Request A Payment Trace Through The Irs

Alternatively you could also send the IRS a completed Form 3911 Taxpayer Statement Regarding Refund. To request a Payment Trace call the IRS at 800-919-9835 or mail or fax a completed Form 3911 Taxpayer Statement Regarding Refund.

Irsnews On Twitter The Irs Get My Payment Tool Is Operating At Record Volumes So Far 9 8m People Got An Economic Impact Payment Status And 1 6m Provided Direct Deposit Info In Some

Irsnews On Twitter The Irs Get My Payment Tool Is Operating At Record Volumes So Far 9 8m People Got An Economic Impact Payment Status And 1 6m Provided Direct Deposit Info In Some

To start a payment trace call the IRS toll-free at 800-919-9835.

Request a payment trace through the irs. Note that if you call the number youll have to listen through. Note that if you call the number youll have to listen through. People should visit IRSgov for the most current information on the second round of Economic Impact Payments rather than calling the agency their financial institutions or tax software providers.

The Get My Payment tool on the IRS website can give you the status of your stimulus check which youll need before you try a Payment Trace. You may need to request a Payment Trace from the IRS for your no-show stimulus check. To request a Payment Trace call the IRS at 800-919-9835 or mail or fax a completed Form 3911 Taxpayer Statement Regarding Refund.

Call the IRS at 800-919-9835. To request a Payment Trace call the IRS at 800-919-9835 or mail or fax a completed Form 3911 Taxpayer Statement Regarding Refund. Payments processed through EFTPS can be identified through the EFT number shown on IDRS.

To request a Payment Trace call the IRS at 800-919-9835 or mail or fax a completed Form 3911 Taxpayer Statement Regarding Refund. Note that if you call the number youll have to listen through. If there is any problem with the payment this number allows IRS to trace the payment quickly.

You should only request a payment trace to track your payment if you received Notice 1444 or Notice 1444-B or if Get My Payment shows your payment was issued and you have not received it within the timeframes below. As of January 29 2021 Get My Payment will no longer be updated for the first and second Economic Impact Payments. Even then you should only request a Payment Trace if youre sure your check isnt being processed by the bank or making its way through the mail.

IRS phone assistors do not have additional information beyond whats available on IRSgov. You may need to request a Payment Trace from the IRS for your no-show stimulus check. Sarah TewCNET By now millions of Americans have received their first and second stimulus checks and we8217.

If youve been told that a payment was sent and you were given a date and if youve waited enough time you can request a trace by one of two ways. Be forewarned that you may experience long wait times because of limited staffing. The form is typically used to track down missing tax refunds.

If Get My Payment does not provide a payment date a payment will not be issued and you may claim the Recovery Rebate Credit if youre eligible. Sarah TewCNET As we inch closer to the approval of the 19 trillion COVID-19 relief bill the third round of stimulus checks for up to 1400 per person could be on track for delivery by the end of this. You can do this by way of a Recovery Rebate Credit even when you do not often file taxesSome conditions nevertheless could require you to contact the IRS immediately and request one thing referred to as a payment trace to monitor down your cash.

To be eligible to request the trace the IRS said you must have been issued Notice 1444 those letters from the White House and signed by President Donald Trump notifying you of a stimulus payment. Experts at CNET recommend waiting five days after a direct deposit or four weeks after a check was mailed to. After taxpayers enter the information EFTPS supplies an acknowledgment number to the taxpayer.

Ad_1 You may need to request a Payment Trace from the IRS for your no-show stimulus check. With tax season shifting alongside you may file for any missing stimulus cash you certified for in your 2020 tax return. You can request an IRS Payment Trace if you received the confirmation letter from the IRS that your payment was sent also called Notice 1444 or if the Get My Payment tool shows that your payment.

Note that if you call the number youll have to listen through. You must file a 2020 tax return to claim the credit even if you usually dont file. Taxpayers should write down this number and keep it for future reference.

How To Get Irs Tax Transcript Online For I 485 Filing Usa

How To Get Irs Tax Transcript Online For I 485 Filing Usa

Payment Plan Letter Inspirational Can T Pay Irs Installment Agreement New Sample Letter To Letter Templates Lettering Quote Template

Payment Plan Letter Inspirational Can T Pay Irs Installment Agreement New Sample Letter To Letter Templates Lettering Quote Template

3 Form Usa 3 Important Life Lessons 3 Form Usa Taught Us Tax Return Irs Important Life Lessons

3 Form Usa 3 Important Life Lessons 3 Form Usa Taught Us Tax Return Irs Important Life Lessons

Https Www Irs Gov Pub Irs Utl Oc March Autotranscrpt 022811 Pdf

Sample Penalty Abatement Letter To Irs To Waive Tax Penalties In Bank Charges Refund Letter Template 10 Lettering Letter Templates Printable Letter Templates

Sample Penalty Abatement Letter To Irs To Waive Tax Penalties In Bank Charges Refund Letter Template 10 Lettering Letter Templates Printable Letter Templates

Tax Season Today For Apr 15 Share Makelifelesstaxing Taxbot Tax Season Paying Taxes Income Tax Return

Tax Season Today For Apr 15 Share Makelifelesstaxing Taxbot Tax Season Paying Taxes Income Tax Return

Income Tax Form W 3 Ten Things That You Never Expect On Income Tax Form W 3 Tax Forms Irs Forms Power Of Attorney Form

