Payment Protection Program Forgiveness Deadline

The new PPP FAQs come as the August 8 2020 deadline to apply for a PPP loan fast approaches and as Congress and the White House negotiate a new Covid relief package expected to both simplify PPP. The following is based on federal legislation that was enacted into law today.

The Not Quite Definitive Guide To Paycheck Protection Program Loan Forgiveness

The Not Quite Definitive Guide To Paycheck Protection Program Loan Forgiveness

We will notify you by email when the forgiveness application is available to you.

Payment protection program forgiveness deadline. And b the date that is 10 months after the date that is the earlier of i 24 weeks after the end of the borrowers Covered Period or ii December 31 2020 if the borrower does. Search for lenders in your area. The newly passed act has provided a greater degree of flexibility to borrowers and allowed more business owners to be eligible for loan forgiveness through the PPP scheme.

Effective Jan 19 2021. It does not constitute legal or financial advice. For most borrowers the maximum loan amount of a Second Draw PPP Loan is 25x average monthly 2019 or 2020 payroll costs up to 2 million.

Prior to the Senates decision to extend the deadline on the scheme President Trump signed into law the Paycheck Protection Program Flexibility Act PPPFA. The PPP loan forgiveness application forms 3508 3508EZ and 3508S display an expiration date of 10312020 in the upper-right corner. Get matched with a lender.

Round 3 PPP Application Deadline The Consolidated Appropriations Act 2021 CAA extends the Paycheck Protection Program PPP through March 31 2021 or until funds are depleted. For borrowers in the Accommodation and Food Services sector use NAICS 72 to confirm the maximum loan amount for a Second Draw PPP Loan is 35x average monthly 2019 or 2020 payroll costs up to 2 million. By Office of Capital Access.

What are important PPP forgiveness dates. If applicable SBA will deduct. Fears of a late-October PPP surprise came to the SBAs attention because the programs loan forgiveness application forms 3508 3508EZ and 3508S display an expiration date of 10312020 in the upper-right corner.

Keep in mind that the federal government may revise any of these dates. The loan application deadline remains June 30 2020 but the time frame for using the funds and still qualifying for forgiveness has been extended up to 24 weeks. The Paycheck Protection Program PPP provides loans to help businesses keep their workforce employed during the Coronavirus COVID-19 crisis.

