Why Are Loans Calculated On 360 Days

The calculation is important to bond traders because when a bond is. Why are loans calculated on 360 days.

All About Loan Amortization How To Amortize A Loan

All About Loan Amortization How To Amortize A Loan

Add-on Interest loan types will have a remaining principal balance at the loans maturity.

Why are loans calculated on 360 days. The first step is to multiply the outstanding principal balance. With the 30360 method the daily accrual amount is higher because the interest rate is divided by 360 days not 365 which is the actual number of days in a year. This creates a larger dollar amount in interest payments because dividing the annual rate by 360 creates a larger daily rate then dividing it by 365.

The 360-day calendar is a method of measuring durations used in financial markets in computer models in ancient literature and in prophetic literary genres. Lets apply this simple multiplication technique to calculate interest for a short-term period based on a quoted rate for short-term US dollars which uses a 360-day year. The promissory note specified that annual interest would be computed on a 365360 basis.

The interest calculation for each month using the daily interest rate is a two-step process. On remand to the trial court the plaintiff certified a class of plaintiffs defined under the 365360 language of the fixed rate loans The annual interest rate of this Note is computed on a 365360 basis. On these loans the difference between using a 360 and a 365-day year in calculating the daily rate is significant because the daily rate is applied every day for the life of the loan.

Lets calculate the amount of interest you will enjoy. The interest payment is the same regardless of the number of days in the month. Mortgage loan processing brings all mortgage loans in line using consistent industry-standard parameters for monitoring and servicing the loans.

This booklet describes in detail how CUBASE handles the 360-day interest calculation process. The daily rate is calculated by dividing the nominal annual rate by 360 days. That is by applying the ratio of the annual interest over a year of 360 days multiplied by the outstanding principal balance multiplied by the actual number of days the principal balance is outstanding.

Traditionally there are two common methods used for calculating interest. It could also be because commercial loans have slightly more complex attributes than residential loans balloons due dates on any day of the month etc. The use of the 360-day calendar dates back to ancient Egyptian times and is based on the lunar calendar rather than a deliberate attempt to confuse.

On your loan the difference in interest accrual would amount to more than 2000 over 30 years. A day-count convention is a standardized methodology for calculating the number of days between two dates. Remember that if your credit union does not need to adhere to the.

Loan Payment Calculator The ZimpleMoney calculator can determine. However the total amount of interest is the lowest of the 3 methods because it only accrues for 30 days each month even in months that have 31 days. If you have a loan with a payment frequency of quarterly semi-annually or annually interest will accrue monthly increasing your principal balance until the next regular payment is received.

I the 365365 method or Stated Rate Method which utilizes a 365-day year. It is based on merging the three major calendar systems into one complex clock with the 360-day year derived from the average year of the lunar and the solar. Yes it could be because commercial banks are greedy.

3652425 solar 3543829 lunar2 71962542 3598127 days. That is by applying the ratio of the annual interest rate over a year of 360 days multiplied by the outstanding principal balance multiplied by the actual number of days the principal is outstanding. And ii the 360365 method or Bank Method which utilizes a 360-day year and charges interest for the actual number of days the loan is outstanding.

Other than the difference in how accruals are calculated the servicing of these loans is exactly the same as normal 365-day type loans making it easy. Understanding the Issue Promissory notes frequently contain language providing that interest will be computed by multiplying the stated interest rate by 365 and dividing that number by 360. Day Interest Calculation for details on the separate 360-day calculation used exclusively for mortgage loans which uses a more complex calculation structure and has specific requirements for automated processing.

Choose whether to use 360 or 365 Days per year interest. The promissory note specified that annual interest would be computed on a 365360 basis. As a result the interest rate that actually accrues in a calendar year is slightly higher than what is stated in the promissory note.

So why is it that residential loans are based on a 365365 method and commercial loans are based on a 365360 method. The interest on most money market deposits and floating-rate notes is calculated on an. For example you deposit 3m for 90 days at a quoted interest rate of 4 based on a 360-day conventional year.

For most commercial loans interest is calculated using a daily rate based on a 360 day year. Lets calculate the amount of interest you will enjoy. When using the Actual360 method the annual interest rate is divided by 360 to get the daily interest rate and then multiplied by the days in the month.

When using the Actual360 method the annual interest rate is divided by 360 to get the daily interest rate and then multiplied by the days in the month. Interest is calculated monthly at 1360th of the annual rate times the number of days in the month on the current outstanding balance of your loan. A day-count convention is used to calculate the number of days and the amount of accrued interest between two coupon dates.

