Payment Voucher Irs 2020

Pay all of your estimated tax by January 18 2022. An even easier way to make 1040-ES quarterly payments is paperless by using IRS Direct Pay electronically and nothing has to be filled out and mailed.

Printable 2019 Form 1040 V Payment Vouchers Page 1 Line 17qq Com

Printable 2019 Form 1040 V Payment Vouchers Page 1 Line 17qq Com

If at least two-thirds of your gross income for 2019 or 2020 is from farming or fishing you can do one of the following.

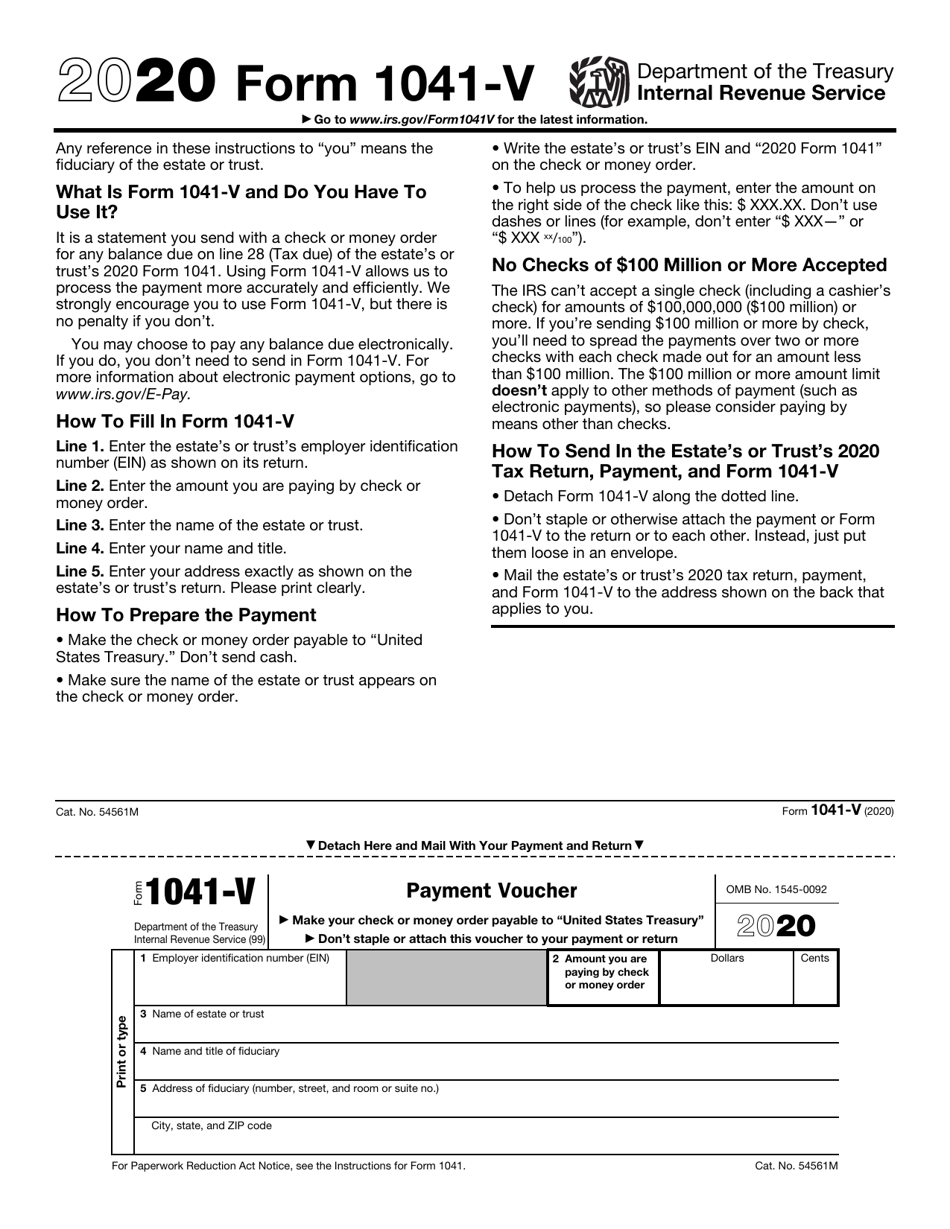

Payment voucher irs 2020. For more information go to Pay by Check or Money Order on IRSgov. PA-8453F -- 2020 Pennsylvania Fiduciary Income Tax Declaration for Electronic Filing. Maryland Resident Income Tax Return.

I e-filed but Im mailing my payment in along with the payment voucher 1040-V. An LLC should use this voucher if any of the following apply. Statement of Person Claiming Refund Due a Deceased Taxpayer.

