How To Enter Paycheck Protection Program In Quickbooks

Follow the instructions on each page to fill out review and complete the application. Apply for a first or second PPP loan through an SBA approved lender.

In the Payee field enter the business or person you bought the expense from.

How to enter paycheck protection program in quickbooks. For information on how to apply for loan forgiveness click here. Optional You can use the Ref no. For QuickBooks Payroll customers the customers data is already in the QuickBooks system.

A complicated job like entering allocated tips as a payroll item is just a matter of a few clicks of your mouse with QuickBooks. Paycheck Protection Program PPP borrowers may engage the services of an accountant to track the use of their PPP funds. QuickBooks was named as a direct lender by the SBA giving them the power to accept approve and fund paycheck protection program applicants.

The Paycheck Protection Program PPP is part of the Coronavirus Aid Relief and Economic Security CARES Act. Open QuickBooks and click on the Lists menu. As a result we are well positioned to help expedite the loan application process for this group.

This loan has allowed many small businesses to stay afloat during the sudden economic recession in 2020. Create a liability account named for the loan and use that account as the source account for the deposit if at tax time the money is indeed tax free do a journal entry. Transfer the gross pay using a journal entry like the one below based on the Total.

Select Payroll Item List Click on Payroll select Setup and Maintain and then click on ViewEdit Payroll Items. Yes when you enter a loan deposit you can enter the loan amount as a balance in the Account balance box. Apply for loan forgiveness.

How the PPP works. As PPP forgiveness for Round 1 starts to roll in we need to move the PPP loan off the Balance Sheet and onto the PL in QuickBooks. Here are the detailed instructions for recording funds received from the Small Business Administrations SBA Paycheck Protection Program PPP in QuickBooks.

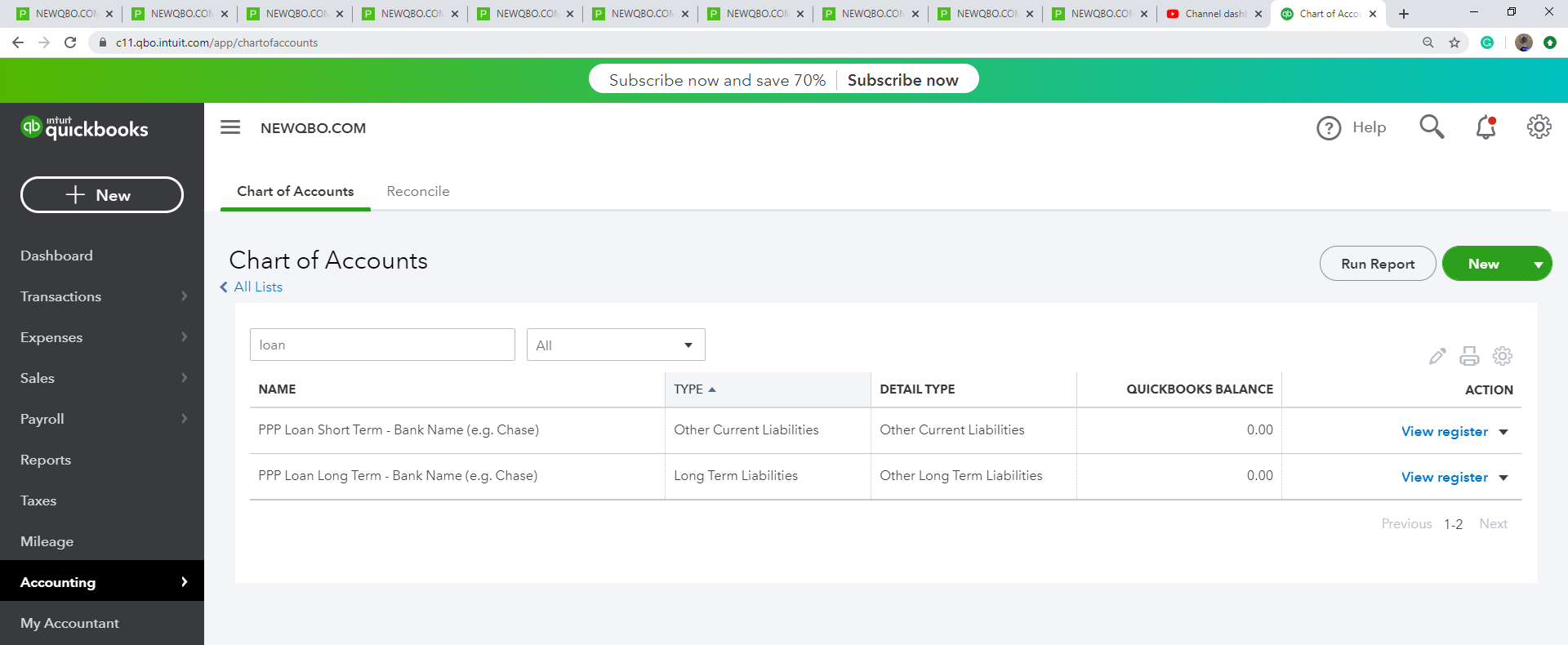

Create a new account. If you use another accounting system youll need to alter these steps accordingly. Click the New button.

