Irs Payment Plan Deferral Covid 19

As a part of the CARES Act the IRS provided interest-free deferral of the part of Self-Employment tax. The IRS is extending the short-term payment plan timeframe to 180 days normally 120 days.

Https Www Taxpayeradvocate Irs Gov Wp Content Uploads 2020 10 Tas Flyer Small Business Tax Programs Biz Tool Final Counsel Approved 9 21 20 1 Pdf

See FAQ21 of IRS.

Irs payment plan deferral covid 19. Changes to filing and payment deadlines and economic impact payments are part of your COVID-19 relief. IRS Suspends Most Payment Programs Liens Levies Collections Activities To help people facing the challenges of COVID-19 issues the Internal Revenue Service announced today a sweeping series of. March 21 2020 The Treasury Department and the Internal Revenue Service are providing special tax filing and payment relief to individuals and businesses in response to the COVID-19 Outbreak.

Taxpayers would be allowed to defer their 2019 tax payments for up to 90 days without interest or penalty due to concern over the. WASHINGTON To help people facing the challenges of COVID-19 issues the Internal Revenue Service announced today a sweeping series of steps to assist taxpayers by providing relief on a variety of issues ranging from easing payment guidelines to postponing compliance actions. Tax Treatment of Unemployment Benefits.

It specifically notes that the current relief does not change any other payment or filing deadlines. The IRS urges taxpayers who are owed a refund to file as quickly as possible. Trumps emergency declaration pursuant to the Stafford Act the US.

The Treasury Department and IRS on Wednesday released guidance on deferring tax payments due to the coronavirus providing further details for taxpayers and tax preparers. Deferral of employment tax deposits and payments through December 31 2020. Because of public health precautions being taken at our processing facilities payments made by check will most likely take longer to appear in your TSP account.

You may be asked to provide proof of changes in your financial situation so have that information available when you call. We appreciate your patience. If you cannot pay off your balance within 120 days setting up a direct debit payment plan online will cost 31 or 107 if set up by phone mail or in-person.

If youre experiencing a hardship due to COVID-19 you have the right to ask for a forbearance of up to 180 days on any federally backed mortgage. COVID Tax Tip 2020-85 July 14 2020. Relief ranges from easing payment guidelines to postponing compliance actions.

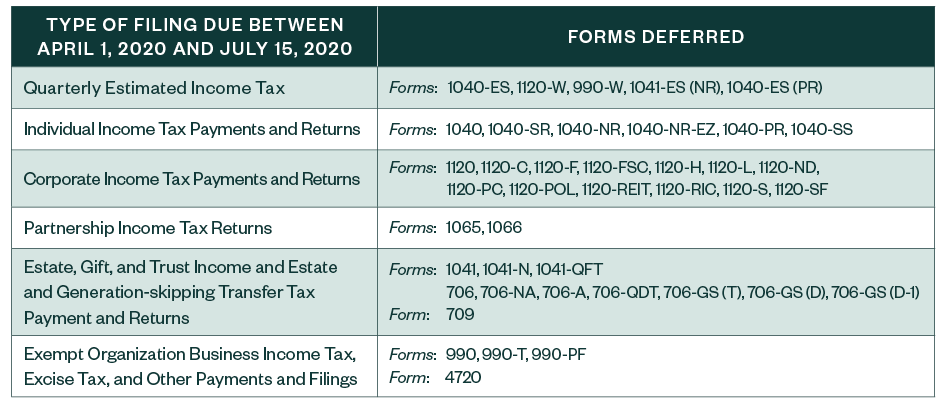

Treasury Department and Internal Revenue Service IRS today issued guidance allowing all individual and other non-corporate tax filers to defer up to 1 million of federal income tax including self-employment tax payments due on April 15 2020 until July 15 2020 without penalties or interest. On Tuesday Treasury Secretary Steve Mnuchin announced that US. Existing Installment Agreements Under an existing Installment Agreement payments due between April 1 and July 15 2020 are delayed.

This Employee Retention Credit applies to qualified wages paid after March 12 2020 and before January 1 2021. Options could include reducing the monthly payment to reflect your current financial condition. These include payments to make up missed loan payments submit additional loan payments or to roll over payments from IRAs or other employer plans.

Announced Tuesday that. The filing deadline for tax returns has been extended from April 15 to July 15 2020. Major changes to retirement plans due to COVID-19.

Treasury and IRS Issue Guidance on Deferring Tax Payments Due to COVID-19 Outbreak. Fees for IRS installment plans. Washington Following President Donald J.

The Internal Revenue Service IRS has announced a series of steps to assist taxpayers impacted by COVID-19. If you can pay off your balance within 120 days it wont cost you anything to set up an installment plan. This relief is effective through the filing and payment deadline Wednesday July 15 2020.

