Down Payment Received Journal Entry

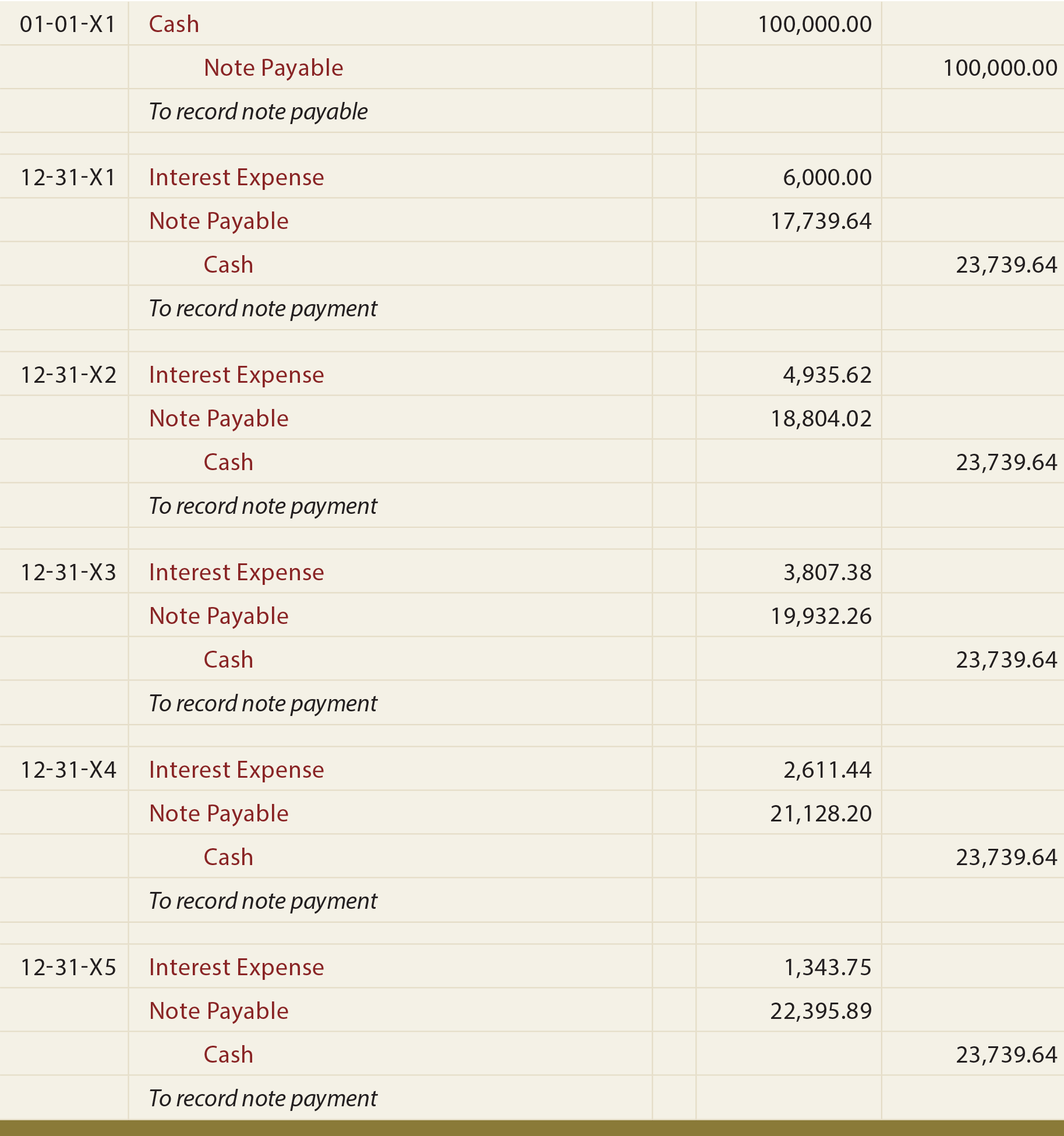

This amount is deducted from the original total amount of the invoice. Journal Entry for Loan Payment Principal Interest Loans are a common means of seeking additional capital by the companies.