Income Tax Form W 3 Ten Things That You Never Expect On Income Tax Form W 3 Tax Forms Irs Forms Power Of Attorney Form

3 17 79 Accounting Refund Transactions Internal Revenue Service

3 17 79 Accounting Refund Transactions Internal Revenue Service

Metabank Statement Regarding Economic Impact Payments And Tax Solutions Metabank

Metabank Statement Regarding Economic Impact Payments And Tax Solutions Metabank

Tax Forms Directory Comprehensive Irs Tax Forms Guide Irs Tax Forms Irs Taxes Tax Forms

Tax Forms Directory Comprehensive Irs Tax Forms Guide Irs Tax Forms Irs Taxes Tax Forms

W9 Form 2020 Futufan Futufan W 9forms Money Irs Finance Tax W9 Form 2020 Irs Forms Tax Forms 1099 Tax Form

W9 Form 2020 Futufan Futufan W 9forms Money Irs Finance Tax W9 Form 2020 Irs Forms Tax Forms 1099 Tax Form

Economic Impact Payment Information Center Topic F Payment Issued But Lost Stolen Destroyed Or Not Received Internal Revenue Service

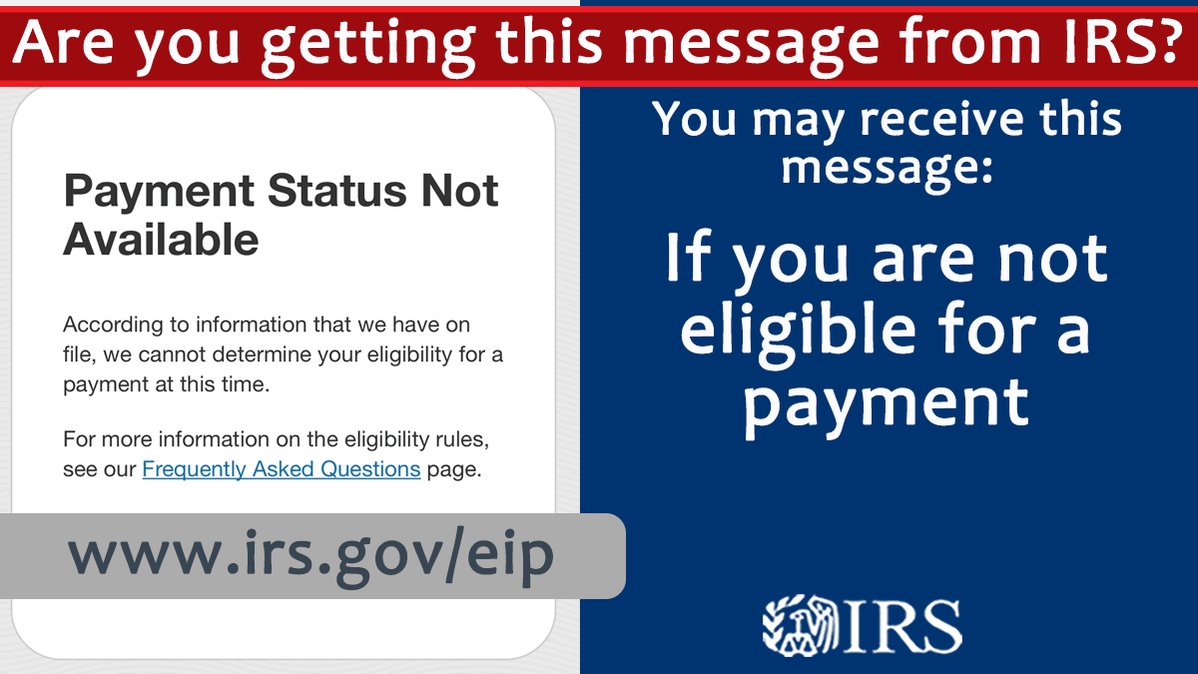

Second Stimulus Check Problems Payment Status Not Available Error On Irs Website Means Some Need To Claim 600 On 2020 Tax Returns Abc11 Raleigh Durham

Second Stimulus Check Problems Payment Status Not Available Error On Irs Website Means Some Need To Claim 600 On 2020 Tax Returns Abc11 Raleigh Durham

How To Request For An Irs Hardship Payment Extension Steps On How To Apply For An Irs Hardship Payment Extension Program Credit Card Statement Irs Tax Help

How To Request For An Irs Hardship Payment Extension Steps On How To Apply For An Irs Hardship Payment Extension Program Credit Card Statement Irs Tax Help

3 17 10 Dishonored Check File Dcf And Unidentified Remittance File Urf Internal Revenue Service

3 17 10 Dishonored Check File Dcf And Unidentified Remittance File Urf Internal Revenue Service

Calling The Irs For Stimulus Check Payment Issues Or Checking The Get My Payment Tool Vs Getting Through To A Live Agent Aving To Invest

Calling The Irs For Stimulus Check Payment Issues Or Checking The Get My Payment Tool Vs Getting Through To A Live Agent Aving To Invest

Pin On Local Third Party Logistics Companies

Pin On Local Third Party Logistics Companies

Still Missing A Stimulus Check Irs Payment Trace Works For These 2 Scenarios Cnet

Still Missing A Stimulus Check Irs Payment Trace Works For These 2 Scenarios Cnet

Post a Comment for "Request A Payment Trace Through The Irs"