Payment Through Electronic Cash Ledger Under Customs Act

This ledger shall contain the RCM tax payment details as the following entries-. 1 The electronic cash ledger under sub-section 1 of section 49 shall be maintained in FORM GST PMT-05 for each person liable to pay tax interest penalty late fee or any other amount on the common portal for crediting th.

All About Form Gstr 9a How To Prepare File

All About Form Gstr 9a How To Prepare File

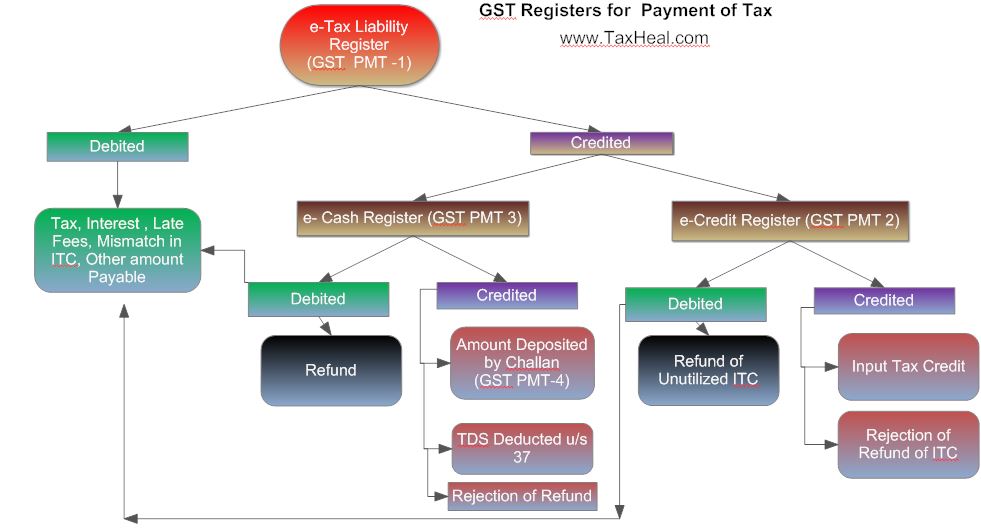

In terms of section 497 read with Rule 853 of CGST Rules 2017 subject to the provision of section 49 payment of every liability by a registered person as per his return shall be made by debiting the electronic credit ledger maintained as per Rule 86 or electronic cash ledger maintained as per Rule 87 and the electronic liability register shall be credited accordingly.

Payment through electronic cash ledger under customs act. Section 50 of the Central Goods and Services Tax Act 2017 CGST Act was amended 1 to provide that the interest on tax payable in respect of supplies made during a tax period and declared in the return for the relevant period furnished after the due date except after commencement of any proceedings under section 73 or section 74 of the CGST Act in respect of the said period shall be levied on that portion of the tax that is paid by debiting the electronic cash ledger. Rule 87 GST - Electronic Cash Ledger. It does not expressly provide that interest is payable even on the tax liability that was offset with accumulated ITC.

It may be noted that such liability can be paid through electronic cash ledger only. Finally electronic liability ledger showcases the amount of tax payable by the registered taxpayer. This means electronic cash ledger is a summary of all deposits or payments made by taxpayers.

Raise power to extend the limit of Periodic statement and annual Statement. CA Rajkumar 7 Manner of payment Similar provision. Section 50 of the CGST Act prescribes for payment of interest when there is a delay in payment of tax.

The electronic cash ledger shall be maintained in FORM GST PMT-05 for each person liable to pay tax interest penalty late fee or any other amount on the common portal for crediting the amount deposited and debiting the payment therefrom towards tax interest penalty fee or any other amount. These ledgers include i Electronic Cash Ledger ii Electronic Credit Ledger and iii Electronic Liability Ledger. The electronic cash ledger under sub-section 1 of section 49 shall be maintained in FORM GST PMT-05 for each person liable to pay tax interest penalty late fee or any other amount on the common portal for crediting the amount deposited and debiting the payment therefrom towards tax interest penalty fee or any other.

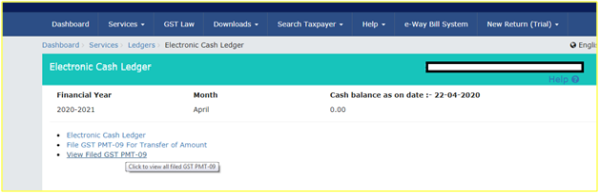

Transfer of amount in between E-cash Ledger under IGSTCGSTSGSTUTGST Under section 52 TCS. Thus any deposit made on the GST portal is credited to your Electronic Cash Ledger. Rule 87 Electronic Cash Ledger.

As in section 17A of IGST Act 2017. So the electronic cash ledger reflects the cash available to settle the tax liability online. The amount available in the electronic credit ledger is utilized in making payments towards outward tax liability by the registered taxpayer.

Insertion of new Rule 86B A new rule 86B was inserted requiring a certain unique segment of taxpayers to compulsorily discharge at least 1 of their output GST liability in cash. This means that the amount available in the Electronic Cash Ledger is used for making payments. If you want to deposit then either you or any person on your behalf can generate a challan in form GST PMT-06 on the common portal by clearly specifying the amount to be deposited towards tax interest penalty fee or any other amount.

