Payment To Facebook Withholding Tax

Other Ways You Can Pay. Make tax due estimated tax and extension payments.

W 4 Form Explained How To Fill Out A W 4 Form Employee Tax Forms Tax Forms W4 Tax Form

W 4 Form Explained How To Fill Out A W 4 Form Employee Tax Forms Tax Forms W4 Tax Form

Pay bills or set up a payment plan for all individual and business taxes.

Payment to facebook withholding tax. Please contact the Division of Revenue at 302 577-8785. Electronic Federal Tax Payment System best option for businesses or large payments. If you are already receiving benefits or if you want to change or stop your withholding youll need a Form W-4V from the Internal Revenue Service IRS.

Additional cost of 8 for businesses to run Google Facebook advertising. Under Section 1521 every person shall deduct tax while making payments for royalties and fee for technical payments to non-resident. Moreover double taxation can occur if the home country classifies the payment as business income and denies any foreign tax credit claims for royalty withholding tax suffered in the software purchasers country.

Most Internet or IT businesses wouldnt have any issue prior to 2017 as payment for services like Google Facebook AWS etc. For help with your withholding you may use the Tax Withholding Estimator. Enrollment required Electronic Funds Withdrawal during e-filing Same-day wire bank fees may apply Check or money order.

However for payment to Singapore Google and Facebook Ireland is 8 as Malaysia has a Double Taxation Agreement DTA with the respective countries. Pay my bill now Cant pay in full. Register for employer withholding tax online through the Online PA-100.

Check or money order. Please note the tax is not a final tax. An employer must withhold Kansas tax if the employee is a resident of Kansas performing services inside or outside of Kansas or a nonresident of Kansas performing services in Kansas.

For more detailed employer withholding tax information please review the Employer Withholding Information. The amount of income tax your employer withholds from your regular pay depends on two things. Business make a payment pay pay Delaware taxes pay division of revenue pay gross receipts tax pay personal income tax pay quarterly estimated tax pay withholding tax payment personal revenue taxes.

Any employer who withholds income tax from an employees wages in Montana must make regular withholding payments. In fact this withholding tax in short WHT has been around since Income Tax Act 1967 which covers various categories including payment for services under special classes of income. Credit or debit card.

How to Manage Withholding Tax Liabilities. If the company wishes to claim for the expenses incurred in the process of earning the income it can forward the certified accounts and tax computation for IRAS examination. Payments made for the right to use of application platform advertising campaign management system such as Google ads and Facebook ads or purchase of software should fall under the scope of royalty instead of payment for services and is subjected to withholding tax if the transaction is provided by a non-resident who has no PE or a business.

All related to Google Facebook and LinkedIn. The amount you earn. The process for reclaiming incorrectly withheld tax is often time-consuming and costly.

You may pay withholding tax using the Montana Withholding Tax Payment Voucher Form MW-1We may provide pre-printed vouchers to registered employers or you can find filing and payment options in My Revenue. The Income Tax Act 1967 provides that where a person referred herein as payer is liable to make payment as listed below other than income of non-resident public entertainers to a non-resident person NR payee he shall deduct withholding tax at the prescribed rate from such payment and whether such tax has been deducted or not pay. If the payer is allowed to use the application which is covered as royalty and withholding tax is applied the payer is required to withhold a certain percentage generally 10 from the payment and only pay the net amount to a non-resident recipient.

You can use the Tax Withholding Estimator to estimate your 2020 income tax. Withholding Income Tax From Your Social Security Benefits You can ask us to withhold federal taxes from your Social Security benefit payment when you first apply. In general all payment to the overseas supplier is required to withhold 10.

The payer has to remit the withholding portion to IRB within 30 days from the payment. In short you just need to pay 8 WHT of your Google or Facebook media spend which is RM8000 in the example earlier if your Google or Facebook invoice is RM100000. The information you give your employer on Form W4.

