Paycheck Protection Program Guidelines For Lenders

Specifically some of those FAQs involve explaining the requirements under the Bank Secrecy Act BSA and how lenders can meet those requirements when issuing a PPP loan. Five 5 percent for loans of not more than 350000.

An Advisor S Guide To The Paycheck Protection Program

An Advisor S Guide To The Paycheck Protection Program

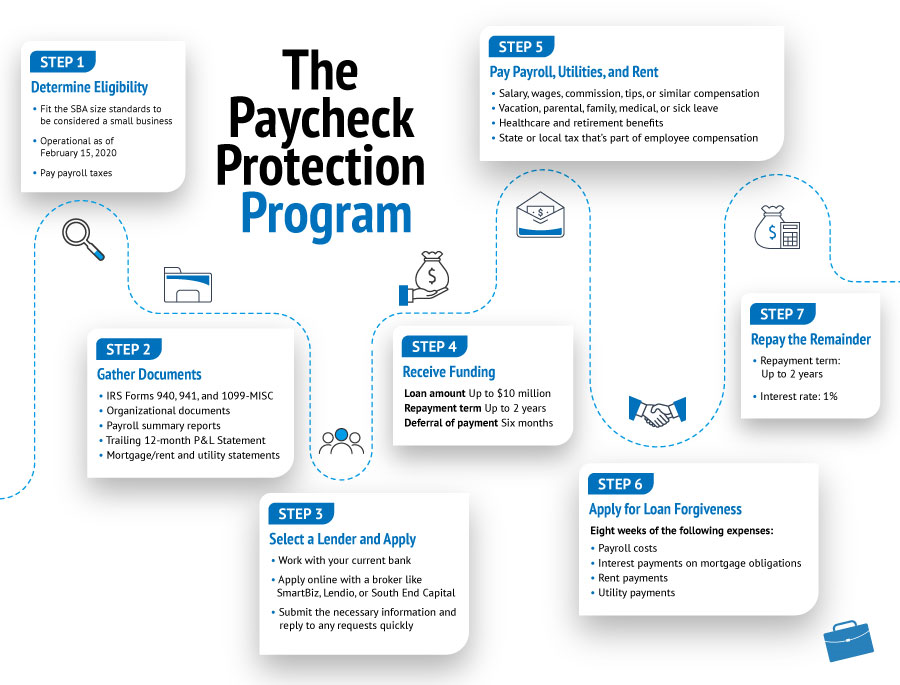

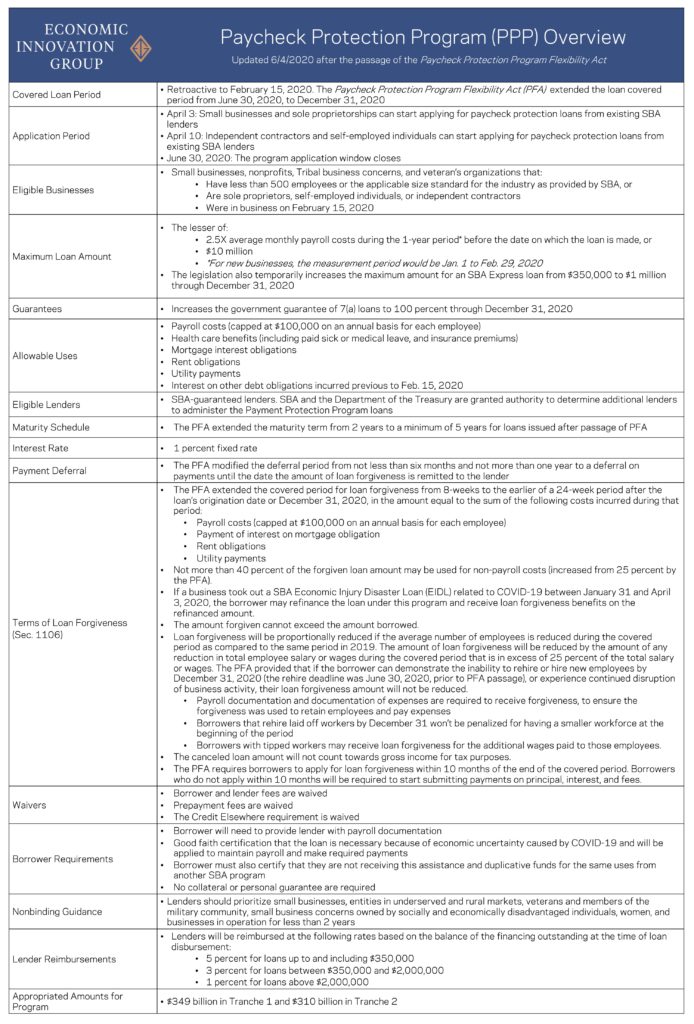

BORROWERS The Paycheck Protection Program PPP authorizes up to 349 billion in forgivable loans to small businesses to pay their employees during the COVID-19 crisis.

