Pay Payroll Remittance Cra

File an information return on or before the last day of February of the following year. The Tax Payment and Filing Service lets you remit payroll source deductions make GST PST and HST payments and pay your corporate income tax to eligible recipients online 1 directly from your TD Canada Trust account 24 hours a day seven days a week.

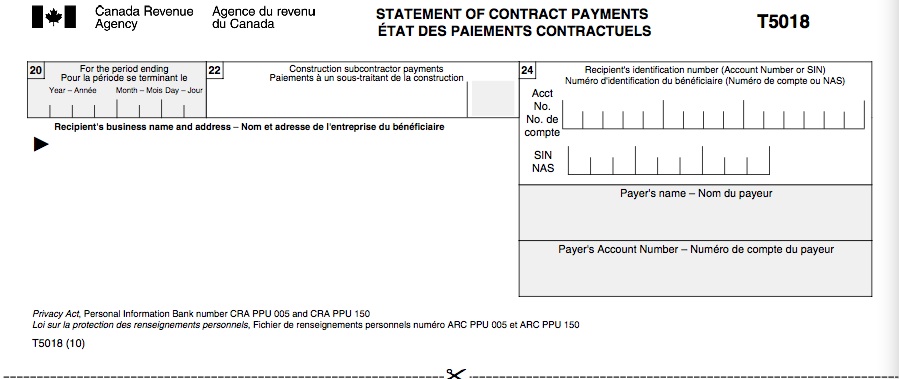

Cra Subcontracting Reporting Requirements

Cra Subcontracting Reporting Requirements

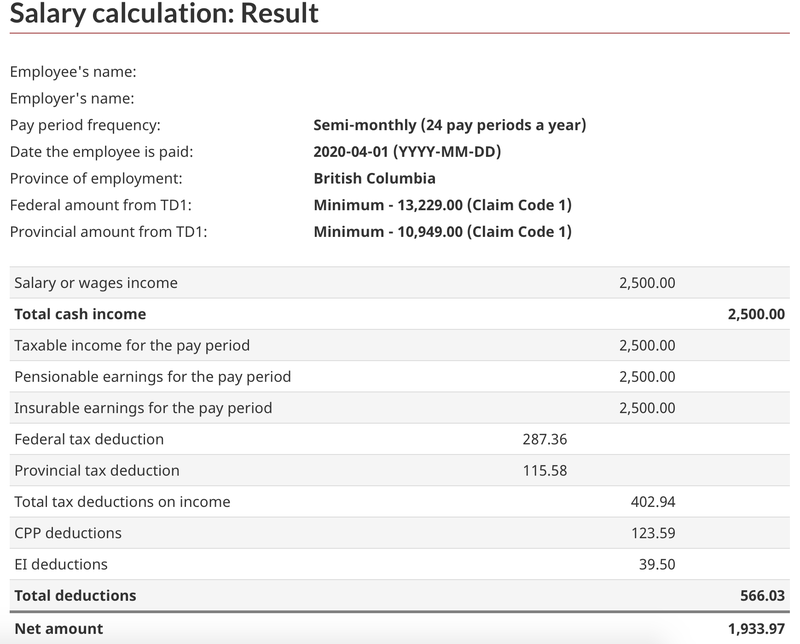

Calculate payroll deductions and withhold them from your employees cheques.

Pay payroll remittance cra. Quarterly remittances are not supported at this time. Report the deductions and income of each employee on the appropriate T4A or T4 slip. Select Start My Payment then select Payroll source deductions You can also make a payment at any major financial institution or through your online banking account.

For the tax you want to pay select Record Payment. Pay now with My Payment My Payment is an electronic service that lets you make payments directly to the Canada Revenue Agency CRA using your bank access card. Report a nil remittance When you do not have to remit deductions because you have seasonal workers no deductions or no employees.

The subsidy is equal to 10 of the remuneration you paid from March 18 to June 19 2020 up to 1375 for each eligible employee. Online using the My Business Account. Your remitting period end date.

The number of employees you paid on your last payday in the remitting period. For credit card payment options go to Pay by credit card PayPal or Interac e-Transfer. My Payment is an online payment option that allows individuals and businesses to pay taxes via the Canada Revenue Agency CRA website.

