Request Payment Plan Irs Turbotax

It can even connect you with an IRS Volunteer Income Tax Assistant. By using the IRS Free File Program delivered by TurboTax low to moderate income tax filers have the ability to prepare and electronically file IRS and all state tax returns.

H R Block Turbotax Confirm Mix Up In 2nd Stimulus Payments Causing Delays Wfaa Com

H R Block Turbotax Confirm Mix Up In 2nd Stimulus Payments Causing Delays Wfaa Com

This is applicable to income tax due from Tax Year 2019 and the first quarter payment for Tax Year 2020 both of which would normally be due on April 15 2020.

Request payment plan irs turbotax. In this situation you must request the payment plan on Form 9465-FS and attach a Collection Information Statement on Form 433-F. Write a letter to the IRS stating your request for a partial payment installment agreement and submit your written request along with Forms 9465 and 433-A. If you cannot pay off your balance within 120 days setting up a direct debit payment plan online will cost 31 or 107 if set up by phone mail or in-person.

See if you qualify for a fee reduction by applying for the low-income certificate via the Form 13844. Taxpayers who cant pay their tax obligation can file Form 9465 to set up a monthly installment payment plan if they meet certain conditions. A payment plan is an agreement with the IRS to pay the taxes you owe within an extended timeframe.

Fees vary by situation and are described in the payment plan form within the HR Block Tax Software. Current Revision Form 9465 PDF Information about Form 9465 Installment Agreement Request including recent updates related forms and instructions on how to file. If not using direct debit setting up the plan by phone mail or in-person will cost 225.

Use Form 9465 to request a monthly installment plan if you cannot pay the full amount you owe shown on your tax return or on a notice we sent you. Keep enough money in my bank account to make my payment. In most cases it is a good idea to pay part of your tax debt and then ask for an installment plan for the leftover balance.

Send it to the IRS revenue officer handling your case to the Automated Collection System unit or to your nearest IRS Service Center. Make monthly payments until my tax bill is paid in full. How much personal info youll need to submit depends on your payment plan.

Short-term payment agreement or payment extension. After you file your tax forms on time without payment the IRS will contact you to ask whether you would be able to pay within 120 days. If you qualify for a short-term payment plan you will not be liable for a user fee.

Adjust my W4 and DE4 so I dont owe taxes in the future. Youll use this payment plan if your IRS debt is 10000 or less and you can pay your debt in 120 days about four months. If you choose this option the agency will charge you a.

You wont see this screen if you owe 0 or are getting a refund. Login to your TurboTax account to start continue or amend a tax return get a copy of a past tax return or check the e-file and tax refund status. Make my estimated tax payments if required.

If you havent filed yet step through the File section of TurboTax until you reach the screen How do you want to pay your federal taxes. Lets take a look at those payment plans now. Then select Request an IRS installment plan Continue and follow the onscreen instructions.

For a long-term payment plan the online setup fee is 149. If your request is approved you will receive a notice detailing the terms of your agreement and a request of 120 52 if you make payment by direct debit to set up the installment agreement. Pay by automatic withdrawal from my bank account.

If the amount of tax you owe at the time you request an installment agreement exceeds 50000 youll need to provide the IRS with additional information about your personal finances. Check the status of your return complete identity verification processes make payments and much more from the comfort of your home through OkTAP. Pay all future income taxes on time.

To get to Form 9465 go through the File section of TurboTax until you reach the screen How would you like to pay your federal taxes. With a payment plan youll be able to pay more of your taxes later. If not using direct debit then setting up the plan online will cost 149.

The IRS charges a fee to set up a payment plan. Select the installment payment plan option Continue and follow the onscreen instructions. The IRS IRS2Go iOS Android is a barebones app that lets you check your refund status and schedule payments if you owe money.

The IRS will respond to your request within about 30 days. If you already filed or youre unable to find this option in TurboTax you can apply for a payment plan at the IRS Payment Plans and Installment Agreements webpage make sure youve filed your return before applying through their site. You should request a payment plan if you believe you will be able to pay your taxes in full within the extended time frame.

Any taxpayer owing no more than 10000 will have their. To set up an installment agreement you can file Form 9465 through HR Block to request a payment plan from the IRS. IRS Free File Program delivered by TurboTax.

Intuit and the Intuit Financial Freedom Foundation are proud to donate tax preparation services to the IRS Free File Program. File my income tax returns on time. IRS Form 9465 is a document you can file to formally request a monthly installment payment plan in the instance you cannot pay what you owe on your federal tax return.

IRS approval allows you to pay the tax over 72 months and by filling out the request you agree to pay on time. Low income taxpayers pay less in setup fees. The phone mail or in-person setup fee is 225.

