Paycheck Protection Program Rules And Regulations

Small Business Administration the US. Below are some of the more significant changes andor clarifications.

This program provides small businesses with funds to pay up to 8 weeks of payroll costs including benefits.

Paycheck protection program rules and regulations. Search for lenders in your area. Christin Biermeier 11 months ago. COVID-19 News and Resources for Non-Profits.

The evening of April 2 2020 the SBA issued regulations pertaining to the Paycheck Protection Program. 116-139 and the Paycheck Protection Program Flexibility Act of 2020 Pub. PPP Application Form Paycheck-Protection-Program-Application-3-30-2020-v3pd_ You may also like.

In addition to payroll costs businesses can use some of the funds to cover other expenses on a commercial property such as rent utilities and mortgage interest. Aggregate payroll costs from the last 12 months for employees whose principal place of residence is the United States. 116-142 and ii all rules regulations guidelines guidance including Frequently Asked Questions and application documentation issued by the US.

Dont need your 2020 RMDs. In order to receive forgiveness for the entire PPP loan however the payroll portion must be at least 60 of the loan. On the Paycheck Protection Program borrower application form for first loans you will be asked to calculate your maximum loan amount by multiplying your average monthly payroll costs by 25 and adding any amount outstanding from an Economic Injury Disaster Loan EIDL made between January 31 2020 and April 3 2020 that you seek to refinance less any advance under an EIDL COVID-19 loan.

All loan terms will be the same for everyone. The regulations are also available on the SBA website and on the Tyler Bursch website as needed. SBAs regulations and guidance also contain important updates concerning other aspects of applicant eligibility.

First-Draw PPP loans are. The Paycheck Protection Program established by the CARES Act is implemented by the Small Business Administration with support from the Department of the Treasury. Get matched with a lender.

The Paycheck Protection Program PPP authorizes up to 349 billion in forgivable loans to small businesses to pay their employees during the COVID-19 crisis. Define Paycheck Protection Program Laws. To maximize loan forgiveness employers must use a minimum of 75 of the loan on payroll expenses and a maximum of 25 on other permitted expenses.

The Paycheck Protection Program PPP provides loans to help businesses keep their workforce employed during the Coronavirus COVID-19 crisis. The loan amounts will be forgiven as long as. Payroll as primary use.

Funds can also be used to pay interest on mortgages rent and utilities. Subtract any compensation paid to an employee in excess of an annual salary of 100000 andor any amounts paid to an independent contractor or sole proprietor in excess of 100000 per year. Section 1102 of the Act temporarily permits SBA to guarantee 100 percent of 7a loans under a new program titled the Paycheck Protection Program Section 1106 of the Act provides for forgiveness of up to the full principal.

Final Regulations for the Paycheck Protection Program PPP Posted by. New loan program to assist small businesses nationwide adversely impacted by the COVID19 emergency. In the evening of April 2 2020 mere hours before the application period was set to open SBA and Treasury published interim regulations a revised Borrowers Application and Lenders Application for the Paycheck Protection Program PPP.

As a result employers cannot easily cram rent mortgage or utility payments into the covered period in order to both maximize loan forgiveness and avoid paying employees. Employers who spend less than 75 of the loan on payroll expenses and more than 25 on other permitted expenses will not be entitled to the full amount of loan forgiveness. Means i Title I of the Coronavirus Aid Relief and Economic Security Act as amended and modified including by the Paycheck Protection Program and Health Care Enhancement Act Pub.

Paycheck Protection Program Interim Regulations Published 04032020. A third round of Paycheck Protection Program PPP loans was authorized by the passage of HR. Borrowers may be eligible for PPP loan forgiveness.

The loan proceeds are used to cover payroll costs and most mortgage interest rent and. While the CARES Act did not specifically address acceptable ratios of non-payroll expenses for forgiveness purposes rules implementing the PPP mandate that no more than 25 of the eligible expenses can include non-payroll costs. You can redeposit these to your retirement account.

SBA released an Interim Final Rule - Paycheck Protection Program as Amended by Economic Aid Act Economic Aid Act Rules which outlines the key provisions of the PPP related to eligibility of. The Paycheck Protection Program PPP Loan program has been the talk of most small businesses circles since the passage of the Coronavirus Aid Relief and Economic Security CARES Act late last month. While the nondiscrimination provisions of employment and public accommodations laws may apply with respect to goods services or accommodations offered generally to the public by recipients of Paycheck Protection Program loans including churches they will not apply to a churchs ministry activities within its own faith community.

The Coronavirus Aid Relief and Economic Security Act CARES Act passed on March 27 2020 sets aside 349 billion for Paycheck Protection Loans which are available through banks credit unions and other lenders and guaranteed by the government and allows for forgiveness of certain amounts. The new Paycheck Protection Program Flexibility Act PPPFA attempts to address many concerns around the PPP loan program aimed at providing COVID-19 relief. Consolidated Appropriations Act 2021 into law on Dec.

