Kentucky Irs Payment Plan

Please be aware that the Originating ID has changed for the Commonwealth of KY payment services. 15 2021 - eFileIT.

Https Revenue Ky Gov Software Developer Software 20development 20documents Ty2020 20e File 20handbook 20publication 201345 Pdf

Kentuckys E-filing and E-payment systems do not currently support Internet Explorer 80.

Kentucky irs payment plan. 2019 estimated tax rules changed to generally follow federal guidelines for individuals. Use Kentuckys Internet Payment Agreement to set up your monthly installments over 24 months. Kentucky does have an Offer in Settlement.

We will represent you before the IRS so that you do not have to speak with them directly. I owe a total of 41000 in back taxes for 06 08 09 that I cannot afford to pay. Minimum monthly payment is 5000.

I already have an approved payment plan by IRS. For members who have made taxed contributions to KRS and elect to receive monthly benefits current Internal Revenue Service regulations provide that the amount of after-tax dollars in the account be recovered by making a portion of each monthly benefit non-taxable. Dont ignore your debt.

In your request you should specify the number of installment payments that you intend to make on a monthly basis. Louisville Kentucky IRS Installment Agreement Payment Plan Phoenix Financial Group can help you with your back tax issues. Maximum payment term is 24 months.

If you owe Kentucky andor IRS income taxes and dont pay them by Tax Day you will be charged Kentucky and IRS late tax payment penalties. You can set up a short-term or long-term plan depending on whether you can afford to pay the IRS within 180 days. Fees apply when paying by card.

Users who have upgraded their Internet Browser to this system will experience screen layout problems when using Kentuckys filing and payment systems. We can establish Installment Agreements Payment Plans with the IRS that are affordable to you. To use this service you will need a Kentuckygov user account.

Calculate and estimate IRS late payment penalties. April 15 June 15 September 15 and January 15 of the following tax year. I selected payment by mail since payment by check option wasnt available for tax year 2018.

Other forms of retirement income pension income 401 k or IRA income are exempt up to a total of 31110 per person. The states sales tax rate is 6. Welcome to the Kentucky Department of Revenues Tax Payment Solution.

Kentucky Tax Changes - Tax Year 2019. Kentucky Purchasing and eProcurement County Information SBAgovs Business Licenses and Permits Search Tool allows you to get a listing of federal state and local permits licenses and registrations youll need to run a business. However IRS accepted my e-file.

State of Kentucky Offer in Compromise. Yes Kentucky is fairly tax-friendly for retirees. If you plan to file or mail-in a Kentucky tax return on paper - the Forms and Mailing Address are below - your due date is.

43 setup fee which may be reimbursed if certain conditions are met. The online setup fee is 149. Four installments at 25 of the estimated tax due each.

The new Originating IDs for the Commonwealth of KY payment services are First Premier Bank ODFI ID 1522077581 and JP Morgan Chase ODFI ID 9006402001. For tax years beginning on or after January 1 2019. I am Self-employed Contractor who has suffered through this recession.

Heres the Application Checklist. I do not have the funds to remit. Am I to wait for to see if the first agreed payment is debited from my checking on May 1 2018.

If you owe taxes at the time that you file your individual tax return and you cannot pay the full amount that you owe you can complete Form 12A200 Kentucky Individual Income Tax Installment Agreement Request and attach it to your tax return. If you dont make acceptable payment arrangements andor dont make the payments you agreed to the Department of Revenue will take action to collect the money you owe. IRS wants Form 433-A to set up a payment plan read more.

The extended IRSKentucky eFile deadline is Oct. If you already have one you can login. The Department of Revenue will always attempt to work with you in order to pay your debt but you must contact us.

Make monthly payment by check money order or debitcredit card. Payment Plans for Qualified Applicants. Otherwise please create a new Kentuckygov account.

Taxes Federal Income Tax. The non-taxable portion of. After 45 days a 25 collection fee is added.

The application fees for this plan varies by how you apply. 5357 to negotiate the terms. Payment methods you can use are direct payments from your checking account checks money orders or a debitcredit card.

Penalties and interest will continue to accrue if you set up an IRS payment plan. As is mentioned in the prior section it does not tax Social Security income. Payment Plans for Qualified Applicants If youre unable to pay the entire tax bill within the first 60 days you should pay what you can in order to avoid additional interest and penalties.

An IRS payment plan lets you spread out the bill when you cant afford your tax debt. Please be aware of the following when asking for a payment plan. Monthly benefits from KERS CERS and SPRS are subject to federal income tax.

After 60 days a 25 cost of collection fee will be added to your Notice of Tax Due. Apply by phone mail or in-person. Apply online by phone or in-person.

Long-term payment plans without automatic withdrawals are allowed to be paid in more than 120 days. KY-DOR Monthly Payment Plan. It printed a voucher 1040-V to remit payment and return to Kentucky.

