Irs Payment Status Issues

Make a payment online. The IRS continues to closely monitor the situation.

Quick Way To Access Your Turbotax Card Stimulus Check Status Turbotax Status Cards

Quick Way To Access Your Turbotax Card Stimulus Check Status Turbotax Status Cards

Payments Internal Revenue Service.

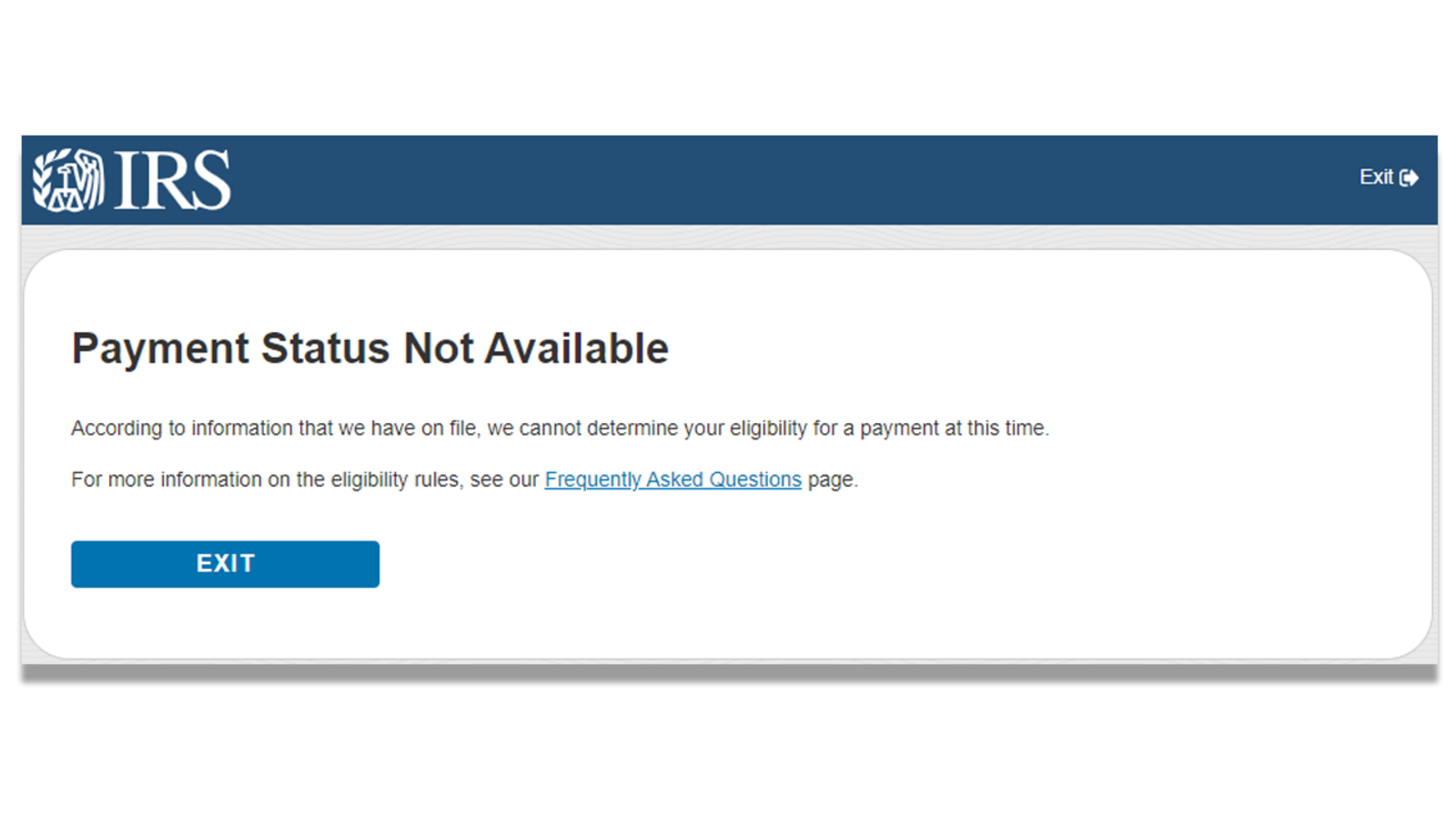

Irs payment status issues. HOUSTON This week the Internal Revenue Service says 80 million Americans will be getting stimulus payments deposited in their bank accounts. Payment Status Not Available. Payment plan details if you have one.