Open a payroll account with the CRA. Check with the CRA or your accountant to see whats right for your business. My Payment simplifies accounting because the funds leave your account immediately.

Your gross payroll in the remitting period. You then have to remit these deductions to the Canada Revenue Agency CRA. It is important to note that this option has a service fee of 25 on each payment while there is no fee if you are paying with Visa debit cards.

Your payroll program RP account number go to How to open a payroll program account if you dont have one which paydays you are remitting for. You can however use a third-party service provider such as Plastiq to make these payments. You can choose your tax remittance frequency here.

Select the CRA remittance you wish to pay follow the instructions and confirm transaction details. You will need to order a payroll remittance form or remittance voucher because it provides CRA with specific account information and has to be submitted with every payment. In order to avoid penalties for remitting your payroll deductions it is ideal to make remittances to their financial institution two to three days before the due date to avoid fines.

Most businesses must submit their last months payroll deductions to the Canada Revenue Agency CRA by the 15th of the current month. How to Pay through the CRA My Payment Site. Save valuable time and resources by letting Rise manage your businesss payroll with 100 compliance.

Make a payment remittance What you need. To pay your small businesss payroll remittance amount you can choose one of the methods below. Remit the payroll deduction employment insurance EI premiums and your share of the Canada Pension Plan CPP contributions to the CRA.

Remittances are considered to have been made on the day they are received by the CRA. Select Pay TaxesQuickBooks Payroll displays a table with your current unpaid tax balances. The CRAs My Payment Service.

It also warns you which balances are due. You can see the remittance date in your General Receiver report. When you pay remuneration such as salary or wages or give a taxable benefit to a recipient you have to take source deductions from that amount.

Simply go to the CRA My Payment site and follow the on-screen directions to pay. The 10 Temporary Wage Subsidy TWS is one of these measures that will allow eligible employers to reduce the amount of the payroll deductions required to be remitted to the Canada Revenue Agency. Plan ahead because it takes 5 to 10 business days to receive the payroll remittance forms by mail after placing an online or phone order.

In Person at your Financial Institution. If you are unsure please contact the CRA for more information. 2020 2021 Payroll Calendar cra payroll remittance calculatorpage2 Payroll Calendar ADP cra payroll remittance calculatorpage2 Payroll Calendar ADP cra payroll remittance calculatorpage2 2021 Payroll Templates.

You cannot use credit cards with My Payment. Have employees fill out a TD1 form. You will need your payroll account number.

Choose a payment dateYou can indicate the Cheque Number and add Notes if you like. Rise Payroll automatically remits all amounts to the CRA on your behalf. This lets you make payments to a wide range of eligible recipients when its convenient for you.

The easiest way to pay is online at the CRA website. Remit payroll deductions EI premiums and CPP contributions to the CRA. To make a tax payment.

With CRA My Payment payments are made securely from your bank account using RBC Online Banking and Interac Online. Alongside the completed form you will need to send the CRA applicable payments. You will need to create a Journal entry manually to move the payroll liabilities once the payment is made on your behalf.

You cannot pay the CRA directly with a credit card. How and when to pay remit source deductions Find out your due dates and how often you have to pay remit make a payment and confirm your payment was received. The My Payment service is offered through Interac Online and is a quick easy and secure way to make payments to the CRA.

Select Taxes from the left then Payroll Tax.

Bookkeeping Services Tst Financial Information Check Stubs Deposit Books Bank Statements Bookkeeping Services Financial Information Bookkeeping

Bookkeeping Services Tst Financial Information Check Stubs Deposit Books Bank Statements Bookkeeping Services Financial Information Bookkeeping

What Is A Small Supplier Business Lifestyle Starting A Business Start A Business From Home

What Is A Small Supplier Business Lifestyle Starting A Business Start A Business From Home