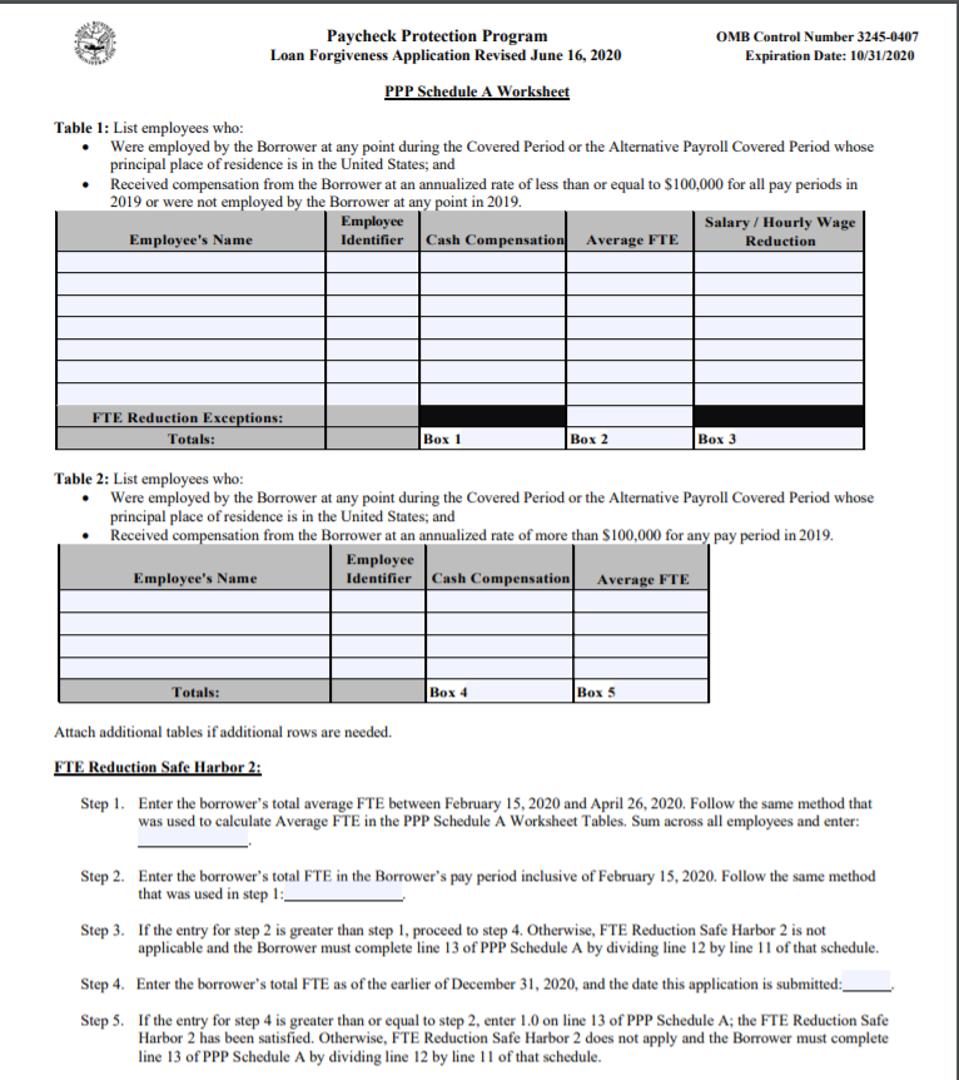

Paycheck Protection Program Loan Forgiveness Application. Specifically if by not later than December 31 2020 the employees annual salary or hourly wage is equal to or greater than their annual salary or hourly wage on February 15 2020 the borrowers loan forgiveness is not reduced. In March 2021 we will begin accepting PPP loan forgiveness applications for loans originated in 2020.