When making payments of estimated tax be sure to take into account any 2019 overpayment that the estate or trust chose to credit against its 2020 tax but dont include the overpayment amount in this box. In this case 2021 estimated tax payments arent required to avoid a penalty. Please write on the check or money order.

Here are the quarterly due dates for the 2020 tax year. Your first estimated tax payment is due on April 15 2020. If you elected to file.

Department of the Treasury Internal Revenue Service 99 Payment Voucher Do not staple or attach this voucher to your payment or return. 2020 Nebraska Individual Income Tax Payment Voucher 012021 1040N-V. 1040-V 2020 Detach Here and Mail With Your Payment and Return Form.

Pay all of your estimated tax by January 15 2021. Individual Income Tax Payment Voucher 4FORM0V 2020 NOTE. Submit this statement with your check or money order for any balance due on the Amount you owe line of your Form 1040 or Form 1040-SR or 1040-NR.

Information about Form 1040-V Payment Voucher including recent updates related forms and instructions on how to file. Do not use this voucher for any other purpose. Election to Exclude Military Retirement Benefits.

Enter in the payment box of the voucher only the amount the estate or trust is sending in. 2020 Estimated Tax Payments Taxpayers making their 2020 estimated tax payment by check money order or cashiers check should include the appropriate Form 1040-ES payment voucher. File your 2021 Form 1040 or 1040-SR by March 1 2022 and pay the total tax due.

2020 Instructions for Form FTB 3522 LLC Tax Voucher General Information Use form FTB 3522 LLC Tax Voucher to pay the annual limited liability company LLC tax of 800 for taxable year 2020. Well we live in Germany so these letters that. If at least two-thirds of your gross income for 2020 or 2021 is from farming or fishing you can do one of the following.

For payment options and information. Income Tax Payment Voucher. SOCIAL SECURITY NUMBER SSN.

For years not listed please click the following link - Email here to order any Kansas tax form not available on this site. This payment voucher can only be used to pay the tax liability for your Alabama individual income tax return auto-matic extension or amended tax return and cannot be used for any other kind of tax payment. Follow the instructions below.

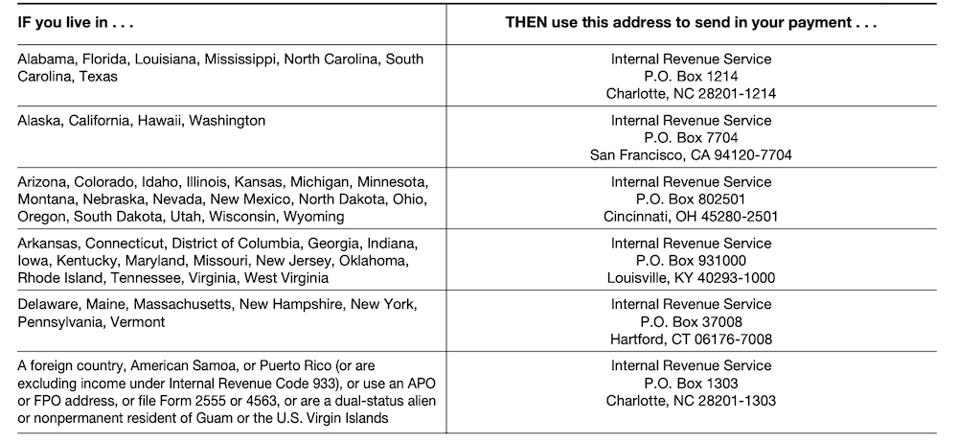

And mail them to the proper IRS service center. Ive handled things as much as I could the end of 2019 and and the rest of 2020 but now we received letter from the IRS saying hes behind on his payments and that they expect 1200 to be paid before Feb. The LLC has articles of organization accepted by the California Secretary of State SOS.

When is my tax return and payment due. Payment voucher with instructions and worksheet for individuals sending check or money order for any balance due on a Form 502 or Form 505 estimated tax payments or extension payments. In this case 2020 estimated tax payments arent required to avoid a penalty.

Your 2020 return and payment for the full amount of tax due must be mailed by the due date of your federal return. 2020 Individual Estimated Income Tax Vouchers Worksheet and Instructions K-40ES Individual Underpayment of Estimated Tax Schedule and instructions K-210 - See above or in year needed. File your 2020 Form 1040 or 1040-SR by March 1 2021 and pay the total tax due.

Read PDF Viewer AndOr Browser Incompatibility if you cannot open this form. 2020 PA-40 Personal Income Tax Return. 2020 PA-40 PAYMENT VOUCHER PA-40 PAYMENT VOUCHER PA-40 V Use the 2020 Form PA-40 V with a payment of tax owed with aOF REVENUE.