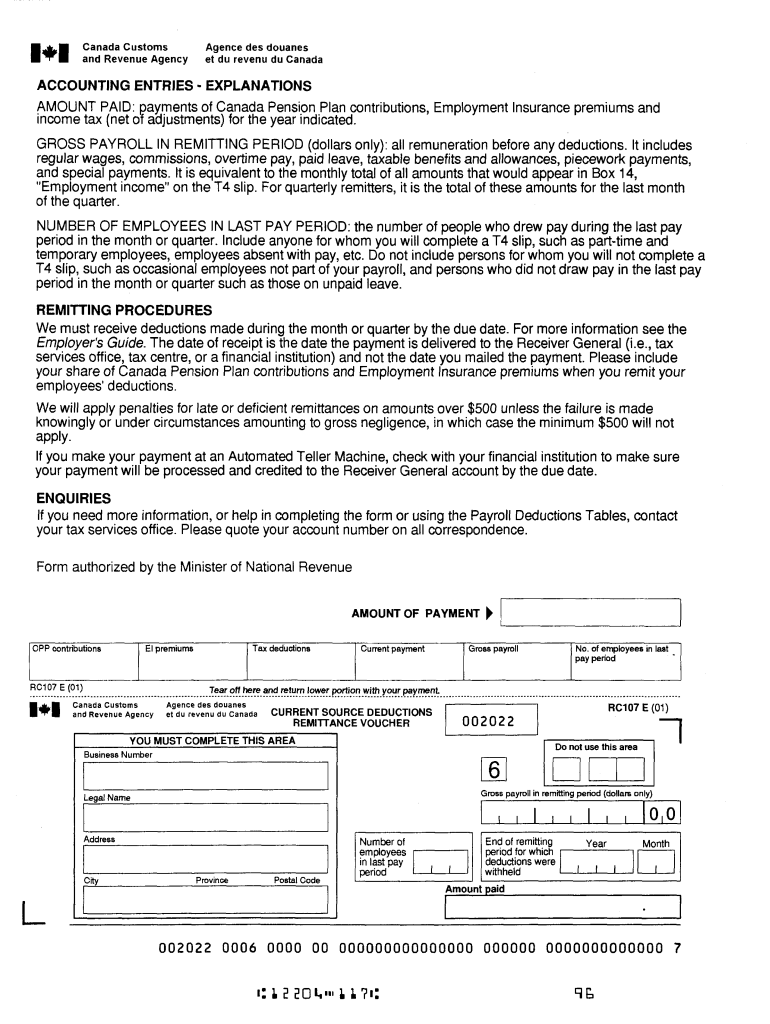

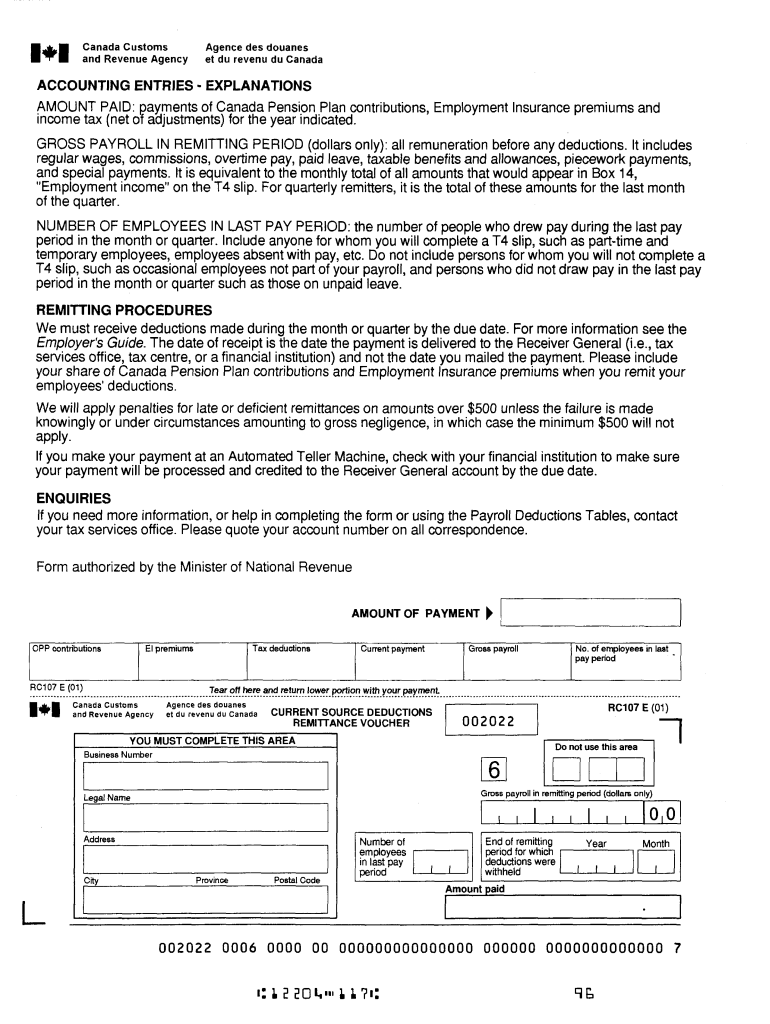

Payroll Remittance Form Ottawa Free Download

Payroll Remittance Form Ottawa Free Download

Cra Payroll Remittance Schedule 101 Knit People Small Business Blog

Cra Payroll Remittance Schedule 101 Knit People Small Business Blog

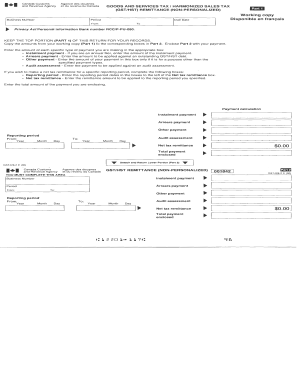

Hst Remittance Form Fill Out And Sign Printable Pdf Template Signnow

Hst Remittance Form Fill Out And Sign Printable Pdf Template Signnow

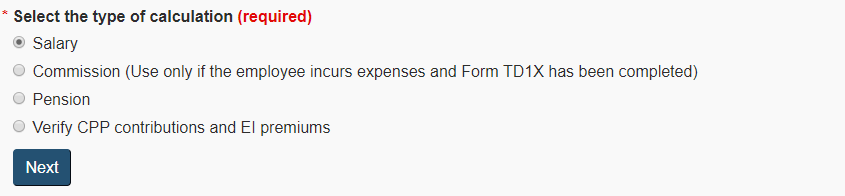

Step By Step Guide To Checkmark Canada Desktop Payroll Deductions Remittance

Step By Step Guide To Checkmark Canada Desktop Payroll Deductions Remittance

Https Files Transtutors Com Cdn Uploadassignments 2343898 2 Chapter 2 Pdf

Track Your Remittances Help Center

Track Your Remittances Help Center

Cra Payroll Remittance Form Printable Fill Online Printable Fillable Blank Pdffiller

Cra Payroll Remittance Form Printable Fill Online Printable Fillable Blank Pdffiller

Excellent Gig And Highly Recommend His Work Gig Excellent Trifold Create Business Planning Print Designs Inspiration How To Plan

Excellent Gig And Highly Recommend His Work Gig Excellent Trifold Create Business Planning Print Designs Inspiration How To Plan