Paycheck Protection Program Farm Credit Administration

Paycheck Protection Program Farm Credit Administration

How To Apply For The Paycheck Protection Program Loudoun County Economic Development Va

How To Apply For The Paycheck Protection Program Loudoun County Economic Development Va

Small Business Paycheck Protection Program Medical Billing And Coding Small Business Small Business Administration

Small Business Paycheck Protection Program Medical Billing And Coding Small Business Small Business Administration

Paycheck Protection Program Reopens With Updated Rules In 2021 Paycheck Small Business Loans Protection

Paycheck Protection Program Reopens With Updated Rules In 2021 Paycheck Small Business Loans Protection

Sba Easing Forgiveness Of Paycheck Protection Program Loans Of 50 000 Or Less Loan Forgiveness Loan Business Journal

Sba Easing Forgiveness Of Paycheck Protection Program Loans Of 50 000 Or Less Loan Forgiveness Loan Business Journal

Paycheck Protection Program Wcg Cpas

Paycheck Protection Program Wcg Cpas

How To Apply For The Sba Payroll Protection Program Loan Simple Guide

How To Apply For The Sba Payroll Protection Program Loan Simple Guide

Sba Paycheck Protection Program Faqs

Sba Paycheck Protection Program Faqs

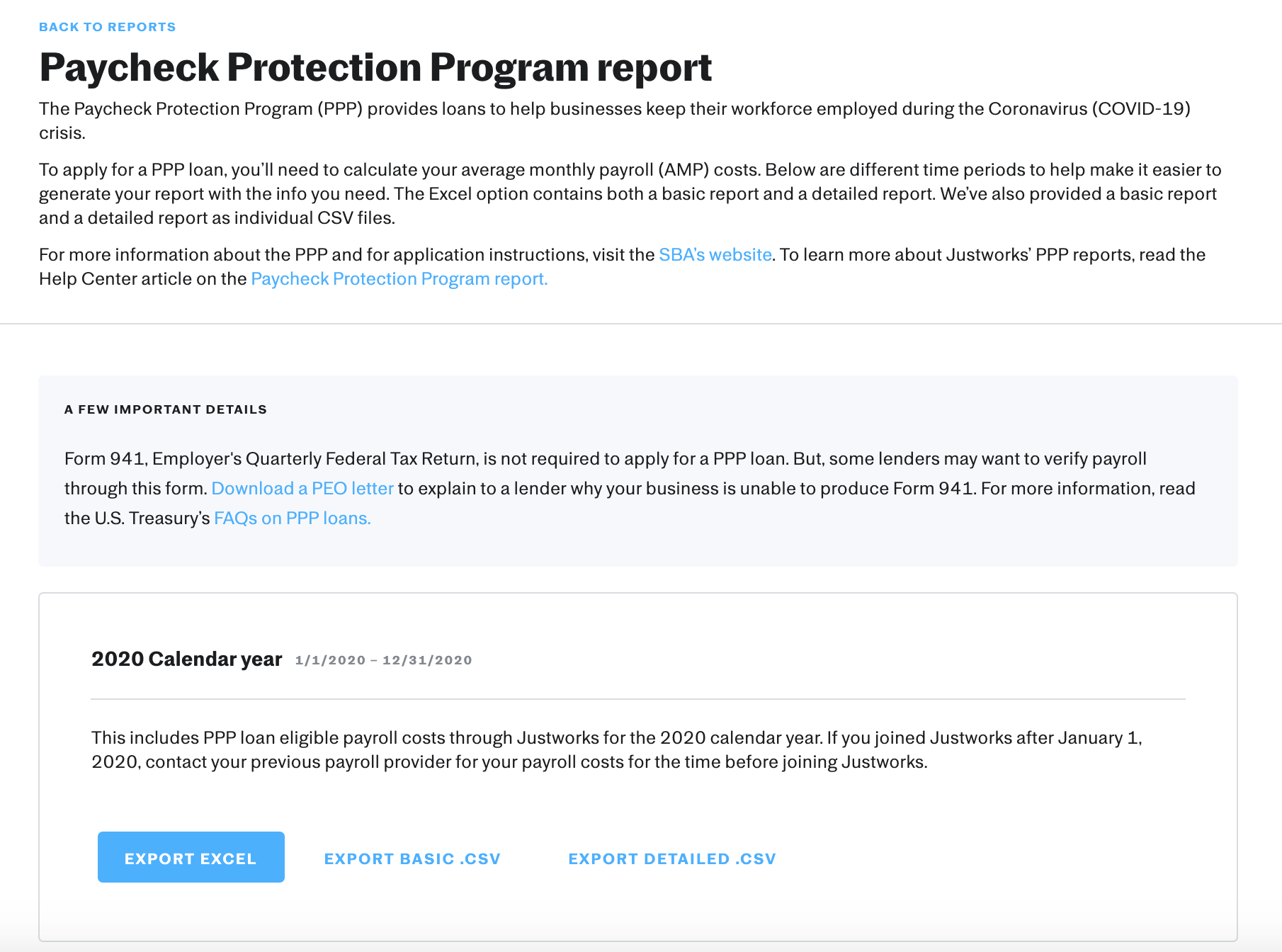

Paycheck Protection Program Report Justworks Help Center

Paycheck Protection Program Report Justworks Help Center

Cares Act Paycheck Protection Program Applications Now Available Guidance For Lenders And Borrowers Baker Donelson

Cares Act Paycheck Protection Program Applications Now Available Guidance For Lenders And Borrowers Baker Donelson

An Advisor S Guide To The Paycheck Protection Program

An Advisor S Guide To The Paycheck Protection Program

The Paycheck Protection Program Shouldn T Pick Winners Losers Within Industries Strict Application Of Sba S Affiliatio Health Club Fitness Club Gym Workouts

The Paycheck Protection Program Shouldn T Pick Winners Losers Within Industries Strict Application Of Sba S Affiliatio Health Club Fitness Club Gym Workouts

Post a Comment for "Paycheck Protection Program Rules And Regulations"