For private mortgage loans you can ask your. The guidance permits all individual and other non-corporate tax filers to defer up to 1 million of federal income tax including self-employment tax payments due on April 15 2020 until July 15 2020 without incurring penalties or interest. The Internal Revenue Service is saying taxpayers can now defer payment on any amount of money until July 15.

SAUL LOEBAFP via Getty Images Individuals and businesses can now defer any amount of. Due to COVID-19 the IRS People First Initiative provides relief to taxpayers on a variety of issues from easing payment guidelines to delaying compliance actions. Are self-employed individuals eligible to defer payment of self-employment tax imposed on net earnings from self-employment income.

IR-2020-59 March 25 2020. The IRS is taking extraordinary steps to help the people of our country said IRS Commissioner Chuck Rettig. Qualified individuals affected by COVID-19 may be able to withdraw up to 100000 from their eligible retirement plans including IRAs between January 1 and December 30 2020.

For individual taxpayers receiving notices letters about a tax bill with tax liabilities up to 250000 for Tax Year 2019 only the IRS can offer one Installment Agreement opportunity with no lien filed. The Employee Retention Credit is a fully refundable tax credit for employers equal to 50 percent of qualified wages including allocable qualified health plan expenses that Eligible Employers pay their employees. Call the IRS immediately at 1-800-829-1040.

Us Treasury Issues Guidance On Payment Deferral

Us Treasury Issues Guidance On Payment Deferral

Tax Administration Responses To Covid 19 Measures Taken To Support Taxpayers

Tax Administration Responses To Covid 19 Measures Taken To Support Taxpayers

Covid 19 Tax Relief Irs Extends Tax Payment And Filing Deadlines Some States Grant Tax Relief Updated Shulman Rogers

Covid 19 Tax Relief Irs Extends Tax Payment And Filing Deadlines Some States Grant Tax Relief Updated Shulman Rogers

Covid 19 Economic Impact Payment Robins Financial Credit Union

Covid 19 Economic Impact Payment Robins Financial Credit Union

Five Coronavirus Related Distribution Bombshell Revelations From Irs Notice 2020 50

Five Coronavirus Related Distribution Bombshell Revelations From Irs Notice 2020 50

Irs Covid 19 Payment Plan Relief Is Over Time To Restart Your Installment Agreement Irs Mind

Irs Covid 19 Payment Plan Relief Is Over Time To Restart Your Installment Agreement Irs Mind

Irs Releases Clarifying Faqs On Cares Act Retirement Plan Relief

Irs Releases Clarifying Faqs On Cares Act Retirement Plan Relief

New Irs Guidance Expands Tax Deadlines Deferred To July 15

New Irs Guidance Expands Tax Deadlines Deferred To July 15

![]() Coronavirus Covid 19 Tax Relief Taxpayer Advocate Service

Coronavirus Covid 19 Tax Relief Taxpayer Advocate Service

Https Www Novoco Com Sites Default Files Atoms Files Ir 2020 58 Tax Day Now July 15 032120 Pdf

Irs Unveils Get My Payment Feature Panacea Payroll Payroll Human Resources And Workforce Management Solutions For The Cannabis And Medical Medicinal Marijuana Industry

Irs Unveils Get My Payment Feature Panacea Payroll Payroll Human Resources And Workforce Management Solutions For The Cannabis And Medical Medicinal Marijuana Industry

Irs Releases Final Instructions For Payroll Tax Form Related To Covid 19 Relief Mauldin Jenkins

Irs Releases Final Instructions For Payroll Tax Form Related To Covid 19 Relief Mauldin Jenkins

Https Www Irs Gov Pub Irs Pdf P5420d Pdf

Irs Clarifies Interplay Between Employment Tax Deferral And Loan Forgiveness The Business Tax Blog

Irs Clarifies Interplay Between Employment Tax Deferral And Loan Forgiveness The Business Tax Blog

Unscrambling Covid 19 Legislation Next Level Solutions

Unscrambling Covid 19 Legislation Next Level Solutions

July 2020 Tax Newsletter Covid Updates Basics Beyond

July 2020 Tax Newsletter Covid Updates Basics Beyond

Irs And Pbgc Issue Relief Extending Certain Employee Benefit Plan Deadlines Due To Covid 19 Pandemic Mccarter English Llp

Irs And Pbgc Issue Relief Extending Certain Employee Benefit Plan Deadlines Due To Covid 19 Pandemic Mccarter English Llp

Irs Faqs On Deferral Of Employment Tax Deposits And Payments Tonneson Co

Irs Faqs On Deferral Of Employment Tax Deposits And Payments Tonneson Co

Https Www2 Deloitte Com Content Dam Deloitte Us Documents Tax Us Tax Multistate Tax 20 Alert Covid 19 Updated State And Local Tax Due Date Relief Developments Pdf

Post a Comment for "Irs Payment Plan Deferral Covid 19"