Is Payment Protection Program Taxable

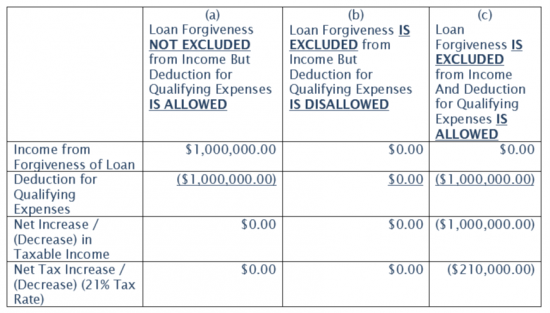

Based on section 265 of the tax code taxpayers generally cannot take deductions tied to tax-exempt income. All loan terms will be the same for everyone.

Paycheck Protection Program Offers Forgivable Loans For Eligible Small Businesses Center For Agricultural Law And Taxation

Paycheck Protection Program Offers Forgivable Loans For Eligible Small Businesses Center For Agricultural Law And Taxation

A recent IRS ruling tying up a loose end in the 2020 economic-relief law could force many small businesses to pay taxes on government aid meant to help through the pandemic.

Is payment protection program taxable. However in Notice 2020-32 the IRS stated that no deduction is allowed for an otherwise deductible expense if the payment of the expense results in forgiveness of the PPP loan. Normally these forgivable uses would be deductible for tax purposes as ordinary and necessary business expenses. Under the federal Coronavirus Aid Relief and Economic Security Act CARES Act borrowers may have their loans forgiven without incurring tax liability that would normally result from discharge of debt income.

Paycheck Protection Program PPP Loan Forgiveness Non-taxableTaxable. The submission will require accurate supporting documents. The forgivable portion of your loan isnt considered taxable business income and therefore you wont have to pay income tax on it.

Any compensation over 100000 per employee. If a customer has a service contract with a certified professional employer organization PEO sometimes referred to as an employee leasing company the customer who directs the PEO to defer the payment of employment taxes has the liability if the taxes are not paid by the deferral date Dec. If you wrote payroll checks or paid utility bills with the funds from your PPP loan you cannot deduct those expenses on your tax return.

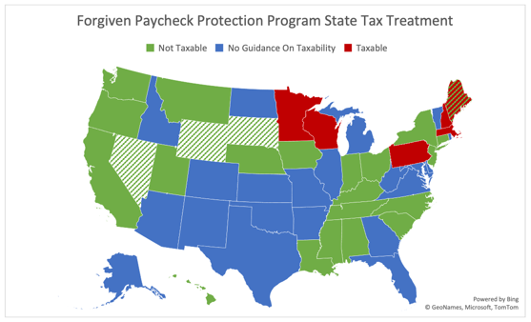

No PPP loans can only be used to pay for specific outlined expenses such as payroll rent mortgage interest utilities personal protective equipment and business software so taxes cannot be paid with PPP funds. IR-2021-04 January 6 2021. Many states follow the federal tax treatment of Paycheck Protection Program PPP loan forgiveness.

31 2021 and Dec. Payment of state and local taxes imposed on the compensation of employees However the PPP does not count the following expenses when calculating the total PPP reimbursement amount. Eligible Paycheck Protection Program expenses now deductible.

Round 3 PPP loans will not be included in your companys taxable income. However using the loan can also reduce the number of tax write-offs you can take on your business. A forgiven PPP loan is tax-exempt meaning it does not cause you to recognize a taxable gain.

Where can I read more about the December 2020 changes to taxes and the PPP. Businesses that are structured as C corporations or S corporations must be using payroll to pay their owners because the corporation is taxed separately from the individual. The loan amounts will be forgiven as long as.

For the small businesses that received funding under this program a formal request to have the loan forgiven will be required and submitted to the bank responsible for loaning the money. Again this is also not a new rule. BORROWERS The Paycheck Protection Program PPP authorizes up to 349 billion in forgivable loans to small businesses to pay their employees during the COVID-19 crisis.

