Down Payment Plus Wisconsin 2018 Income Limits

We achieve this with unique mortgage products designed to expand whats possible for our partners and the families they serve. The new policy limits annual increases in income limits to 5 percent or twice the change in the national median family income whichever is greater.

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities

Loan is payable at the time that the first mortgage is paid off.

Down payment plus wisconsin 2018 income limits. W-2 is a program that provides employment preparation services case management and cash assistance to eligible families. Federal Home Loan Bank of Chicago FHLBC. Level 1 Out-of-Pocket Expenses.

1 the amount of the future house payment plus all other required monthly debt payments and. 234900 Institutions Categorically Needy Income Limit. Movin Out AHP Down Payment Assistance.

2018 Income Tax Forms. Buyers may have no more than 3 months PITI reserves or 3000 whichever is greater on hand after making their contribution to the purchase. The Downpayment Plus Program provides up to 6000 in grant assistance to homebuyers state-wide who meet income guidelines and other qualifying criteria.

For the Medicaid Deductible Program as of February 2021 the income limit is 107333 month for a single senior applicant and is 145167 month for a household of two. Parents caretakers and childless adults already have the income disregard included in the income limit of 100 percent FPL. Its a no-charge electronic tax filing option.

Level 2A Income Limits. Home purchase based on income. The Wisconsin Housing and Economic Development Authority WHEDA offers down payment assistance to borrowers who qualify for a WHEDA Advantage mortgage via the Easy Close Advantage Program.

Sometimes called a Spend Down program ones excess income the amount that is determined as ones deductible is used to cover medical bills. SSI Payment Level E Supplement. The Downpayment Plus DPP is a matching program that works on a 31 ratio of the homebuyers net contribution capped at 6000 25 percent of the first mortgage.

Seffrood Sharon L - DOR. Funds may be used for down payment closing costs and home buyer education expenses. 96277 Home Maintenance Maximum Allowance 165241.

Funds will be made available based on need. Ensuring that the housing debt does not. The opportunity to maintain and expand their customer base.

Debt-to-income ratio is determined by two factors. For areas where income limits are decreasing HUD limits the decrease to no more than 5 percent per year. Read the W-2 Benefits and Services.

Starting February 1 2020 some changes to the BadgerCare Plus program may affect BadgerCare Plus applicants and members age 1964 who are not pregnant and do not have dependent children under age 19 living in their home. Downpayment Plus DPP and Downpayment Plus Advantage DPP Advantage offer Federal Home Loan Bank of Chicago members easy-to-access down payment and closing cost assistance to help their income-eligible customers achieve homeownershipThese programs give our members. Income between 160 and 200 of the FPL.

Adjustments to Convert 2018 Federal Adjusted Gross Income and Itemized Deductions To The Amounts Allowable for Wisconsin Fill-In Form. Level 2A Out-of-Pocket Expenses. Affordability will be determined by.

Loan amount 3 of purchase price or 3050 whichever is greater. No deductible or spenddown. No more than 10 down payment is.

The Easy Close Advantage Program is a 10-year fixed interest loan designed to help individuals afford the down payment and closing. Wisconsin Works W-2 is Wisconsins primary Temporary Assistance for Needy Families TANF program. Community Waivers Special Income Limit.

15 copay for each covered brand name prescription drug. Level 1 Income Limits. 5 copay for each covered generic prescription drug.

Funds are for down payment and closing costs and are forgivable over a five year period of owner occupancy. For over 40 years WHEDA has helped more than 133000 home buyers in Wisconsin realize their dreams. Income purchase price limits apply.

While the income limit remains 300 percent FPL CWW will actually test against an income limit of 306 percent FPL once the income disregard and conversion factor are included. The ability to assist any eligible borrowers purchasing. Please read to see if you qualify.

Income at or below 160 of the FPL Individual. For the FY 2018 income limits the cap is almost 115 percent. Mortgage Lending - Getting Started.

Wisconsin Department of Revenue. For instance someone making 4000 per month and 2000 in housing credit card and student loan debt payments would have a 50 debt-to-income ratio. Important Changes for Childless Adults.

The changes include an emergency room copay for nonemergency visits monthly premiums depending on income an optional health.

Offer In Compromise How To Settle Your Irs Tax Debt

Offer In Compromise How To Settle Your Irs Tax Debt

:max_bytes(150000):strip_icc()/states-without-an-income-tax-36d1d404657e490db7bb3be36a9d0619.png) The Best And Worst States To Pay Taxes On Lottery Winnings

The Best And Worst States To Pay Taxes On Lottery Winnings

Pin By Karen Dietrich On Giveaways Best Candy Halloween Candy Pinata Fillers

Pin By Karen Dietrich On Giveaways Best Candy Halloween Candy Pinata Fillers

Humid Subtropical Climate Wikipedia The Free Encyclopedia World Geography Climates United States Map

Humid Subtropical Climate Wikipedia The Free Encyclopedia World Geography Climates United States Map

Meaningful Use Ehr Adoption Charts Ehr Market Analysis Ehr Healthcare Marketing Incentive Programs

Meaningful Use Ehr Adoption Charts Ehr Market Analysis Ehr Healthcare Marketing Incentive Programs

8 Coding Boot Camps That Defer Tuition Until You Find A Job Student Loan Hero

8 Coding Boot Camps That Defer Tuition Until You Find A Job Student Loan Hero

We Re Giving Away One Year Worth Of Nescafe 3 In 1 Instant Coffee To 1 Lucky Winner The Winner Will Be Announced On 8 Free Coffee Contests Sweepstakes Nescafe

We Re Giving Away One Year Worth Of Nescafe 3 In 1 Instant Coffee To 1 Lucky Winner The Winner Will Be Announced On 8 Free Coffee Contests Sweepstakes Nescafe

