Online Payment Of Income Tax Through Hdfc Bank

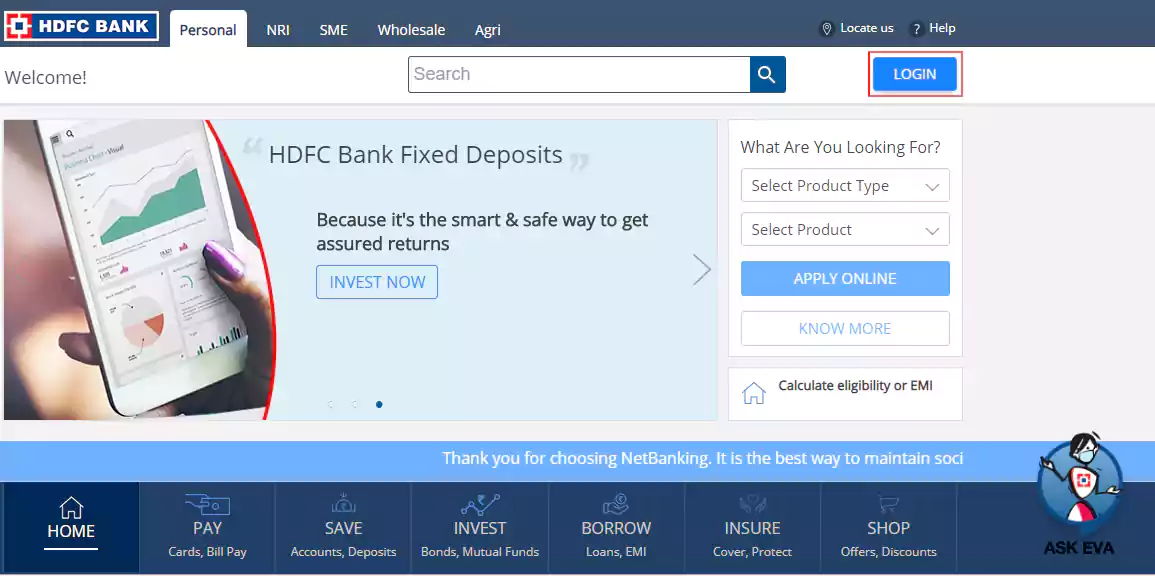

All you need is your OnlineBanking login and transaction password. The taxpayer has to login to the net-banking site with the user id password provided by the bank for net-banking purpose and enter payment details at the bank site.

Hdfc Net Banking Hdfc Internet Banking Online How To Apply

Hdfc Net Banking Hdfc Internet Banking Online How To Apply

Pay your Excise Duty Service Tax online with ease.

Online payment of income tax through hdfc bank. Step1 - Log on to HDFC Bank Ltd. HDFC Bank offers you a one stop destination for all online Tax payments. Challan NoITNS 282- Payment of Securities transaction tax Estate duty Wealth-tax Gift-tax Interest-tax Expenditureother.

If you dont have an account in one of the designated banks you can use an account that belongs to your spouse or friend to make an online tax payment. Step6 - Check if the payment is Executed Rejected. Pay your taxes with HDFC Bank Debit Card and get a CashBack of Rs 100 said the bank.

Checkout our online Multi Tax and Bill Payment Centre now. Through HDFC Bank Debit Card payment you can get plenty of offers and rewards on payment of your income tax. While filing Income tax return there might be case that you need to pay additional tax.

From June 01 2004 the Income-tax Department has introduced a new system for payment of taxes called Online Tax accounting System OLTAS. HDFC Bank allows making online payment of Service Tax Excise Duty using NetBanking service. You can pay your direct taxes online using your IDFC FIRST Bank Accounts.

