Letter Of Credit Payment Terms Dp

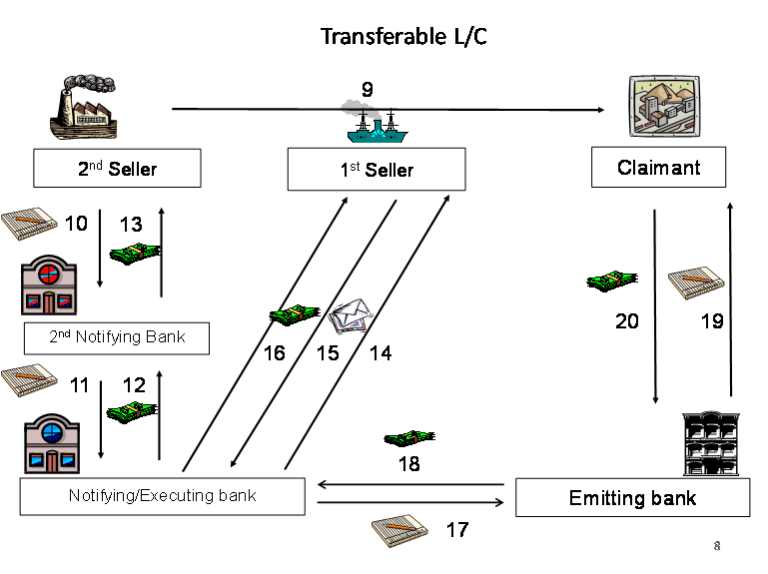

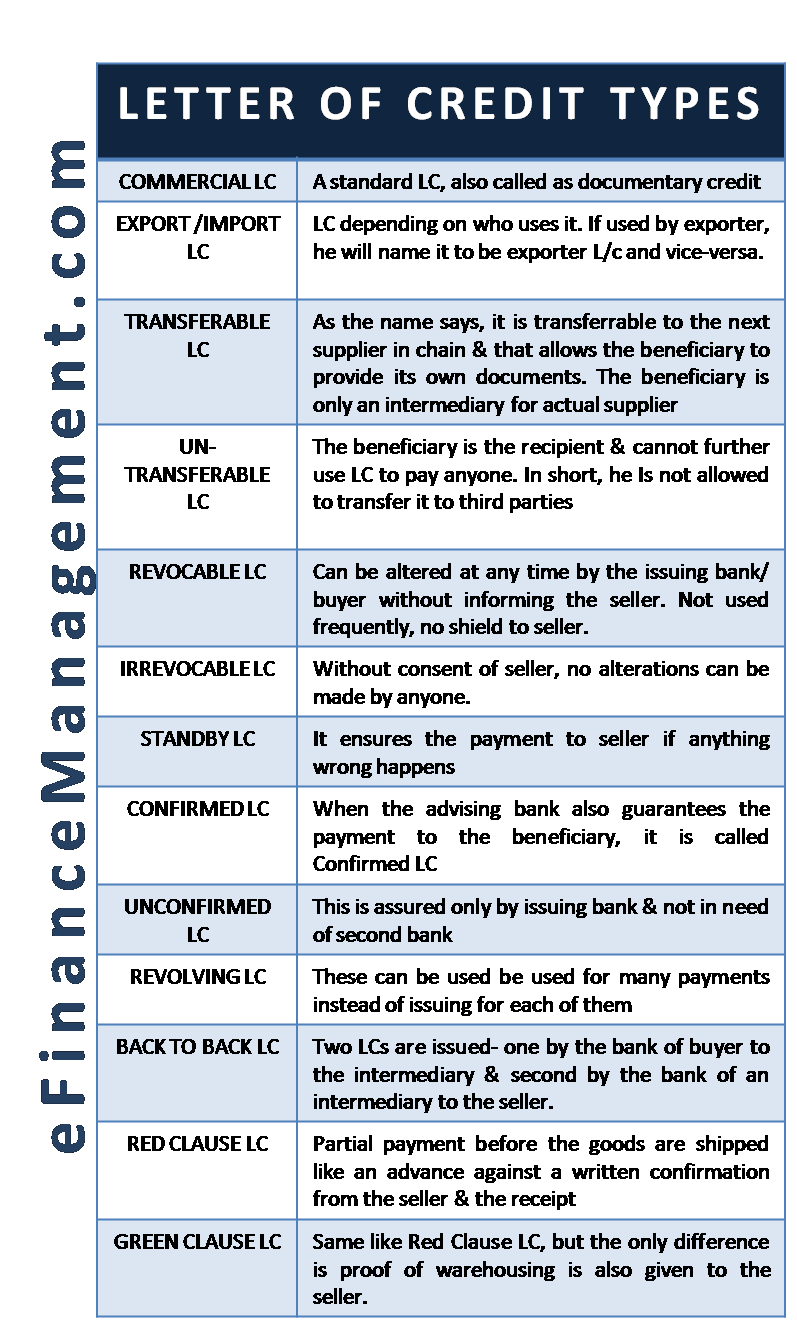

An alternative form of LC is a deferred payment letter of credit or a usance or term letter of credit. Exporters can reach the payment sooner with negotiable letters of credit while offering usance terms to the importers.

Initial Letter Dp Logo Template Design Royalty Free Vector

Initial Letter Dp Logo Template Design Royalty Free Vector

LC Payment thru Letter of Credit.

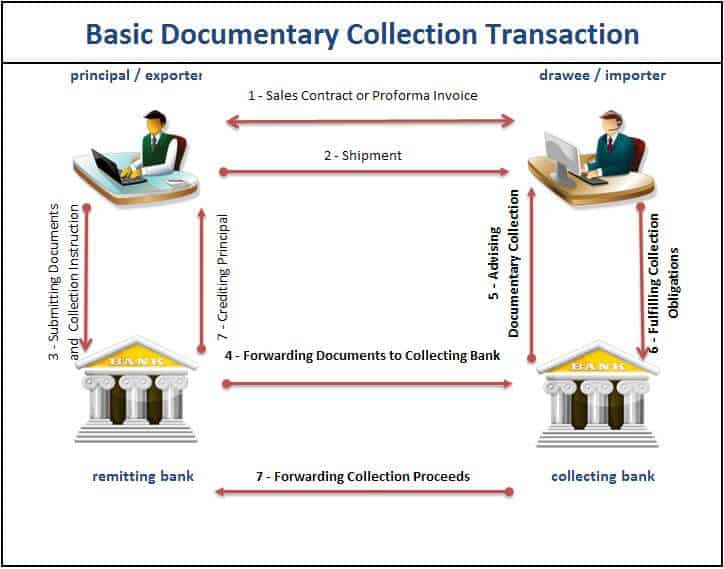

Letter of credit payment terms dp. The letter of credit conditions which must be met to ensure payment usually presentation of documents andor some type of statement about the underlying obligation. Letters of credit give more assurance to the exporters than cash against documents. The most common payment terms for contracts are open account the seller delivers without any guarantee and expects the payment at a later stage documentary collections the exchange of the documents representative of the goods and the payment are managed via banks letters of credit cash in advance.

Deferred payment gives the buyer more time to come up with funds. Updated September 07 2020. Buyer is not required to disclose any export information or details regarding the export of the goods.

Banks play a key role in letters of credit transactions and they have high levels of. The importer will be charged interest acceptance commission and other charged as per the terms of LC for using this letter of credit. Its economic effect is to introduce a bank as an underwriter where it assumes the counte.

The EXW term is never involved with an AWB or OBL. In the event that the buyer is. LC Payment Terms and Conditions There are certain LC payment terms that must be fulfilled when the letter of credit is issued.

A letter of credit also known as a documentary credit or bankers commercial credit or letter of undertaking is a payment mechanism used in international trade to provide an economic guarantee from a creditworthy bank to an exporter of goods. Responsibilities of Banks. What Are the Benefits of a Negotiable Letter of Credit to the Exporters.