According to the withholding tax rates. A withholding agent who fails to withhold the tax andor pay to ZIMRA on behalf of the non-resident artiste or entertainer will be held personally liable for the tax that should have been paid to the Commissioner General of ZIMRA and in addition a 100 penalty is also chargeable on the amount due. For services performed in Singapore the withholding tax is imposed at the prevailing corporate tax rate on the gross payment.

Are sort of exempted as the services are performed offshore aka out of the country. Direct debit from your bank account. The amount to withhold can be found in the Montana Withholding Tax Table.

Employers can file and pay employer withholding tax returns and submit W-2 information online using e-TIDES by phone using TeleFile or through third-party software. The withholding tax rate shall be 15 percent of the gross amount and it shall be increased by 100 percent in case the person is not on the Active Taxpayers List ATL. Pay all business taxes including sales and use employer withholding corporate income and other miscellaneous taxes.

Withholding State withholding is the money an employer withholds from each employees wages to help pre-pay the state income tax of the employee.

Withholding Of Taxes On Payments To Foreign Persons Lorman Education Services

Withholding Of Taxes On Payments To Foreign Persons Lorman Education Services

Hong Kong Withholding Tax What You Need To Know

Hong Kong Withholding Tax What You Need To Know

Tax Partner Financial Services Financial Services Bookkeeping Services Accounting Services

Tax Partner Financial Services Financial Services Bookkeeping Services Accounting Services

Sss Contribution Table As Of January 2007 Public Information Contribution Social Security

Sss Contribution Table As Of January 2007 Public Information Contribution Social Security

Dua Marketing Network Offering Complete Digital Marketing Service To Promote Your Business E Internet Marketing Agency Sms Marketing Digital Marketing Services

Dua Marketing Network Offering Complete Digital Marketing Service To Promote Your Business E Internet Marketing Agency Sms Marketing Digital Marketing Services