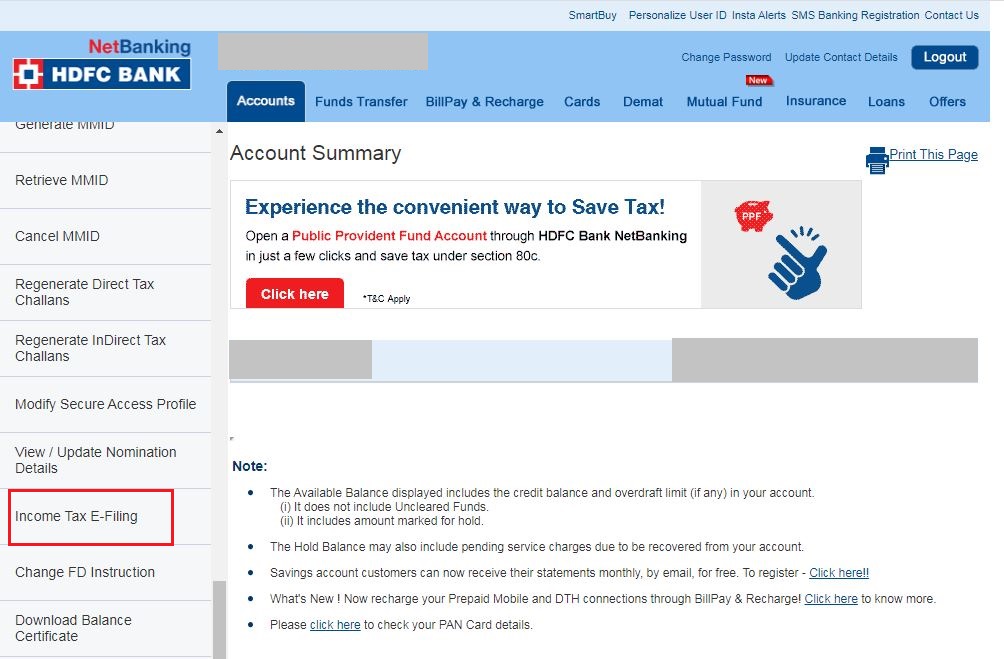

This system not only simplifies the procedure for payment at the collecting branches of designated banks but is also a breakthrough in accounting of direct tax payments. In Request Tab there would be an option called Regenerate Direct Tax challansClick on that. You can use either HDFC Netbanking login or through your HDFC debit card.

Challan NoITNS 280- Payment of Advance tax Self-Assessment tax Tax on Regular Assessment Surtax Tax on Distributed Profits of Domestic Company and Tax on Distributed income to unit holders. What are the ways to make e-Payment of taxes through HDFC. If you are yet to pay your taxes and you have an HDFC Bank debit card then you can pay your taxes online using the card and even get a cashback too.

HDFC Bank is one of the designated banks that can accept online income tax payments. Tax paying becomes convenient with HDFC Bank. We have stated in an earlier post about how to pay this Self-Assessment tax using Challan 280The problem is sometimes people forget to save the receipt and later cannot find the details to fill up in the ITR Form.

How to avail HDFC Bank income tax cashback offer. HDFC Bank facilitates Custom Duty Payments through an Authorised Bank. Its a secured quick and a convenient way to pay your taxes online via a simple process.

Now you can pay your direct indirect tax online through NetBanking service offered by HDFC Bank say goodbye to the hassles of standing in long queues. Your tax payment transaction would be subject to the Daily Debit Limit applicable on OnlineBanking. Step-7 On successful payment a challan counterfoil will be displayed containing CIN payment details and bank name through which e-payment has been made.

You cannot use a credit card to pay taxes. Challan NoITNS 281- Payment of TDSTCS by Company or Non Company. Calculate your taxes for the 2019-20 year using an online tax calculator by HDFC Bank.

Corporates having account with HDFC Bank can pay their Custom Duty using HDFC Bank Corporate and Retail Netbanking. Step2 - Click on NSDL Site Link and Input the required Tax Information Step3 - Select HDFC Bank as a Corporate User Step4 - Login to ENet and confirm the payment Step5 - Authorise the payment as per the Board Resolutions Requirements. Please enter your HDFC Bank Credit Card number and payment amount Select your net banker and click on PAY.

After that we will get a window where list of all recent payments of TDS and Income tax from this HDFC Bank account will appear with the heading Regenerate Direct Tax Challans. To pay income tax online through your bank you can use NetBanking or your Debit Card. The facility that provides a platform to taxpayers to pay Income Tax payment online.

Income Tax Calculator helps you to do fundamental tax calculations for the financial year. But remember to write your PAN in the challan. You cannot use a Credit Card to pay taxes.

