Does Guaranteed Payments Qualify For Ppp

Moreover whether PPP lenders will accept applications on that basis remains to be seen. Small Business Administration SBA and Treasury issued an interim final rule Monday addressing Paycheck Protection Program PPP forgiveness issues related to owner-employee compensation and the eligibility of nonpayroll costs.

Ppp Loans For Partnerships What You Need To Know Bench Accounting

Ppp Loans For Partnerships What You Need To Know Bench Accounting

Charge a prepayment penalty.

Does guaranteed payments qualify for ppp. The Paycheck Protection Program PPP is designed to support American small businesses with eight weeks of cash support during the COVID-19 pandemic. The CARES Act and the new bill offer have allocated money to a number of different loan and grant programs outside of PPP. Specifically the question is whether guaranteed payments or distributions are treated as payroll costs as defined by the CARES Act.

SBA Rationale for PPP Partnership Aggregation Instead the most recent SBA guidance has taken an aggregate approach for partners and partnerships. April 6 2020 One of the more debated topics in the newly established Paycheck Protection Program PPP is the treatment of partner compensation whether in the form of guaranteed payments or distributions. If you employee is considered highly compensated you are still able to pay them using PPP.

Several types of businesses qualify for this program including partnerships. The PPP implemented by section 1102 of the CARES Act expanded the Small Business Administration SBA 7a loan program to provide up to 349 billion increased by an additional 310 billion on April 24 in 100 percent federally-guaranteed loans to small employers and eligible self-employed individuals impacted by COVID-19. Because those regulations treat the recipient of a guaranteed payment for services but not distributive share as being self-employed in a trade or business it is possible that such a recipient may themselves be eligible to apply for a PPP loan.

Check here for the full details on who can apply for a PPP loan. Permit payments for vision and dental benefits to be included in the group health care benefits and insurance premiums that are eligible to be paid with PPP funds. You can still pay them with your loan as they qualify as a legitimate expense but that portion you spend on them will not qualify for loan forgiveness if it is used to pay independent contractors.

Establish that the payment or nonpayment of fees of an agent or other third party is not material to the SBAs guarantee of a PPP loan or to the SBAs payment of fees to lenders. Womply has helped. If you dont have employees there is another way to get there.

If you are a partner in a multi-member LLC or partnership heres what you need to know about the PPP and what youll need to apply. Charge a guaranteed fee. The Paycheck Protection Program PPP loan is a type of SBA loan designed to provide funds to help small businesses impacted by COVID-19 to keep their workers on payroll.

If you do not qualify for PPP you have other options to access capital. As a result the SBA appears to have opened up the definition of payroll costs to partners K-1 distributions and presumably guaranteed payments. The rule does not address partners or partnerships at any point over the remainder of its text.

On March 27 the president signed into law the CARES Act to provide relief to taxpayers and businesses facing hardship due to COVID-19. These loans may be completely forgiven if spent on eligible expenses mainly payroll during a specific time period. Guaranteed Payments to Partners and Tax Law Guaranteed payments to partners are outlined in Section 707 c of the Internal Revenue Code IRC which defines such payments as those made by a.

Generally speaking income that is classified as self-employment income for a member or partner includes guaranteed payments as well as that members or partners distributable share of income arising from the trade or business of the LLC or partnership. This document was prepared based on information available on March 30 2020 and was updated on April 2 2020 from information available on the SBA website. Guaranteed payments for partners are not specifically included in the definition of payroll costs for PPP however I have heard many banks are telling their customers to include it in their wage number if they had employees.

This legislation includes the Paycheck Protection Program PPP which provides cash-flow assistance through federally guaranteed loans to employers who maintain their payroll during the coronavirus pandemic. However the rule makes it very clear that it is acceptable to include the self-employment income of partners up to 100000 annualized as a payroll cost on a PPP loan application filed by or on behalf of the partnership. The SBA has issued Paycheck Protection Program PPP guidance for self-employed individuals who file an IRS Schedule C with their Form 1040 to report their self-employment income.