Roughly each quarter you will mail an estimated tax payment voucher with a check to the IRS. Download or print the 2020 Federal Payment Voucher 2020 and other income tax forms from the Federal Internal Revenue Service. Use Form 1040-ES to figure and pay your estimated tax.

PA-41 V -- 2020 PA-41 Payment Voucher Form and Instructions PA-41 X -- 2020 Schedule PA-41 X - Amended PA Fiduciary Income Tax Schedule Form and Instructions PA-8453 -- 2020 Pennsylvania Individual Income Tax Declaration for Electronic Filing. Another option is to download blank 2020 Forms 1040-ES vouchers from the IRS website and write in the payment amount bio info etc. In addition if you do not elect voluntary withholding you should make estimated tax payments on other taxable income such as unemployment compensation and the.

Indicate on the check memo line that this is a 2020 estimated tax payment. Purchase of a Nebraska Residence in a Designated Extremely Blighted Area Credit 012021 1040N-EB. Estimated tax is the method used to pay tax on income that is not subject to withholding for example earnings from self-employment interest dividends rentsalimony etc.

How To Make The 2 Estimated Tax Payments Also Due July 15 Don T Mess With Taxes

Payroll Tax Form Payroll Taxes Tax Payment Tax Forms

Payroll Tax Form Payroll Taxes Tax Payment Tax Forms

How To Pay Your Tax Bill In 2020

How To Pay Your Tax Bill In 2020

1040 Es 2020 First Quarter Estimated Tax Voucher

1040 Es 2020 First Quarter Estimated Tax Voucher

Explore Our Sample Of Bank Payment Voucher Template Voucher Templates Payment

Explore Our Sample Of Bank Payment Voucher Template Voucher Templates Payment

Paystub Generator For Self Employed Fill Online Printable Intended For Independent Contractor In 2020 Best Templates Free Business Card Templates Business Template

Paystub Generator For Self Employed Fill Online Printable Intended For Independent Contractor In 2020 Best Templates Free Business Card Templates Business Template

2020 1040 V Payment Voucher Form 1040v

2020 1040 V Payment Voucher Form 1040v

1st 2020 Individual Estimated Tax Payment Extended To July 15 But Not The 2nd Tntax Business Services Inc

1st 2020 Individual Estimated Tax Payment Extended To July 15 But Not The 2nd Tntax Business Services Inc

Irs Form 1041 V Download Fillable Pdf Or Fill Online Payment Voucher 2020 Templateroller

Irs Form 1041 V Download Fillable Pdf Or Fill Online Payment Voucher 2020 Templateroller

2018 1040 V Form And Instructions 1040v

2018 1040 V Form And Instructions 1040v

Explore Our Example Of In Kind Donation Acknowledgement Letter Template Receipt Template Letter Templates School Donations

Explore Our Example Of In Kind Donation Acknowledgement Letter Template Receipt Template Letter Templates School Donations

14 V Form 14 Ways On How To Prepare For 14 V Form Reference Letter Internal Revenue Service Important Life Lessons

14 V Form 14 Ways On How To Prepare For 14 V Form Reference Letter Internal Revenue Service Important Life Lessons

3 10 73 Batching And Numbering Internal Revenue Service

3 10 73 Batching And Numbering Internal Revenue Service

Get Our Sample Of Salary Payment Slip Template For Free Excel Templates Templates Slip

Get Our Sample Of Salary Payment Slip Template For Free Excel Templates Templates Slip

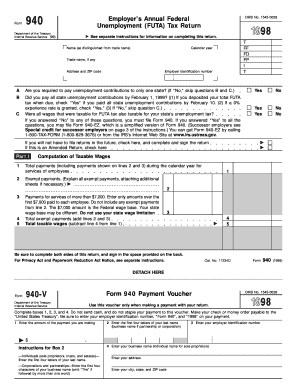

Fillable Online Futa Tax Return Form 940 Payment Voucher Irs Gov Fax Email Print Pdffiller

Fillable Online Futa Tax Return Form 940 Payment Voucher Irs Gov Fax Email Print Pdffiller

Browse Our Sample Of Rent Payment Slip Template Being A Landlord Payment Templates

Browse Our Sample Of Rent Payment Slip Template Being A Landlord Payment Templates

Petty Cash Voucher Template Excel Petty Cash Excel

Petty Cash Voucher Template Excel Petty Cash Excel

/ScreenShot2021-02-11at1.09.54PM-a0f5478dda0b440f99a2d4d10e61321e.png)

Post a Comment for "Payment Voucher Irs 2020"