How Do Payment Processing Companies Make Money

Credit card companies make the bulk of their money from three things. If there are enough funds in your customers card and it is valid the transaction will go through.

Stripe Payment Gateway Payment Mobile Payments

Stripe Payment Gateway Payment Mobile Payments

If you want to set up or make easy payments online you should know that the company uses the industrys best practices to process payments and the lowest rates for your eСommerce needs.

How do payment processing companies make money. Processors make most of their money from. Here is a list of our partners and heres how we make money. AeroPay is a payment solution that saves businesses money on credit card processing fees.

Some companies use mobile payments to sell their products and services directly to their customers. Discover which part of the process renders income for sales re. In the simplest terms a payment processor is a company that handles transactions between two parties such as a merchant and a customer.

In other words the revenues for. These processors perform many functions such as evaluating whether transactions are valid and approved using anti-fraud measures to assure that a purchase transaction is initiated by the source it claims to be. Networks typically make their money from the merchants who pay a fee to accept electronic payments from credit cards.

Credit card companies make money from cardholders in several ways. Here are the four most common. Monitored by the National Automated Clearing House Association this method allows customers to give you their bank account and routing numbers for electronic payment.

That means the payment processing company communicates and relays information from your customers credit or debit card to both your bank and your customers bank. If you have a Bank of. This works especially well for recurring and subscription payments.

How payments companies make money Lets first identify the source of all payments revenues it is called the Discount Fee and it is paid for by the merchant. They do not make money directly from merchant discount interchange fees by the merchant to the acquiring or issuing bank or from fees charged. Another way credit card companies make money is through interest on revolving loans if the card balance is not paid in full each month.

There are generally four parties that are involved in a payments transaction. While many banks charge a 5 fee the companys processing fees are only 125 of the total purchase and 1 of that is passed through to the customer as a cash back reward. Theres the issuing bank that actually loans money to the customer through their credit card.

Accepting and processing payments. The payment processor who might also be your merchant bank makes money by charging a fee called an authorization fee every time you process a transaction whether its a sale a decline or a return no matter. The reason for an initial franchise fee is to help recoup the money you spent on setting up the franchise and the cost of recruiting training and supporting franchisees.

Here is how franchisors make money. Plus it can charge fees for setup monthly usage and even account cancellation. The Ways Credit Card Companies Profit From Cardholders.

How its using fintech in payments. The most common way credit card companies make money is through fees such as the annual fee overlimit fee and past due fees. By paying the.

Certain processors like Vantiv also work with financial institutions to integrate other services. Credit Card Companies make money in a variety of ways. Interest annual fees and miscellaneous charges like late payment fees.

A dollar amount for every transaction processed. In Q1 FY 2021 data processing revenue accounted for the largest portion of the companys gross revenue. Mobile payments are changing the way we spend money by making payments more convenient.

Interest fees charged to cardholders and transaction fees paid. How processors make money. Whether you need online payment ecommerce product uploads checks by web Quickbooks integration chargeback control or recurring billing National Merchants has just the right service for you.

ACH processing is another popular way to accept payments. The issuers make money from the consumer by charging them interest and fees according to their credit card agreements. Visa and MasterCard make money by charging fees to banks that participate in their respective networks.

All a customer needs to do to purchase their coffee or a new shirt with AeroPay is sync their bank account and the app will automatically connect when the customer enters a participating store. This figure is up 59 compared to Q1 FY 2020. Here is a breakdown of how each of those charges works.

The franchise fee is a flat fee that the new franchisee pays up front when you sign the franchise agreement. For merchant services revenue is driven by the number of transactions and the dollar amount of sales volume. And all of this all happens in a matter of seconds.

30 billion or about 40. Payment processors enable merchants to receive debit or credit card payments online by providing a connection to an acquiring bank. It accomplishes the payment by relaying the payment.

Mobilize Your Business With Our Safe Secure And Reliable Payment Gateway Solutions Save Time And Money With Better Pa Payment Gateway Online Business Gateway

Mobilize Your Business With Our Safe Secure And Reliable Payment Gateway Solutions Save Time And Money With Better Pa Payment Gateway Online Business Gateway

