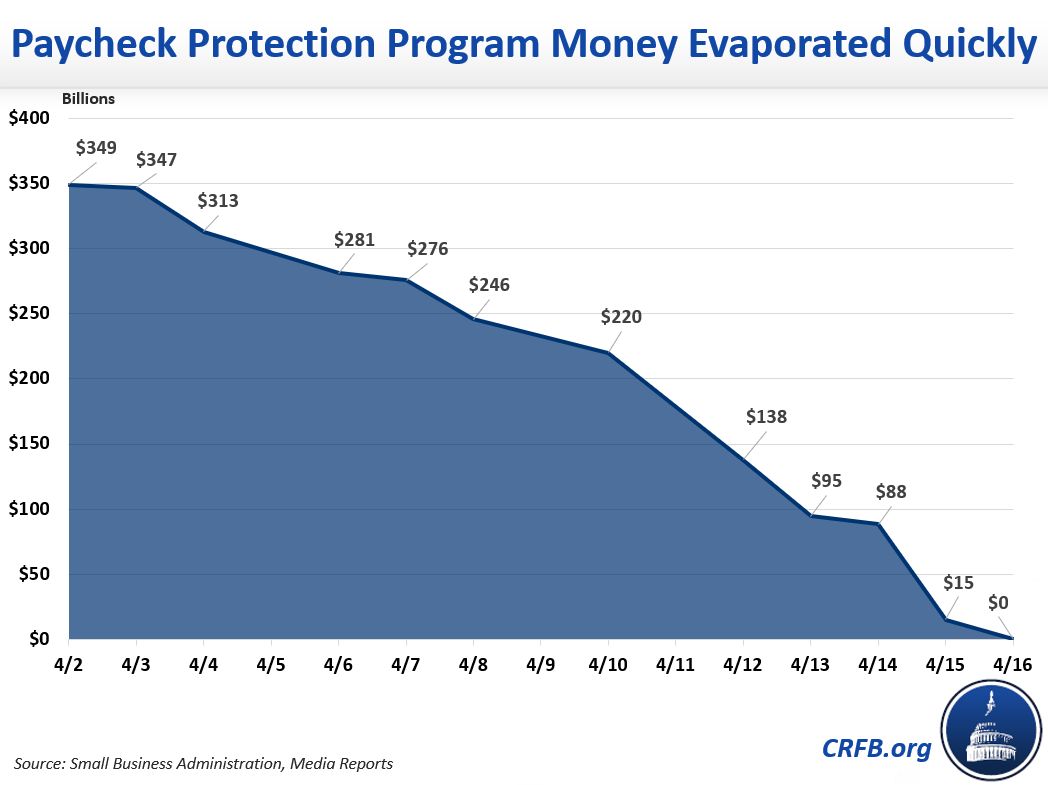

What S In The Fourth Coronavirus Package Committee For A Responsible Federal Budget

What S In The Fourth Coronavirus Package Committee For A Responsible Federal Budget

How To Calculate Your Paycheck Protection Program Loan Amount Bench Accounting

How To Calculate Your Paycheck Protection Program Loan Amount Bench Accounting

Small Business Paycheck Protection Program Medical Billing And Coding Small Business Small Business Administration

Small Business Paycheck Protection Program Medical Billing And Coding Small Business Small Business Administration

Quickbooks Paycheck Protection Program In 2020 Paycheck Quickbooks Family Medical

Quickbooks Paycheck Protection Program In 2020 Paycheck Quickbooks Family Medical

Post a Comment for "Payment Protection Program Application Status"