Pd7a Statement Of Account For Current Source Deductions Canada Ca

Pd7a Statement Of Account For Current Source Deductions Canada Ca

Td Canada On Twitter Great Q Ken If This Is Your First Installment Please Use Cra Personal Income Tax 2017 Tax Return Remittance Voucher If This Is Not Your First Installment

Td Canada On Twitter Great Q Ken If This Is Your First Installment Please Use Cra Personal Income Tax 2017 Tax Return Remittance Voucher If This Is Not Your First Installment

Aircraft Cable In 2020 Cable Aircraft It Works

Aircraft Cable In 2020 Cable Aircraft It Works

Nanny Me Payroll Deductions How To Payroll Nanny Payroll Nanny

Nanny Me Payroll Deductions How To Payroll Nanny Payroll Nanny

Chapter 4 How To Remit Payroll Deductions Your Complete Guide To Canadian Payroll Humi E Books

Chapter 4 How To Remit Payroll Deductions Your Complete Guide To Canadian Payroll Humi E Books

Canada Reporting Nil Remittances Help Center

Canada Reporting Nil Remittances Help Center

How To Do Payroll In Canada A Step By Step Guide The Blueprint

How To Do Payroll In Canada A Step By Step Guide The Blueprint

Payroll Fcc Agexpert Community

Post a Comment for "Pay Payroll Remittance Cra"