Get your PPP loan or second draw PPP loan through Womply. Specifically the interim final rule establishes that owner-employees with less than a 5 stake in a C or S corporation are exempted from the PPP owner-employee compensation rule for determining the amount of their compensation for loan. An SBA-backed loan that helps businesses keep their workforce employed during the Coronavirus COVID-19 crisis.

In this article well guide your partnership through the process of calculating how much you can request for your PPP loan. The reason for this is that independent contractors are self-employed and thus can apply for their own PPP loans as of April 10 2020 to cover.

Do Owner Draws Count As Salary For The Paycheck Protection Program Bench Accounting

Do Owner Draws Count As Salary For The Paycheck Protection Program Bench Accounting

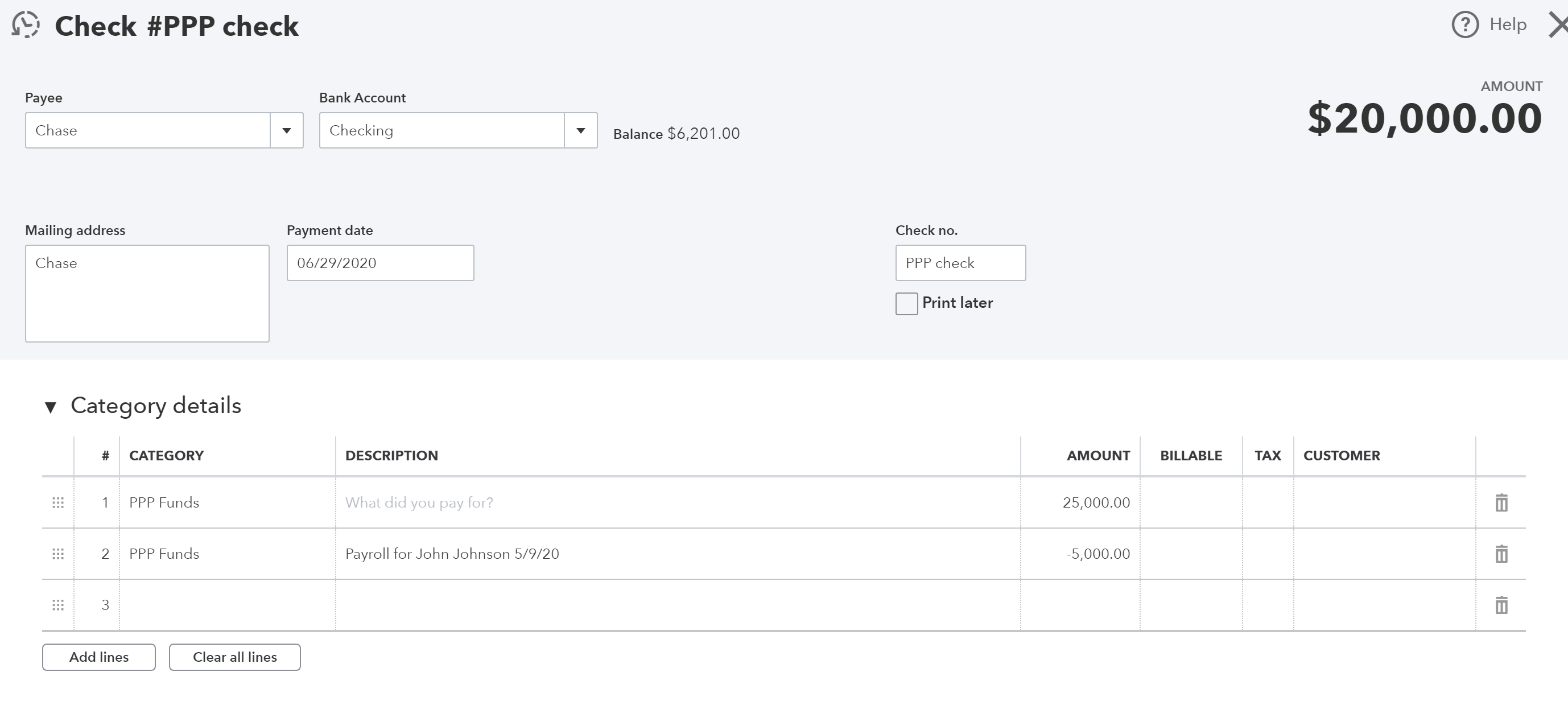