Hdfc Bank Deposit Form The 1 Secrets That You Shouldn T Know About Hdfc Bank Deposit Form Bank Deposit Reference Letter Template Power Of Attorney Form

Hdfc Bank Deposit Form The 1 Secrets That You Shouldn T Know About Hdfc Bank Deposit Form Bank Deposit Reference Letter Template Power Of Attorney Form

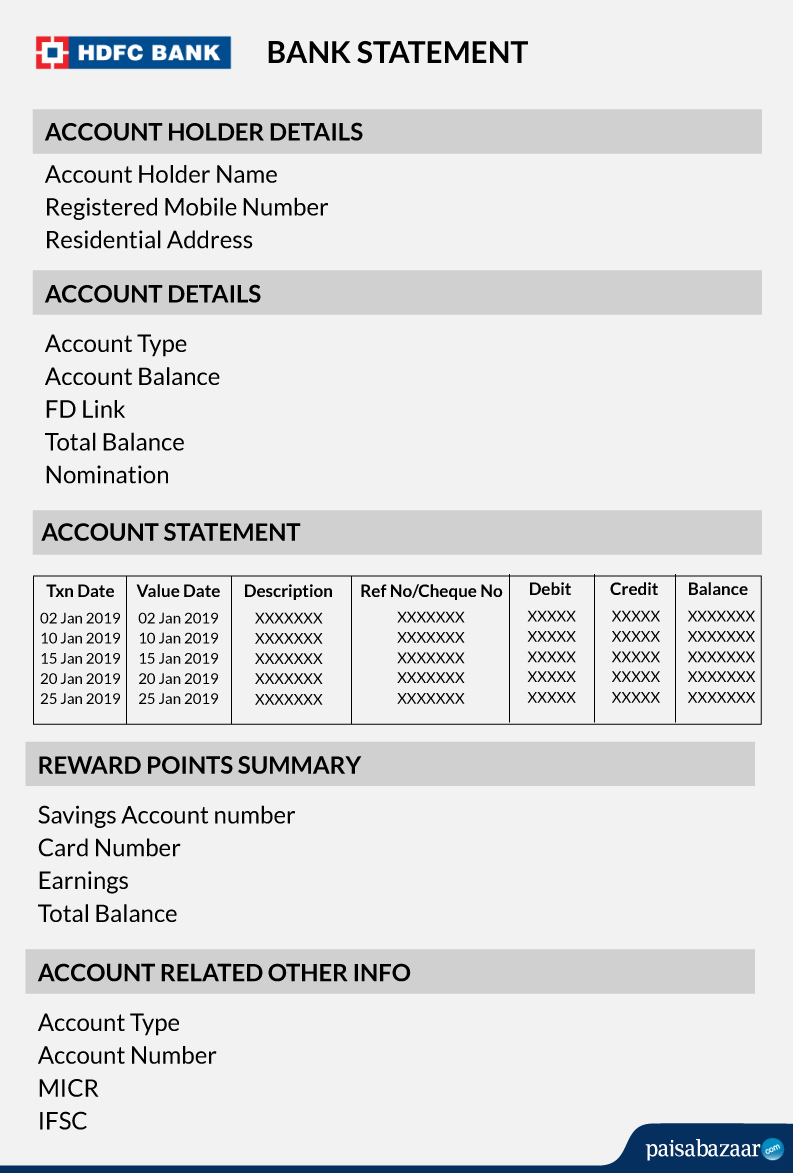

Hdfc Bank Statement Format View Download Benefits Paisabazaar

Hdfc Bank Statement Format View Download Benefits Paisabazaar

How To Transfer Money From Hdfc Netbanking To Other Bank Accounts

How To Transfer Money From Hdfc Netbanking To Other Bank Accounts

Icici Bank Has Many Happy Customers Due To Its Expertise In The Arena Of Financial Services Be It Loan Investments Or Simp Credit Score Income Tax Tax Refund

Icici Bank Has Many Happy Customers Due To Its Expertise In The Arena Of Financial Services Be It Loan Investments Or Simp Credit Score Income Tax Tax Refund

How To E Verify Itr Using Hdfc Net Banking Youtube

How To E Verify Itr Using Hdfc Net Banking Youtube

How To Order Cheque Books Through Hdfc Bank Internet Banking Facility Order Cheque Books Banking

How To Order Cheque Books Through Hdfc Bank Internet Banking Facility Order Cheque Books Banking