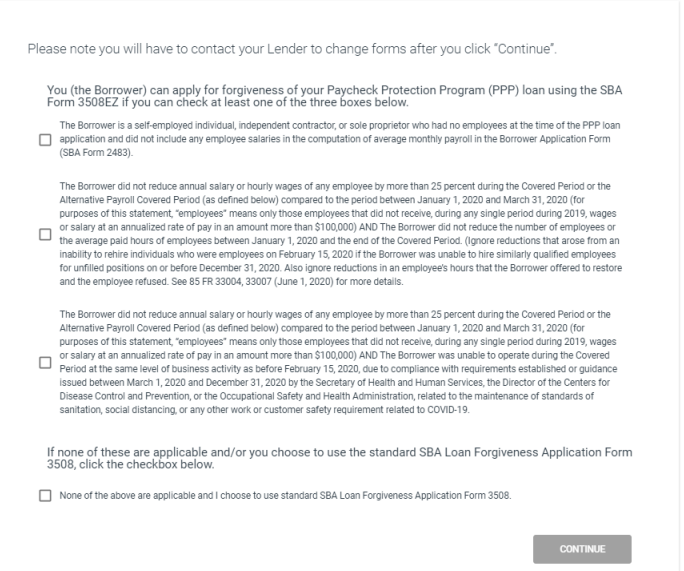

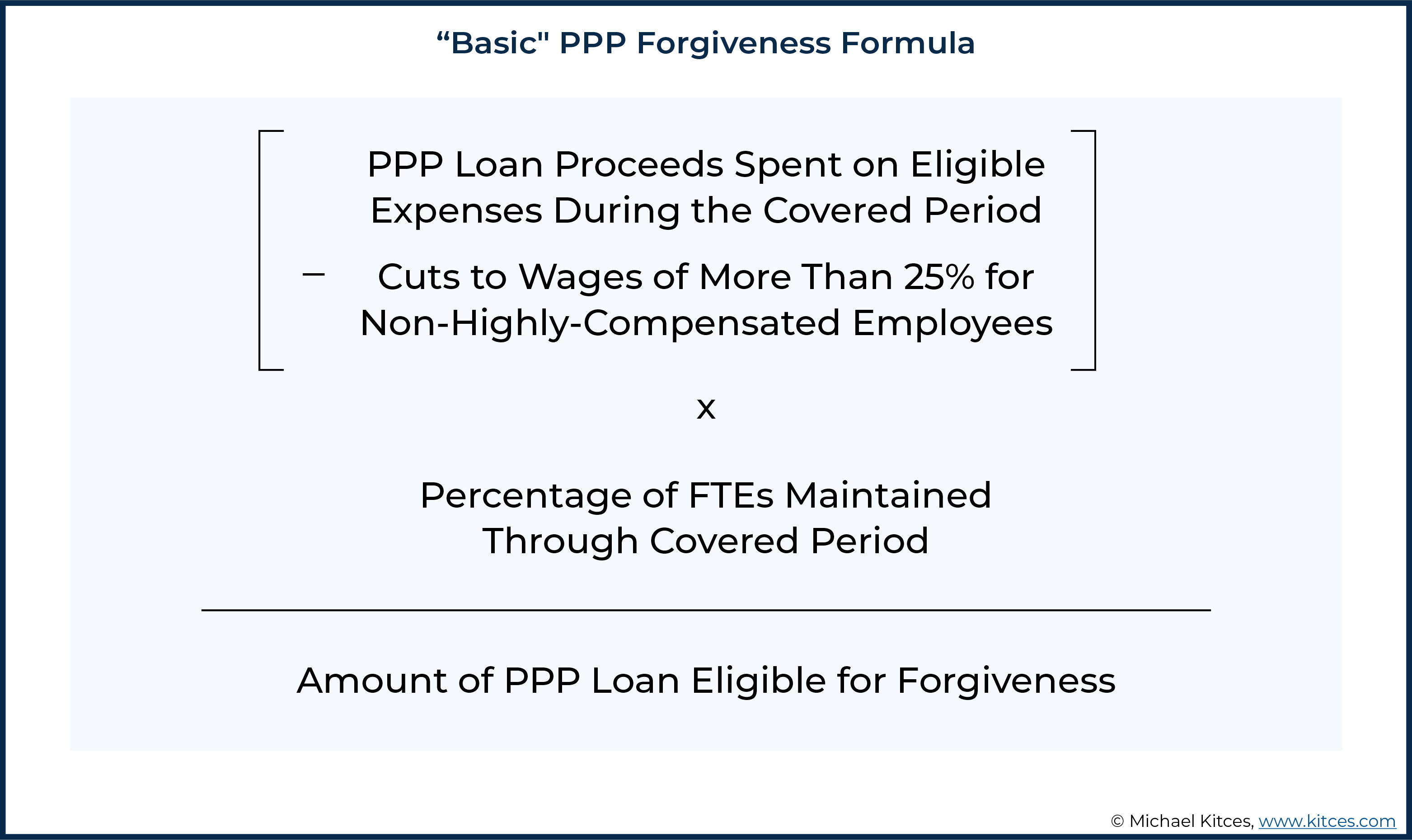

Determine loan forgiveness reduction based on a reduction in the average number of employees. As you may know the Paycheck Protection Program PPP Flexibility Act was signed into law which makes it easier for many businesses to spend PPP funds in a way that is forgivable. Paycheck Protection Program PPP Loan Forgiveness Application Beginning on February 19th the forgiveness portal will temporarily stop accepting new applications for the 3508 and 3508EZ forms designed for borrowers with loans above 150000.

Borrowers may submit a loan forgiveness application any time before the. Act now to access this important COVID-19 financial relief program. The original application deadline was June 30 2020.

The covered period is the time frame the borrower has to incur andor pay payroll and eligible non-payroll costs to be eligible for forgiveness. Forgiveness amount to the Lender plus any interest accrued through the date of payment not later than 90 days after the Lender issues its decision to SBA. The SBA has not set a deadline to apply for forgiveness but its expected that borrowers will have 10 months after the end of your covered period before youll be required to start making monthly payments.

The PPP Flexibility Act extended the covered period from 8 weeks to 24 weeks but no later than December 31 2020 from the date we disbursed your PPP loan to you. Borrowers may be eligible for PPP loan forgiveness. The Paycheck Protection Program Flexibility Act of 2020 Flexibility Act extended the deferral period for borrower payments of principal and interest on all PPP loans to the earlier of a the date that the SBA remits the forgiven amount to the lender or notifies the lender that no forgiveness is allowed.

We encourage you to review this site to prepare for forgiveness. New legislation signed by Trump on July 4 2020 extended the deadline to apply for a Paycheck Protection Program Loan through Aug. Is October 31 2020 the deadline for borrowers to apply for forgiveness.

This blog is offered as educational information.