States that do impose a tax on PPP loan forgiveness usually allow expenses paid with the loan proceeds to be deducted. If your loan is forgiven expenses paid with the proceeds of your loan will be tax-deductible. PAYCHECK PROTECTION PROGRAM PPP INFORMATION SHEET.

Over the summer President Trump used an executive order to allow certain employees to defer the 62 share of Social Security tax on wages paid from September 1 2020 through the end of the year. WASHINGTON The Treasury Department and the Internal Revenue Service issued guidance PDF today allowing deductions for the payments of eligible expenses when such payments would result or be expected to result in the forgiveness of a loan covered loan under the Paycheck Protection Program PPP. Even better while a cancellation of a borrowers debt typically creates taxable income under Section 61 a 11 of the Internal Revenue Code the CARES Act provides that forgiveness of a PPP loan.

Expenses paid with PPP loans are not deductible. Borrowers may be eligible for loan forgiveness. An SBA-backed loan that helps businesses keep their workforce employed during the Coronavirus COVID-19 crisis.

If you own a business and do not give yourself a salary through a payroll service you are likely still eligible for the Paycheck Protection Programwith one exception. Heres some great news about federal government taxes if you receive the PPP loan. The agency on Nov.

If The Sba Made Six Loan Payments On Your Behalf Are You Taxed

If The Sba Made Six Loan Payments On Your Behalf Are You Taxed

Paycheck Protection Program How To Make Things As Smooth As Possible

Paycheck Protection Program How To Make Things As Smooth As Possible

Irs And Congress Differ On Taxability Of Ppp Loan Forgiveness

Irs And Congress Differ On Taxability Of Ppp Loan Forgiveness

Taxation Of Forgiveness Of Paycheck Protection Program Loans 2020 Articles Resources Cla Cliftonlarsonallen

Taxation Of Forgiveness Of Paycheck Protection Program Loans 2020 Articles Resources Cla Cliftonlarsonallen

How The Paycheck Protection Program Affects 2020 Taxes Bench Accounting

How The Paycheck Protection Program Affects 2020 Taxes Bench Accounting

Some States May Tax Forgiven Ppp Loan Proceeds Sba S Office Of Advocacy

Some States May Tax Forgiven Ppp Loan Proceeds Sba S Office Of Advocacy

No Deduction For Business Expenses Paid Out Of Forgivable Paycheck Protection Program Loans

No Deduction For Business Expenses Paid Out Of Forgivable Paycheck Protection Program Loans

Do Owner Draws Count As Salary For The Paycheck Protection Program Bench Accounting

Do Owner Draws Count As Salary For The Paycheck Protection Program Bench Accounting

Sba Easing Forgiveness Of Paycheck Protection Program Loans Of 50 000 Or Less Loan Forgiveness Loan Business Journal

Sba Easing Forgiveness Of Paycheck Protection Program Loans Of 50 000 Or Less Loan Forgiveness Loan Business Journal

Https Www Hsdl Org View Did 845764

Paycheck Protection Program Ppp Loan Tax Implications

Paycheck Protection Program Ppp Loan Tax Implications

Paycheck Protection Program Wcg Cpas

Paycheck Protection Program Wcg Cpas

Your Ppp Loan May Get Taxed In Some States Marine Retailers Association Of The Americas

Your Ppp Loan May Get Taxed In Some States Marine Retailers Association Of The Americas

Paycheck Protection Program Michigan Small Business Development Center

Paycheck Protection Program Michigan Small Business Development Center

What Is The Paycheck Protection Program Ppp Loan Turbotax Tax Tips Videos

What Is The Paycheck Protection Program Ppp Loan Turbotax Tax Tips Videos

Are Ppp Loans Eidl Grants Taxable Everything You Need To Know

Are Ppp Loans Eidl Grants Taxable Everything You Need To Know

The Paycheck Protection Program Free Money For Small Businesses What You Need To Know Murray Plumb Murray

The Paycheck Protection Program Free Money For Small Businesses What You Need To Know Murray Plumb Murray

Post a Comment for "Is Payment Protection Program Taxable"