Irs Payment Plan During Shutdown

What the IRS will do during shutdown. You can apply online.

Irs Grants One Day Extension After Website Suffers Technical Difficulties On Tax Day Tax Day Income Tax Budgeting

Irs Grants One Day Extension After Website Suffers Technical Difficulties On Tax Day Tax Day Income Tax Budgeting

For details see the IRS Apply Online for a Payment Plan web page.

Irs payment plan during shutdown. Due to the lapse in appropriations most IRS operations are closed during the shutdown. These are in the IRS case per the contingency plan actions that are Necessary for the Safety of Human Life or Protection of Government Property The Budget Enforcement Act of 1990 amended the Anti-Deficiency Act. The IRS has since make it clear it is suspending most collection activities from March.

If you cannot pay off your balance within 120 days setting up a direct debit payment plan online will cost 31 or 107 if set up by phone mail or in-person. During this period the IRS reminds taxpayers that the underlying tax laws remain in effect and all taxpayers should continue to meet their tax obligations as normal. Taxpayers who are currently unable to comply with the terms of an Installment Payment Agreement including a Direct Deposit Installment Agreement may suspend payments during this period if they.

If you can pay off your balance within 120 days it wont cost you anything to set up an installment plan. Currently taxpayers may only apply for a short-term payment plan of more than 120 days up to 180 days by phone or mail. Several weeks ago the IRS said it was easing installment and other payments as people deal with the pandemic.

If not using direct debit then setting up the plan online will cost 149. Long-term payment plan installment agreement. In government shutdown situations the IRS focuses on what are termed excepted actions.

If you decide to pay via a periodic payment submit your first payment with your offer and continue to make monthly payments on your specific payment plan while the IRS considers your offer. Meet your tax obligation in monthly installments by applying for a payment plan including installment agreement Find out if you qualify for an offer in compromise -- a way to settle your tax debt for less than the full amount Request that we temporarily delay collection until your financial situation improves. If you are an individual you may qualify to apply online if.

Note that if you meet the Low-Income Certification Guidelines you arent expected to send the application fee or your first payment. Taxpayers who are. Though an existing IRS contingency plan laid out how the agency would run during a shutdown through December 31 that plan has since expired just before tax season officially started.

Taxpayers who cant afford to pay the IRS the taxes they owe can enter into an offer in compromise OIC in which the IRS accepts payment of less than the full amount owed. This is also one of the more noticeable functions performed by the IRS that taxpayers would be likely to miss if payments were to be delayed. Taxpayers who qualify for a short-term payment plan option may now receive up to 180 days to pay back the money instead of the usual 120 days.

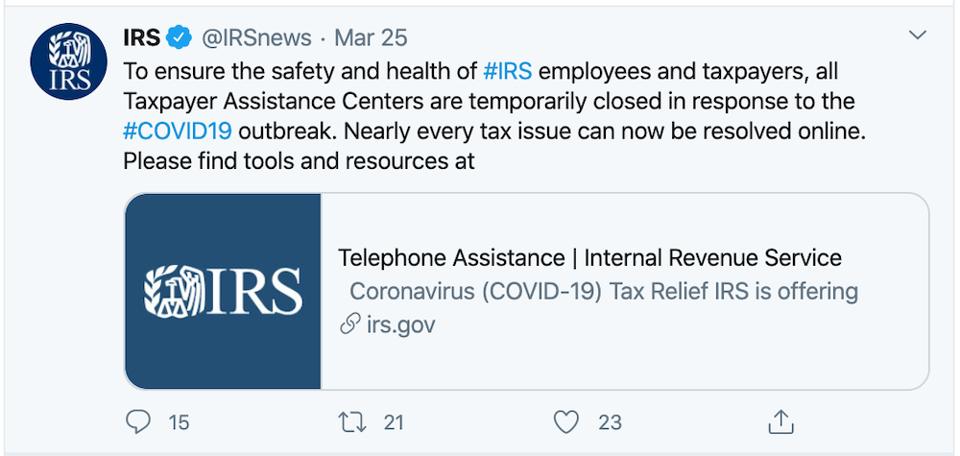

Taxpayers need to file a lengthy OIC application disclosing their financial situation. To help people facing the challenges of COVID-19 issues the IRS through the People First Initiative will temporarily adjust and suspend key compliance programs. For taxpayers under an existing Installment Agreement payments due between April 1 and July 15 2020 are suspended.

You owe 50000 or less in combined tax penalties and interest and filed all required returns. For taxpayers under an existing Installment Agreement payments due between April 1 and July 15 2020 are suspended. IR-2020-59 March 25 2020 WASHINGTON To help people facing the challenges of COVID-19 issues the Internal Revenue Service announced today a sweeping series of steps to assist taxpayers by providing relief on a variety of issues ranging from easing payment guidelines to postponing compliance actions.

