Payment Status Not Available But Filed 2018 Taxes

So I filed 2018 and 2019 taxes at the same time. Which tax year is the refund for.

Will You Get A Second Stimulus Check Forbes Forbes Com Https Digitalive World Will You Get A Second Stimulus Check F Irs Website Filing Taxes Tax Credits

Will You Get A Second Stimulus Check Forbes Forbes Com Https Digitalive World Will You Get A Second Stimulus Check F Irs Website Filing Taxes Tax Credits

This may occur for a variety of reasons for example if you didnt file either a 2018 or 2019 tax.

Payment status not available but filed 2018 taxes. I was in school and only had a serving job so didnt make much anyways since it is 2020 I had to send in a paper copy of my taxes for 2018. Havent filed for 2019. Get My Payment - Payment Status Not Available - filed 2018 but not 2019.

If you are eligible and either didnt receive Economic Impact Payments or qualify for more than received you may claim the Recovery Rebate Credit and must file a 2020 tax return even if you are not normally required to file. You recently filed your tax return or provided information through Non-Filers. I want to enter Direct Deposit information so as to get my stimulus payment faster but cannot figure out how.

Shows the date amount due amount paid and more about my 2018 return. Additionally if you filed the 2018 federal tax return and there were taxes owed and you selected Direct Debit from your bank account for the taxes owed and the tax payment was debited from your bank account then the IRS received your tax return. You are not eligible for payment OR.

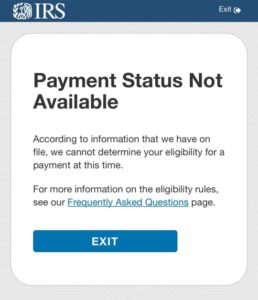

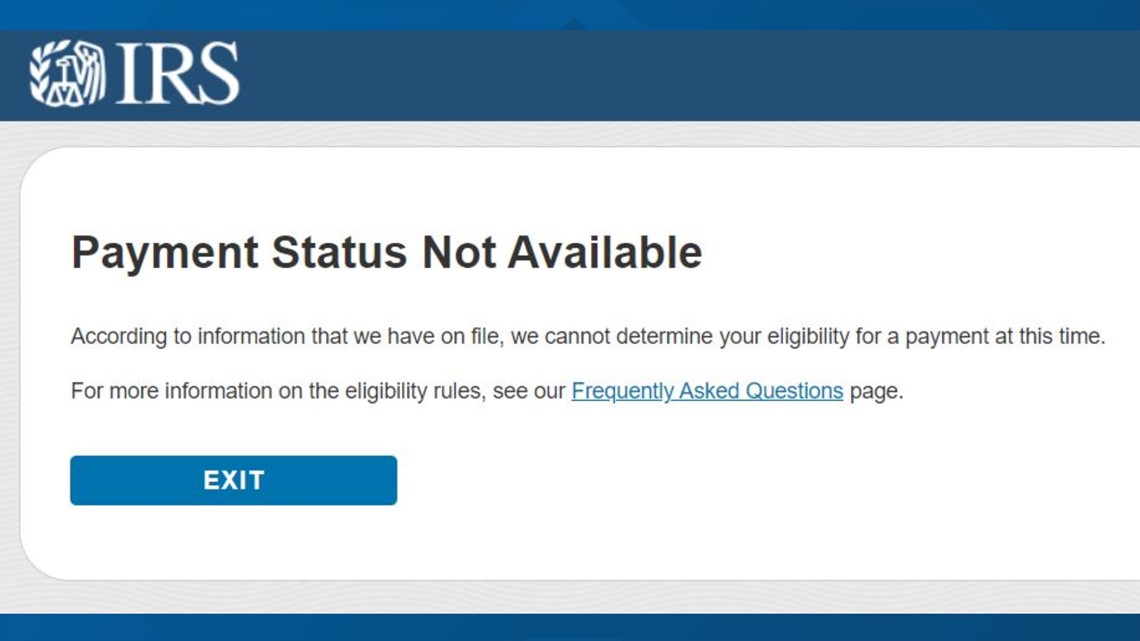

If you recently filed either your 2018 or 2019 tax return the IRS might still be processing it. My 2019 taxes were processed and I received my federal and state taxes back this week. The Get My Payment application will return Payment Status Not Available if we didnt have enough information to issue you a payment or you werent eligible for a payment.

This may occur for a variety of reasons for example if you didnt file either a 2018 or 2019 tax. The star denotes availability of a Verification of Non-Filing letter for the year so it appears they dont have my 2018 return. So it appears part of the IRSs system doesnt have my 2018 return.

The IRS is using data from 2019 tax returns for people who have already filed or 2018 returns for those who havent. You are required to file a tax return and have not filed in the tax year 2018 or 2019 OR. I filed my 2019 return last week but I owed taxes.

File jointly and filed in 2019 f0r 2018. Until I click on my 2018 Account Transcript. The IRS wants anyone.

I get payment Status Not Available My husband and. IRS I have filed every. IR-2019-99 June 3 2019 WASHINGTON The Internal Revenue Service today advised those now receiving tax bills because they filed on time but didnt pay in full that there are many easy options for paying what they owe.

According to the IRS this means the agency could not determine your eligibility for a payment. I also owed taxes last year and used the same bank account for both years but the status page gives me the same Payment Status Not Available message that youre getting. Read this note sure if this is known yet or if theres a way around this but for those getting this message and have not filed their 2019 and are sure youre supposed to get a stimulus check it is most likely that you need to update your direct deposit information.