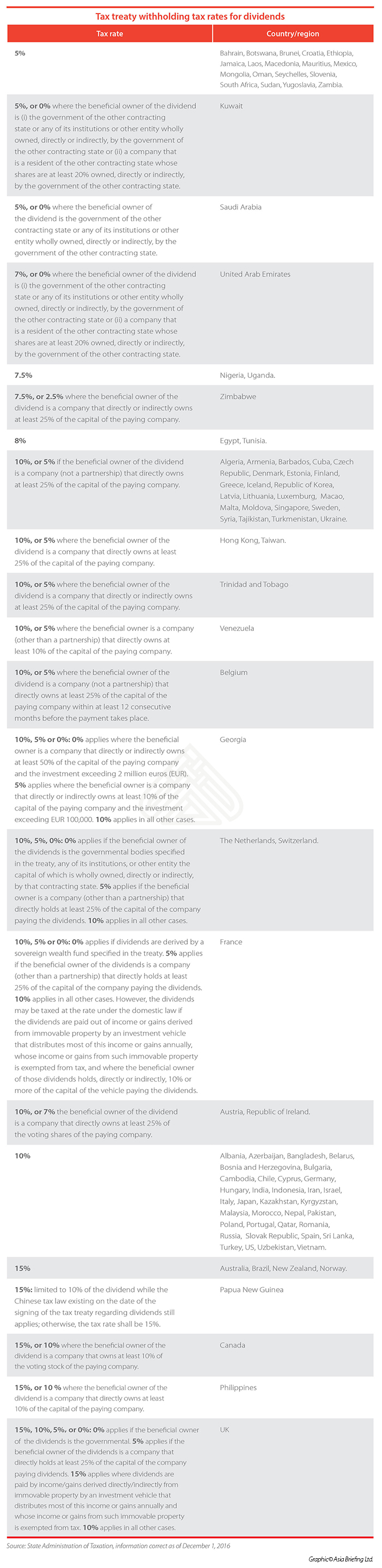

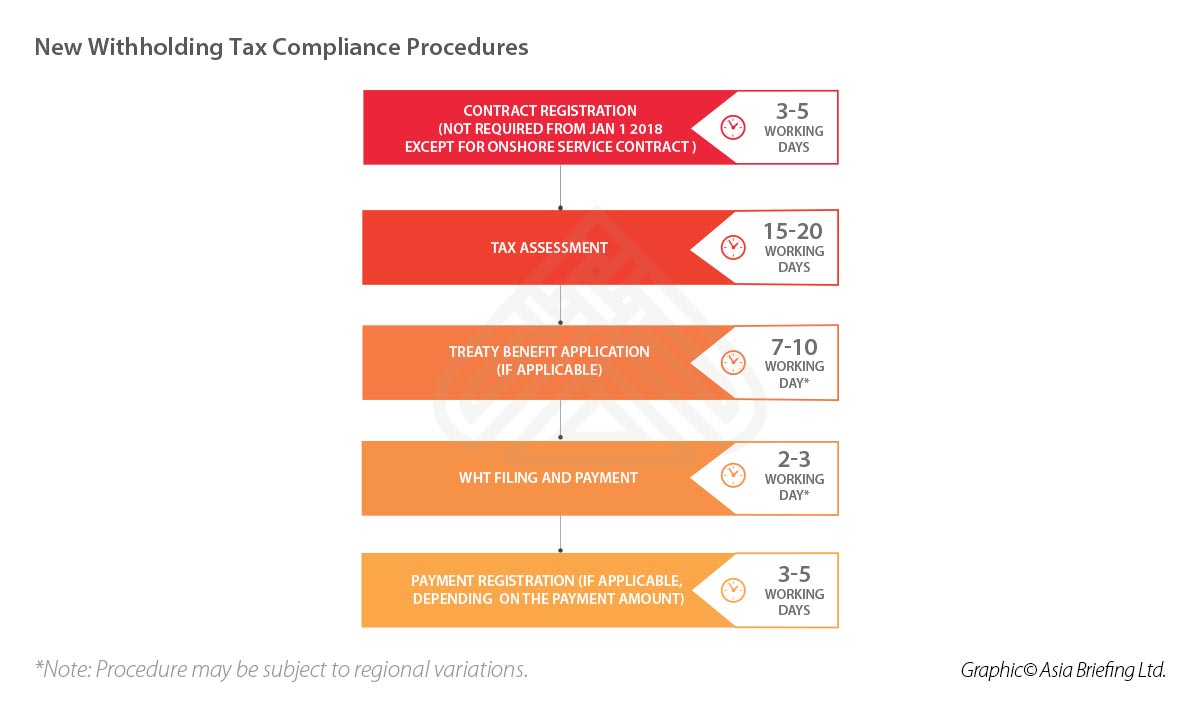

Withholding Tax In China China Briefing News

Withholding Tax In China China Briefing News

Softax Private Limited Day Long Workshop On Withholding Tax Under Incometax Federal Provincial Salestax Laws Network Marketing Provincial Federation

Softax Private Limited Day Long Workshop On Withholding Tax Under Incometax Federal Provincial Salestax Laws Network Marketing Provincial Federation

Wired Usa The Money Go Round On Behance Information Graphics Wire Money

Wired Usa The Money Go Round On Behance Information Graphics Wire Money

This Annual Tax Reference Guide Is For Any Business That Has Employee S And Contractors Or That Ha Bookkeeping Business Business Tax Small Business Bookkeeping

This Annual Tax Reference Guide Is For Any Business That Has Employee S And Contractors Or That Ha Bookkeeping Business Business Tax Small Business Bookkeeping

Withholding Tax Service Tax On Imported Services For Digital Ads Services

Withholding Tax Service Tax On Imported Services For Digital Ads Services

Revised Withholding Tax Table For Compensation Withholding Tax Table Tax Table Compensation

Revised Withholding Tax Table For Compensation Withholding Tax Table Tax Table Compensation

Uploading A Withholding Tax Certificate Billing Center User Guide Invoices Management Huawei Cloud

