Calculate Unemployment Payment Texas

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. If you worked part-time estimate your monthly or quarterly wages.

Base Period Calculator Determine Your Base Period For Ui Benefits

Base Period Calculator Determine Your Base Period For Ui Benefits

Your WBA will be between 68 and 507 minimum and maximum weekly benefit amounts in Texas depending on your past wages.

Calculate unemployment payment texas. The unemployment benefits program starts when an employee gets laid off or let go. Unemployment compensation has its own line Line 7 on Schedule 1 which accompanies your 1040 tax return. This number cannot.

For more information refer to How Unemployment Insurance Benefits Are Computed PDF or the Unemployment Insurance Benefit Table PDF. When Juan requests benefit payment he reports that he worked 25 hours and earned 231 181 50. In addition to slogging through each states unemployment policies to determine each states unemployment pay outs we added the 600 a week included in the new stimulus package.

This calculator uses the average weekly state benefit amount reported by the Department of Labor from Jan 2020 to Nov 2020 to calculate total unemployment compensation. The estimator assumes a 40-hour work week. You usually can get information about the location of the office the phone number and any email addresses under the Contact Us section of the unemployment office website.

Once you file your claim the EDD will verify your eligibility and wage information to determine your weekly benefit amount WBA. However it often is difficult to get through to an unemployment office over the phone. Your weekly benefit amount WBA is the amount you receive for weeks you are eligible for benefits.

You must request payment to receive benefits. For your WBA find your base period quarter with the highest wages. If you do not.

However this number is a good indicator of what you can expect. An example of finding your WBA would be 150025 which is a WBA of 60. To find your MBA multiply your weekly amount by 26 and find what 27 of all.

View a tutorial on how to apply for benefits online. Overview of Texas Taxes Texas has no state income tax which means your salary is only subject to federal income taxes if you live and work in Texas. This calculator uses the average weekly state benefit amount reported by the Department of Labor from Jan 2020 to Oct 2020 to calculate total unemployment compensation.

Most offices encourage you to file claims and calculate benefits online. The maximum WBA is 521 for highest quarterly earnings of 13025. Enter amounts earned before withholding gross pay.

Employee 3 has 37100 in eligible FUTA wages but FUTA applies only to the first 7000 of each. Use the Internet to apply for benefits estimate your benefits request payments view claim and payment status change your payment option and more. The Unemployment Insurance UI benefit calculator will provide you with an estimate of your weekly UI benefit amount which can range from 40 to 450 per week.

Divide those wages by 25 then round to the nearest dollar. Enter your Wages and select the Pay Period for each Calendar Quarter. Use Online Unemployment Benefits Services.

The weekly benefit amount is calculated by dividing the sum of the wages earned during the highest quarter of the base period by 26 rounded down to the next lower whole dollar. Your weekly benefit amount and the number of weeks of entitlement are based on the wages you were paid and amount of time you worked during your base period. You may be.

Heres how to pay state unemployment taxes for your small business. Texas Weekly Benefit Amount Calculator. Youll transfer the amount in Box 1 of Form 1099-G to Line 7 of Schedule 1 then the withholding amount in Box 4 of the 1099-G if any goes directly onto your 1040 tax return on Line 25b.

To calculate your WBA we divide your base period quarter with the highest wages by 25 and round to the nearest dollar. Your WBA will be between 70 and 535 minimum and maximum weekly benefit amounts in Texas depending on your past wages. The minimum WBA is 69 provided you meet eligibility requirements.

If you are receiving benefits you may have federal income taxes withheld from your unemployment benefit payments. You can find the date you are scheduled to request payment online using TWCs Unemployment Benefits Services or by calling Tele-Serv at 800-558-8321. To calculate your WBA your base period quarter is divided with the highest wages by 25 and round to the nearest dollar.

Unemployment benefits are taxable income reportable to the Internal Revenue Service IRS under federal law. TWC calculates 125 of his WBA 396 x 125 495. The FUTA tax liability is based on 17600 of employee earnings 4900 5700 7000.

Request benefit payment as instructed approximately one to two weeks after you apply for benefits and every two weeks after that. Results Estimated Weekly Benefit Amount WBA The calculator returns your estimated WBA based on your highest quarterly earnings during the base period. If you did not receive wages during a quarter enter zero for that quarter.

Because Juan meets all other eligibility requirements TWC pays him 264 the difference between 125 of his WBA and his earnings ie 495 - 231. You must report all unemployment benefits you receive to the IRS on your federal tax return. Depending on the distribution of your quarterly pay the results may vary from your actual unemployment.

