How To Explain Working Capital

Simply put working capital indicates a companys operating liquidity and efficiency. Net working capital provides a much more thorough comprehensive picture of a companys financial health.

Difference Between Fixed Capital And Working Capital Top 8 Differences

Difference Between Fixed Capital And Working Capital Top 8 Differences

To make sure your working capital works for you youll need to calculate your current levels project your future needs and consider ways to make sure you always have enough cash.

How to explain working capital. More Quick Liquidity Ratio Definition. Describe the working capital cycle. Working capital is the easiest of all the balance sheet formulas to calculate.

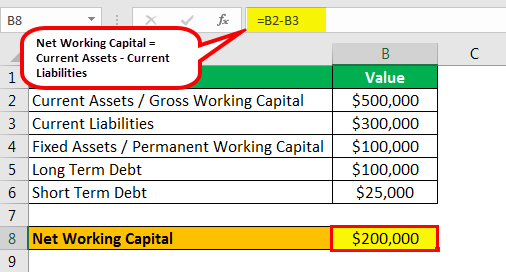

Net working capital is calculated by taking a companys total current assets and. Current assets - Current liabilities Working capital 1 For example say a company has 500000 in cash on hand. This ratio indicates whether the company possesses sufficient assets to cover its short-term debt.

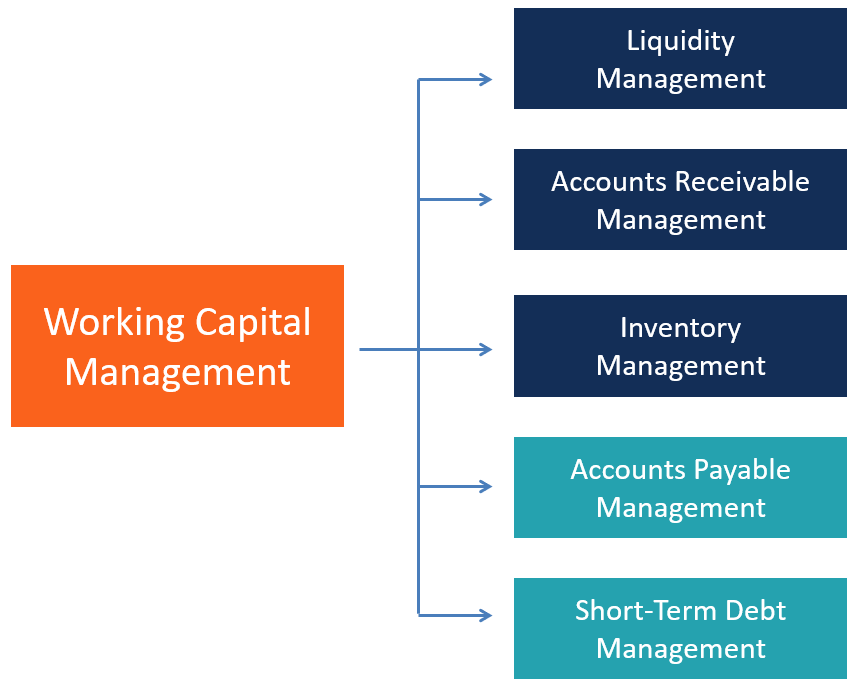

Steps in the Working Capital Cycle For most companies the working capital cycle works as follows. Needs for working capital An effective operation of a business is based on the proper management of working capital. Examples of current assets are raw material semi-finished goods finished goods debtors bills receivable prepaid expenses cash at bank and cash in hand.

It is a measure of a companys liquidity and its ability to meet short-term obligations as well as fund operations of the business. Working capital is the amount used to meet the day to day operation activities of a business. Working Capital is obtained by subtracting the current liabilities from the current assets.

How to calculate working capital. Working capital abbreviated WC is a financial metric which represents operating liquidity available to a business organization or other entity including governmental entities. But before we explain working capital in more detail its important.

However if you simply run this calculation each period to try to analyze working capital you wont. In an ordinary sense working capital denotes the amount of funds needed for meeting day-to-day operations of a concern. Working capital is vital for the day-to-day operations of a company such as procuring raw materials payment of wages salaries and overheads and making sure that production matches demand among other key objectives.

This is related to short-term assets and short-term sources of financing. Working capital is that part of a firms capital which is required to hold current assets of the firm. The company sells its inventory in 85 days on average.

Meaning of Working Capital. A companys working capital reflects a host of company activities including cash inventory accounts receivable accounts payable and the portion of debt due within one year as well as any other short-term accounts. In the broad sense the term working capital is used to denote the total value of current assets.

Working capitalis an amount of money borrowed from a bank or other lender and used by a business for money to keep operations going and pay business bills. Working capital also known as net working capital NWC is a measure of a companys liquidity operational efficiency and short-term financial health. When we talk about working capital what we really mean is CASH.

Hence it deals with both assets and liabilitiesin the sense of managing working capital it is the excess of current assets over current liabilities. Along with fixed assets such as plant and equipment working capital is considered a part of operating capital. By definition working capital is the amount by which current assets exceed current liabilities.

