Paycheck Protection Program For Self Employed April 10

Consolidated Appropriations Act 2021 into law on Dec. If you are a sole proprietor an independent contractor or a gig worker heres what you need to know and what youll need to apply.

The Cares Act Title 1 Keeping American Workers Paid And Employed Act Forrest Firm

The Cares Act Title 1 Keeping American Workers Paid And Employed Act Forrest Firm

The SBAs Paycheck Protection Program PPP was included in the CARES Act federal stimulus package.

Paycheck protection program for self employed april 10. Starting April 10 2020 independent contractors and self-employed individuals can apply. Today is the first day independent contractors and self-employed individuals can apply for the 349 billion Paycheck Protection Program. Self-Employment 1099s and the Paycheck Protection Program.

Compute 2019 payroll costs by adding the following. The Paycheck Protection Program PPP provides loans to help businesses keep their workforce employed during the Coronavirus COVID-19 crisis. A third round of Paycheck Protection Program PPP loans was authorized by the passage of HR.

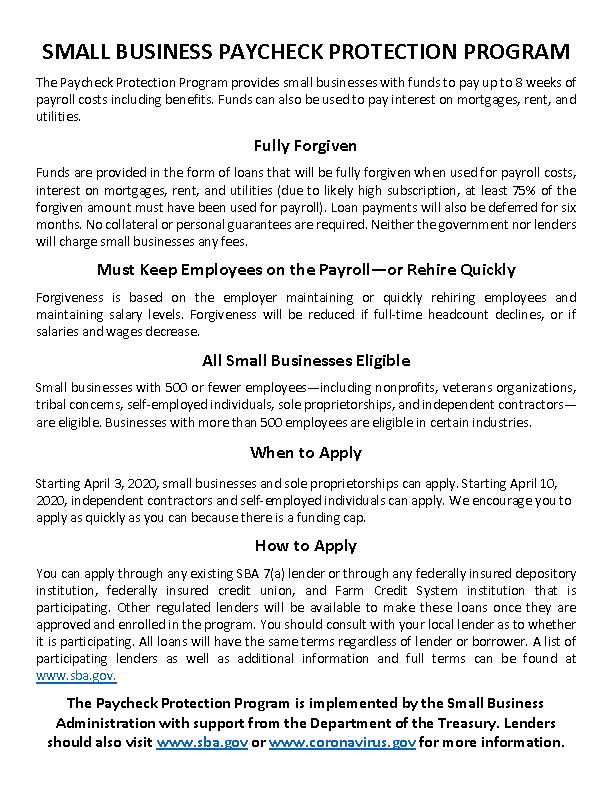

The Paycheck Protection Program PPP is a 953-billion business loan program established by the 2020 US Federal government Coronavirus Aid Relief and Economic Security Act CARES Act to help certain businesses self-employed workers sole proprietors certain nonprofit organizations and tribal businesses continue paying their workers. This program provides small businesses with funds to pay up to 8 weeks of payroll costs including benefits. O 2019 Schedule K-1 IRS Form 1065 Net earnings from self-employment of individual US-based general partners that are subject to self-employment tax multiplied by 092355 up to 100000 per partner6 Compute the net earnings from self-employment of individual.

Your Pinnacle financial advisor is best equipped to help you see how this SBA program fits into your overall needs and help you apply. It is designed to keep employees on payroll and allow your business to pay essential expenses during the crisis. Funds can also be used to pay interest on mortgages rent and utilities.

The loan amounts will be forgiven as long as. Although the program emphasizes keeping workers on payroll. What if I just started as an independent contractor or am self-employed.

One of the more confusing aspects of the Paycheck Protection Program PPP is how to apply for a PPP loan if you are self-employed including if you are a 1099 contractor or gig worker. The Paycheck Protection Program which is part of the 2 trillion economic stimulus signed into law last month allocated 349 billion for small businesses hurt by COVID-19. We all thought that was okay since self-employed and independent contractors could not apply for PPP until April 10 but April 10 came and went and this group of business owners was left dangling.

Theres been a lot of coverage on the new Paycheck Protection Program PPP intended to help eligible organizations retain their workforce. At Nav weve received numerous questions from those who want to apply but arent sure how to calculate the loan amount for which they are eligible or the. The Paycheck Protection Program PPP is designed to support American small businesses with immediate cash support during the COVID-19 pandemic.

