Irs Tax Refund Status Information Does Not Match

RIRS does not represent the IRS. The IRS typically sends out over 6 million CP2000 Notices annually.

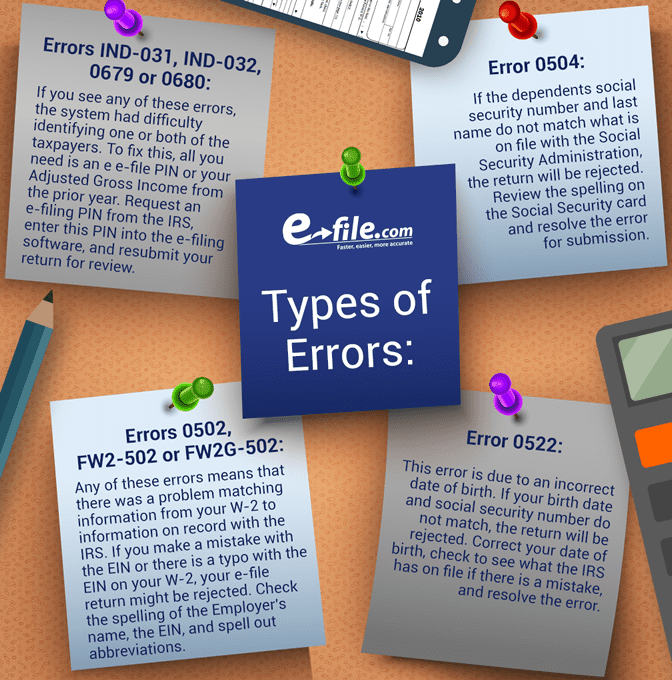

How To Correct An E File Rejection E File Com

How To Correct An E File Rejection E File Com

Ive input all the information correctly and rechecked it over and over.

Irs tax refund status information does not match. Dont count on getting your refund by a certain date to make major purchases or pay other financial obligations. The letter is called an IRS Notice CP2000 and it gives detailed information about issues the IRS identified and provides steps taxpayers should take to resolve those issues. You can also call the IRS to check on the status of your refund.

IRS Letter 2531 Your Tax Return Doesnt Match the Information We Have On File The income reported on your Form 1120 does not match the income reported to the IRS by banks businesses and other payers. Until our system can read the information on your tax return under your Social Seciurity number the amount of the refund reads 0. Note that the IRS only updates tax return statuses once a day during the week usually between midnight and 6 am.

Please reenter your information then watch this video to find out what does it mean. Compare the information on the notice with the information reported on the Form 1120. If you submit information that doesnt match the IRSs records multiple times youll be locked out of portal for 24 hours youll get a Please try again later message.

Your information is not available in this app yet. Using the IRS tool Wheres My Refund enter your Social Security number or ITIN your filing status and your exact refund amount then press Send. I initially filed with Turbo Tax on April 28 2020 and I never heard back from the IRS until November 1 2020 when I was asked to provide more documents.

Even though the IRS issued more than 9 out of 10 refunds to taxpayers in less than 21 days its possible your tax return may require more review and take longer. If you entered your information correctly youll. This sub-reddit is about news questions and well-reasoned answers for maintaining compliance with the Internal Revenue Service IRS.

-If you are a SSA or RRB Form 1099 recipient SSI or VA benefit recipient the IRS is working with your agency to issue your payment. Originally started by John Dundon an Enrolled Agent who represents people against the IRS rIRS has grown into an excellent portal for quality information from any number of tax professionals. If you entered your information correctly youll.

If you were expecting a federal tax refund and did not receive it check the IRS Wheres My Refund page. Youll need to enter your Social Security number filing status and the exact whole dollar amount of your refund. When a tax returns information doesnt match data reported to the Internal Revenue Service by employers banks and other third parties the IRS will send a letter to the taxpayer.

If you do not have internet access call IRSs Refund Hotline at 1-800-829-1954. Until the return is available on our system without reason for adjustment or further review you will get the message that the amount you entered does not match our records. Wait times to speak with a representative can be long.

Also Box 20a on your return is the number you should be entering. You may be prompted to change your address online. It essentially says please look at your return and reply.

Long time lurker first time poster. I also called the irs hotline and i. If you get Refund Status Error that says Information does not match.

The IRS issues a CP2000 Notice or a CP2501 Notice when your tax return information does not match the IRS records. I rechecked the information and it is correct. Today I finally received a date for my tax refund check after 10 months of waiting.

