Payment Protection Program Loan Forgiveness Guidelines

The Paycheck Protection Program PPP provides loans to help businesses keep their workforce employed during the Coronavirus COVID-19 crisis. Borrowers may be eligible for PPP loan forgiveness.

How To Calculate Your Paycheck Protection Program Loan Amount Bench Accounting

How To Calculate Your Paycheck Protection Program Loan Amount Bench Accounting

To qualify for loan forgiveness a borrower must use at least 60 of the PPP loan amount for payroll costs.

Payment protection program loan forgiveness guidelines. Salary wages commission or similar compensation recent SBA guidance states that payroll costs include all cash compensation including a housing stipend or allowance Payments for vacation parental family medical or sick leave. Are Expenses Paid with Forgiven Loan Proceeds Deductible. Borrowers may be eligible for loan forgiveness.

The following costs and expenses are eligible for loan forgiveness under the Paycheck Protection Program. Paycheck Protection Program PPP Loan Forgiveness Checklist. Youll have time to request Forgiveness before you need to start making payments.

Borrowers can apply for forgiveness any time up to the maturity date of the loan. Paycheck Protection Program PPP loan forgiveness guidelines. Borrowers now have 24 weeks to spend loan.

All loan terms will be the same for everyone. Paycheck Protection Program Loan Forgiveness Application. The Paycheck Protection Program PPP authorizes up to 349 billion in forgivable loans to small businesses to pay their employees during the COVID-19 crisis.

Any portion of the loan that is not forgiven will carry an interest rate of 10 and is due to be paid back within five years. A borrower may submit a loan forgiveness application any time on or before the maturity date of the loan if the borrower has used all of the loan proceeds for which the borrower is requesting forgiveness except that a borrower applying for forgiveness of a Second Draw PPP Loan that is more than 150000 must submit the loan forgiveness application for its First Draw PPP Loan before or simultaneously with the loan forgiveness application for its Second Draw PPP Loan. Continue to check this page for updates and visit SBAgov and Treasurygov for full program details.

Effective Jan 19 2021. In your application for loan forgiveness you must document the following. If you received a PPP loan through Kabbage sign into your dashboard for updates on loan forgiveness.

If you have previously received a PPP loan certain businesses are eligible for a Second Draw PPP Loan. If you are not receiving emails from us about Forgiveness please check your spam folder and email privacy settings. These costs must be paid or incurred during the covered period.

Compensation in the form of salaries wages commissions or similar compensation up to 100000. You must apply for forgiveness with your PPP lender through the official PPP forgiveness application. Loan proceeds for which the borrower is requesting forgiveness.