The IRS says it issues most tax refunds within 21 days but many people will get their refunds far sooner. The best way to check the status of your federal tax refund is to visit the Wheres My Refund page at the IRS website. The first round of people getting money are those who.

If you file your taxes and havent yet received your stimulus money from the IRS chances are youre trying to check on it with the new status tracker the agency now has online. If you scheduled a payment through IRS Direct Pay you can use your confirmation number from the payment to access the Look Up a Payment feature. The IRS issues most refunds in less than 21 days if e-filed or 4 weeks if mailed.

Because of the speed at which the law required the IRS to issue the second round of Economic Impact Payments some payments may have been sent to an account that may be closed or is no longer active or unfamiliar. If Get My Payment does not provide a payment date a payment will not be issued and you will need to claim the Recovery Rebate Credit if eligible. You will need to wait at least 4 weeks if you mailed in your tax return.

If you are a SSA or RRB Form 1099 recipient SSI or VA benefit recipient the IRS is working with your agency to issue your payment. The IRS and Treasury have issued all first and second Economic Impact Payments. If there are any errors it might take the agency longer to process and issue your tax.

Your payment history and any scheduled or pending payments. What you will need. You can modify or cancel a scheduled payment until two business days before the payment date.

The Get My Payment tool on IRSgov is designed to show the statuses of the first and second stimulus payments. You do not need to do anything to receive your payment. The IRS reminds taxpayers that Get My Payment data is updated once per day so theres no need to check back more frequently.

Your Economic Impact Payments EIP 1 and EIP 2 if any. You can also get a status update using the IRS tracker. Key information from your most recent tax return.

Please note that Direct Pay availability has no bearing on your due date so plan ahead to ensure timely payment. See payment plan options and request a plan via Online Payment Agreement. And if youre doing.

Penalties and interest may apply to money you owe after the due date. For larger electronic payments use EFTPS or same-day wire. And well send you a notification as soon as it hits your Chime account.

You can find how and when we issued your first and second payments using Get My Payment. People can check the status of their payment at IRSgovgetmypayment. Check the status of your Economic Impact payment from the IRS using the Get My Payment application.