The IRS understands that many taxpayers face. The IRS is always going to accept a payment plan that full-pays the liability principal only within 5 years. IRS phone lines are closed so taxpayers cannot contact the IRS to skip the automatic payments during this time.

The Internal Revenue Service is one of the federal agencies that is impacted by the current partial government shutdown. If the government shutdown continues into 2019 a new plan will have to be formulated. In anticipation of a lapse in funding Treasury in late November issued a fiscal year 2019 Lapsed Appropriations Contingency Plan that governs what will happen at the IRS during a government shutdown but only through Dec.

Taxpayers are in a pickle. If you think youll be able to pay off your balance within 120 days of when its due for this year that means within 120 days of July 15 you wont pay a fee to set up that arrangement. To shed some light on the automated process.

An IRS-wide furlough began on December 22 2018 that affects many operations. According to the agencys contingency plan for lapsed appropriations taxpayer refunds are one of the things that will be affected. Also the IRS is not automatically suspending direct.

The IRS will not default any Installment Agreements during this period. OP whatever your amount owing is divide that number by 72 the number of months in 5 years and make sure to pay at least that amount monthly.

Social Security Recipients To Get Stimulus Checks No Tax Return Needed Payroll Taxes Income Tax Return Filing Taxes

Social Security Recipients To Get Stimulus Checks No Tax Return Needed Payroll Taxes Income Tax Return Filing Taxes

If You Fall Into Any Of These Categories You May Not Get Your Money Debt Taxes Tax Refund Tax Debt Child Support Payments

If You Fall Into Any Of These Categories You May Not Get Your Money Debt Taxes Tax Refund Tax Debt Child Support Payments

Irs Eases Tax Enforcement During Virus Shutdown

Irs Eases Tax Enforcement During Virus Shutdown

2020 Tax Information Standard Deduction Standard Deduction Tax Irs

2020 Tax Information Standard Deduction Standard Deduction Tax Irs

Some People Who Did Not Receive The Extra Money For Eligible Dependents Can Expect It Soon Money Payroll Taxes Irs

Some People Who Did Not Receive The Extra Money For Eligible Dependents Can Expect It Soon Money Payroll Taxes Irs

Coronavirus Covid 19 Tax Relief Taxpayer Advocate Service

Coronavirus Covid 19 Tax Relief Taxpayer Advocate Service

I R S Will Issue Tax Refunds During Shutdown Trump Official Says Tax Refund Irs Federal Income Tax

I R S Will Issue Tax Refunds During Shutdown Trump Official Says Tax Refund Irs Federal Income Tax

How Sole Proprietors Are Taxed Tax Day Filing Taxes Tax Season

How Sole Proprietors Are Taxed Tax Day Filing Taxes Tax Season

Pre Register Now For Next Year S Taxes Https Www Eztaxreturn Com Offers Plan Html Review Taxes Math About Me File Taxes Online Customer Testimonials

Pre Register Now For Next Year S Taxes Https Www Eztaxreturn Com Offers Plan Html Review Taxes Math About Me File Taxes Online Customer Testimonials

Irs Continues To Limit Operations Due To Coronavirus Crisis But Will Still Issue Tax Refunds

Irs Continues To Limit Operations Due To Coronavirus Crisis But Will Still Issue Tax Refunds

Hack Your Taxes With Our Tax Season Webinar Consolidated Credit Credit Consolidation Tax Season Filing Taxes

Hack Your Taxes With Our Tax Season Webinar Consolidated Credit Credit Consolidation Tax Season Filing Taxes

Irs Delays The Start Of The 2021 Tax Season To Feb 12 The Washington Post

Irs Delays The Start Of The 2021 Tax Season To Feb 12 The Washington Post

Coinbase Sends American Clients Irs Tax Form 1099 K Cryptocurrency Bitcoin Coinbase Https News Bitcoin Com Coinbase Irs Taxes Irs Tax Forms Tax Forms

Coinbase Sends American Clients Irs Tax Form 1099 K Cryptocurrency Bitcoin Coinbase Https News Bitcoin Com Coinbase Irs Taxes Irs Tax Forms Tax Forms

Best Use For 1040 Sr Tax Form For Seniors Tax Forms Irs Forms Tax

Best Use For 1040 Sr Tax Form For Seniors Tax Forms Irs Forms Tax

Thousands Of Recalled Irs Workers Arent Showing Up Government Shutdown Irs Worker

Thousands Of Recalled Irs Workers Arent Showing Up Government Shutdown Irs Worker

How To Speak To Someone At The Irs According To Reddit Irs Paying Taxes Money Savvy

How To Speak To Someone At The Irs According To Reddit Irs Paying Taxes Money Savvy

Impact Of Government Shutdown On Irs Collections Varnum Llp

Impact Of Government Shutdown On Irs Collections Varnum Llp

Post a Comment for "Irs Payment Plan During Shutdown"