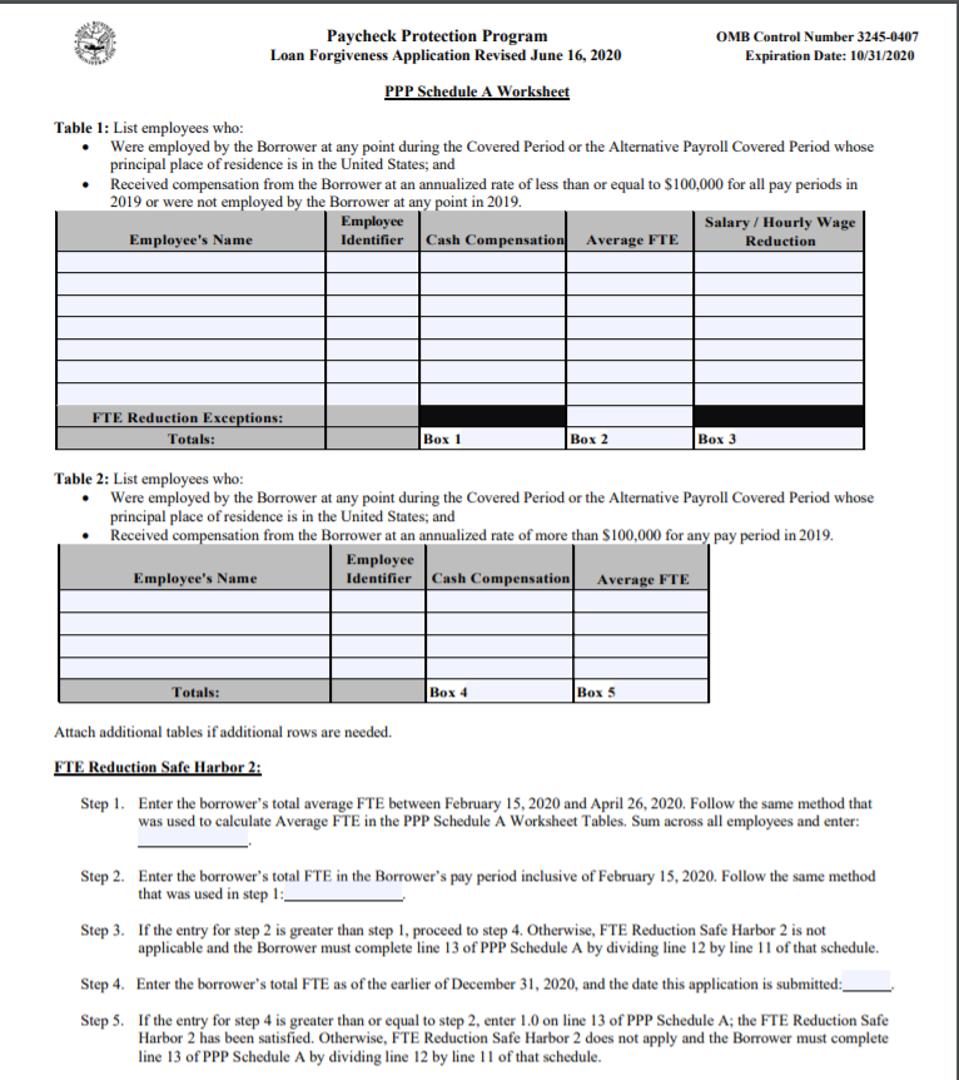

Relief options and Additional Resources. To calculate the loan forgiveness amount the borrower must compete the PPP loan forgiveness application. The loan amounts will be forgiven as long as.

Up to 40 of the PPP loan may be used for mortgage interest rent and certain utilities. Payment of cash tips or. The process isnt automatic.

Key Takeaways The PPP Flexibility Act amends the Paycheck Protection Program to give borrowers more time to spend loan funds and still obtain forgiveness. The SBA is no longer accepting applications for PPP loans. The Paycheck Protection Program Flexibility Act signed into law on June 5 2020 contained the following changes to the program.

If borrowers do not apply for forgiveness within 10 months after the last day of the covered period then PPP loan payments are no longer deferred and borrowers will begin making loan payments to their PPP lender. The second loan can be up to 25 times the business average monthly payroll costs up to a 2 million loan maximum or 4 million for a corporate group Accommodations and Food Services companies with NAICS code 72 can borrow up to 35 times the business average monthly payroll costs up to a 2 million loan maximum. Get matched with a lender.

Search for lenders in your area. You now have a 24-week Covered Period the period in which you must spend the PPP loan proceeds for full loan forgiveness starting on the date the funds were disbursed. For example a borrower whose covered period ends on October 30 2020 has until August 30 2021 to apply for forgiveness before loan repayment begins.

A borrowers loan forgiveness amount will be reduced based on reductions in full-time equivalent employees FTEs or in salary or wages during an eight-week56 day Covered Period subject to several safe-harbor provisions. The loan proceeds are used to cover payroll costs and most mortgage interest rent and. Eligible Costs for Loan Forgiveness.

If you were one of the millions of businesses approved for SBA Paycheck Protection Program PPP loans your next step is applying for loan forgiveness. Period which ends on a date selected by you that is at least 8 weeks following the date of loan. By Office of.

Last day of the borrowers loan forgiveness covered period loan payments are no longer deferred and the borrower must begin making payments on the loan. PPP Loan Forgiveness Calculation Form Coronavirus COVID-19. The first step in preparing your Loan Forgiveness Application is to determine your Covered.

Disbursement and not more than 24 weeks after the date of loan disbursement.

Pin On Jerrybanfield Com Blog Posts

Pin On Jerrybanfield Com Blog Posts

An Advisor S Guide To The Paycheck Protection Program

An Advisor S Guide To The Paycheck Protection Program

The Not Quite Definitive Guide To Paycheck Protection Program Loan Forgiveness

The Not Quite Definitive Guide To Paycheck Protection Program Loan Forgiveness

Maximize Paycheck Protection Program Ppp Loan Forgiveness

Maximize Paycheck Protection Program Ppp Loan Forgiveness

Pin On Best Of Personal Finance

Pin On Best Of Personal Finance

Know About Ppp Loan Forgiveness For Loans Of 50 000 Or Less

Know About Ppp Loan Forgiveness For Loans Of 50 000 Or Less

Pin On Pandemic Financial Info

Pin On Pandemic Financial Info

Ppp Loan Forgiveness Guidance For Employers

Ppp Loan Forgiveness Guidance For Employers

Post a Comment for "Payment Protection Program Loan Forgiveness Guidelines"