Paycheck protection program guidelines for lenders. Frequently Asked Questions for Lenders and Borrowers participating in the Paycheck Protection Program PPP. We have partnered with two leading funding marketplaces and one direct lender who can support you in getting a PPP loan 1. Youll go into E-Tran enter the loan data parameters and will receive a loan number from the SBA which is your approval he said.

The loan amounts will be forgiven as long as. Loan agreements identify the issuing lender to small businesses at signing. The Paycheck Protection Program PPP loan is a type of SBA loan designed to provide funds to help small businesses impacted by COVID-19 to keep their workers on payroll.

Regarding implementation of the Paycheck Protection Program PPP established by section 1102 of the Coronavirus Aid Relief and Economic Security Act CARES Act or the Act. The Paycheck Protection Program PPP now allows certain eligible borrowers that previously received a PPP loan to apply for a Second Draw PPP Loan with the same general loan terms as their First Draw PPP Loan. Search for lenders in your area.

This document will be updated on a regular basis. Specifically Section 311 of the Additional Coronavirus Response and Relief provisions of the CAA provides for PPP second draw loans for eligible businesses. Paycheck Protection Program Updated Guidelines.

Get matched with a lender. All loan terms will be the same for everyone. Paychex wants to continue providing every opportunity for your business to gain access to apply for these much-needed funds.

Small Business Administration SBA in consultation with the Treasury Department announced today that the Paycheck Protection Program PPP will re-open the week of January 11 for new borrowers and certain existing PPP borrowers. SBA and Treasury Announce PPP Re-Opening. PPP loans are made by one or more approved US.

The Paycheck Protection Program signed into law March 27 2020 is expected to be replenished April 24 2020. And One 1 percent for loans of at least 2000000. The Paycheck Protection Program Flexibility Act changed how PPP loans issued after June 5 2020 work.

Paycheck Protection Program deadline approaches Targeted Business Exclusivity Ends March 9th The first deadline in the latest round of Paycheck Protection Program loans is on the way. Lenders are limited to submitting PPP applications for businesses with fewer than 20 employees from Feb. Intends to provide timely additional guidance to address borrower and lender questions concerning the implementation of the Paycheck Protection Program PPP established by section 1102 of the Coronavirus Aid Relief and Economic Security Act CARES Act or the Act.

All loans for the Paycheck Protection Program will be approved by lenders delegated authority said John Miller Deputy Associate Administrator for the Office of Capital Access during the ABA webinar. The Paycheck Protection Program PPP provides loans to help businesses keep their workforce employed during the Coronavirus COVID-19 crisis. Businesses funded after that date are automatically covered for 24 weeks.

As of January 29 2021. PAYCHECK PROTECTION PROGRAM PPP INFORMATION SHEET. Second Draw PPP Loans can be used to help fund payroll costs including benefits.

Those issued before that date give borrowers a choice between covering 8 weeks or 24 weeks of spending to qualify for forgiveness. A third round of Paycheck Protection Program PPP loans was authorized by the passage of HR. Consolidated Appropriations Act 2021 into law on Dec.

Rates for the Paycheck Protection Program PPP are at 1. These loans may be completely forgiven if spent on eligible expenses mainly payroll during a specific time period. This article outlines the latest guidance on this program from the US.

Approval and loan forgiveness are subject to your availability to meet government-set eligibility requirements. SBA will pay lenders fees for processing PPP loans in the following amounts. Save For Later Print.

Small Business Administration SBA lenders. 24 to March 9. First-Draw PPP loans are.

WASHINGTON The US. The Consolidated Appropriations Act CAA 2021 includes a provision that modified and extended the Small Business Administrations SBA Paycheck Protection Program PPP. Three 3 percent for loans of more than 350000 and less than 2000000.

Lenders may not collect any fees from the applicant. Borrowers may be eligible for PPP loan forgiveness. The Biden administration announced several changes Monday to the Paycheck Protection Program in an effort to reach minority-owned and very small businesses that may have previously missed out on.