But same payment status not available message keeps coming up TurboTax user as well. The 2019 tax deadline was extended to July 15 but if you havent filed for either year submit your 2019 return ASAP to get your payment. Payment Status Not Available According to information that we have on file we cannot determine your eligibility for a payment at this time one Twitter user wrote.

If the status of the 2018 federal tax return shows as Accepted the IRS received your 2018 e-filed tax return. This message doesnt mean. Enter Your Payment Info on IRSgov.

Its normal for the Get My Payment tool to give you a message that says Payment Status Not Available until the payment is scheduled to be issued according to the IRS. Check your status in the Get My Payment portal for instructions. I should be able to at least update my Direct Deposit info since Im eligible and filed in 2018.

We received a refund by check. Filed and owed for 2018 set-up a payment plan. However the IRS may not have processed your tax return.

IRSs official FAQ page says that message Payment status not available means. But my 2018 taxes have not been received yet. Youre Required to Submit a Tax Return but Didnt in 2018 or 2019.

If you dont receive those benefits and did not file a tax return for 2019 you may need to file one to confirm your eligibility. According to the IRS this means the agency could not determine your eligibility for a payment. If you recently filed you could be receiving the status not available message because the IRS hasnt processed your return yet.

Until its processed the IRS wont be able to determine your stimulus check eligibility and youll. Taxpayers can pay online by phone or using their mobile device. If you recently filed a tax return the IRS may have your tax return.

This includes your 2018 or 2019 federal tax return depending when you. Taxpayer who cant pay in full may consider payment plans and compromise options.

Income Tax Filing Know Your Jurisdiction What You Know About Income Tax Filing Know Your Jur Filing Taxes Income Tax Income

Income Tax Filing Know Your Jurisdiction What You Know About Income Tax Filing Know Your Jur Filing Taxes Income Tax Income

9 Potential Hacks To Escape Irs Payment Status Not Available Purgatory And Track Your Stimulus Check

9 Potential Hacks To Escape Irs Payment Status Not Available Purgatory And Track Your Stimulus Check

Irs Stimulus Check Portal Payment Status Not Available Error What Does It Mean Abc7 San Francisco

Irs Stimulus Check Portal Payment Status Not Available Error What Does It Mean Abc7 San Francisco

Get My Payment Status Refundtalk Com

Get My Payment Status Refundtalk Com

Forget Stimulus Payments Many Are Asking The Irs Where S My Refund Irs Irs Website Filing Taxes

Forget Stimulus Payments Many Are Asking The Irs Where S My Refund Irs Irs Website Filing Taxes

Printable W5 Form 5 5 Quick Tips For Printable W5 Form 5 Tax Forms Income Tax Irs Tax Forms

Printable W5 Form 5 5 Quick Tips For Printable W5 Form 5 Tax Forms Income Tax Irs Tax Forms

Payment Status Not Available Here S How To Decode The Irs Stimulus Check Tool

If Till Now Not Filed Your Income Tax Return Before 31 Dec 2018 Calculate Your Late Filing Fee Latefee Sec234f Inc Income Tax Return Income Tax Tax Return

If Till Now Not Filed Your Income Tax Return Before 31 Dec 2018 Calculate Your Late Filing Fee Latefee Sec234f Inc Income Tax Return Income Tax Tax Return

Irs Stimulus Tracker Payment Status Not Available Issue Common 11alive Com

Irs Stimulus Tracker Payment Status Not Available Issue Common 11alive Com

Irs Second Stimulus Get My Payment Status Gmp Tool For Direct Deposit And Update Portal For Non Filers Updates And Latest News Aving To Invest

Irs Second Stimulus Get My Payment Status Gmp Tool For Direct Deposit And Update Portal For Non Filers Updates And Latest News Aving To Invest

Numerous Glitches Reported With Stimulus Check Distribution Rogue Rocket

Numerous Glitches Reported With Stimulus Check Distribution Rogue Rocket

Second Stimulus Check Problems Payment Status Not Available Error On Irs Website Means Some Need To Claim 600 On 2020 Tax Returns Abc11 Raleigh Durham

Second Stimulus Check Problems Payment Status Not Available Error On Irs Website Means Some Need To Claim 600 On 2020 Tax Returns Abc11 Raleigh Durham

The Irs S Get My Payment App Is Going Offline Here S Why And For How Long Irs Payment Tax Return

The Irs S Get My Payment App Is Going Offline Here S Why And For How Long Irs Payment Tax Return

Pin On Tax Finance Consultancy

Pin On Tax Finance Consultancy

Perfect Irs Stimulus Check Tracking In 2020 Monthly Calendar Template Printable Calendar Template Calendar Program

Perfect Irs Stimulus Check Tracking In 2020 Monthly Calendar Template Printable Calendar Template Calendar Program

Payment Status 2 Not Available Will Not Receive Automatically Where S My Refund

Payment Status 2 Not Available Will Not Receive Automatically Where S My Refund

Fillable Form 1040 2018 Income Tax Return Irs Tax Forms Irs Taxes

Fillable Form 1040 2018 Income Tax Return Irs Tax Forms Irs Taxes

Post a Comment for "Payment Status Not Available But Filed 2018 Taxes"