Pin On Ecommerce Payment Processing

Pin On Ecommerce Payment Processing

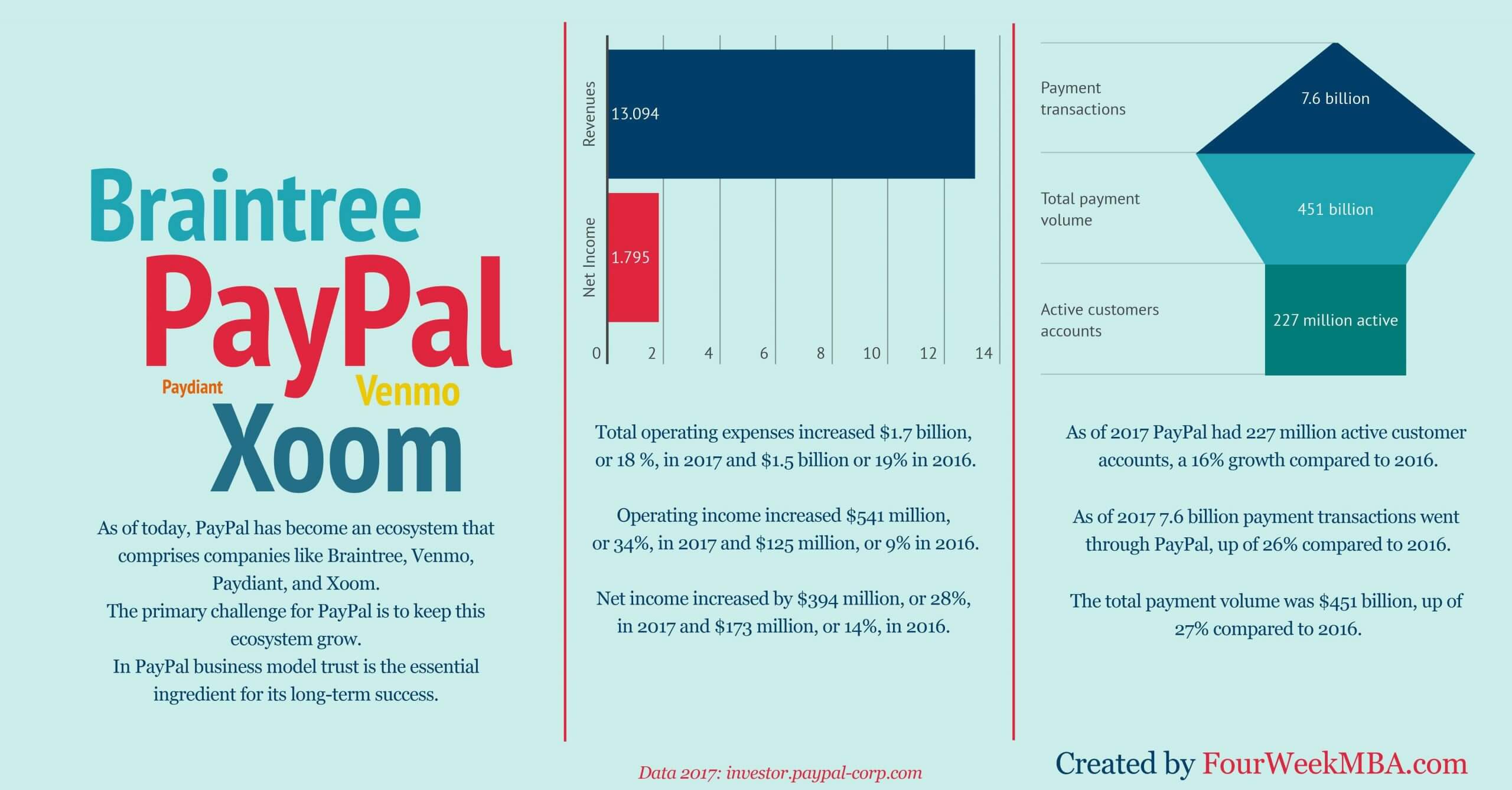

How Does Paypal Make Money Paypal Business Model In A Nutshell

How Does Paypal Make Money Paypal Business Model In A Nutshell

6 Cheapest Credit Card Processing Companies Credit Card Processing Credit Card Paypal Business

6 Cheapest Credit Card Processing Companies Credit Card Processing Credit Card Paypal Business

Pin On Us Company Formation And Registration

Pin On Us Company Formation And Registration

High Risk Credit Card Processing And Merchant Services Merchant Services Credit Card Credit Card Processing

High Risk Credit Card Processing And Merchant Services Merchant Services Credit Card Credit Card Processing

The Payments Industry Explained The Trends Creating New Winners And Losers In The Card Processing Secure Credit Card Credit Card Processing Payment Processing

The Payments Industry Explained The Trends Creating New Winners And Losers In The Card Processing Secure Credit Card Credit Card Processing Payment Processing

More So Than Ever Before Customers Are Relying On Online Reviews On Sites Like Yelp A Small Business Credit Cards Business Credit Cards Credit Card Technology

More So Than Ever Before Customers Are Relying On Online Reviews On Sites Like Yelp A Small Business Credit Cards Business Credit Cards Credit Card Technology

Payment Processing Technology Payment Processing Payment Technology

Payment Processing Technology Payment Processing Payment Technology

Merchant Payment Solutions Payment Gateway Credit Card Machine Payment

Merchant Payment Solutions Payment Gateway Credit Card Machine Payment

Why Are Payment Processors Important For Online Business Online Business Merchant Services Stronghold 1

Why Are Payment Processors Important For Online Business Online Business Merchant Services Stronghold 1

The Payments Industry Explained The Trends Btcnews Credit Card Processing Ecosystems Payment

The Payments Industry Explained The Trends Btcnews Credit Card Processing Ecosystems Payment

Payment Integration Solutions For Software Application Partners Credit Card Statement Solutions Credit Card Readers

Payment Integration Solutions For Software Application Partners Credit Card Statement Solutions Credit Card Readers

Our Professionals Have Negotiated The Best Rates For You In 2020 Credit Card Services Credit Card Fees Business Credit Cards

Our Professionals Have Negotiated The Best Rates For You In 2020 Credit Card Services Credit Card Fees Business Credit Cards

High Risk Continuity Merchant Account Provider Merchant Stronghold Merchant Account Accounting Merchants

High Risk Continuity Merchant Account Provider Merchant Stronghold Merchant Account Accounting Merchants

Electronic Payment Processing Services Credit Card Machine Platinum Credit Card Credit Card

Electronic Payment Processing Services Credit Card Machine Platinum Credit Card Credit Card

How Credit Card Payment Processing Works Merchant Industry Credit Card Payment Credit Card Credit Card Terminal

How Credit Card Payment Processing Works Merchant Industry Credit Card Payment Credit Card Credit Card Terminal

Best Merchant Service Provider Merchant Services Credit Card Online Credit Card Processing

Best Merchant Service Provider Merchant Services Credit Card Online Credit Card Processing

Post a Comment for "How Do Payment Processing Companies Make Money"