Uploading A Withholding Tax Certificate Billing Center User Guide Invoices Management Huawei Cloud

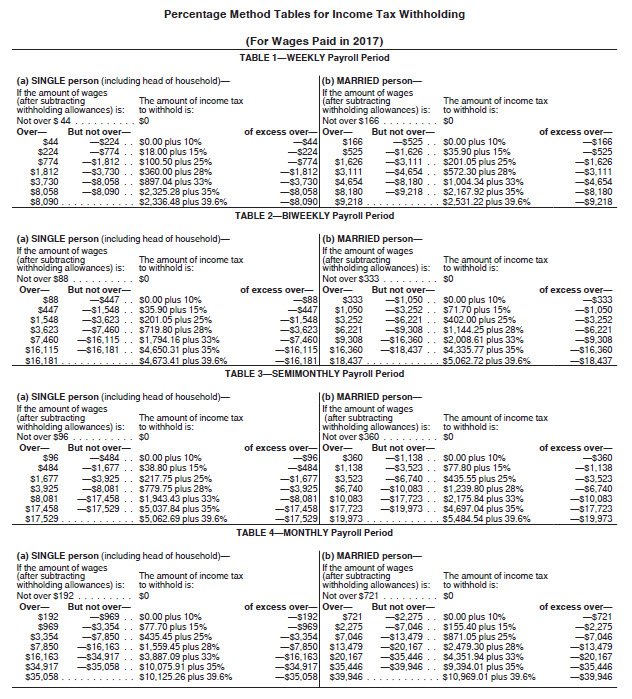

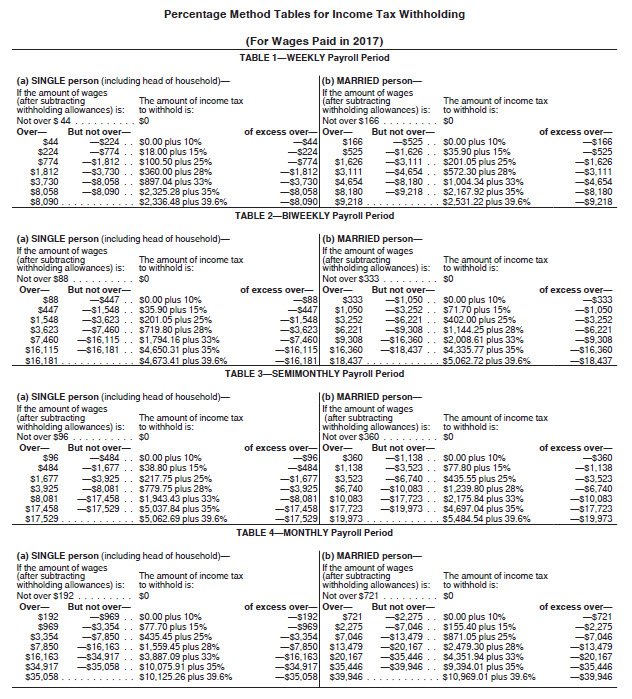

Irs Releases New Withholding Tax Tables For 2018 Insightfulaccountant Com

Irs Releases New Withholding Tax Tables For 2018 Insightfulaccountant Com

Withholding Corporate Income Tax In China China Briefing News

Withholding Corporate Income Tax In China China Briefing News

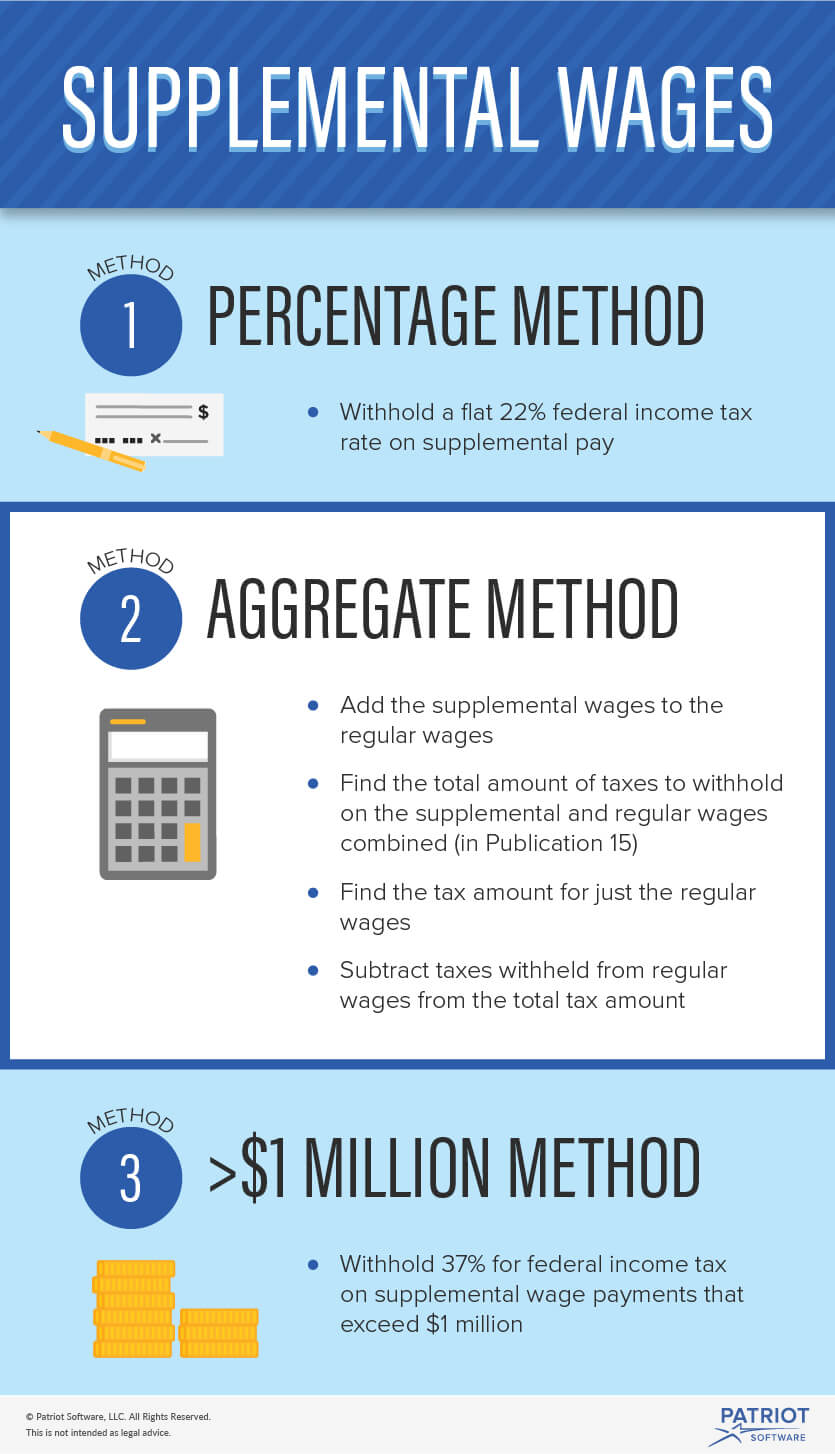

Supplemental Wages Definition And Tax Withholding Rules

Supplemental Wages Definition And Tax Withholding Rules

How To Get Jazz Withholding Tax Certificate In Whatsapp Tax Deductions Income Tax Return Certificate

How To Get Jazz Withholding Tax Certificate In Whatsapp Tax Deductions Income Tax Return Certificate

Down Payment With Withholding Tax Process Sapspot Down Payment Payment Tax

Down Payment With Withholding Tax Process Sapspot Down Payment Payment Tax

Post a Comment for "Payment To Facebook Withholding Tax"