Fill out the Payment date and Payment method fields. Click Lists on the top menu bar. How to you record the loan from the Paycheck Protection Program in QBO.

This article will help you report Paycheck Protection Program PPP loan forgiveness and Economic Injury Disaster Loan EIDL grants on business returns in the partnership S-corporate and corporate modules. 1If you use Checks to enter your expenses in QuickBooks it would look like this. Click Chart of Accounts.

Box select the Apply now or check the status. Paycheck Protection Program loans are intended to support businesses with their expenses with the primary goal to keep Americans employed in pre COVID-19 jobs as well as help with their expenses. The PPP consists of 349 billion for government-backed loans to help small businesses and others continue paying payroll costs and certain operating expenses.

About the Paycheck Protection Program. Fill out the Payment account fields. Let me help you enter a loan account in your QuickBooks Online.

Table of Contents. PPP provides cash-flow assistance through 100 federally-guaranteed loans to employers who maintain their payroll during this public health emergency. Guide Using QuickBooks to track your clients Paycheck Protection Program loan.

In the Easily apply for a Paycheck Protection Program loan. Below are steps for recording Paycheck Protection Program PPP funds and expenses in QuickBooks Online. Field to enter an identifying number from the purchase receipt.

How To Enter PPP Forgiveness Into QuickBooks This post addresses entries to make in the books when a PPP loan has been forgiven all or in part. Paycheck Protection Program. Best Practices in QuickBooks.

One in 12 American workers are paid through our payroll systems which makes this an impactful place to start About the Paycheck Protection Program. However only the borrower or an authorized representative who is legally authorized to make certifications on the borrowers behalf may submit an application for loan forgiveness. Go to the Gear icon and select Chart of Accounts.

Congress passed the Paycheck Protection Program PPP loan as part of the Coronavirus Aid Relief and Economic Security CARES Act to provide fast and direct economic assistance for small businesses and to preserve jobs for Americans. Select the Account Type and also the Detail Type. How the QuickBooks paycheck protection program works.

Click the Account dropdown or right click in the list Click New. The QuickBooks paycheck protection program is open to all QuickBooks Payroll and Self-Employed TurboTax customers. Intuit Expands Paycheck Protection Program Loan Support and Tools in QuickBooks New this month is the release of the Paycheck Protection Program PPP Center a resource featuring new tools including a loan forgiveness estimator and PPP-specific reports within QuickBooks Online.

Pin By Collette Watkins On Microsoft Office In 2021 Quickbooks Payroll Quickbooks Payroll

Pin By Collette Watkins On Microsoft Office In 2021 Quickbooks Payroll Quickbooks Payroll

![]() How To Add And Track Ppp Loans In Quickbooks Candus Kampfer

How To Add And Track Ppp Loans In Quickbooks Candus Kampfer

How To Fix Quickbooks Error 6150 In 2020 Quickbooks Accounting Software Quickbooks Payroll

How To Fix Quickbooks Error 6150 In 2020 Quickbooks Accounting Software Quickbooks Payroll

Quick Answer On How To Enter A Quickbooks 1099 Wizard In 2020 Quickbooks Online Quickbooks Online

Quick Answer On How To Enter A Quickbooks 1099 Wizard In 2020 Quickbooks Online Quickbooks Online

Payroll Not Working In Quickbooks Quickbooks Payroll Quickbooks Payroll

Payroll Not Working In Quickbooks Quickbooks Payroll Quickbooks Payroll

Quickbooks Tutorial How To Record Proceeds From A Ppp Loan Youtube

Quickbooks Tutorial How To Record Proceeds From A Ppp Loan Youtube

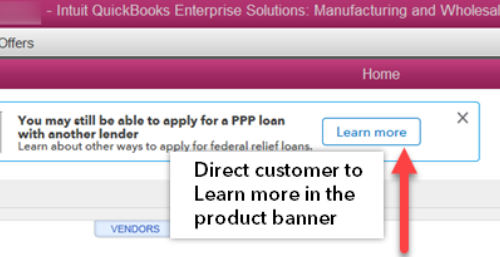

Cares Act Paycheck Protection Program Has Been Dep

Cares Act Paycheck Protection Program Has Been Dep

How To Record Or Enter Non Payroll Transactions In Quickbooks Steps To Solve Paychecks Liability Check Non Payroll Issue Quickbooks Quickbooks Online Payroll

How To Record Or Enter Non Payroll Transactions In Quickbooks Steps To Solve Paychecks Liability Check Non Payroll Issue Quickbooks Quickbooks Online Payroll

Manually Enter Payroll Paychecks In Quickbooks Onl

Manually Enter Payroll Paychecks In Quickbooks Onl

Post a Comment for "How To Enter Paycheck Protection Program In Quickbooks"