The loan proceeds are used to cover payroll costs and most mortgage interest rent and. PPP loans are available for 501 c 3 nonprofits 501 c 19 veterans organizations most small businesses with 500 or fewer employees sole proprietorships self-employed individuals and independent contractors. Get matched with a lender.

March 31 2020 Small businesses and sole proprietorships affected by the coronavirus pandemic can apply for loans under the federal Paycheck Protection Program PPP beginning Friday. Starting April 10 independent contractors and self-employed individuals can apply. Heres What the Paycheck Protection Program Means for You.

The changes include a new way to calculate loans for self-employed people and a 14-day exclusive window for applications from businesses with fewer than 20 employees. Treasury Department and the Small Business Administration SBA with rules requirements protocols and processes that all participating lenders including Bank of America must follow. Can I apply for a Paycheck Protection Program loan if my business started in 2020.

Search for lenders in your area. By Heather Bant on February 2 2021. The Paycheck Protection Program PPP is a federal relief program established by Congress and implemented by the US.

In a supplemental letter on 41420 the treasury department stated. Starting April 3 2020 small businesses and sole proprietorships can apply for loans under the Paycheck Protection Program. The exception appears to be for sole proprietors independent contractors and self-employed individuals.

All loan terms will be the same for everyone. The Paycheck Protection. The Paycheck Protection Program allows entities to.

The Paycheck Protection Program PPP authorizes up to 349 billion in forgivable loans to small businesses to pay their employees during the COVID-19 crisis. Borrowers may be eligible for PPP loan forgiveness. The Paycheck Protection Program prioritizes millions of Americans employed by small businesses by authorizing up to 659 billion toward job retention and certain other expenses.

Ppp Loan Program Extended Loan Data Released What Small Businesses Need To Know

Ppp Loan Program Extended Loan Data Released What Small Businesses Need To Know

How To Apply For The Paycheck Protection Program Loudoun County Economic Development Va

How To Apply For The Paycheck Protection Program Loudoun County Economic Development Va

Paycheck Protection Program Self Employed Youtube

Paycheck Protection Program Self Employed Youtube

Paycheck Protection Program Columbus Lowndes County Chamber Of Commerce

Paycheck Protection Program Columbus Lowndes County Chamber Of Commerce

Sba Opens Two Week Paycheck Protection Program Window For Smallest Businesses Nh Business Review

Sba Opens Two Week Paycheck Protection Program Window For Smallest Businesses Nh Business Review

The Paycheck Protection Program Free Money For Small Businesses What You Need To Know Murray Plumb Murray

The Paycheck Protection Program Free Money For Small Businesses What You Need To Know Murray Plumb Murray

Sba S Paycheck Protection Program Ppp Loans And Self Employed Individuals Everycrsreport Com

Sba S Paycheck Protection Program Ppp Loans And Self Employed Individuals Everycrsreport Com

Small Business Paycheck Protection Program Semca

Small Business Paycheck Protection Program Semca

Sba Paycheck Protection Program Virginia Water Well Association

Sba Paycheck Protection Program Virginia Water Well Association

How To Calculate Your Paycheck Protection Program Loan

How To Calculate Your Paycheck Protection Program Loan

Updated The Economic Injury Disaster Loan Eidl Program Vs The Paycheck Protection Program Ppp Comparison Chart Krost

Updated The Economic Injury Disaster Loan Eidl Program Vs The Paycheck Protection Program Ppp Comparison Chart Krost

Self Employed Payroll Protection Program Loan Guidance Saville Dodgen Company

Self Employed Payroll Protection Program Loan Guidance Saville Dodgen Company

The Paycheck Protection Program Cares About Sole Proprietorships And The Self Employed Burke Costanza Carberry Llp

The Paycheck Protection Program Cares About Sole Proprietorships And The Self Employed Burke Costanza Carberry Llp

An Advisor S Guide To The Paycheck Protection Program

An Advisor S Guide To The Paycheck Protection Program

How To Apply For The Sba Payroll Protection Program Loan Simple Guide

How To Apply For The Sba Payroll Protection Program Loan Simple Guide

How The Paycheck Protection Program Affects Self Employed People Wendroff Associates Cpa

How The Paycheck Protection Program Affects Self Employed People Wendroff Associates Cpa

Paycheck Protection Program Relief For Small Businesses Within The Cares Act Alloy Silverstein

Paycheck Protection Program Relief For Small Businesses Within The Cares Act Alloy Silverstein

Post a Comment for "Paycheck Protection Program For Self Employed April 10"