Guide To Irs Form 8888 Direct Deposit Of Your Tax Refund In Multiple Accounts Turbotax Tax Tips Videos

Guide To Irs Form 8888 Direct Deposit Of Your Tax Refund In Multiple Accounts Turbotax Tax Tips Videos

Can I Apply For Naturalization If I Owe Back Taxes Maybe

Can I Apply For Naturalization If I Owe Back Taxes Maybe

Turbotax H R Block Hid Free Tax Filing Option Lawsuits Claim Top Class Actions

Turbotax H R Block Hid Free Tax Filing Option Lawsuits Claim Top Class Actions

Turbotax Class Action Lawsuit Settlement Reached Over Whether Its Service Is Free Top Class Actions

Turbotax Class Action Lawsuit Settlement Reached Over Whether Its Service Is Free Top Class Actions

How To Enter 1099 Misc Fellowship Income Into Turbotax Evolving Personal Finance Evolving Personal Finance

What Is The Irs Form 1099 Misc Turbotax Tax Tips Videos

What Is The Irs Form 1099 Misc Turbotax Tax Tips Videos

2020 Stimulus Tax Relief For This Year S Taxes Turbotax Tax Tips Videos

2020 Stimulus Tax Relief For This Year S Taxes Turbotax Tax Tips Videos

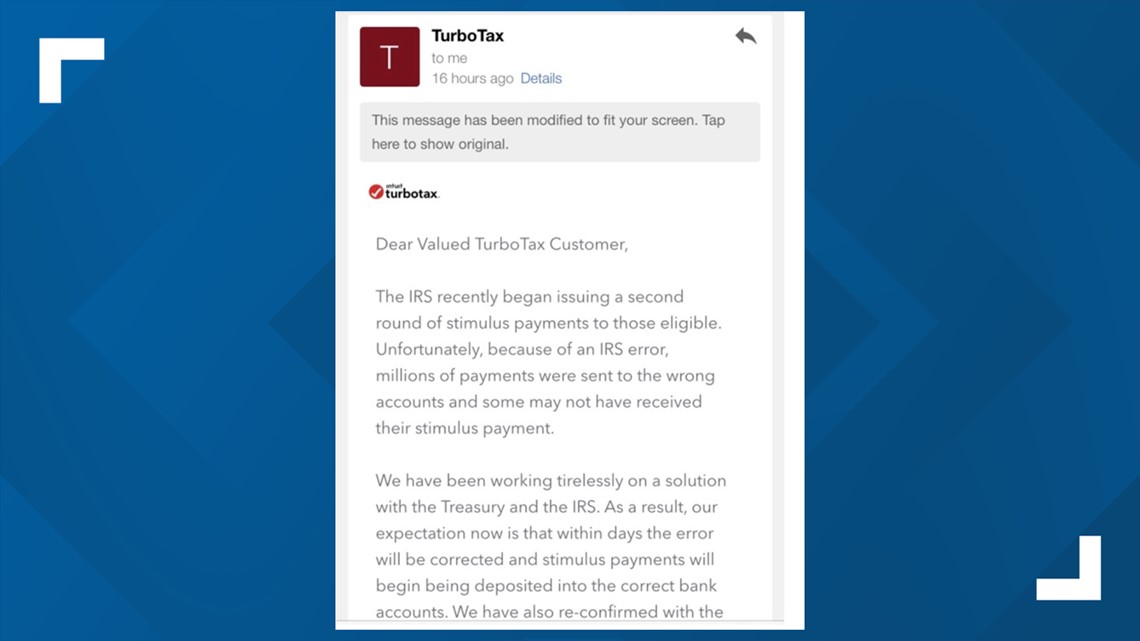

Why Haven T I Received My Second Stimulus Check The Turbotax Blog

Why Haven T I Received My Second Stimulus Check The Turbotax Blog

Stimulus Payments For Turbotax Customers Being Deposited Company Says Abc7 Southwest Florida

Stimulus Payments For Turbotax Customers Being Deposited Company Says Abc7 Southwest Florida

Video Irs Payment Plans Explained Turbotax Tax Tips Videos

Video Irs Payment Plans Explained Turbotax Tax Tips Videos

What Is Irs Form W 9 Turbotax Tax Tips Videos

What Is Irs Form W 9 Turbotax Tax Tips Videos

H R Block Turbotax Confirm Mix Up In 2nd Stimulus Payments Causing Delays Wfaa Com

H R Block Turbotax Confirm Mix Up In 2nd Stimulus Payments Causing Delays Wfaa Com

Video What Is Irs Form 9465 Installment Agreement Request Turbotax Tax Tips Videos

Video What Is Irs Form 9465 Installment Agreement Request Turbotax Tax Tips Videos

8 Things To Know About Irs Installment Payment Plans The Turbotax Blog

8 Things To Know About Irs Installment Payment Plans The Turbotax Blog

Status Not Available Message Means You Re Not Getting Stimulus Ksdk Com

Status Not Available Message Means You Re Not Getting Stimulus Ksdk Com

Second Stimulus Why Turbotax H R Block Customers Don T Have It Weareiowa Com

Second Stimulus Why Turbotax H R Block Customers Don T Have It Weareiowa Com

Turbotax To Help Millions Of Americans Get Their Stimulus Payments With Launch Of Free Stimulus Registration Product The Turbotax Blog

Turbotax To Help Millions Of Americans Get Their Stimulus Payments With Launch Of Free Stimulus Registration Product The Turbotax Blog

Tax Return Time Turbotax Irs Tax Tools More Can Help Amid Covid

Tax Return Time Turbotax Irs Tax Tools More Can Help Amid Covid

H R Block Turbotax Confirm Mix Up In 2nd Stimulus Payments Causing Delays Kcentv Com

H R Block Turbotax Confirm Mix Up In 2nd Stimulus Payments Causing Delays Kcentv Com

Post a Comment for "Request Payment Plan Irs Turbotax"