Payment Reversal Loan Meaning

Payment reversal is a bit of a broad term. My wife has a fairly substantial amount of student debt.

Real Estate Update Credit Score Myths Credit Score Infographic Credit Score Myths Credit Score

Real Estate Update Credit Score Myths Credit Score Infographic Credit Score Myths Credit Score

Based on 1 documents Examples of Reversal Loan Agreement in a sentence.

Payment reversal loan meaning. NOTE The Loan Payment Reversal tool can be used to reverse the most recent payment but must be used when there are subsequent payments that also need to be reversed and reposted. Those using a reverse mortgage. This process can happen in a couple of ways.

A bank reversal sometimes known as an ACH Return is when PayPal receives a request to return funds for a transaction that was funded by a bank account. Credit card reversal reversal payment etc. In this situation it is common to want to reverse the actions that a transaction triggered when it was originally received.

So Im three months ahead on my auto loan payments. For loan payments made via ACH Share Draft Payroll or Periodic Payment NOTE You cannot use the Loan Payment Reversal tool to reverse Average Daily Balance. A payment reversal can be carried out by several different methods and can be initiated by a cardholder merchant acquiring or issuing bank or the card network.

While Reversal in simple term can be explained as transaction which can be either complete full transaction lifecycle from initiation to posting or can be made due to error of system which got. Because this payment is not a full payment in the eyes of the servicer it places this amount in a suspense account and nothing is applied to the loan. Noun pey-muh nt ri-vur-suh l A payment reversal is a situation in which funds from a transaction are returned to the cardholders bank account.

This could be because of a problem with the account eg. Even if you make Novembers payment of 1100 on time and in full youll still be considered behind. Common reasons why payment reversals occur.

Payment reversal after five days. A payment reversal is when a transaction paid to you is returned to the buyer. The servicer now considers you one month behind in payments.

A payment reversal is when a customer receives back the funds from a transaction. Everybody hates the chargeback except the cardholder because they get what they want the same as with any other reversal. Reversal Loan Agreement means the Reversal Loan and Control Share Pledge and Security Agreement by and between the Borrower and the Lender dated as of even date herewith.

A reverse mortgage is a type of home loan available to homeowners aged 62 or older which is essentially a large home equity loan borrowed against their homes value. The item ended up being sold out. What are Payment Reversals.

This typically happens after a chargeback or having lost a dispute with a customer ie. The reversal of last resort is the chargeback. Reverse mortgage loans allow homeowners to convert their home equity into cash income with no monthly mortgage payments.

Customer disputes authorization reversal and refunding payment. N-28 Lump Sum Payment Reversal and Re-Issue Taxable Description. The cheque is returned to the Direct Clearer for a payment reversal in the T1 clearing and settlement cycle.

Insufficient funds or the mortgage company could have had an error that caused the charge to bounce back unlikely but possible. This month we attached my checking account to her Navient account and I tried to pay off 12000 worth of her loans with money I had saved. Heres the low down.

What does payment reversal on auto loan mean. It also goes by many names. A request for a bank reversal can come from the buyer who holds the bank account or the bank itself.

This can be initiated by the cardholder the merchant the issuing bank the acquiring bank or the card association. A reverse mortgage is a type of loan for seniors ages 62 and older. Usually such a request is the result of suspected unauthorized use of a bank account.

A payment reversal is when the funds a cardholder used in a transaction are returned to the cardholders bank. CSBF Loan payments reversed by the lender after five working days must be credited to the loan reducing the amount claimed correspondingly. This is where the issuer basically bills the merchant account to get the disputed funds.

She had paid over 5000 in the past with no issues. A payment reversal means that payment was initiated either a check credit card or debit card but it was unable to go through. Each of these reversals takes place at different stages of the payment process and for different reasons.

For example a participant loan has a repayment period of six years. But for the rest of us a chargeback means extra work and tacked-on fees and penalties. A lost PayPal claim.

The product was conceived as a means to help retirees with limited income use the accumulated wealth in their homes to cover basic monthly living expenses and pay for health care. She is on an income based plan. When PayPal receives a bank reversal we will open an investigation into the transaction and may request additional information from both the buyer and.

Where a plan loan has a payment schedule that is greater than allowable by law the loan can be reamortized over the remaining period of the proper maximum payment period measured from the original date of the loan. What does payment reversal mean. A reverse mortgage is a loan available to homeowners 62 years or older that allows them to convert part of the equity in their homes into cash.

I got a letter in the mail saying you can only be three months ahead and no more than that so they are going to do a payment reversal for my last deposit.