Ppp Loan Forgiveness F M Trust

Ppp Loan Forgiveness F M Trust

Paycheck Protection Program Forgiveness Request Process Rockland Trust

Paycheck Protection Program Forgiveness Request Process Rockland Trust

Bill Would Loosen Restrictions In Paycheck Protection Program Making Loan Forgiveness Easier The Real Economy Blog

Bill Would Loosen Restrictions In Paycheck Protection Program Making Loan Forgiveness Easier The Real Economy Blog

Ppp Loan Forgiveness How To Apply And Get Accepted Nav

Ppp Loan Forgiveness How To Apply And Get Accepted Nav

Paycheck Protection Program Guidance On Forgiveness Sa M

Paycheck Protection Program Guidance On Forgiveness Sa M

Timelines For Ppp Forgiveness Causing Confusion For Tax Planning Jones Roth

Timelines For Ppp Forgiveness Causing Confusion For Tax Planning Jones Roth

Paycheck Protection Program Rejected For Forgiveness Now What Sgr Law

Paycheck Protection Program Rejected For Forgiveness Now What Sgr Law

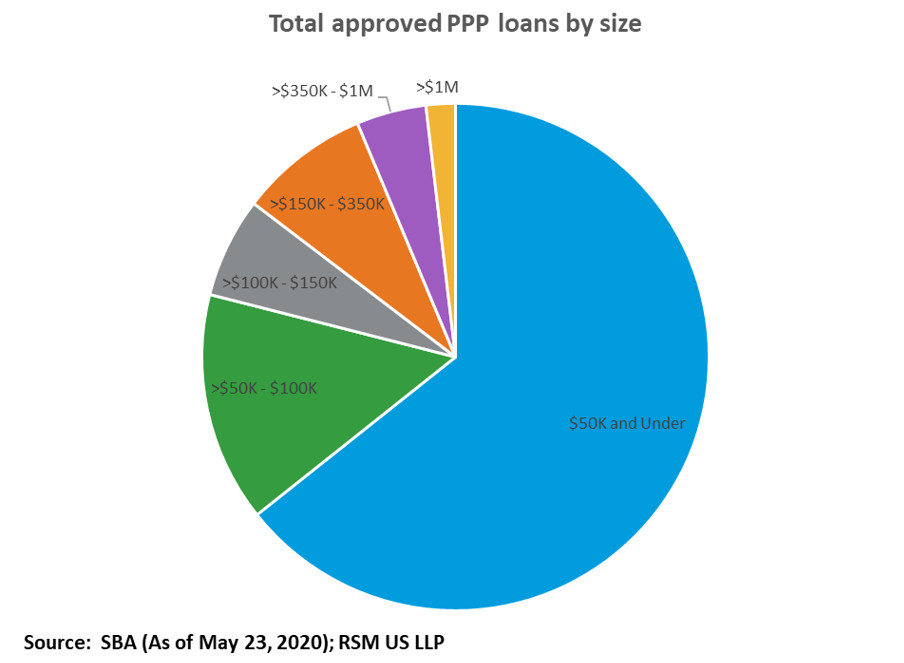

Know About Ppp Loan Forgiveness For Loans Of 50 000 Or Less

Know About Ppp Loan Forgiveness For Loans Of 50 000 Or Less

Ppp Loan Forgiveness New Choice Bank

Ppp Loan Forgiveness New Choice Bank

-1200x640.jpg?width=1200&name=FAQ-Forgiveness-numerated(3)-1200x640.jpg) Paycheck Protection Program Loan Forgiveness Faqs For Banks And Credit Unions

Paycheck Protection Program Loan Forgiveness Faqs For Banks And Credit Unions

Paycheck Protection Program Ppp Loan Forgiveness

Paycheck Protection Program Ppp Loan Forgiveness

Maximize Paycheck Protection Program Ppp Loan Forgiveness

Maximize Paycheck Protection Program Ppp Loan Forgiveness

Sba Releases Paycheck Protection Program Loan Forgiveness Application Wiss Company Llp

Sba Releases Paycheck Protection Program Loan Forgiveness Application Wiss Company Llp

Paycheck Protection Program Ppp Loan Forgiveness Regions

Paycheck Protection Program Ppp Loan Forgiveness Regions

Pin On Wbc At Jedi Workshops And Events

Pin On Wbc At Jedi Workshops And Events

Post a Comment for "Payment Protection Program Forgiveness Deadline"