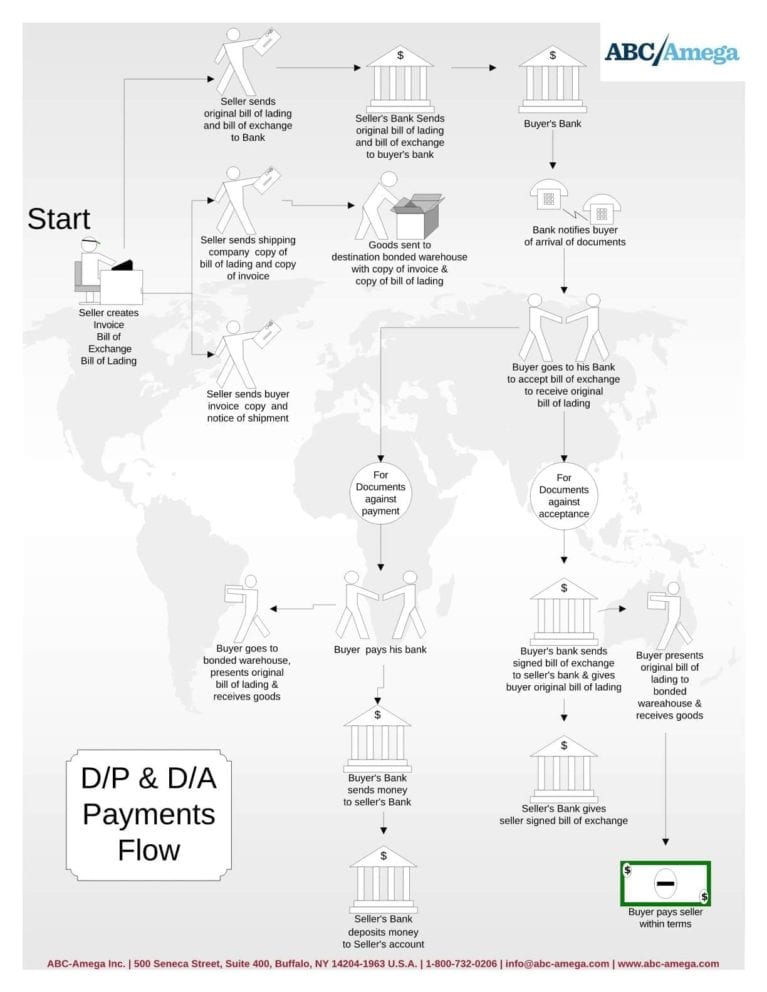

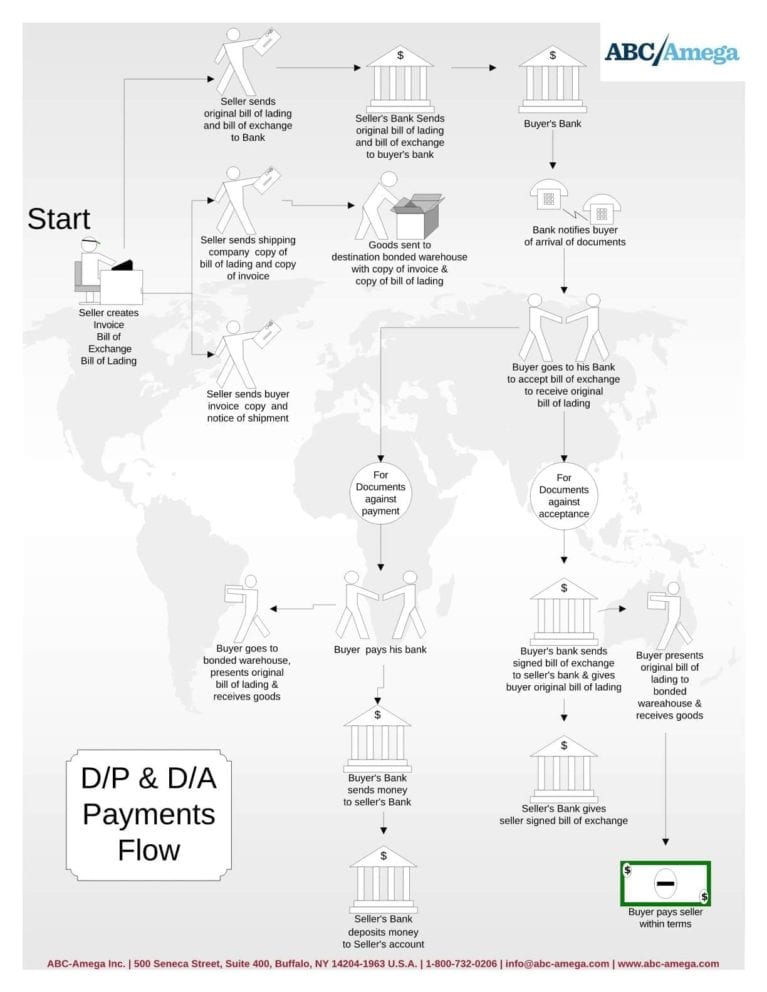

The buyers bank gives a written commitment to the seller called a Letter of Credit. A commercial letter of credit is essentially an agreement in international trade whereby a bank assumes a conditional obligation on behalf of its customer a buyer to make payment to a seller. In a DP payment terms the imported need to effect payment against respective import consignment before collecting documents for delivery of imported goods.