Gross working capital is equal to current assets. Heres the formula youll need. In short working capital is the money available to meet your current short-term obligations.

A working capital loan is simply a loan that will give you this working capital. Explain what is meant by the accrual of liabilities. The company purchases on credit materials to manufacture a product for example they have 90 days to pay for the raw materials.

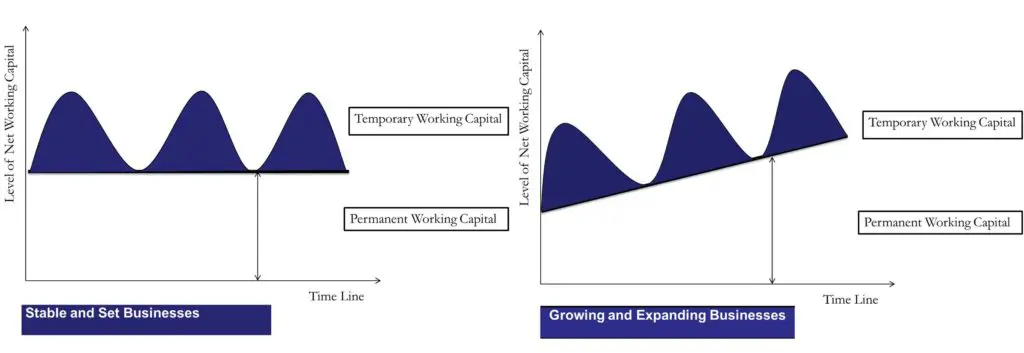

Working Capital is basically an indicator of the short-term financial position of an organization and is also a measure of its overall efficiency. Simply put working capital is the money available to a company to handle all of its operating activities for the upcoming year. The ideal position is to have more current assets than current liabilities and thus have a positive net working capital balance.

Explain how the suppliers payment period is calculated.

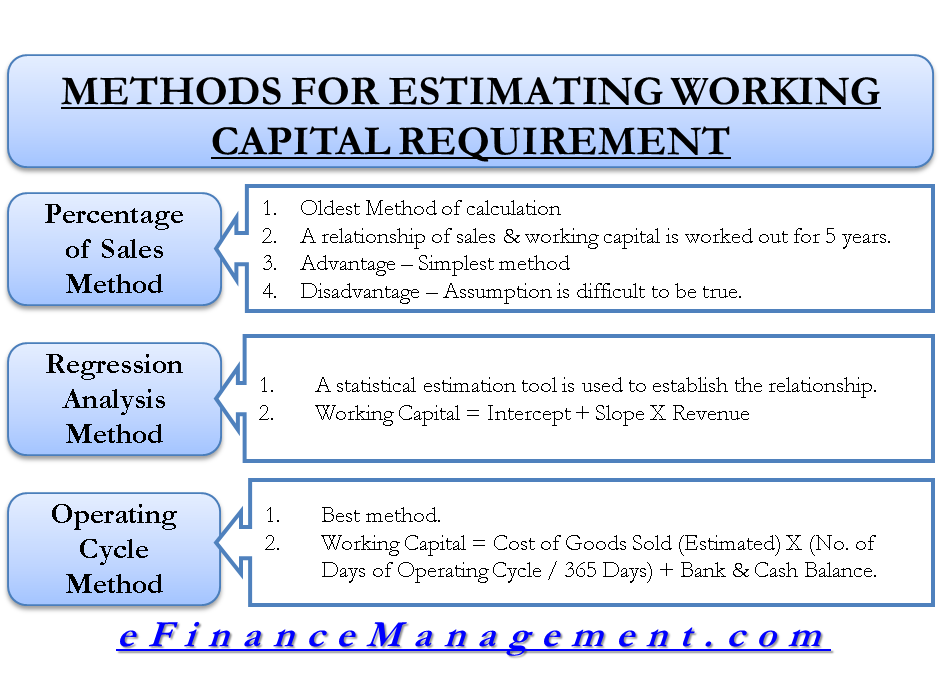

Methods For Estimating Working Capital Requirement

Methods For Estimating Working Capital Requirement

Working Capital Formula Examples More Wall Street Prep

Working Capital Formula Examples More Wall Street Prep

Working Capital Management At Tinplate Company Of India Limited The Project Proposed Is To Study The Working Capital Manage Management Capital Finance Capitals

Working Capital Management At Tinplate Company Of India Limited The Project Proposed Is To Study The Working Capital Manage Management Capital Finance Capitals

:max_bytes(150000):strip_icc()/dotdash_Final_How_Do_You_Calculate_Working_Capital_Aug_2020-01-a35d03d74be84f8aa3ad4c26650142f6.jpg) How Do You Calculate Working Capital

How Do You Calculate Working Capital

Factors Affecting Working Capital Common Factors Factors Credit Facility

Factors Affecting Working Capital Common Factors Factors Credit Facility

Working Capital Raising Capital Book Worth Reading Worth Reading

Working Capital Raising Capital Book Worth Reading Worth Reading

Working Capital Types Of Working Capital Types Of Work Temporary Work Work

Working Capital Types Of Working Capital Types Of Work Temporary Work Work

Advantages And Disadvantages Of Working Capital Management Efinancemanagement Financial Strategies Budgeting Money Management