Reverse Mortgage Line Of Credit Explained Credit Line Growth Reverse Mortgage Line Of Credit Mortgage Payoff

Reverse Mortgage Line Of Credit Explained Credit Line Growth Reverse Mortgage Line Of Credit Mortgage Payoff

Lowermybills Com Home Refinance Home Purchase Reverse Mortgage Personal Loans Auto Loans Credit Cards Aut Home Refinance Reverse Mortgage Personal Loans

Lowermybills Com Home Refinance Home Purchase Reverse Mortgage Personal Loans Auto Loans Credit Cards Aut Home Refinance Reverse Mortgage Personal Loans

Reverse Mortgage Defined Hud Reverse Mortgage Faq Reverse Mortgage Mortgage Info Mortgage

Reverse Mortgage Defined Hud Reverse Mortgage Faq Reverse Mortgage Mortgage Info Mortgage

Taxes Insurance Down Payment Amortization Schedule Mortgage Amortization Mortgage Calculator

Taxes Insurance Down Payment Amortization Schedule Mortgage Amortization Mortgage Calculator

Mortgage Interest Rates Today California Https Refinancemortgagelender Blogspot In 2017 09 Ho Mortgage Interest Rates Mortgage Refinance Calculator Fha Loans

Mortgage Interest Rates Today California Https Refinancemortgagelender Blogspot In 2017 09 Ho Mortgage Interest Rates Mortgage Refinance Calculator Fha Loans

What Is Reverse Mortgage Scheme Reverse Mortgage Mortgage Reverse

What Is Reverse Mortgage Scheme Reverse Mortgage Mortgage Reverse

This Veterans Basic Entitlement Is 36000 Loan Calculator Reverse Mortgage Amortization Schedule

This Veterans Basic Entitlement Is 36000 Loan Calculator Reverse Mortgage Amortization Schedule

What Is Dirac Equation What Does Dirac Equation Mean Dirac Equation Meaning Explanation Youtube Dirac Equation Reverse Mortgage Meant To Be

What Is Dirac Equation What Does Dirac Equation Mean Dirac Equation Meaning Explanation Youtube Dirac Equation Reverse Mortgage Meant To Be

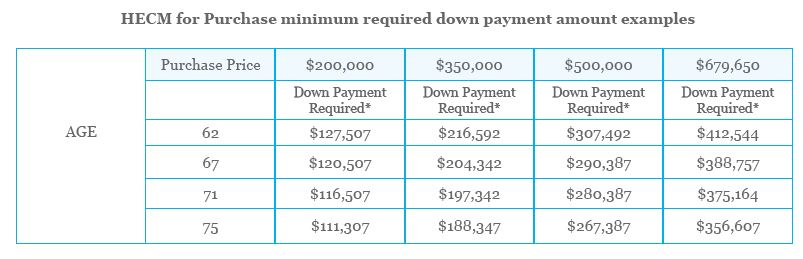

Hecm For Purchase Reverse Mortgage

Hecm For Purchase Reverse Mortgage

Does Your Credit Score Drops If You Check Your Own Cre Credit Score Infographic Credit Score Myths Credit Score

Does Your Credit Score Drops If You Check Your Own Cre Credit Score Infographic Credit Score Myths Credit Score

10 Ways To Pay Off Your Mortgage Early Pay Off Mortgage Early Mortgage Tips Mortgage Payoff

10 Ways To Pay Off Your Mortgage Early Pay Off Mortgage Early Mortgage Tips Mortgage Payoff

Fixed Rate Vs Adjustable Rate Mortgage How To Decide Which One You Should Get Adjustable Rate Mortgage Mortgage Mortgage Protection Insurance

Fixed Rate Vs Adjustable Rate Mortgage How To Decide Which One You Should Get Adjustable Rate Mortgage Mortgage Mortgage Protection Insurance

Pros And Cons Of Short Term Business Loans Business Loans Loan Small Business Loans

Pros And Cons Of Short Term Business Loans Business Loans Loan Small Business Loans

How A Reverse Mortgage Works Reverse Mortgage Mortgage Amortization Calculator Mortgage Calculator

How A Reverse Mortgage Works Reverse Mortgage Mortgage Amortization Calculator Mortgage Calculator

Reverse Mortgage Loan Enabled Annuity Plan Rmla In India Explained I Let S Understand What Is Reverse Reverse Mortgage Mortgage Loans Mortgage Payoff

Reverse Mortgage Loan Enabled Annuity Plan Rmla In India Explained I Let S Understand What Is Reverse Reverse Mortgage Mortgage Loans Mortgage Payoff

Reverse Mortgage Rates And What Are Your Rates Are Very Common Questions That We Mortgage Information Mor Reverse Mortgage What Is Credit Score Credit Score

Reverse Mortgage Rates And What Are Your Rates Are Very Common Questions That We Mortgage Information Mor Reverse Mortgage What Is Credit Score Credit Score

Saving Vs Debt Payoff Should You Save Money Or Pay Off Debt Reverse The Crush In 2020 Debt Payoff Investing Money Personal Finance Lessons

Saving Vs Debt Payoff Should You Save Money Or Pay Off Debt Reverse The Crush In 2020 Debt Payoff Investing Money Personal Finance Lessons

Home Equity Conversion Loan Home Equity Private Lender Mortgage Loans

Home Equity Conversion Loan Home Equity Private Lender Mortgage Loans

The Ways That Will Make A Home Loan Lefinance Effective Home Loans Mortgage Plan Mortgage Brokers

The Ways That Will Make A Home Loan Lefinance Effective Home Loans Mortgage Plan Mortgage Brokers

Post a Comment for "Payment Reversal Loan Meaning"