Weekly Unemployment Benefits Calculator Fileunemployment Org

Weekly Unemployment Benefits Calculator Fileunemployment Org

Mortgage Calculator Mortgage Calculator Bloomberg Chapter 15 Calculate Mortgage Amortization Calculator Mortgage Loan Calculator Mortgage Payment Calculator

Mortgage Calculator Mortgage Calculator Bloomberg Chapter 15 Calculate Mortgage Amortization Calculator Mortgage Loan Calculator Mortgage Payment Calculator

Calculate Child Support Payments Child Support Calculator Parental Income Inf Child Support Quote With Images Child Support Quotes Child Support Child Support Payments

Calculate Child Support Payments Child Support Calculator Parental Income Inf Child Support Quote With Images Child Support Quotes Child Support Child Support Payments

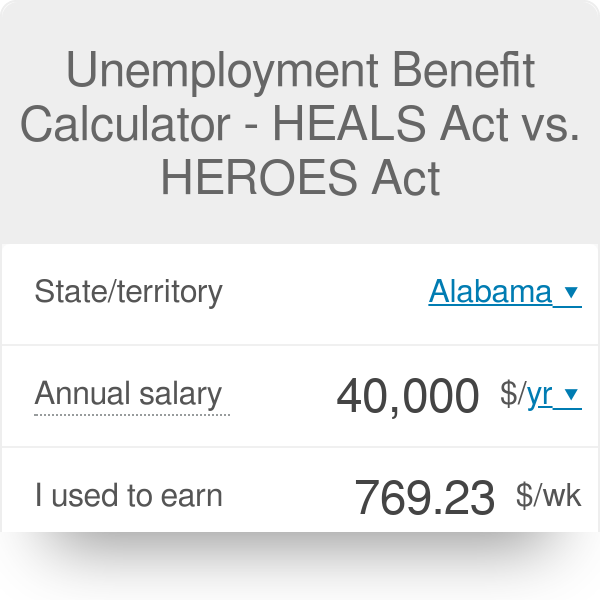

Unemployment Benefit Calculator Heals Act Vs Heroes Act

Unemployment Benefit Calculator Heals Act Vs Heroes Act

Pin On Personal Money Management

Pin On Personal Money Management

Mortgage Calculator Mortgage Calculator Extra Payment Amortization By Mobile Mortgage Loan Calculator Mortgage Amortization Calculator Amortization Schedule

Mortgage Calculator Mortgage Calculator Extra Payment Amortization By Mobile Mortgage Loan Calculator Mortgage Amortization Calculator Amortization Schedule

How To Calculate Texas Unemployment Benefits 7 Steps

How To Calculate Texas Unemployment Benefits 7 Steps

New Ios App Texas Child Support Calculator Ez Law Apps Llc Child Support Quote Calculat Child Support Laws Child Support Quotes Child Support Payments

New Ios App Texas Child Support Calculator Ez Law Apps Llc Child Support Quote Calculat Child Support Laws Child Support Quotes Child Support Payments

Use Countifs Not Frequency To Calculate Frequency Distribution Tables For Charting Histograms Chart Histogram Frequency Table

Use Countifs Not Frequency To Calculate Frequency Distribution Tables For Charting Histograms Chart Histogram Frequency Table

Texas Unemployment Calculator Fileunemployment Org

Texas Unemployment Calculator Fileunemployment Org

,%20%20How%20to%20Calculate%20Child%20Support%20in%20Texas.PNG)

Texas Weekly Benefit Amount Calculator Unemployment Real World Machine

Texas Weekly Benefit Amount Calculator Unemployment Real World Machine

Mortgage Calculator Mortgage Loan Originator Free Online Web Tool For You Mortgage Amortization Calculator Mortgage Loan Calculator Mortgage Loan Originator

Mortgage Calculator Mortgage Loan Originator Free Online Web Tool For You Mortgage Amortization Calculator Mortgage Loan Calculator Mortgage Loan Originator

Calculate Child Support Payments Child Support Calculator Child Support Payme Child Support Calcula Child Support Payments Child Support Child Support Laws

Calculate Child Support Payments Child Support Calculator Child Support Payme Child Support Calcula Child Support Payments Child Support Child Support Laws

How To Calculate A Rv Loan In 2020 Send Money Credit Union Paying Bills

How To Calculate A Rv Loan In 2020 Send Money Credit Union Paying Bills

Trellis Company Texas Guaranteed Student Loans What To Know Student Loans Student Loan Repayment Student Loan Debt

Trellis Company Texas Guaranteed Student Loans What To Know Student Loans Student Loan Repayment Student Loan Debt

How To Apply For Unemployment In Texas In 2020 Child Support Laws Supportive Child Support

How To Apply For Unemployment In Texas In 2020 Child Support Laws Supportive Child Support

Mortgage Calculator Zillow S Mortgage Affordability Calculator Calculat Mortgage Amortization Calculator Mortgage Loan Calculator Mortgage Payment Calculator

Mortgage Calculator Zillow S Mortgage Affordability Calculator Calculat Mortgage Amortization Calculator Mortgage Loan Calculator Mortgage Payment Calculator

Post a Comment for "Calculate Unemployment Payment Texas"