When checking on the status of my refund it keeps saying the information was entered incorrectly and does not match. Using the IRS tool Wheres My Refund enter your Social Security number or ITIN your filing status and your exact refund amount then press Send. If you are unable to verify your identity.

You should only call if it has been. The CP2501 is more of a soft Notice. EbonyL122824 Ok so Im having the same issue on the IRS2GO app checking the status of my refundThis message keeps popping up on the bottom of the screen saying my information does not match to check it and enter it again.

If the information you enter does not match the IRS records multiple times you will be locked out of Get My Payment for 24 hours for security reasons. There may be a problem. You can also call the IRS at 1-800-829-1954 or 1-800-829-4477 or 1-800-829-1040 and inquire about your tax return status with an IRS a customer service representative.

21 days or more since you e-filed Wheres My Refund tells you to contact the IRS Do not file a second tax return.

1099 Int Software E File Tin Matching Tax Forms Envelopes Irs Forms Irs Efile

1099 Int Software E File Tin Matching Tax Forms Envelopes Irs Forms Irs Efile

1099 K Software E File Tin Matching Tax Forms Envelopes Irs Forms Irs Tax Forms

1099 K Software E File Tin Matching Tax Forms Envelopes Irs Forms Irs Tax Forms

Change Your Name It Can Affect Your Taxes Changing Your Name Names You Changed

Change Your Name It Can Affect Your Taxes Changing Your Name Names You Changed

Free Tax Filing Software From The Irs Get Information And Links At Www Wealthforseniors Com Free Tax Filing Filing Taxes Irs

Free Tax Filing Software From The Irs Get Information And Links At Www Wealthforseniors Com Free Tax Filing Filing Taxes Irs

Taxpayers Confused By Unavailable Status For Stimulus Payment

Taxpayers Confused By Unavailable Status For Stimulus Payment

Irs The Information Does Not Match Our Records Fix Get My Payment Stimulus Youtube

Irs The Information Does Not Match Our Records Fix Get My Payment Stimulus Youtube

Understanding Wage Garnishment What To Do If The Irs Garnishes Your Wages If You Ever Get Involved In A Wage Garnishment I Wage Garnishment Wage Tax Help

Understanding Wage Garnishment What To Do If The Irs Garnishes Your Wages If You Ever Get Involved In A Wage Garnishment I Wage Garnishment Wage Tax Help

Tax Refund Letter Template Sample For Money From Bank

Tax Refund Letter Template Sample For Money From Bank

Wmr And Irs2go Status Differences Return Received Accepted Or Under Review And Refund Approved Versus Refund Sent Aving To Invest

Wmr And Irs2go Status Differences Return Received Accepted Or Under Review And Refund Approved Versus Refund Sent Aving To Invest

Irs Audits Can Happen For A Variety Of Reasons It Could Occur Because The Documents Used To Report Your Taxes Do Not Match What Is Reporte Irs Taxes Audit Irs

Irs Audits Can Happen For A Variety Of Reasons It Could Occur Because The Documents Used To Report Your Taxes Do Not Match What Is Reporte Irs Taxes Audit Irs

Six Tips To Avoid An Irs Audit Irs Audit Tips

Six Tips To Avoid An Irs Audit Irs Audit Tips

1099 Misc Form 1099 Misc Instructions Irs Form 1099 Misc 1099 Tax Form Tax Forms Irs Forms

1099 Misc Form 1099 Misc Instructions Irs Form 1099 Misc 1099 Tax Form Tax Forms Irs Forms

Basic Income Tax Formula Income Tax Income Income Tax Return

Basic Income Tax Formula Income Tax Income Income Tax Return

Everyone Who Works At Home Should Know These Tax Terms Tax Forms Irs Forms 1099 Tax Form

Everyone Who Works At Home Should Know These Tax Terms Tax Forms Irs Forms 1099 Tax Form

Accounts Tax Refund Tax Refund Accounting Irs

Accounts Tax Refund Tax Refund Accounting Irs

Form 4 C This Story Behind Form 4 C Will Haunt You Forever Irs Forms Irs Tax Forms

Form 4 C This Story Behind Form 4 C Will Haunt You Forever Irs Forms Irs Tax Forms

What Is A 1099 Form And How Do I Fill It Out Bench Accounting Tax Forms Irs Forms 1099 Tax Form

What Is A 1099 Form And How Do I Fill It Out Bench Accounting Tax Forms Irs Forms 1099 Tax Form

Post a Comment for "Irs Tax Refund Status Information Does Not Match"