The Tax Payment Solution allows you to Register. If your desired payment terms exceed these limits or if you wish to pay by credit card you must contact the Department of Revenue at 502-564-4921 ext.

1099 G Tax Form Causing Confusion For Some In Kentucky Wthr Com

1099 G Tax Form Causing Confusion For Some In Kentucky Wthr Com

Kentucky Department Of Revenue

Kentucky Department Of Revenue

Second Stimulus Check Track The Status Of Your 600 Payment Whas11 Com

Second Stimulus Check Track The Status Of Your 600 Payment Whas11 Com

Https Revenue Ky Gov Software Developer Software 20development 20documents 2018 20package 20k 20 12 14 18 20final Pdf

Https Revenue Ky Gov Forms 2016 42a740 S4 Pdf

Covid 19 Kentucky Income Tax Relief 2019 And 2020 Department Of Revenue

Covid 19 Kentucky Income Tax Relief 2019 And 2020 Department Of Revenue

How To Register For A Stimulus Check If You Don T File Taxes Whas11 Com

How To Register For A Stimulus Check If You Don T File Taxes Whas11 Com

Https Taxanswers Ky Gov Documents Kyos Public User Guide Registrationservices Pdf

Https Revenue Ky Gov Forms 42a003515 Pdf

Kentucky Tax Relief Guide Resolve Back Tax Problems

Kentucky Tax Relief Guide Resolve Back Tax Problems

Kentucky State Income Tax Return For 2020 Can Be Prepared In 2020

Kentucky State Income Tax Return For 2020 Can Be Prepared In 2020

Https Apps Kcc Ky Gov Documents Employerguide Pdf

Https Revenue Ky Gov Forms 740 202017 20kentucky 20individual 20income 20tax 20form 20packet 20for 20full 20year 20resident Pdf

Https Revenue Ky Gov Forms 741 20instructions Pdf

Https Kyret Ky Gov Publications All 20forms Form 206017 Pdf

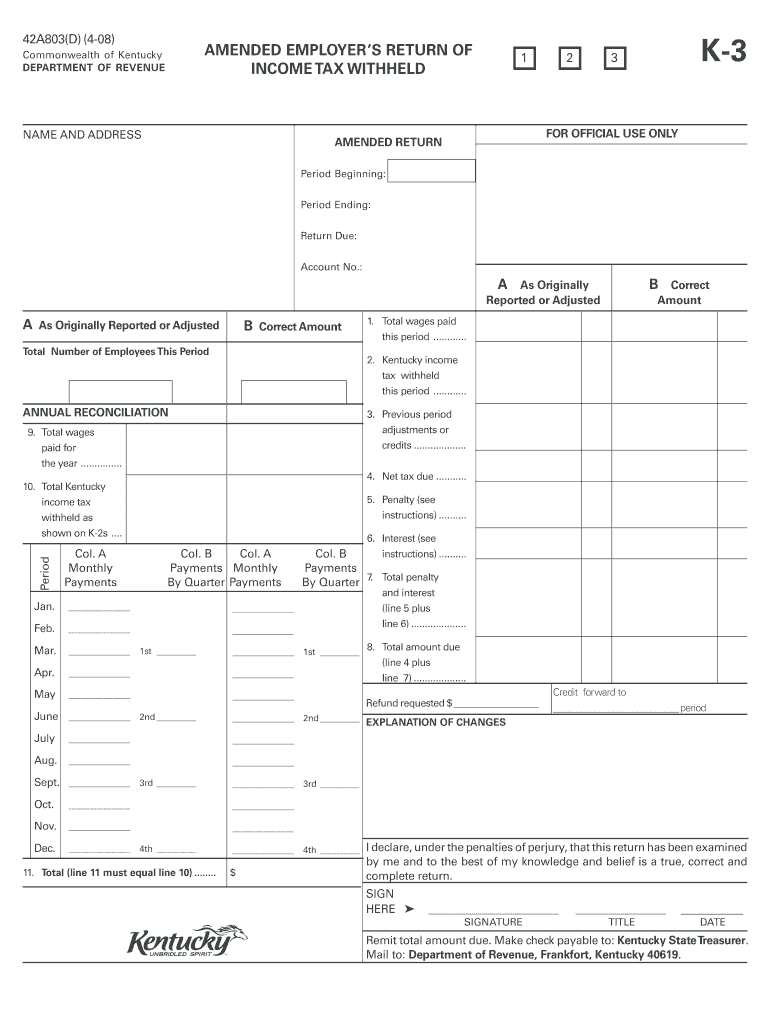

Revenue Ky Gov Form K 3 Fill Out And Sign Printable Pdf Template Signnow

Revenue Ky Gov Form K 3 Fill Out And Sign Printable Pdf Template Signnow

Post a Comment for "Kentucky Irs Payment Plan"