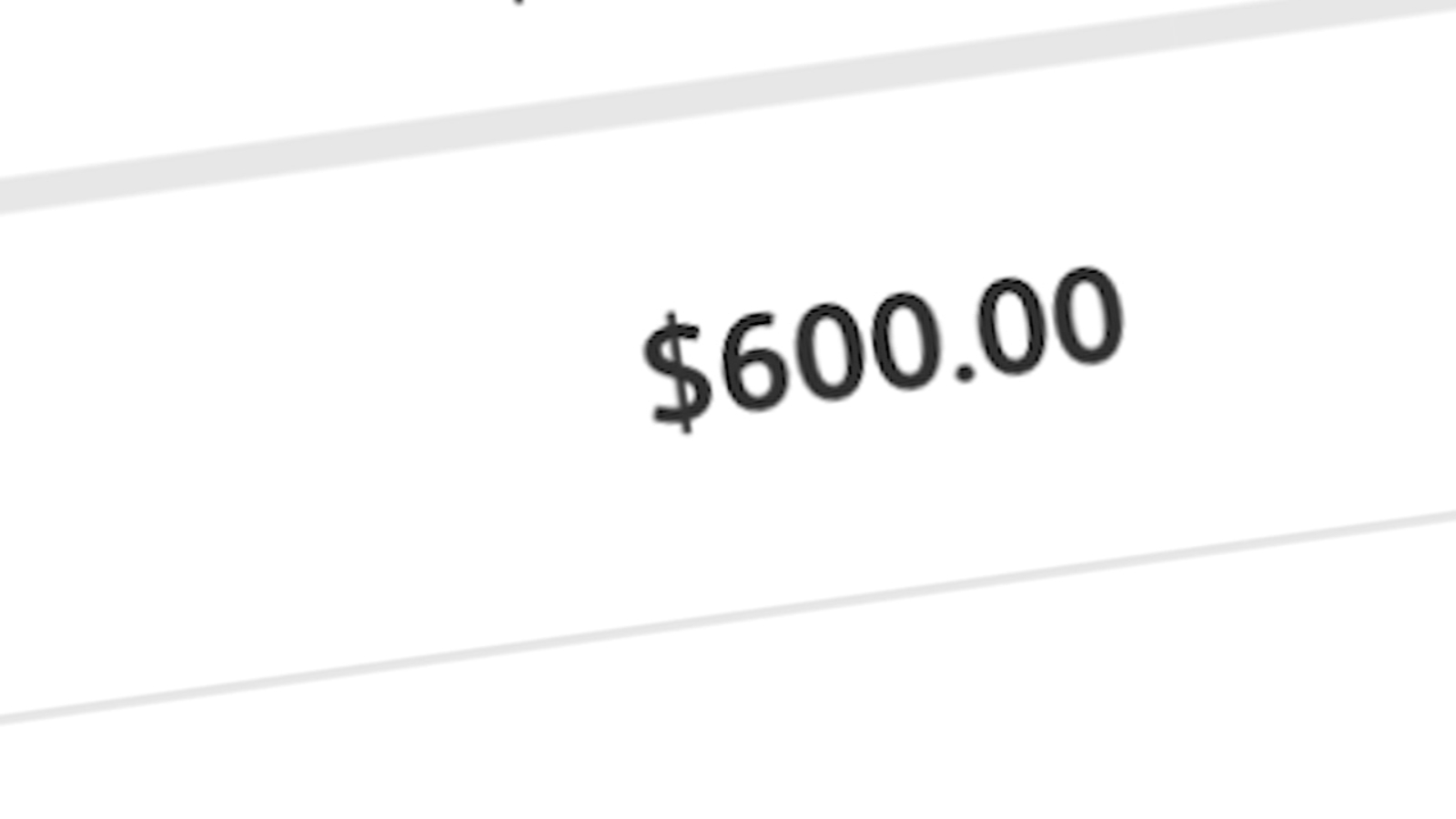

The IRS is distributing 600 Economic Impact stimulus payments for qualifying individuals as part of the Coronavirus Response and Relief Supplemental Appropriations Act of 2021. The CARES Act created a stimulus check for many Americans and tasked the Internal Revenue Service to make those 1200 payments. If you didnt get any Economic Impact Payments or got less than the full amounts you may qualify for the Recovery Rebate Credit and must file a 2020 tax return to claim the credit even if you dont normally file.

The email notification you received when you scheduled the payment will contain the confirmation number. You can also call the IRS at 1-800-829-1954 or 1-800-829-4477 or 1-800-829-1040 and inquire about your tax return status with an IRS a customer service representative. That relief effort which directed 1200 for each eligible adult and 500 for each eligible child encountered a number of problems such as a delay in payment to people who didnt have their bank.

The IRS announced Tuesday that eligible Americans who see a status that reads Payment. See Recovery Rebate Credit for more information. Your information is not available in this app yet.

Digital copies of select notices from the IRS. Amount and frequency limitations. If you file your taxes and havent yet received your stimulus money from the IRS chances are youre trying to check on it with the new status tracker the agency now has online.

At the end of the 2019 tax filing season the IRS processed 155. Pay your taxes view your account or apply for a payment plan with the IRS. You can check the app again to see whether there has been an update to your information.

IRS Direct Pay wont accept more than two payments within a 24-hour period and each payment must be less than 10 million. As of January 29 2021 Get My Payment will no longer be updated for the first or second round of payments. And if youre doing that you may be seeing this message.