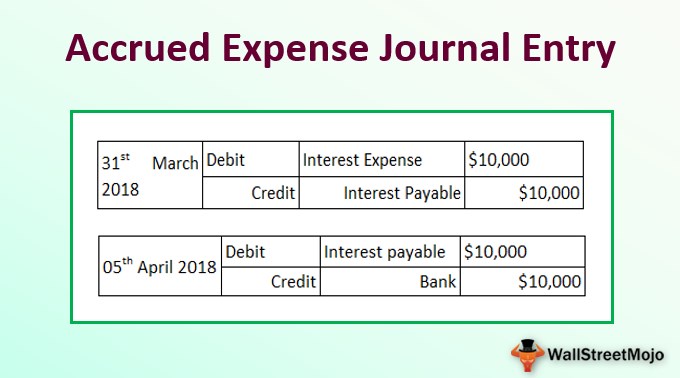

Accrued Expense Journal Entry Examples How To Record

Accrued Expense Journal Entry Examples How To Record

The total amount of the drawn down payments is taken from the Total Down Payment field in the invoice.

Down payment received journal entry. Journal Entries for Accounts Payable. Once the receipt or delivery of goods and services occurs the down payment clears against the final invoice. What is the entry for the down payment from a signed contract.

Journal Entry of Discount Received. Discount received and the net amount paid or the total amount payable is given. 05022018 Amount paid to Mr.

A down payment is a payment made or received before the physical exchange of goods and services. And then you just do the usual entry to record the final payment by the insurance company. Create a regular invoice.

Once the invoice is received the amount owed is recorded which consequently raises the credit balance. Under Outstanding Transactions select the invoice. Received 6300 in cash as advanced payment from customers.

Electricity bill received. Before you add it click Browse to open the Down Payments to Draw window. There is an increase in an asset account debit Service Equipment 16000 a decrease in another asset credit Cash 8000 the amount paid and an increase in a liability account credit Accounts Payable 8000 the balance to be paid after 60 days.

Discount received acts as a gain for the business and is shown on the. The double entry bookkeeping journal entry to record the purchase of the networking equipment is as follows. I think you would enter the vehicle purchase as an asset for the total amount of the purchase.

Discounts are common in both B2B and B2C transactions to push both credit and cash sales they are usually given in lieu of some consideration which can be prompt payments trade practices recoveries etcWhile posting a journal entry for discount received Discount Received Account is credited. This is true at any time and applies to each transaction. They can be obtained from banks NBFCs private lenders etc.

The company paid a 50 down payment and the balance will be paid after 60 days. Under Receive Payment select the customer. The Credits section only appears if there is an unapplied customer credit.

Down payment paid to Eram Motors Rs. This will result in a compound journal entry. Under Credits select the journal entry to be applied as a credit.

Office supplies were purchased totaling 3500 on account. A down payment received before it is earned is recorded with a debit to the current asset account Cash and a credit to the current liability account Customer Deposits. Then you would set up a liability account for the amount of the loan and the first entry would be the down payment and all other entries would be reducing the loan balance.

Make sure to record the journal entry correctly. The business was started with 300000. Bankdr 60000 Insurance claim receivablecr 60000 Hope that makes sense.

Make no entry on the form. How we can pass the journal entry by. This account would be debited and cash would be credited to reflect the down payment.

In this tutorial we describe the below steps involved in setting up the. A loan received becomes due to be paid as per the repayment schedule it may be paid in instalments or all at once. 1On 01112019 bought a delivery Van of Rs400000 from Eram Motors on the following terms.

When the contract is completed the account Customer Deposits will be debited for the amount of the down payment the sale will be recorded with a credit and Cash or Accounts Receivable will be debited. The above journal entry means the loss due to the fire is cancelled out and the insurance claim is 10000 more now a full 60000. When you actually receive the inventory you would credit the prepaid inventory account and debit inventory.

Accounting Equation for Received Cash on Account Journal Entry The Accounting Equation Assets Liabilities Owners Equity means that the total assets of the business are always equal to the total liabilities plus the equity of the business. The Indian Auto Parts IAP Ltd sold some truck parts to Mr. Now We will discuss the Journal Entry for Discount Received in three different cases shown as following.