The Succarotte Team Extended Rate Locks Extended Credit Repair Rate

The Succarotte Team Extended Rate Locks Extended Credit Repair Rate

Simple Interest Loan Calculator How It Works

Simple Interest Loan Calculator How It Works

Free Balloon Loan Calculator For Excel Balloon Mortgage Payment

Free Balloon Loan Calculator For Excel Balloon Mortgage Payment

Simple Interest Loan Calculator For Excel Amortization Schedule Simple Interest Loan Calculator

Simple Interest Loan Calculator For Excel Amortization Schedule Simple Interest Loan Calculator

Military Veteran Loans Www Mobilehomemai Va Mortgage Loan Watch This Before Applying Va Mortgage Loan Vamor Va Loan Mortgage Loan Officer Mortgage Loans

Military Veteran Loans Www Mobilehomemai Va Mortgage Loan Watch This Before Applying Va Mortgage Loan Vamor Va Loan Mortgage Loan Officer Mortgage Loans

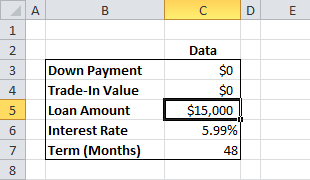

Create A Basic Car Loan Calculator In Excel Using The Pmt Function

Create A Basic Car Loan Calculator In Excel Using The Pmt Function

How Is A Loan Amortization Schedule Calculated

How Is A Loan Amortization Schedule Calculated

Create An Amortization Schedule Payment Table For Loans Car Loans And Mortgages Amortization Schedule Mortgage Amortization Mortgage Amortization Calculator

Create An Amortization Schedule Payment Table For Loans Car Loans And Mortgages Amortization Schedule Mortgage Amortization Mortgage Amortization Calculator

Mortgage Calculator Downloadable Free Mortgage Calculator Tool Calculate Your Monthly Mortgage Calculator Tools Free Mortgage Calculator Mortgage Calculator

Mortgage Calculator Downloadable Free Mortgage Calculator Tool Calculate Your Monthly Mortgage Calculator Tools Free Mortgage Calculator Mortgage Calculator

Since 1934 The Federal Housing Administration Has Been Insuring Fha Home Loans In The U S With Competitive Mortgage Rate Fha Loans First Time Home Buyers Fha

Since 1934 The Federal Housing Administration Has Been Insuring Fha Home Loans In The U S With Competitive Mortgage Rate Fha Loans First Time Home Buyers Fha

Loan Amortization With Extra Principal Payments Using Microsoft Excel Tvmcalcs Com

More Than 40 Of Student Borrowers Aren T Making Payments Federal Student Loans Student The Borrowers

More Than 40 Of Student Borrowers Aren T Making Payments Federal Student Loans Student The Borrowers

What Is Apr And What Exactly Do You Need To Know Lexington Law

What Is Apr And What Exactly Do You Need To Know Lexington Law

Mortgage Calculator Excel 5 Mortgage Payoff Calculator Calculate The Mont Mortgage Amortization Calculator Mortgage Payment Calculator Mortgage Calculator

Mortgage Calculator Excel 5 Mortgage Payoff Calculator Calculate The Mont Mortgage Amortization Calculator Mortgage Payment Calculator Mortgage Calculator

How Can I Calculate Compounding Interest On A Loan In Excel

Excel Formula Calculate Cumulative Loan Principal Payments Exceljet

Excel Formula Calculate Cumulative Loan Principal Payments Exceljet

Calculator For Microsredits Calculator Design Online Mortgage Calculator

Calculator For Microsredits Calculator Design Online Mortgage Calculator

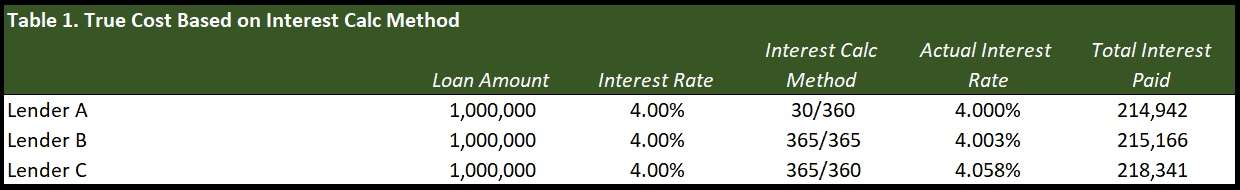

30 360 Actual 365 And Actual 360 How Lenders Calculate Interest On Cre Loans Some Important Insights Adventures In Cre

30 360 Actual 365 And Actual 360 How Lenders Calculate Interest On Cre Loans Some Important Insights Adventures In Cre

Usda Loan Payment Calculator Calculate Loan Guarantee Eligibility Closing Costs How Much You Can Afford To Borrow

Usda Loan Payment Calculator Calculate Loan Guarantee Eligibility Closing Costs How Much You Can Afford To Borrow

Post a Comment for "Why Are Loans Calculated On 360 Days"