Ppp Loan Forgiveness Step By Step Accounting Instructions Scalefactor

Ppp Loan Forgiveness Step By Step Accounting Instructions Scalefactor

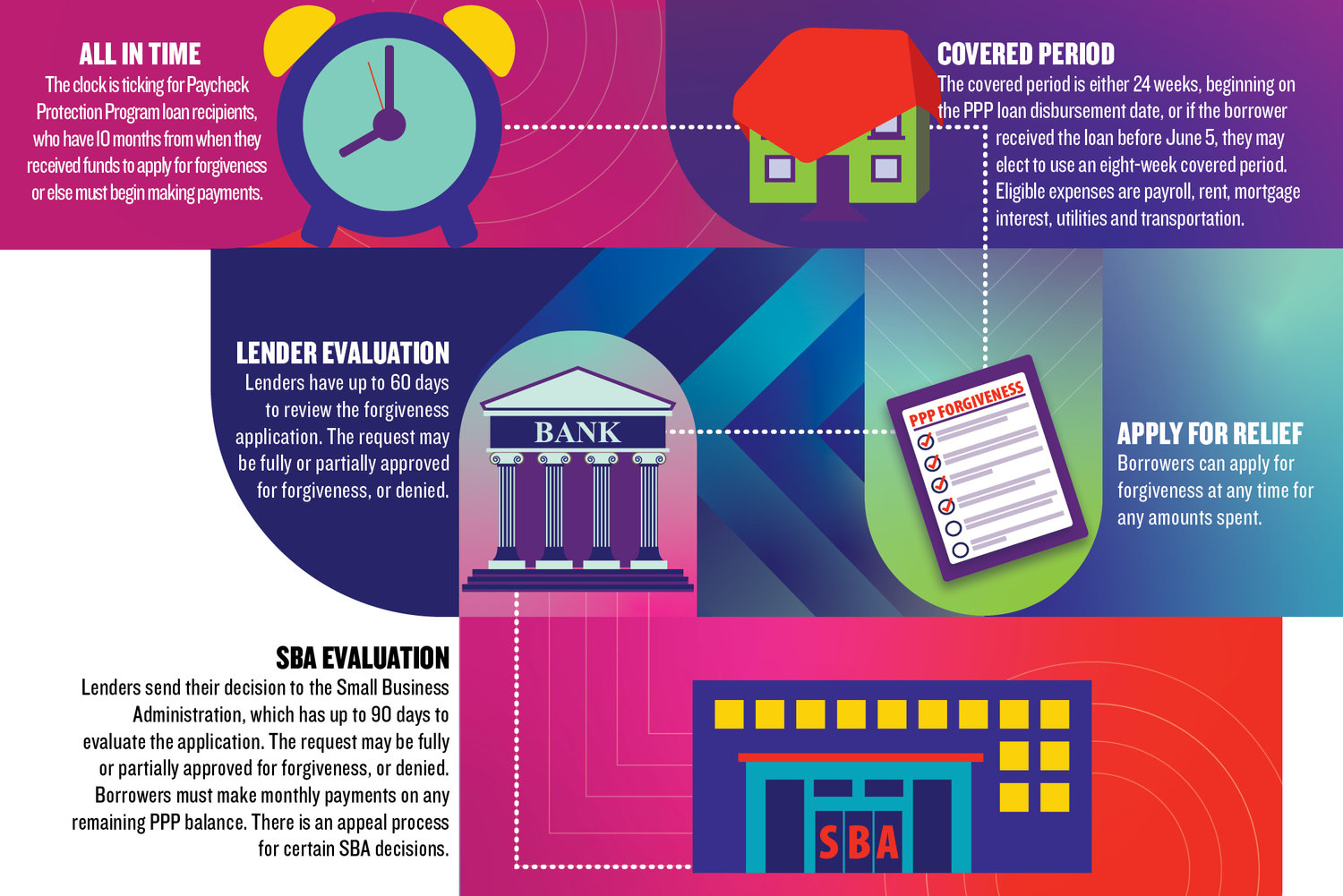

Asking For Forgiveness Banks Note Application Uptick As Sba Begins Forgiving Ppp Loans Springfield Business Journal

Asking For Forgiveness Banks Note Application Uptick As Sba Begins Forgiving Ppp Loans Springfield Business Journal

Paycheck Protection Program Ppp Frequently Asked Questions Christian Small

Paycheck Protection Program Ppp Frequently Asked Questions Christian Small

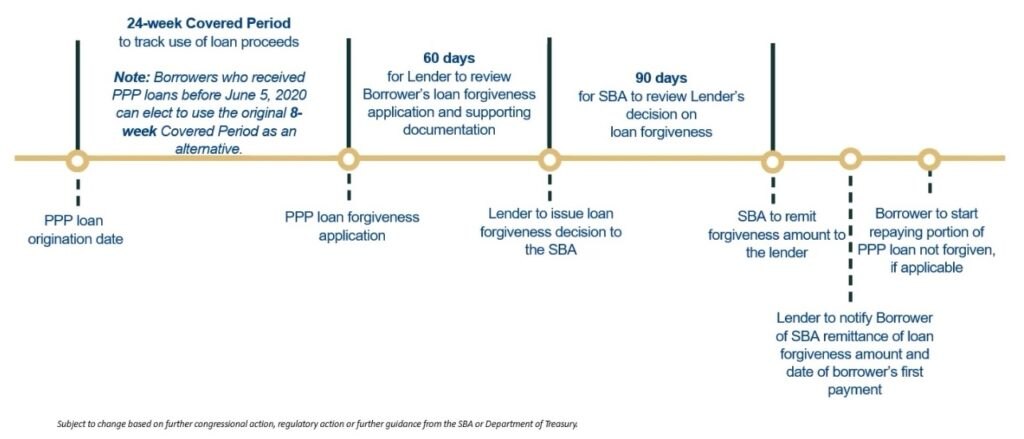

Ppp Forgiveness Series Part 3 A Visual Timeline Bbva

Ppp Forgiveness Series Part 3 A Visual Timeline Bbva

Https Www Bkd Com Sites Default Files 2020 08 Important New Details On Ppp Loan Forgiveness Pdf

Ppp Loan Forgiveness And Recording Ppp Loan Funds Tax Queen

Ppp Loan Forgiveness And Recording Ppp Loan Funds Tax Queen

Irs Notice 2020 32 Ppp Loan Updates Scheffel Boyle

Irs Notice 2020 32 Ppp Loan Updates Scheffel Boyle

Partners Self Employment Income Now Qualifies As Payroll Costs For Ppp Loans Wilkinguttenplan

Partners Self Employment Income Now Qualifies As Payroll Costs For Ppp Loans Wilkinguttenplan

What You Need To Know About Ppp Loan Forgiveness Bader Martin

What You Need To Know About Ppp Loan Forgiveness Bader Martin

Understanding The Updated Ppp Loan Criteria Trilogy

Understanding The Updated Ppp Loan Criteria Trilogy

Ppp Forgiveness Apply Now Or Wait

Ppp Forgiveness Apply Now Or Wait

Pin On Coronovirus Business Tips

Pin On Coronovirus Business Tips

Paycheck Protection Program Round 2 Knowns Unknowns Rkl Llp

Paycheck Protection Program Round 2 Knowns Unknowns Rkl Llp

Post a Comment for "Does Guaranteed Payments Qualify For Ppp"