Advantages And Disadvantages Of Working Capital Management Efinancemanagement Financial Strategies Budgeting Money Management

Balance Sheet With Working Capital Microsoft Excel Template Smb Balance Sheet Template Statement Template Balance Sheet

Balance Sheet With Working Capital Microsoft Excel Template Smb Balance Sheet Template Statement Template Balance Sheet

Working Capital Explained Youtube

Working Capital Explained Youtube

Types Of Working Capital Check Factors Meaning Quickbooks

Types Of Working Capital Check Factors Meaning Quickbooks

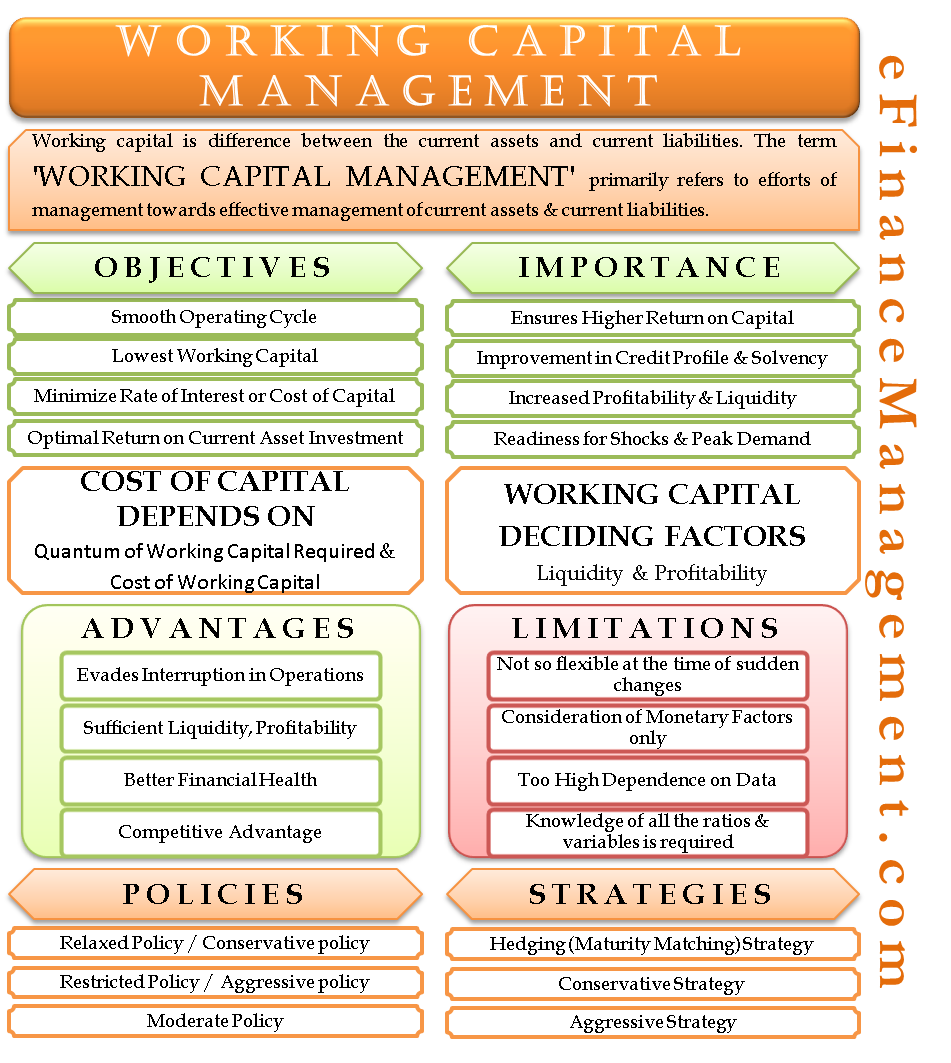

Working Capital Management Meaning Goals Strategies Policies Etc

Working Capital Management Meaning Goals Strategies Policies Etc

We Can Make Your Company S Business Processes Work Better By Improving Working Capital Management And Reducin Business Process Outsourcing Business Process Bpo

We Can Make Your Company S Business Processes Work Better By Improving Working Capital Management And Reducin Business Process Outsourcing Business Process Bpo

Working Capital Management Overview How It Works Importance

Working Capital Management Overview How It Works Importance

Working Capital Loans For Businesses 8 Best Options For 2021 Business Bank Account Loan Business Expansion

Working Capital Loans For Businesses 8 Best Options For 2021 Business Bank Account Loan Business Expansion

/WORKINGCAPITALFINALJPEG-4ca1faa51a5b47098914e9e58d739958.jpg) Working Capital Nwc Definition

Working Capital Nwc Definition

Working Capital Examples Top 4 Examples With Analysis

Working Capital Examples Top 4 Examples With Analysis

Post a Comment for "How To Explain Working Capital"