Understanding Seller Concessions On Usda Loans

Understanding Seller Concessions On Usda Loans

Free And Low Cost Internet Assistance Highspeedinternet Com

Free And Low Cost Internet Assistance Highspeedinternet Com

How Much Is Mortgage Insurance Pmi Cost Vs Benefit

How Much Is Mortgage Insurance Pmi Cost Vs Benefit

1040 Income Tax Calculator Free Tax Return Estimator

1040 Income Tax Calculator Free Tax Return Estimator

Setting Child Support Payment Amounts

Setting Child Support Payment Amounts

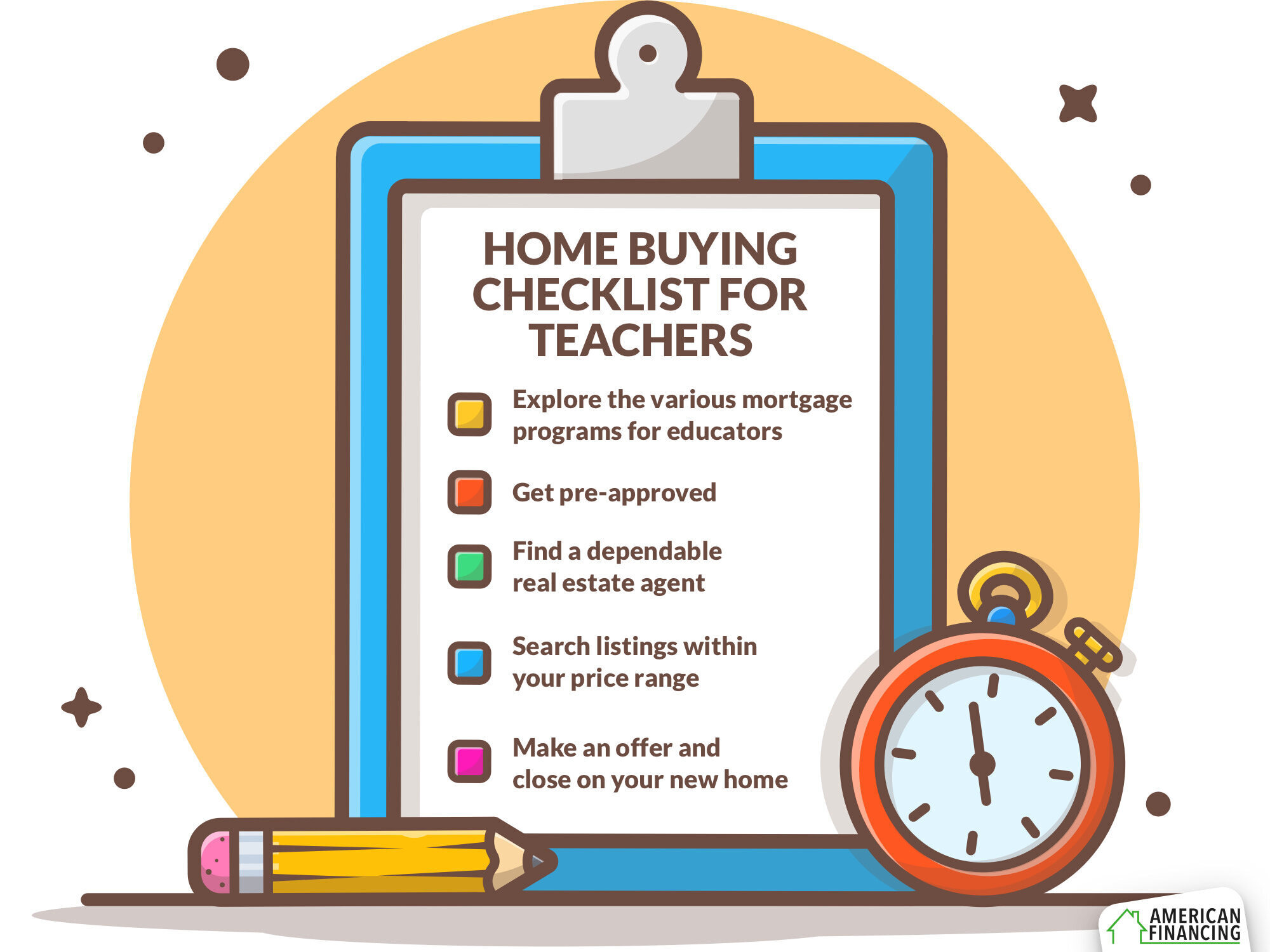

Teacher Mortgage Programs Benefits Options Assistance

Teacher Mortgage Programs Benefits Options Assistance

How To Tell If You Have A Rare 1965 Silver Quarter Worth 7 000 A List Of Other Rare Transitional Error Coins To Look For Rare Coins Worth Money Error Coins Old Coins Value

How To Tell If You Have A Rare 1965 Silver Quarter Worth 7 000 A List Of Other Rare Transitional Error Coins To Look For Rare Coins Worth Money Error Coins Old Coins Value

Forget Everything You Know About Renters This Is Who S Renting Today Renter Rent Being A Landlord

Forget Everything You Know About Renters This Is Who S Renting Today Renter Rent Being A Landlord

Fha Loan Pros And Cons What You Need To Know Lendingtree

Fha Loan Pros And Cons What You Need To Know Lendingtree

Jeannieborin On Twitter This Or That Questions Health Yahoo News

Jeannieborin On Twitter This Or That Questions Health Yahoo News

Here Are The Best And Worst States For Taxes What Is Credit Score Healthcare Costs Income Tax

Here Are The Best And Worst States For Taxes What Is Credit Score Healthcare Costs Income Tax

Post a Comment for "Down Payment Plus Wisconsin 2018 Income Limits"