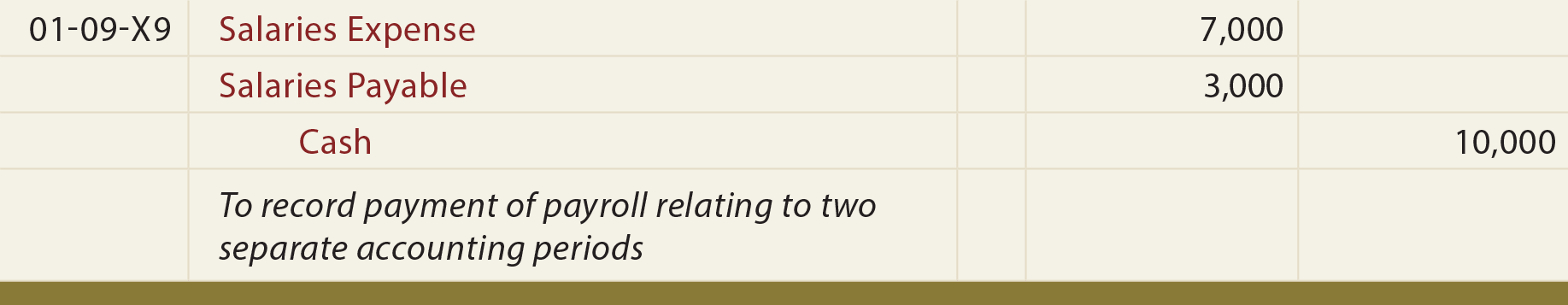

A of Rs 900-and he allowed a discount of Rs 100-. When you receive the remaining inventory that account would be debited and the accounts payable account would be credited. Accrual accounting requires recording the revenues as for and when they are earned whether payments in cash is received or not.

However in double-entry accounting an increase in accounts payable is always recorded as a credit. When the contract is completed the account Customer Deposits will be debited for the amount of the down payment the sale will be recorded with a credit and Cash or Accounts Receivable will be debited. Down payments are sometimes also referred to as advance payments.

A down payment received before it is earned is recorded with a debit to the current asset account Cash and a credit to the current liability account Customer Deposits. Buy Equipment with Down Payment in Cash Journal Entry. Accounts Payable Journal Entries refers to the amount payable accounting entries to the creditors of the company for the purchase of goods or services and are reported under the head current liabilities on the balance sheet and this account debited whenever any payment is been made.

Credit balance in accounts payable represents the total amount a company owes to its suppliers. Journal Entries for Accounting Receivable. The accounting records will show the following bookkeeping transaction entries to buy equipment with a down payment in cash and the balance on supplier credit.

Here are journal entry examples to help you better understand journal entries. The company started business on June 6 2013. Anonymous How we can pass the journal entry for this question.

Draw the required down payments from this window and specify the net or gross amount to be copied into the regular invoice.