Sba Paycheck Protection Program Faqs

Sba Paycheck Protection Program Faqs

Paycheck Protection Program Information Now Available Honor Credit Union

Paycheck Protection Program Information Now Available Honor Credit Union

Nonprofit Paycheck Protection Program Ppp Application Insidecharity Org

Nonprofit Paycheck Protection Program Ppp Application Insidecharity Org

How The Upcoming Round Of The Paycheck Protection Program Ppp Works

How The Upcoming Round Of The Paycheck Protection Program Ppp Works

Cares Act Paycheck Protection Program Applications Now Available Guidance For Lenders And Borrowers Baker Donelson

Cares Act Paycheck Protection Program Applications Now Available Guidance For Lenders And Borrowers Baker Donelson

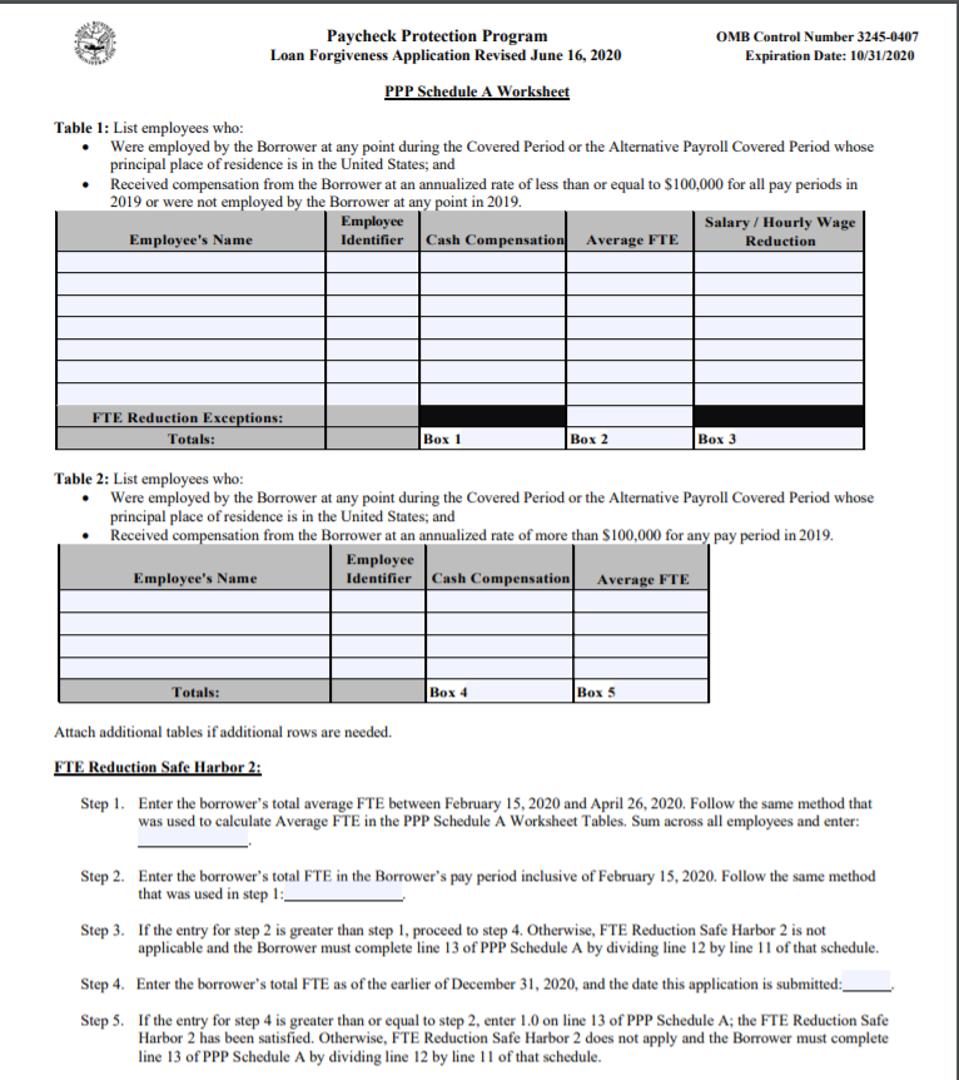

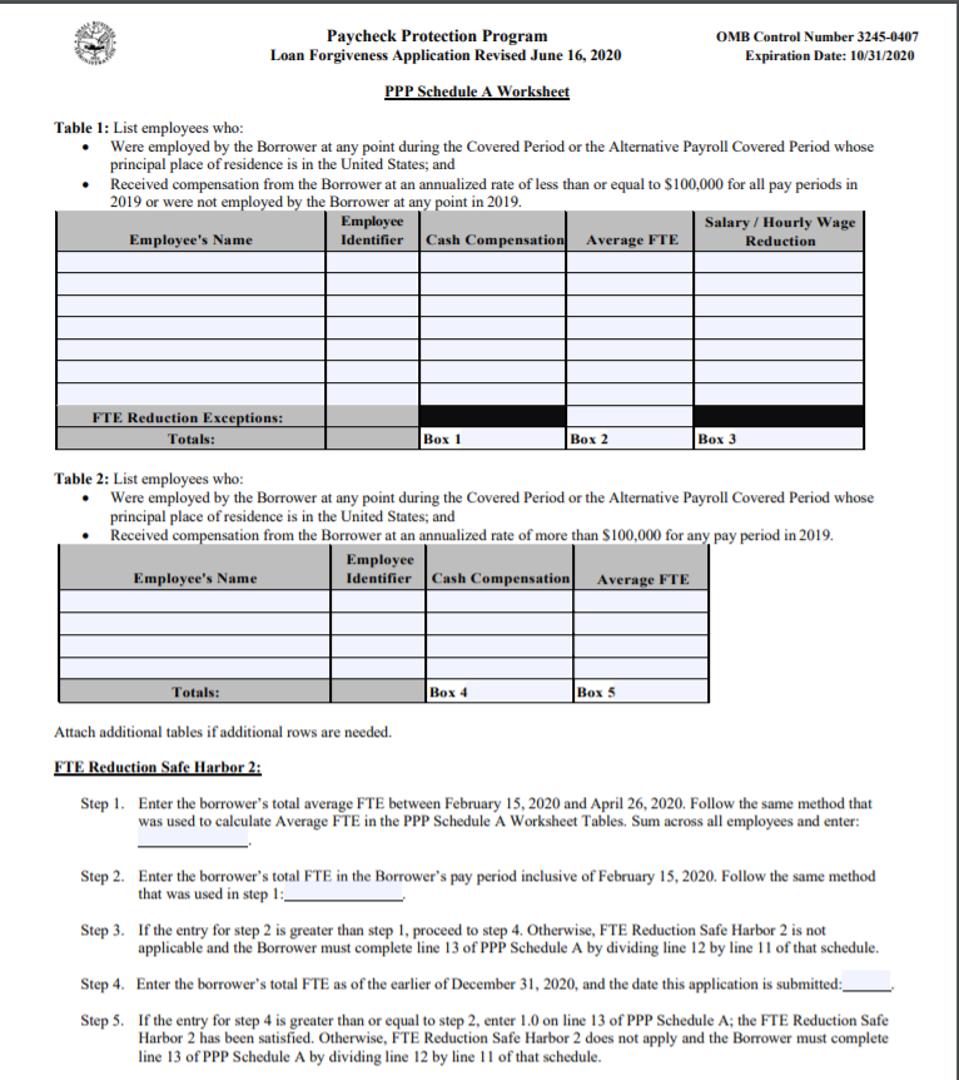

Paycheck Protection Program Loan Forgiveness Application Loan Forgiveness Forgiveness Loan

Paycheck Protection Program Loan Forgiveness Application Loan Forgiveness Forgiveness Loan

The Not Quite Definitive Guide To Paycheck Protection Program Loan Forgiveness

The Not Quite Definitive Guide To Paycheck Protection Program Loan Forgiveness

Sba Cares Act Relief Loans Money Source Of America Llc

Sba Cares Act Relief Loans Money Source Of America Llc

Sba Paycheck Protection Program Ppp Forgivable Loans For Small Businesses

How To Apply For The Paycheck Protection Program Loudoun County Economic Development Va

How To Apply For The Paycheck Protection Program Loudoun County Economic Development Va

Paycheck Protection Program Farm Credit Administration

Paycheck Protection Program Farm Credit Administration

Pin On Starting A Business Business Success Tips

Pin On Starting A Business Business Success Tips

Changes To Ppp Loans By The Paycheck Protection Program Ppp Flexibility Act Of 2020 Liskow Lewis Jdsupra

Changes To Ppp Loans By The Paycheck Protection Program Ppp Flexibility Act Of 2020 Liskow Lewis Jdsupra

Congress Improves The Paycheck Protection Program Economic Innovation Group

Congress Improves The Paycheck Protection Program Economic Innovation Group

Post a Comment for "Paycheck Protection Program Guidelines For Lenders"