Payroll Protection Program How Many Weeks

The 24-week period during which expenses must be incurred or paid. Alternatively the seasonal employer may use any consecutive 12-week period between May 1 2019 and September 15 2019.

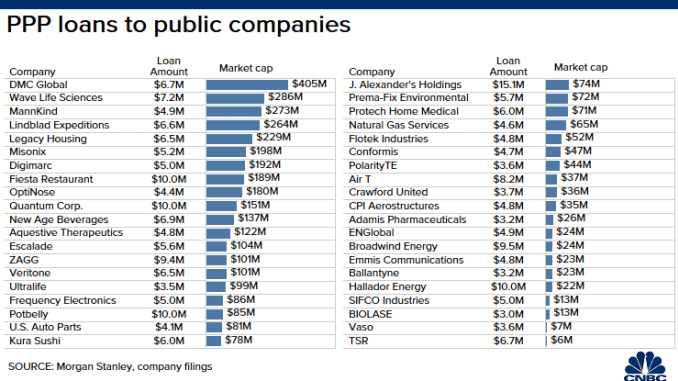

Here Are The Largest Public Companies Taking Payroll Loans Meant For Small Businesses Public Company Small Business Funding Payroll

Here Are The Largest Public Companies Taking Payroll Loans Meant For Small Businesses Public Company Small Business Funding Payroll

22 2021 five changes to the Paycheck Protection Program one with a set term of two weeks the other four effective until at least the end of March 2021.

Payroll protection program how many weeks. If you were assigned a PPP loan number on or before June 5 2020 you now have the option of taking 24 weeks to spend the funds instead of eight weeks. The legislation makes a slate of changes to the so-called PPP a forgivable loan program for. Requires that lenders defer repayment until 10 months after the last day of the covered period.

This is if the employee is unable to work because the employee is quarantined andor experiencing COVID-19 symptoms and seeking a medical diagnosis. Loans are considered to be made on the date the SBA assigned a loan number to your PPP Loan. For loans made on or after June 5 2020 your loan forgiveness covered period is 24 weeks.

Get matched with a lender. The Whitehouse announced Feb. Search for lenders in your area.

Reduces the amount that must be spent on payroll in order to qualify for loan forgiveness from 75 to 60. Two Weeks of ⅔ Pay. Borrowers may be eligible for PPP loan forgiveness.

By Janet Berry-Johnson CPA on July 22 2020. Loan forgiveness was expanded from eight weeks of eligible costs to the 24 weeks or December 31 2020 whichever is earlier. Provides borrowers the option of extending the covered period from 8 to 24 weeks.

The 24 weeks 168 days beginning on the day the PPP loan was disbursed or For borrowers with a biweekly or more frequent payroll schedule the 24 weeks 168 days beginning on the first day of the first pay period following the PPP loan disbursement. Your lender can provide you with this information. The 40 percent limitation in this bill is much more realistic.

Third PPP borrowers can now elect a covered period that ends at any point between 8-weeks and 24-weeks after loan disbursement. The Paycheck Protection Program PPP provides loans to help businesses keep their workforce employed during the Coronavirus COVID-19 crisis. Last Friday President Donald Trump signed the Paycheck Protection Program Flexibility Act into law.

Extending the program from June 30 to December 31. For most borrowers the maximum loan amount of a Second Draw PPP Loan is 25x average monthly 2019 or 2020 payroll costs up to 2 million. For borrowers in the Accommodation and Food Services sector use NAICS 72 to confirm the maximum loan amount for a Second Draw PPP Loan is 35x average monthly 2019 or 2020 payroll costs up to 2 million.

The Paycheck Protection Program Flexibility Act of 2020 amended the Paycheck Protection Program. For loans made before June 5 2020 you can choose to use either an 8-week or 24-week loan forgiveness covered period. If youve already had to lay off employees you have until June 30 2020 to restore employment and salary levels for any changes made between February 15 2020 and April 26 2020.

The PPP loans will help literally millions of small businesses keep those valuable assets as they navigate the coming weeks. Two Weeks of Full Pay The Act provides that employees of eligible employers can receive two weeks up to 80 hours of paid sick leave at 100 of the employees pay. However if you are a seasonal business you can apply to borrow 25 times your payroll for either the 12-week period beginning February 15 2019 and ending May 10 2019 or the period of March 1 2019 through June 30 2019.

Loan forgiveness will be provided for the sum of documented payroll costs covered. The Paycheck Protection Program Flexibility Act made some significant changes to PPP loans. By ensuring the PPP program will operate for 24 weeks rather than only eight this.

Equivalent employees on payroll and the dollar amounts of payroll costs covered mortgage interest payments covered rent payments and covered utilities for the eight weeks after getting this loan. The bill enhances the PPP by increasing the time small businesses can use funds and receive forgiveness from eight weeks to twenty-four weeks and by reducing the payroll cost rule from 75 percent. Previously PPP borrowers that obtained their loans before June 5.

Alternatively a business whose PPP loan was made before June 5 may opt to use the eight-week period instead. Payroll costs including salary wages and tips up to 100000 of annualized pay per employee for eight weeks a maximum of 15385 per individual as well as covered benefits for employees but. One of the biggest changes was to the eight-week forgiveness period.

The bill enhances the PPP by increasing the time small businesses can use funds and receive forgiveness from eight weeks to twenty-four weeks and by reducing the payroll cost rule from 75 percent.