Reimbursed Employee Expenses Journal Double Entry Bookkeeping

Reimbursed Employee Expenses Journal Double Entry Bookkeeping

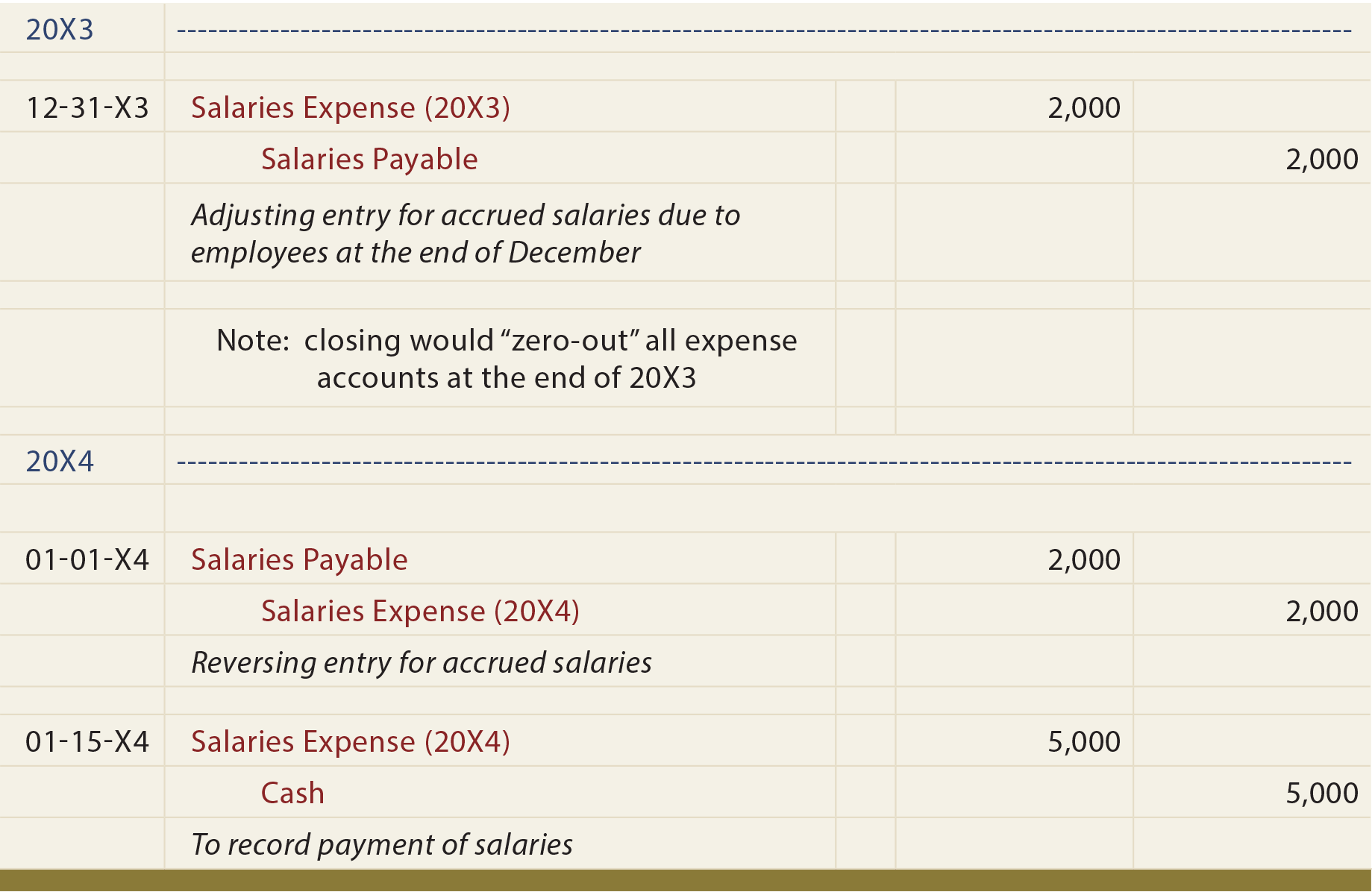

Reversing Entries Principlesofaccounting Com

Reversing Entries Principlesofaccounting Com

Accounting For Bonds Payable Principlesofaccounting Com

Accounting For Bonds Payable Principlesofaccounting Com

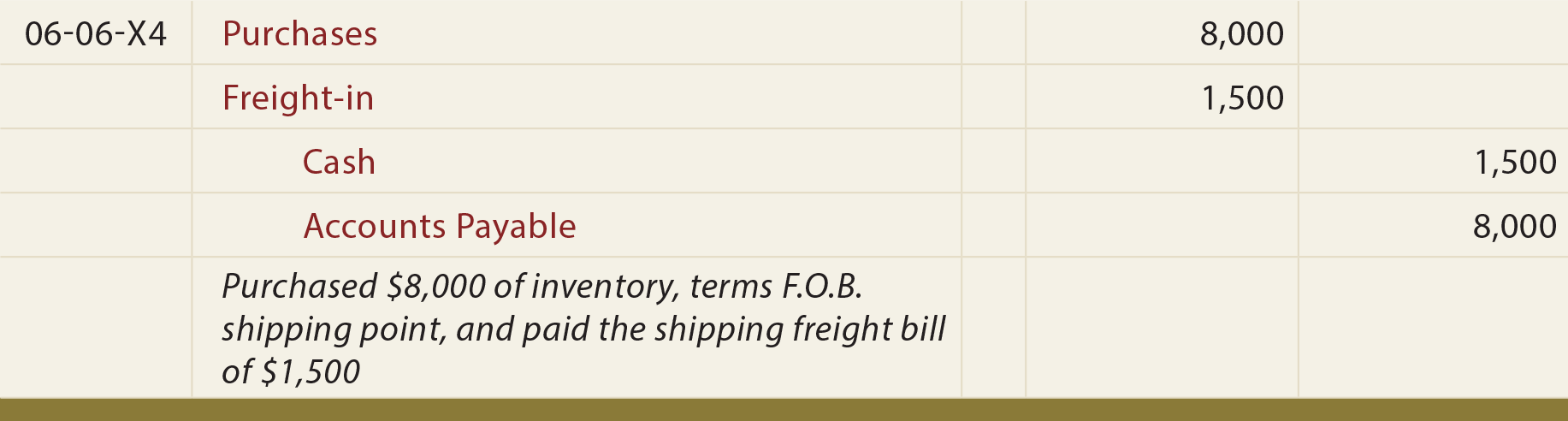

Freight Principlesofaccounting Com

Freight Principlesofaccounting Com

Interest Payable Guide Examples Journal Entries For Interest Payable

Interest Payable Guide Examples Journal Entries For Interest Payable

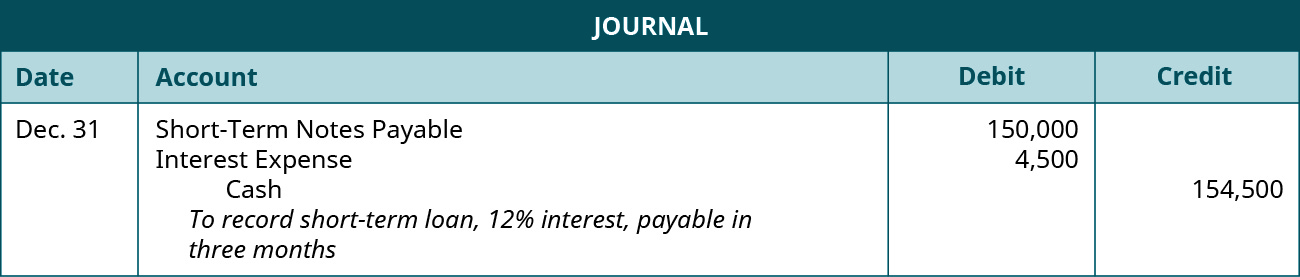

Prepare Journal Entries To Record Short Term Notes Payable Principles Of Accounting Volume 1 Financial Accounting

Prepare Journal Entries To Record Short Term Notes Payable Principles Of Accounting Volume 1 Financial Accounting

Bond Premium With Straight Line Amortization Accountingcoach

Bond Premium With Straight Line Amortization Accountingcoach

Notes Payable Principlesofaccounting Com

Notes Payable Principlesofaccounting Com

Long Term Notes Principlesofaccounting Com

Long Term Notes Principlesofaccounting Com

Basics Of Accounting Chart Of Accounts General Journal General Led Chart Of Accounts Accounting Cost Accounting

Basics Of Accounting Chart Of Accounts General Journal General Led Chart Of Accounts Accounting Cost Accounting