A letter of credit or credit letter is a letter from a bank guaranteeing that a buyers payment to a seller will be received on time and for the correct amount. Read The Balances Financial Review Board. CASH IN ADVANCE CA.

The negotiating bank or the accepting bank. Letter of Credit This is a safe and common international trade payment mechanism. This letter is to request a change in the payment terms that you presently offer our organization.

DP Payment against receipt of document. A letter of credit LOC is a promise from a bank to make a payment after verifying that somebody meets certain conditions. When you hear the phrase letter of credit it might be natural to think it refers to a document verifying that you are creditworthy but that isnt the case.

TT Telegraphic transfer. The easiest way to understand how LOCs work is to see an example and this tutorial describes the process step-by-step. Instrument similar to check presented with original letter of credit for amount of draw.

Payment is conditional upon a sellers compliance with the terms and conditions specified in the letter of credit. It is an assurance to the exporter that the buyers payment will be settled as per the agreed timeline and will be subject to the agreed terms and conditions. A letter of credit is a written undertaking by the buyer or the buyers bank known as the issuing bank to pay a certain amount of money to the seller or sellers bank ie.

A letter of credit that assures the payment if the buyer does not pay. A letter of credit is a document provided by a third party who verifies the payment for the associated goods or services will be paid. Letters of credit are used extensively in the financing of international trade where the reliability of contracting parties cannot be readily and easily determined.

8 With those instruments payment happens at some future point in time potentially long after the documents have been submitted perhaps 30 90 or 180 days after. In this situation the bank will pay to the seller. The document lists the precise conditions under which the.

In a nutshell it does not facilitate a transaction but guarantees the payment. After fulfilling all the terms under SBLC if the seller proves that the promised payment was not made. Major problems if used with a Letter of Credit.

For this reason the letter of credit is accepted as a more secure payment method in international trade than the documentary collection. Sellers inability to control the shipping document for payment. Our organization is able and willing to pay your invoices more promptly than the normal thirty-day business terms or what your present payment terms require.

Under a payment terms Documents against Payments the bank delivers documents required for import clearance only after receiving the value of goods from the importer. The shipper will likely be required to present an AWB or OBL. With the help of the negotiable letters of credit exporters can balance their cash flows and able to propose competitive payments terms to the importers.

DA Payment against acceptance. Under this Letter of credit the exporter will get the payment at sight if the documents are credit compliant. A letter of credit is a document.

Divorce Attorney Cover Letter Dp

Divorce Attorney Cover Letter Dp

Initial Letter Dp Logo Template Design Royalty Free Vector

Initial Letter Dp Logo Template Design Royalty Free Vector

Terms Of Payment In Export And Import

Terms Of Payment In Export And Import

Guide To Trade Financing Credit Facilities For Singapore Smes

Guide To Trade Financing Credit Facilities For Singapore Smes

6 Types Of Payment Terms For Exporters Projectmaterials

6 Types Of Payment Terms For Exporters Projectmaterials

What Is The Difference Between An Lc Dap And Tt Quora

Export Payment Terms Listing Safest Mode Of Payments In International Trade Drip Capital

Export Payment Terms Listing Safest Mode Of Payments In International Trade Drip Capital

Initial Letter Dp Logo Template Design Royalty Free Vector

Initial Letter Dp Logo Template Design Royalty Free Vector

Initial Letter Dp Creative Elegant Logo Template Vector Image

Initial Letter Dp Creative Elegant Logo Template Vector Image

Difference Between Da And Dp Terms Of Payment

Difference Between Da And Dp Terms Of Payment

Initial Dp Letter Logo Design With Gold And Vector Image

Initial Dp Letter Logo Design With Gold And Vector Image

Types Of Letter Of Credit Indiafilings

Types Of Letter Of Credit Indiafilings

How Does Bill Of Lading Work In Dp Payment Terms

How Does Bill Of Lading Work In Dp Payment Terms

D P D A International Sales Transactions Abc Amega

D P D A International Sales Transactions Abc Amega

Any Difference Between Da And Dp Terms Of Payment

Any Difference Between Da And Dp Terms Of Payment

Is Dp Terms Of Payment Safe In Export Business

Is Dp Terms Of Payment Safe In Export Business

Post a Comment for "Letter Of Credit Payment Terms Dp"