How To E Verify Itr Through Hdfc Net Banking Learn By Quicko

How To E Verify Itr Through Hdfc Net Banking Learn By Quicko

Income Tax Payment Know How To Pay Income Tax Online Hdfc Bank

Income Tax Payment Know How To Pay Income Tax Online Hdfc Bank

Finance Guru Speaks How To Open Online Recurring Deposits Rd In Hdfc Bank Through Netbanking Credit Card Online Online Credit Card

Finance Guru Speaks How To Open Online Recurring Deposits Rd In Hdfc Bank Through Netbanking Credit Card Online Online Credit Card

Income Tax Filing Hdfc How To Have A Fantastic Income Tax Filing Hdfc With Minimal Spending Filing Taxes Income Tax Income

Income Tax Filing Hdfc How To Have A Fantastic Income Tax Filing Hdfc With Minimal Spending Filing Taxes Income Tax Income

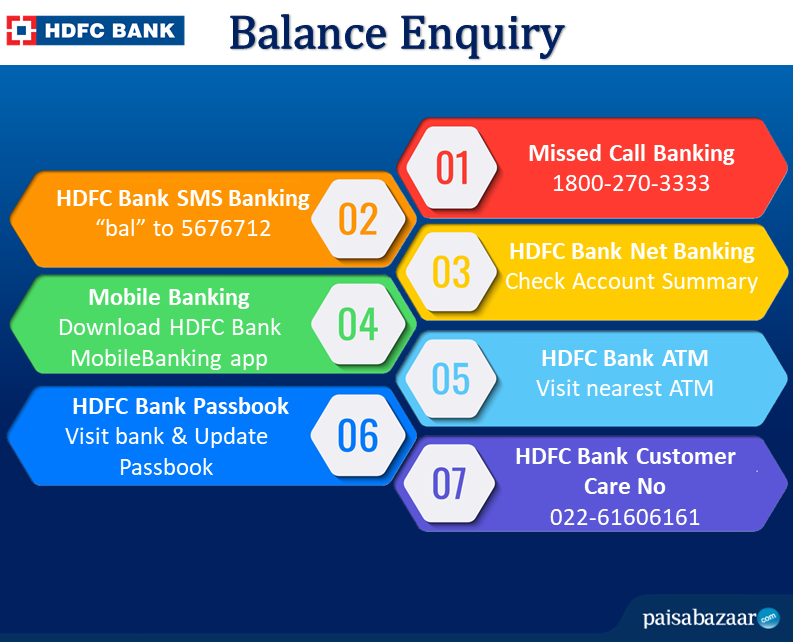

Hdfc Balance Check By Number Missed Call Sms Netbanking Atm

Hdfc Balance Check By Number Missed Call Sms Netbanking Atm

Online Pay Make All Your Online Payment With Payzapp By Hdfc Bank

Online Pay Make All Your Online Payment With Payzapp By Hdfc Bank

Apply For Online Hdfc Home Loan 9 15 Interest Rate Check Eligibility Emi Calculator Loan Amount Up To 10 C Home Loans Loan Loan Interest Rates

Apply For Online Hdfc Home Loan 9 15 Interest Rate Check Eligibility Emi Calculator Loan Amount Up To 10 C Home Loans Loan Loan Interest Rates

How To E Verify Itr Using Hdfc Bank Net Banking Tax2win

How To E Verify Itr Using Hdfc Bank Net Banking Tax2win

Hdfc Net Banking Hdfc Bank Internet Banking Online

Hdfc Net Banking Hdfc Bank Internet Banking Online

Hdfc Credit Card Login Using Hdfc Netbanking Hdfc Online Banking Credit Card Transactions Credit Card Bank Credit Cards

Hdfc Credit Card Login Using Hdfc Netbanking Hdfc Online Banking Credit Card Transactions Credit Card Bank Credit Cards

Finance Guru Speaks How To Stop Cheque Payment Through Hdfc Netbanking Finance Payment Guru

Finance Guru Speaks How To Stop Cheque Payment Through Hdfc Netbanking Finance Payment Guru

Https V1 Hdfcbank Com Assets Pdf Retail Process Pdf

Post a Comment for "Online Payment Of Income Tax Through Hdfc Bank"