Quarterly Taxes 5 Quick Steps To Pay Estimated Tax Payments Online Careful Cents Estimated Tax Payments Tax Payment Quarterly Taxes

Quarterly Taxes 5 Quick Steps To Pay Estimated Tax Payments Online Careful Cents Estimated Tax Payments Tax Payment Quarterly Taxes

Irs2go 101 Tax Refund Personal Finance Tax Help

Irs2go 101 Tax Refund Personal Finance Tax Help

Irs Stimulus Check Portal Payment Status Not Available Error What Does It Mean Abc7 San Francisco

Irs Stimulus Check Portal Payment Status Not Available Error What Does It Mean Abc7 San Francisco

The Three Irs Payment Plans Explained Irs Payment Plan Irs How To Plan

The Three Irs Payment Plans Explained Irs Payment Plan Irs How To Plan

Irstaxdebtresolution Tax Problems Merit Professional Help When Individuals Cannot Pay Tax Liabilities Of 10 000 Or More T Irs Taxes Tax Debt Tax Relief Help

Irstaxdebtresolution Tax Problems Merit Professional Help When Individuals Cannot Pay Tax Liabilities Of 10 000 Or More T Irs Taxes Tax Debt Tax Relief Help

Can T Pay Your Tax Debt Try Currently Not Collectible Status Irs Taxes Tax Debt Tax Attorney

Can T Pay Your Tax Debt Try Currently Not Collectible Status Irs Taxes Tax Debt Tax Attorney

Irs Commissioner Chuck Rettig Said We Urge People To Take Extra Care During This Period The Irs Isn T Going Estimated Tax Payments Payroll Taxes Tax Payment

Irs Commissioner Chuck Rettig Said We Urge People To Take Extra Care During This Period The Irs Isn T Going Estimated Tax Payments Payroll Taxes Tax Payment

Irs2go 101 All About The Internal Revenue Service App Tax Help Internal Revenue Service Irs Website

Irs2go 101 All About The Internal Revenue Service App Tax Help Internal Revenue Service Irs Website

Tax Id Issue Letter Ein Assignment Letter Tax Irs Federal Business Fake Organization Co Confirmation Letter Doctors Note Template Letter Of Employment

Tax Id Issue Letter Ein Assignment Letter Tax Irs Federal Business Fake Organization Co Confirmation Letter Doctors Note Template Letter Of Employment

5 Things You Can Do To Prevent Irs Passport Block Irs Tax Lawyer Tax Attorney

5 Things You Can Do To Prevent Irs Passport Block Irs Tax Lawyer Tax Attorney

Stimulus Check Problems What To Do If Check Goes Into Wrong Account Irs Get My Payment Portal Shows Error Abc7 New York Tax Refund Irs How To Get Money

Stimulus Check Problems What To Do If Check Goes Into Wrong Account Irs Get My Payment Portal Shows Error Abc7 New York Tax Refund Irs How To Get Money

Stimulus Check What Payment Status Not Available Really Means Irs Student Loans Irs Website

Stimulus Check What Payment Status Not Available Really Means Irs Student Loans Irs Website

Know When To Request An Irs Penalty Waiver Tax Debt Irs Payment Plan Irs

Know When To Request An Irs Penalty Waiver Tax Debt Irs Payment Plan Irs

Problems Tracking Your Stimulus Check Or Setting Up Direct Deposit 10 Reasons Why Cnet Tax Deadline Prepaid Debit Cards Supplemental Security Income

Problems Tracking Your Stimulus Check Or Setting Up Direct Deposit 10 Reasons Why Cnet Tax Deadline Prepaid Debit Cards Supplemental Security Income

What The News Media Isn T Telling You About Stimulus Payments

3 Important Questions Asked About Irs Payment Plan Irs Taxes Irs Payment Plan Tax Debt

3 Important Questions Asked About Irs Payment Plan Irs Taxes Irs Payment Plan Tax Debt

Economic Impact Payments Money Problems Prepaid Debit Cards Library Events

Economic Impact Payments Money Problems Prepaid Debit Cards Library Events

Tax Blog Faq S Information On All Tax Irs Related Subjects Irs Taxes Tax Preparation Tax Attorney

Tax Blog Faq S Information On All Tax Irs Related Subjects Irs Taxes Tax Preparation Tax Attorney

Second Stimulus Check Problems Payment Status Not Available Error On Irs Website Means Some Need To Claim 600 On 2020 Tax Returns Abc7 New York

Second Stimulus Check Problems Payment Status Not Available Error On Irs Website Means Some Need To Claim 600 On 2020 Tax Returns Abc7 New York

Post a Comment for "Irs Payment Status Issues"