Accounts Payable Explanation Journal Entries Examples Accounting For Management

Accounts Payable Explanation Journal Entries Examples Accounting For Management

Unearned Revenue Journal Entry Double Entry Bookkeeping

Unearned Revenue Journal Entry Double Entry Bookkeeping

Loan Note Payable Borrow Accrued Interest And Repay Principlesofaccounting Com

Loan Note Payable Borrow Accrued Interest And Repay Principlesofaccounting Com

The Adjusting Process And Related Entries Principlesofaccounting Com

The Adjusting Process And Related Entries Principlesofaccounting Com

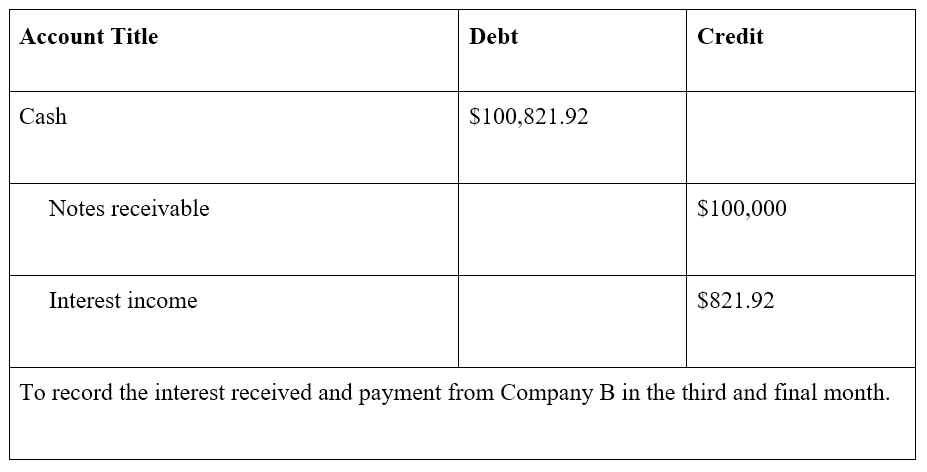

What Are Notes Receivable Examples And Step By Step Guide

What Are Notes Receivable Examples And Step By Step Guide

A Refresher On Accounting For Leases The Cpa Journal

A Refresher On Accounting For Leases The Cpa Journal

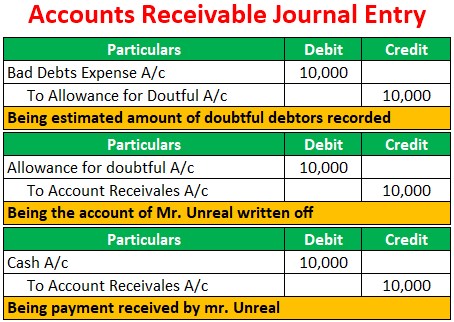

Accounts Receivable Journal Entries Examples Bad Debt Allowance

Accounts Receivable Journal Entries Examples Bad Debt Allowance

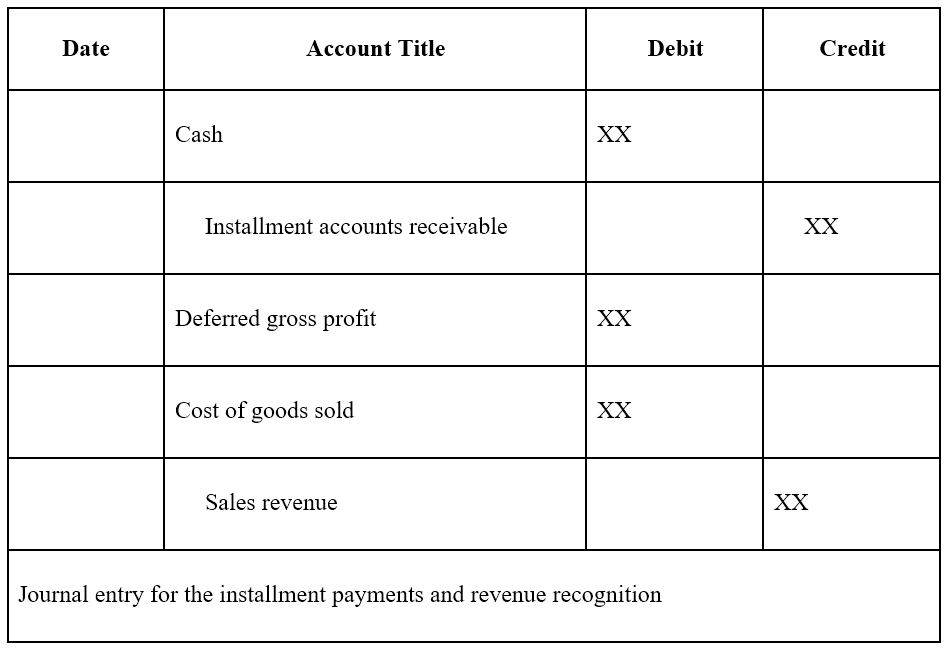

Installment Sale Overview Examples Of The Installment Sales Method

Installment Sale Overview Examples Of The Installment Sales Method

Accounting Journal Entries Examples Bookkeeping And Accounting Accounting Student Accounting Career

Accounting Journal Entries Examples Bookkeeping And Accounting Accounting Student Accounting Career

Post a Comment for "Down Payment Received Journal Entry"