However in my view if liability has arisen due to ineligible credit that can be paid through Electronic Credit Ledger. PAYMENT OF TAX RULE. According to Rule 87 of Central Goods and Service Tax Act 2017 as passed by Lok Sabha.

However the credit of the same can be availed used to discharge other tax liabilities. See Column No10 of serial no7 of Form GST DRC 03 which indicates that payment through cash or credit is allowed but in view of situation. Electronic Cash Ledger provides a summary of all your GST payments.

By co-reading of section 49 4 and 49 8 of CGST Act 2017 the amount available in electronic credit ledger would be utilized against any payment towards output tax liability arising through self-assessed tax and other dues relating to returns GSTR-3B or any other amount payable under GST say through DRC-03 including demand determined under section 73 and section 74. Last updated at July 14 2017 by Teachoo. Where any person avails ineligible ITC or avails ITC fraudentely then the officer will not allow debit or refund from E credit.

2 The amount available in the electronic cash ledger may be used for making any payment towards duty interest penalty fees or any other sum payable under the provisions of this Act or under the Customs Tariff Act 1975 51 of 1975 or under any other law for the time being in force or the rules and regulations made thereunder in such manner and subject to such conditions and within such time as may be prescribed. As per Rule 853 of CGST Rules 2017 Subject to the provisions of sections 49 49A and 49B payment of every liability by a registered person as per his return shall be made by debiting the Electronic Credit Ledger maintained as per Rule 86 or the Electronic Cash Ledger maintained as per Rule 87 and the Electronic Liability Register shall be credited accordingly. Electronic cash ledger will be credited for the amount deposited and debited for the payments out of it towards tax interest penalty fee or any other amount.

1 Every deposit made towards duty interest penalty fee or any other sum payable by a person under the provisions of this Act or under the Customs Tariff Act 1975 51 of 1975 or under any other law for the time being in force or the rules and regulations made thereunder using authorised mode of payment shall subject to such conditions and restrictions be credited to the electronic cash le. 1 The electronic cash ledger under sub-section 1 of section 49 shall be maintained in FORM GST PMT-05 for each person liable to pay tax interest penalty late fee or any other amount on the common portal for crediting the amount deposited and debiting the payment therefrom towards tax interest penalty fee or any other amount. It reflects the cash available to pay off your GST tax liability.

RCM charges need to be paid using the Electronic Cash Ledger only. Provided that the interest on tax payable in respect of supplies made during a tax period and declared in the return for the said period furnished after the due date in accordance with the provisions of section 39 except where such return is furnished after commencement of any proceedings under section 73 or section 74 in respect of the said period shall be levied on that portion of the tax that is paid by debiting the electronic cash ledger. Whereas the electronic credit ledger reflects the amount of input tax credit available to settle the output tax liability of the taxpayer.

Accountants need to maintain a separate Ledger for RCM transactions.

How An E Commerce Seller Can Claim Tcs Credit In Gst

How An E Commerce Seller Can Claim Tcs Credit In Gst

Electronic Cash Ledger Under Gst How To View The Same

Electronic Cash Ledger Under Gst How To View The Same

What Are The Various Types Of Electronic Ledgers Under Gst Hostbooks

What Are The Various Types Of Electronic Ledgers Under Gst Hostbooks

Big Relief For Gst Registered Person Shifting Of Amount Between Major Minor Heads In E Cash Ledger

Big Relief For Gst Registered Person Shifting Of Amount Between Major Minor Heads In E Cash Ledger

Refund Of Excess Balance In Electronic Cash Ledger Priha Priyal Shah S Blog Cash Refund Electronics

Refund Of Excess Balance In Electronic Cash Ledger Priha Priyal Shah S Blog Cash Refund Electronics

Tds Under Gst Section 51 Cgst Act 2017 A Detailed Study

Tds Under Gst Section 51 Cgst Act 2017 A Detailed Study

Cbic Extends Relaxation Rule On Requirement To Submit Bonds In 2020 Indirect Tax Bond Finance

Cbic Extends Relaxation Rule On Requirement To Submit Bonds In 2020 Indirect Tax Bond Finance

Teach Back Session Revisiting Returns Ppt Download

Teach Back Session Revisiting Returns Ppt Download

Taxheal Gst And Income Tax Complete Guide Portal

Taxheal Gst And Income Tax Complete Guide Portal

Electronic Liability Register Under Gst

Electronic Liability Register Under Gst

Functionality To Claim Refund Of Excess Amount In Electronic Cash Ledger Enabled

Functionality To Claim Refund Of Excess Amount In Electronic Cash Ledger Enabled

Electronic Credit Ledger Under Gst

Electronic Credit Ledger Under Gst

Presentation Ppt On Gst Payments

Presentation Ppt On Gst Payments

Manual Claim Filing Processing Of Gst Refund Of Excess Balance In E Cash Ledger

Gst Challan Payment Accounting Tally Taxation Tutorials

Gst Challan Payment Accounting Tally Taxation Tutorials

Gst Pmt 09 Transfer Amount From One Head To Another Head In Cash Ledger

Gst Pmt 09 Transfer Amount From One Head To Another Head In Cash Ledger

Cbic Enables Form Pmt 09 For Shifting Wrongly Paid Tax In The Electronic Cash Ledger Tax Update India

Cbic Enables Form Pmt 09 For Shifting Wrongly Paid Tax In The Electronic Cash Ledger Tax Update India

Post a Comment for "Payment Through Electronic Cash Ledger Under Customs Act"