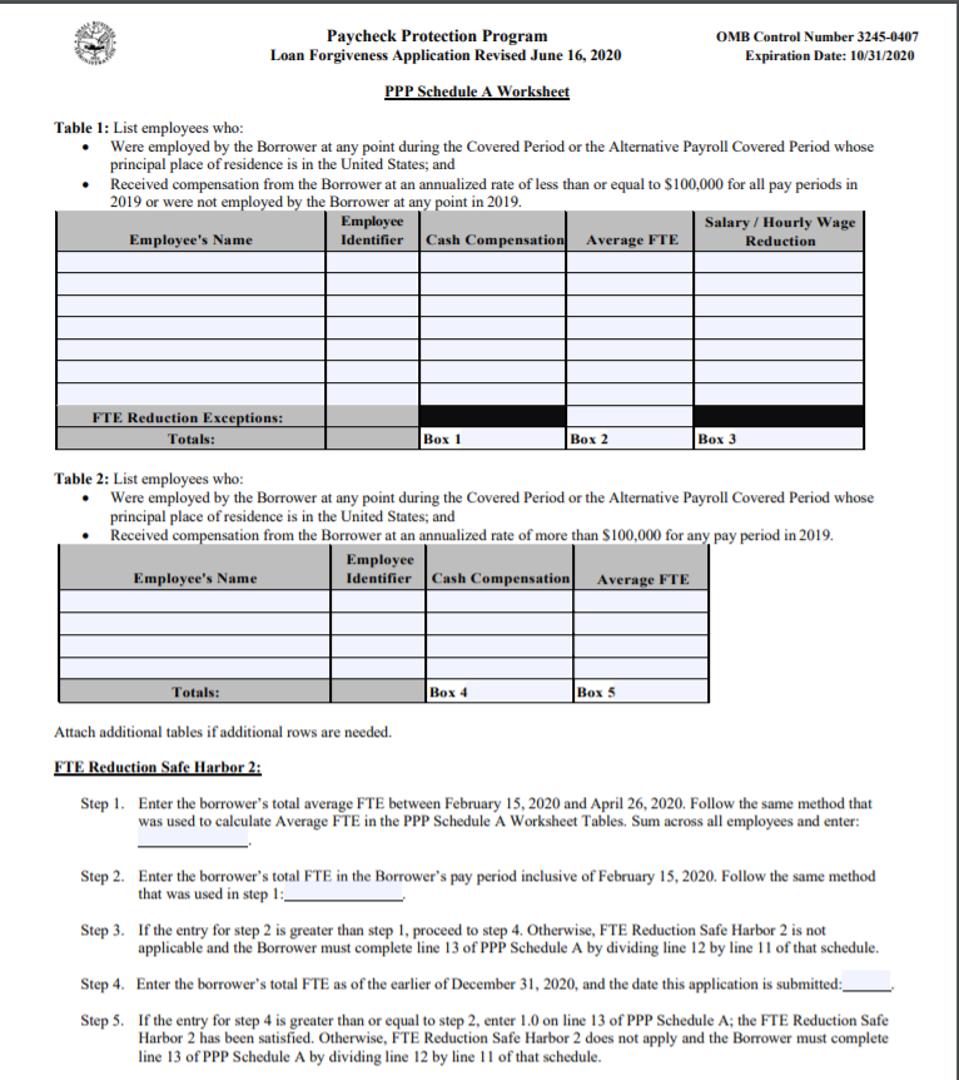

The Not Quite Definitive Guide To Paycheck Protection Program Loan Forgiveness

The Not Quite Definitive Guide To Paycheck Protection Program Loan Forgiveness

How To Calculate Your Paycheck Protection Program Loan Amount Bench Accounting

How To Calculate Your Paycheck Protection Program Loan Amount Bench Accounting

Paycheck Protection Program Ppp Qualified Expenses

Paycheck Protection Program Ppp Qualified Expenses

Paycheck Protection Program Protection Paycheck How To Apply

Paycheck Protection Program Protection Paycheck How To Apply

Irs Taxes Most Loan Forgiveness Be Careful With Exceptions Loan Forgiveness Irs Taxes Filing Taxes

Irs Taxes Most Loan Forgiveness Be Careful With Exceptions Loan Forgiveness Irs Taxes Filing Taxes

The Cares Act Paycheck Protection Program What You Need To Know In 2020 Paycheck Sba Loans Protection

The Cares Act Paycheck Protection Program What You Need To Know In 2020 Paycheck Sba Loans Protection

White House Says Small Business Loan Program For Coronavirus Impacted Firms Is Out Of Money The Washington Post

Large Public Companies Are Taking Small Businesses Payroll Loans

Large Public Companies Are Taking Small Businesses Payroll Loans

Paycheck Protection Program Ppp Loan Forgiveness

Paycheck Protection Program Ppp Loan Forgiveness

Nonprofit Paycheck Protection Program Ppp Application Insidecharity Org

Nonprofit Paycheck Protection Program Ppp Application Insidecharity Org

Paycheck Protection Program Round 2 Knowns Unknowns Rkl Llp

Paycheck Protection Program Round 2 Knowns Unknowns Rkl Llp

Paycheck Protection Program Information Tmc Financing

Paycheck Protection Program Information Tmc Financing

Chase Bank Paycheck Protection Program Application Detailed Walk Through Youtube

Chase Bank Paycheck Protection Program Application Detailed Walk Through Youtube

Step By Step Guide To The Payroll Protection Program Amy Northard Cpa The Accountant For Creatives In 2020 Payroll Small Business Tax Business Tax Deductions

Step By Step Guide To The Payroll Protection Program Amy Northard Cpa The Accountant For Creatives In 2020 Payroll Small Business Tax Business Tax Deductions

Post a Comment for "Payroll Protection Program How Many Weeks"